What is Price-to-Sales Ratio?

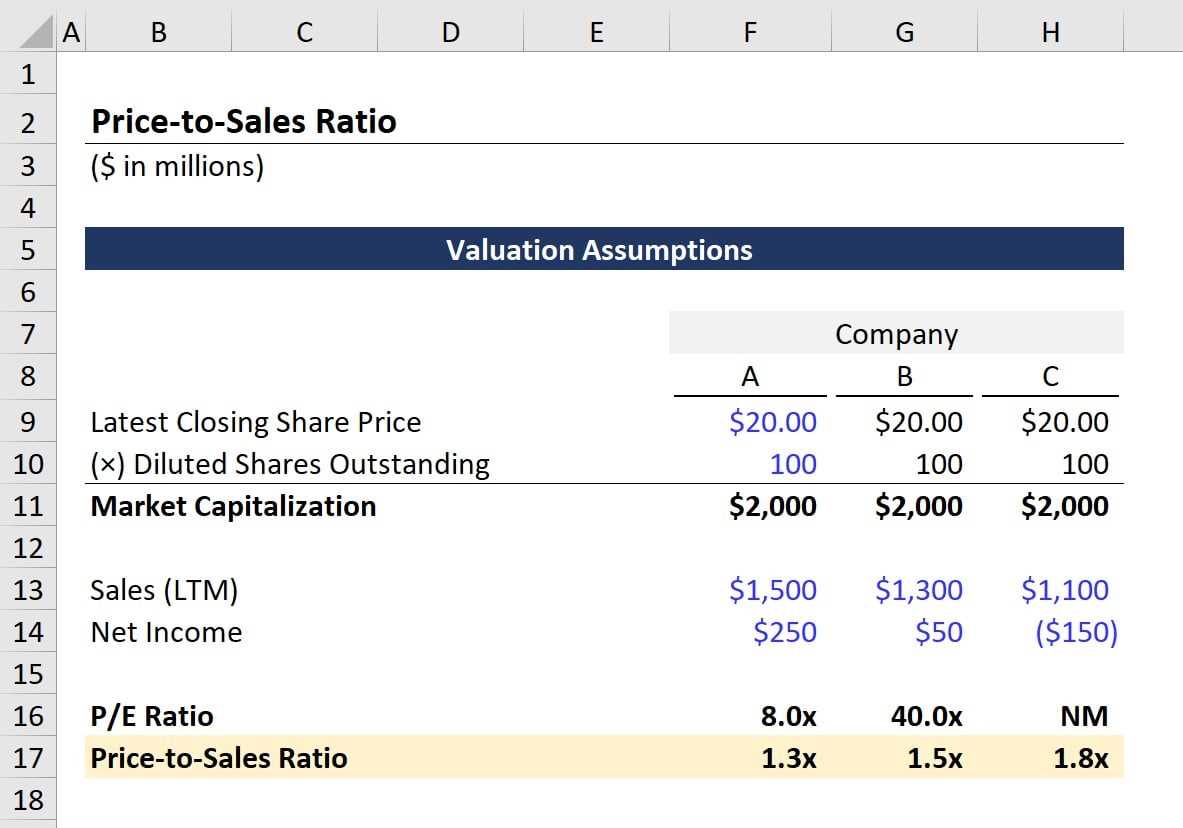

The Price-to-Sales Ratio (P/S Ratio) is a financial metric used to evaluate the valuation of a company’s stock. It is calculated by dividing the market capitalization of a company by its total sales revenue over a specific period, usually the trailing twelve months.

