Average Revenue Per Unit (ARPU) Definition

ARPU, or Average Revenue Per Unit, is a financial metric used to measure the average revenue generated by each unit or customer of a business over a specific period of time. It is commonly used in industries such as telecommunications, software, and subscription-based services to assess the financial performance and profitability of a company.

Importance of ARPU

ARPU is an important metric for businesses as it provides insights into the revenue generated per customer or unit. By analyzing ARPU, companies can evaluate the effectiveness of their pricing strategies, identify trends in customer spending, and make informed decisions regarding product offerings and marketing campaigns.

Calculating ARPU

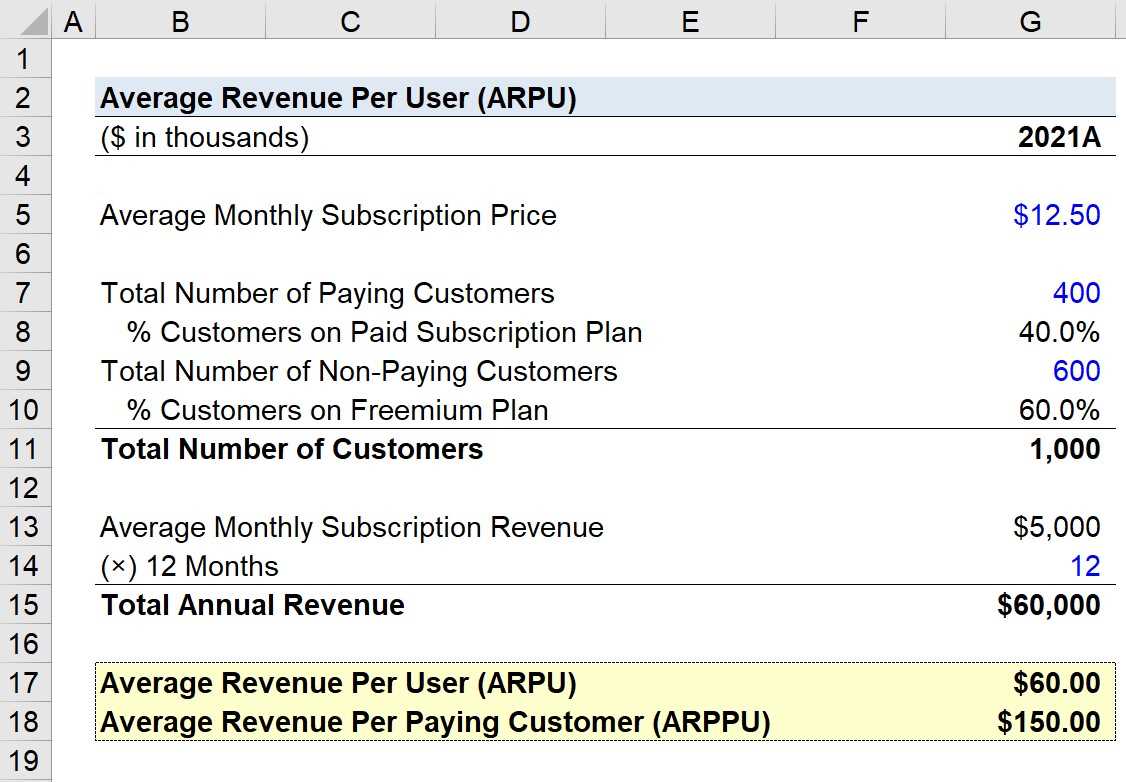

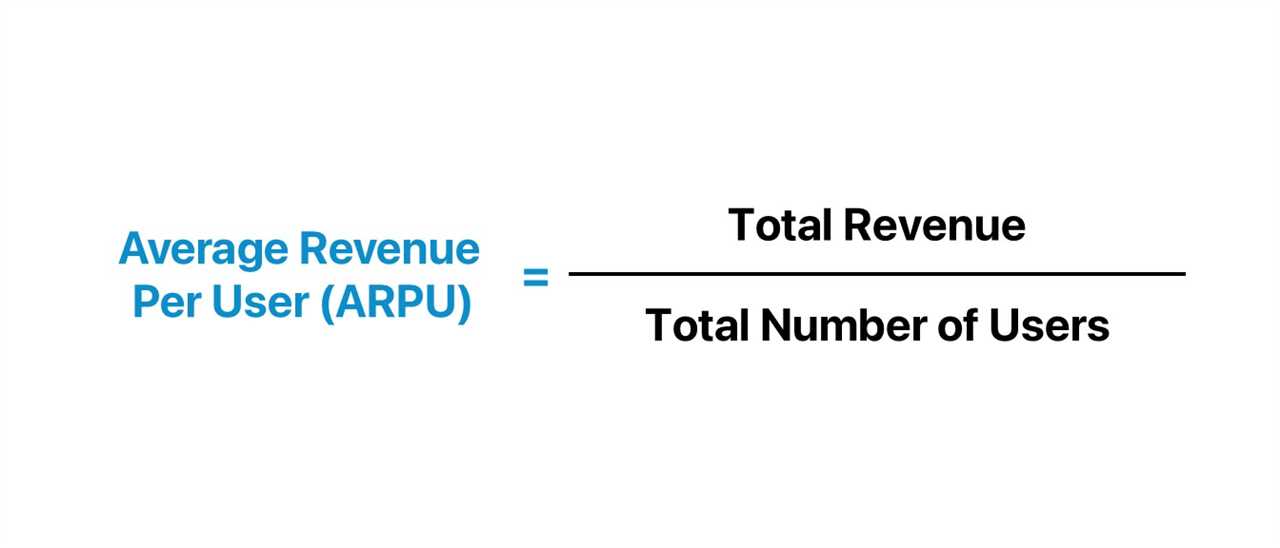

The formula to calculate ARPU is simple:

| Total Revenue | |

|---|---|

| Total Number of Units or Customers |

For example, if a company generates $1,000,000 in revenue and has 10,000 customers, the ARPU would be $100.

Factors Affecting ARPU

Several factors can influence ARPU, including pricing strategies, customer acquisition and retention rates, upselling and cross-selling techniques, and changes in customer behavior. By monitoring these factors, businesses can identify opportunities to increase ARPU and improve their overall financial performance.

What is ARPU and Why is it Important?

ARPU, or Average Revenue Per Unit, is a key performance indicator used in business and finance to measure the average revenue generated by each unit or customer. It is a metric that provides valuable insights into the financial health and performance of a company.

