Open-Ended Fund: Definition

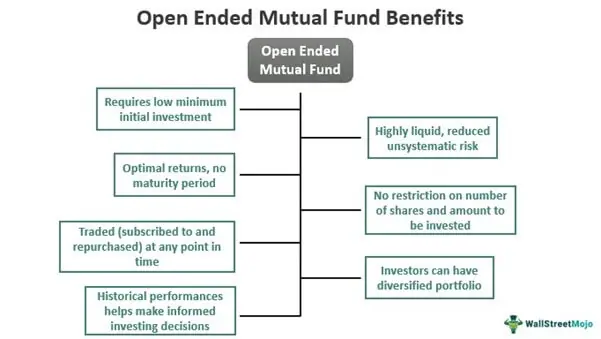

An open-ended fund is a type of mutual fund that does not have a fixed number of shares. Instead, the fund continuously issues and redeems shares based on investor demand. This means that investors can buy or sell shares of the fund at any time, and the fund manager is responsible for buying and selling the underlying assets to accommodate these transactions.

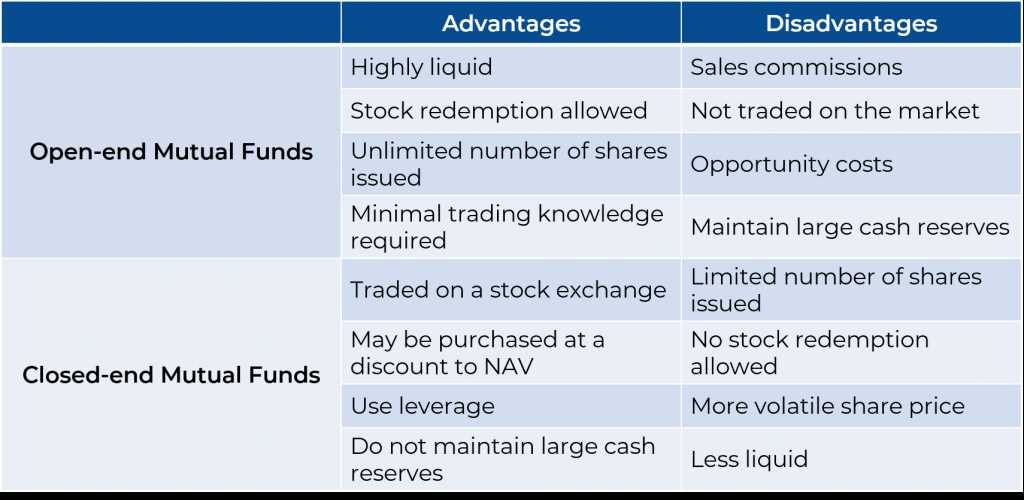

Open-ended funds are designed to provide investors with flexibility and liquidity. Unlike closed-ended funds, which have a fixed number of shares and trade on an exchange, open-ended funds can be bought and sold directly from the fund company at the net asset value (NAV) per share. This allows investors to enter or exit the fund at any time, without having to wait for a buyer or seller.

Open-ended funds are typically managed by professional fund managers who make investment decisions on behalf of the investors. These managers aim to achieve the investment objectives of the fund by investing in a diversified portfolio of securities, such as stocks, bonds, or a combination of both. The fund manager is responsible for monitoring the performance of the fund and making adjustments to the portfolio as needed.

Example of an Open-Ended Fund

Let’s say there is an open-ended equity fund called ABC Growth Fund. This fund aims to provide long-term capital appreciation by investing in a diversified portfolio of growth-oriented stocks. Investors can buy shares of the ABC Growth Fund directly from the fund company, and the fund manager will use the invested money to purchase stocks of various companies.

If an investor decides to sell their shares of the ABC Growth Fund, they can do so by contacting the fund company, and the fund manager will sell the corresponding number of stocks in the portfolio to accommodate the redemption. The investor will receive the proceeds from the sale based on the current NAV per share.

On the other hand, if more investors want to invest in the ABC Growth Fund, the fund manager will use the additional money to buy more stocks and issue new shares to the investors. This ensures that the fund remains open to new investments and can accommodate the demand from existing investors.

Overall, open-ended funds provide investors with the flexibility to buy or sell shares at any time, allowing them to easily adjust their investment positions based on their financial goals and market conditions.

Open-ended funds are a type of investment fund that offers investors the flexibility to buy or sell shares at any time. Unlike closed-ended funds, which have a fixed number of shares, open-ended funds can issue and redeem shares on an ongoing basis. This means that the fund can grow or shrink in size depending on investor demand.