Definition and Calculation

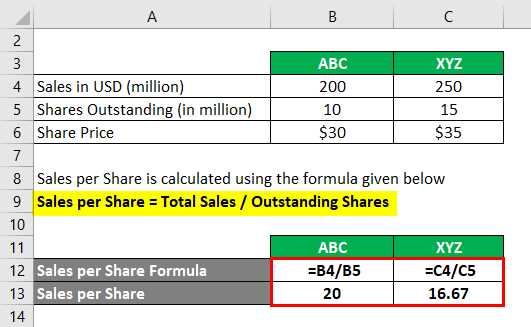

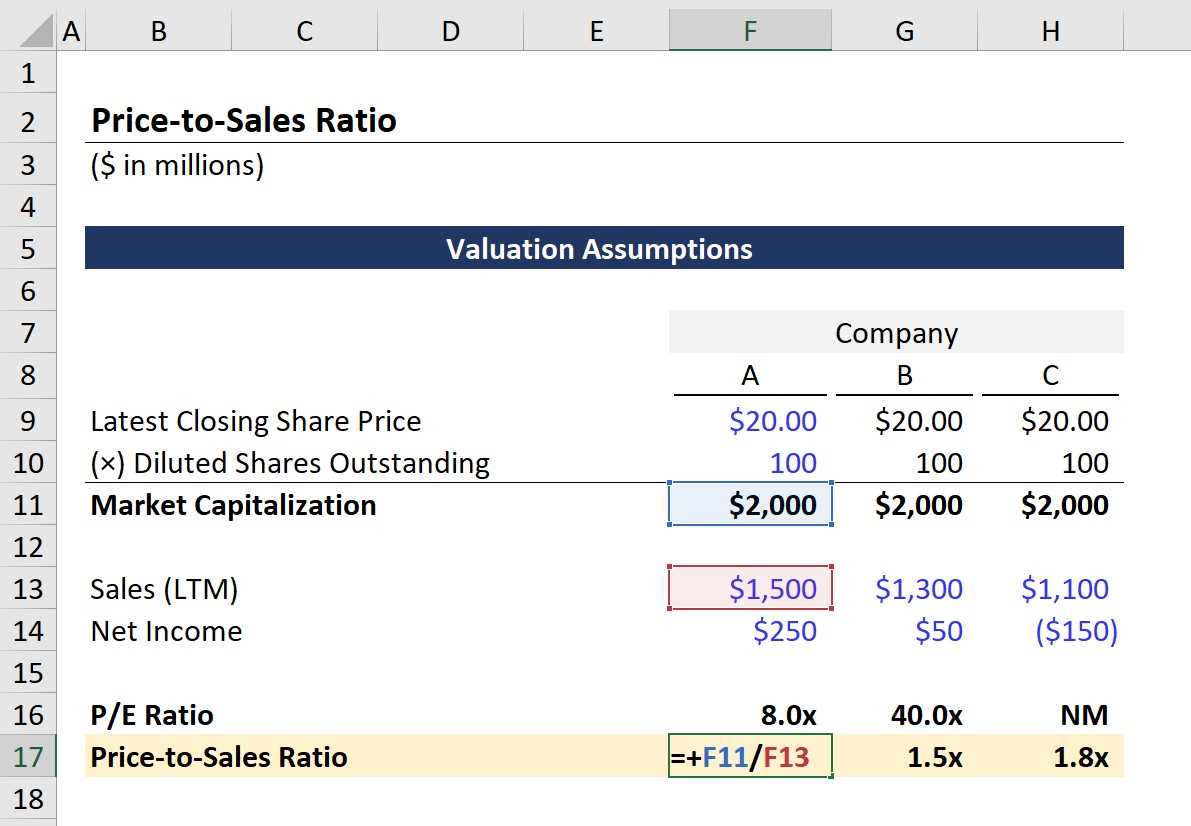

The Price-to-Sales Ratio is calculated by dividing the market capitalization of a company by its total sales revenue. The market capitalization is the total value of a company’s outstanding shares of stock, calculated by multiplying the current stock price by the number of outstanding shares. The total sales revenue is the total amount of money generated by a company from the sales of its products or services over a specific period, usually the trailing twelve months.

The formula for calculating the Price-to-Sales Ratio is:

P/S Ratio = Market Capitalization / Total Sales Revenue

Importance of Price-to-Sales Ratio

The Price-to-Sales Ratio is an important valuation metric because it provides investors with a quick and easy way to assess the relative value of a company’s stock. It is particularly useful for comparing companies in the same industry, as it allows investors to identify companies that may be overvalued or undervalued based on their sales revenue.

Benefits and Limitations

How to Interpret Price-to-Sales Ratio

Definition and Calculation

The Price-to-Sales (P/S) ratio is a financial metric used to evaluate a company’s valuation by comparing its market capitalization to its total revenue. It is calculated by dividing the market capitalization of a company by its total revenue in a given period.

To calculate the Price-to-Sales ratio, you need to know the market capitalization of the company, which is the total value of all its outstanding shares. You also need to know the total revenue of the company, which can be found in its financial statements.

Once you have the market capitalization and total revenue, you can use the following formula to calculate the Price-to-Sales ratio:

Price-to-Sales Ratio = Market Capitalization / Total Revenue

The resulting ratio represents the amount of money investors are willing to pay for each dollar of the company’s revenue. A higher P/S ratio indicates that investors are willing to pay a premium for the company’s revenue, while a lower P/S ratio suggests that the company may be undervalued.

Furthermore, the Price-to-Sales ratio is most effective when comparing companies within the same industry, as different industries may have varying revenue structures and profit margins.