ARPU is calculated by dividing the total revenue generated by a company within a specific period by the total number of units or customers during that same period. This metric is commonly used in industries such as telecommunications, software-as-a-service (SaaS), and subscription-based businesses.

ARPU is important because it helps businesses understand how much revenue they are generating from each individual customer or unit. By tracking ARPU over time, companies can identify trends and changes in customer spending habits, pricing strategies, and overall market conditions.

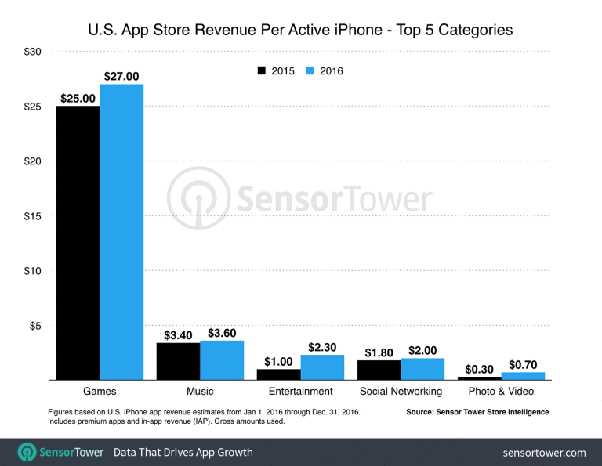

ARPU is particularly useful in subscription-based businesses, where customers pay a recurring fee for a product or service. By monitoring ARPU, companies can assess the effectiveness of their pricing strategies and identify opportunities for upselling or cross-selling to increase revenue per customer.

Additionally, ARPU can help businesses evaluate the success of marketing and sales efforts. By comparing ARPU across different customer segments or marketing campaigns, companies can determine which strategies are most effective in attracting high-value customers and driving revenue growth.

Furthermore, ARPU is often used by investors and analysts to assess the financial performance and growth potential of a company. A high ARPU indicates that a company is generating significant revenue from each customer, which can be a positive sign for investors.

Key Takeaways:

- ARPU, or Average Revenue Per Unit, measures the average revenue generated by each unit or customer.

- ARPU is calculated by dividing total revenue by the total number of units or customers.

- ARPU helps evaluate the success of marketing and sales efforts and can be used by investors to assess a company’s financial performance.