Open-ended funds are typically managed by professional fund managers who make investment decisions on behalf of the investors. These fund managers have the responsibility of selecting the securities that will be included in the fund’s portfolio. The portfolio may consist of stocks, bonds, or other types of assets, depending on the fund’s investment objectives.

Investors in open-ended funds can benefit from the diversification provided by the fund’s portfolio. By pooling their money with other investors, they gain access to a wide range of securities that they may not be able to afford individually. This diversification helps to spread the risk and can potentially enhance returns.

One key feature of open-ended funds is their net asset value (NAV). The NAV represents the value of the fund’s assets minus its liabilities, divided by the number of outstanding shares. The NAV is calculated at the end of each trading day and is used to determine the price at which shares are bought or sold.

Another advantage of open-ended funds is their liquidity. Since investors can buy or sell shares at any time, they have the flexibility to access their money when needed. This makes open-ended funds a popular choice for investors who value liquidity and want the ability to quickly convert their investments into cash.

Open-Ended Fund: Example

An open-ended fund is a type of mutual fund that allows investors to buy and sell shares at any time. Unlike closed-ended funds, which have a fixed number of shares, open-ended funds can issue new shares or redeem existing shares based on investor demand. This flexibility makes open-ended funds a popular choice for many investors.

Let’s take a closer look at an example to better understand how open-ended funds work. Suppose you want to invest in a technology-focused mutual fund. You find an open-ended fund that specializes in technology companies and has a net asset value (NAV) of $10 per share. You decide to invest $1,000, so you purchase 100 shares of the fund at the NAV price.

A Real-Life Illustration of Open-Ended Funds

Open-ended funds are a popular investment option for individuals looking to diversify their portfolio and potentially earn higher returns. To better understand how open-ended funds work, let’s consider a real-life illustration:

John’s Investment Journey

Meet John, a young investor who wants to grow his wealth over time. He has heard about open-ended funds and decides to invest in one to achieve his financial goals.

John researches different open-ended funds available in the market and decides to invest in a technology-focused fund. He believes that the technology sector has great growth potential and wants to capitalize on it.

After carefully reviewing the fund’s prospectus, John decides to invest $10,000 in the technology-focused open-ended fund. He purchases units of the fund at the prevailing net asset value (NAV) per unit, which is calculated at the end of each trading day.

Over time, the technology sector experiences significant growth, and the value of the open-ended fund’s assets increases. As a result, the NAV per unit of the fund also rises.

John decides to monitor his investment regularly and notices that the NAV per unit has increased by 20% since he initially invested. This means that the value of his investment has also grown by 20%.

John decides to sell a portion of his units in the open-ended fund to lock in his profits. He sells $2,000 worth of units at the current NAV per unit and receives the proceeds in his investment account.

However, John still believes in the long-term growth potential of the technology sector and decides to keep the remaining units in the open-ended fund. He plans to hold onto them for a few more years to potentially benefit from further growth.

John continues to monitor his investment and makes informed decisions based on his financial objectives. He enjoys the convenience and liquidity provided by the open-ended fund, as it allows him to adjust his investment strategy as needed.

Open-Ended Fund: Pros and Cons

An open-ended fund is a type of mutual fund that allows investors to buy and sell shares at any time. This flexibility is one of the main advantages of open-ended funds, as it provides liquidity and allows investors to easily enter or exit the fund as per their convenience.

Here are some of the pros and cons of investing in open-ended funds:

| Pros | Cons |

|---|---|

| 1. Liquidity: Investors can buy or sell shares at any time, providing easy access to their investment. | 1. Fees: Open-ended funds may charge management fees, which can reduce overall returns. |

| 2. Diversification: Open-ended funds often invest in a wide range of securities, reducing the risk associated with investing in a single security. | 2. Price Fluctuations: The price of open-ended fund shares can fluctuate based on market conditions, potentially resulting in losses. |

| 3. Professional Management: Open-ended funds are managed by professional fund managers who have expertise in selecting and managing investments. | 3. Lack of Control: Investors in open-ended funds have limited control over the investment decisions made by the fund manager. |

| 4. Convenience: Investors can easily buy or sell shares online or through a broker, making it a convenient investment option. | 4. Capital Gains Tax: Investors may be subject to capital gains tax when selling shares of an open-ended fund. |

Overall, open-ended funds offer flexibility and convenience to investors, allowing them to easily enter or exit the fund. However, it is important for investors to carefully consider the fees, price fluctuations, lack of control, and potential tax implications associated with investing in open-ended funds.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.