Overall, the Price-to-Sales ratio provides investors with valuable insights into a company’s valuation and can be used as a tool for identifying potential investment opportunities.

Importance of Price-to-Sales Ratio

The Price-to-Sales (P/S) ratio is a key financial ratio that is used by investors and analysts to evaluate the value of a company’s stock. It is calculated by dividing the market price per share by the company’s annual sales per share.

The P/S ratio is an important tool for investors because it provides a snapshot of how much investors are willing to pay for each dollar of a company’s sales. A low P/S ratio may indicate that a company is undervalued, while a high P/S ratio may suggest that a company is overvalued.

There are several reasons why the P/S ratio is considered important:

| 1. Valuation: | The P/S ratio can help investors determine whether a stock is overvalued or undervalued. By comparing a company’s P/S ratio to its historical average or to the P/S ratios of its competitors, investors can get a sense of whether the stock is priced attractively or not. |

| 2. Growth Potential: | The P/S ratio can also provide insights into a company’s growth potential. A low P/S ratio may indicate that investors have low expectations for future growth, while a high P/S ratio may suggest that investors have high expectations for future growth. |

| 3. Comparability: | The P/S ratio is a useful tool for comparing companies within the same industry. By comparing the P/S ratios of different companies, investors can identify which companies are more attractively priced relative to their sales. |

| 4. Risk Assessment: | The P/S ratio can also be used as a measure of risk. A high P/S ratio may indicate that a company’s stock is more risky, as investors are paying a premium for each dollar of sales. Conversely, a low P/S ratio may suggest that a company’s stock is less risky. |

Benefits and Limitations of Price-to-Sales Ratio

The price-to-sales ratio (P/S ratio) is a valuable financial metric that provides investors with insights into a company’s valuation and potential investment opportunities. However, it is important to understand both the benefits and limitations of using this ratio in financial analysis.

Benefits:

- Simple Calculation: The P/S ratio is easy to calculate, making it accessible to both novice and experienced investors. It is calculated by dividing a company’s market capitalization by its total sales.

- Comparative Analysis: The P/S ratio allows for easy comparison between companies within the same industry. Investors can use this ratio to identify undervalued or overvalued stocks relative to their peers.

- Early Indicator: The P/S ratio can serve as an early indicator of a company’s financial health. A declining P/S ratio may suggest decreasing sales, while an increasing ratio may indicate growing sales.

Limitations:

- Industry Variations: The P/S ratio varies significantly across industries, making it less effective for comparing companies in different sectors. For example, technology companies often have higher P/S ratios compared to manufacturing companies.

- Revenue Manipulation: Companies can manipulate their revenue figures, making the P/S ratio less reliable. It is important to consider other financial metrics and conduct thorough due diligence before making investment decisions.

- Macro Factors: The P/S ratio does not consider macroeconomic factors or market conditions that may impact a company’s sales. Investors should consider the broader economic environment when interpreting the P/S ratio.

Despite its limitations, the P/S ratio can be a valuable tool for investors when used in conjunction with other financial ratios and analysis methods. It provides a snapshot of a company’s valuation relative to its sales and can help identify potential investment opportunities.

How to Interpret Price-to-Sales Ratio

Interpreting the price-to-sales ratio can provide valuable insights into a company’s financial health and market valuation. Here are some key considerations when analyzing this ratio:

1. Comparison to Industry Peers

One way to interpret the price-to-sales ratio is by comparing it to other companies in the same industry. A higher ratio may indicate that the company is overvalued compared to its peers, while a lower ratio may suggest undervaluation. It is important to consider factors such as growth prospects, profitability, and competitive advantages when making these comparisons.

2. Historical Trend

Analyzing the price-to-sales ratio over time can reveal the company’s performance and market sentiment. If the ratio has been consistently increasing, it may indicate positive investor sentiment and expectations for future growth. Conversely, a declining ratio could signal deteriorating financial performance or a lack of confidence in the company’s prospects.

3. Industry Average

4. Comparing to Historical Ratios

Comparing the current price-to-sales ratio to the company’s historical ratios can provide insights into its valuation relative to its own past performance. If the ratio is higher than its historical average, it may indicate a potential overvaluation, while a lower ratio may suggest undervaluation. This analysis should consider any significant changes in the company’s business model, industry dynamics, or market conditions.

5. Limitations and Context

| Advantages | Limitations |

|---|---|

| – Simple and easy to calculate | – Does not consider profitability |

| – Provides insight into market valuation | – Ignores debt levels and cash flow |

| – Can be used for industry and historical comparisons | – Interpretation depends on industry and company-specific factors |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.