Overall, ARPU is a valuable metric that provides insights into a company’s revenue generation, customer behavior, and market dynamics. By tracking and analyzing ARPU, businesses can make informed decisions to optimize their pricing strategies, improve customer acquisition and retention, and drive sustainable growth.

How to Calculate ARPU

Calculating Average Revenue Per Unit (ARPU) is a straightforward process that involves dividing the total revenue generated by the number of units or subscribers.

Step 1: Determine the Time Period

First, you need to decide on the time period for which you want to calculate ARPU. It could be a month, a quarter, or a year, depending on your business needs.

Step 2: Gather the Revenue Data

Next, you need to collect the total revenue generated during the chosen time period. This can include revenue from various sources, such as product sales, service fees, and subscriptions.

Step 3: Count the Units or Subscribers

Count the total number of units or subscribers during the same time period. For example, if you are calculating ARPU for a telecommunications company, you would count the number of active mobile phone users or subscribers.

Step 4: Divide Revenue by Units or Subscribers

Finally, divide the total revenue by the number of units or subscribers to calculate ARPU. The formula for ARPU is:

ARPU = Total Revenue / Number of Units or Subscribers

For example, if a company generates $1,000,000 in revenue during a month and has 10,000 subscribers, the ARPU would be:

ARPU = $1,000,000 / 10,000 = $100

This means that, on average, each subscriber contributes $100 to the company’s revenue during the specified time period.

By calculating ARPU regularly, businesses can track their revenue per customer and identify trends or changes over time. This information can be valuable for making strategic decisions, optimizing pricing strategies, and evaluating the effectiveness of marketing campaigns.

Factors Affecting ARPU

1. Pricing Structure

The pricing structure of a product or service can have a significant impact on ARPU. Different pricing tiers or packages can attract customers with varying purchasing power and preferences. Offering higher-priced plans with additional features or benefits can increase ARPU by encouraging customers to upgrade. On the other hand, lower-priced plans may attract a larger customer base but result in a lower ARPU.

2. Customer Segmentation

3. Cross-Selling and Upselling

Cross-selling and upselling techniques involve offering additional products or services to existing customers. By encouraging customers to purchase complementary or upgraded products, businesses can increase their ARPU. For example, a telecommunications company may offer a discounted bundle of internet and cable TV services to customers who already subscribe to one of their services. This can result in higher revenue per customer and overall ARPU.

4. Customer Retention

Customer retention plays a crucial role in determining ARPU. Acquiring new customers can be costly, so retaining existing customers is often more cost-effective. By providing excellent customer service, personalized experiences, and loyalty programs, businesses can increase customer satisfaction and loyalty, leading to higher ARPU. Repeat purchases and long-term customer relationships contribute to a higher average revenue per unit.

5. Market Competition

ARPU in Accounting

ARPU, or Average Revenue Per Unit, is a key metric used in accounting to measure the average revenue generated by each unit of a product or service. It is a valuable indicator of a company’s financial performance and can provide insights into its pricing strategy, customer base, and overall profitability.

Why is ARPU Important?

ARPU is important for several reasons. Firstly, it helps businesses assess the effectiveness of their pricing strategy. By calculating the average revenue generated per unit, companies can determine whether their pricing is too high or too low compared to the value they provide.

ARPU is also crucial for evaluating the financial health of a company. By comparing ARPU with other financial metrics such as cost of goods sold (COGS) and operating expenses, businesses can determine their profitability and make informed decisions about resource allocation and budgeting.

Calculating ARPU

The formula for calculating ARPU is relatively straightforward. Simply divide the total revenue generated by the total number of units sold or subscribed to within a specific period. The formula can be represented as:

ARPU = Total Revenue / Total Units Sold

For example, if a company generates $100,000 in revenue from selling 1,000 units of a product, the ARPU would be $100.

Factors Affecting ARPU

Several factors can influence ARPU. One of the main factors is pricing. If a company increases its prices, the ARPU is likely to increase, assuming the demand for the product or service remains constant. Conversely, if prices are lowered, the ARPU may decrease.

Another factor is the mix of products or services sold. If a company offers multiple products or service tiers with different price points, the ARPU may vary depending on the mix of sales. For example, if more customers opt for higher-priced tiers, the ARPU will increase.

Lastly, external factors such as market competition and economic conditions can also affect ARPU. Increased competition may lead to price wars and lower ARPU, while favorable economic conditions may result in higher consumer spending and increased ARPU.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.