Net Interest Rate Spread: Definition and Use in Profit Analysis

The net interest rate spread is an indicator of a financial institution’s ability to generate income from its interest-earning assets, such as loans and investments. It is calculated by subtracting the interest expense from the interest income and dividing the result by the average interest-earning assets. The net interest rate spread is typically expressed as a percentage.

A positive net interest rate spread indicates that a financial institution is earning more interest income than it is paying out in interest expense. This is generally considered favorable, as it means that the institution is able to generate a profit from its interest-earning activities. On the other hand, a negative net interest rate spread indicates that the institution is paying out more in interest expense than it is earning in interest income, which can be a sign of financial distress.

Calculating Net Interest Rate Spread

To calculate the net interest rate spread, you need to gather the necessary financial data from a financial institution’s income statement and balance sheet. The interest income can be found under the “interest income” or “interest earned” line item, while the interest expense can be found under the “interest expense” or “interest paid” line item. The average interest-earning assets can be calculated by taking the average of the beginning and ending balances of the institution’s interest-earning assets.

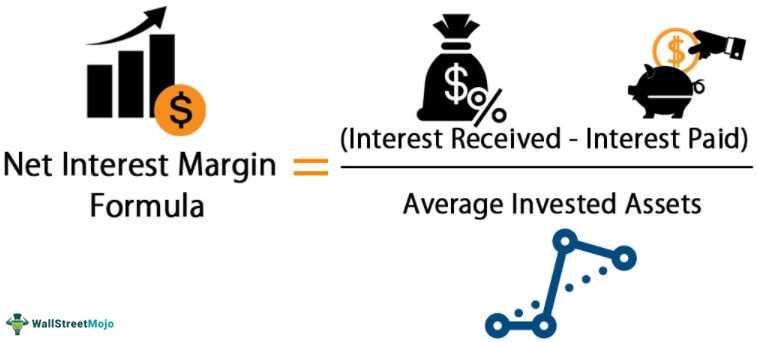

Once you have gathered the necessary data, you can calculate the net interest rate spread using the following formula:

Importance of Net Interest Rate Spread in Profit Analysis

The net interest rate spread is a key metric in profit analysis for financial institutions. It provides insights into the institution’s ability to generate income from its interest-earning activities and its overall profitability. A positive net interest rate spread indicates that the institution is able to generate a profit from its interest income, while a negative net interest rate spread may indicate financial difficulties.

By analyzing the net interest rate spread over time, financial institutions can identify trends and make informed decisions about their interest rate management, loan pricing, and overall business strategy. It can also help investors and stakeholders evaluate the financial health and performance of a financial institution.

The net interest rate spread is a financial metric that measures the difference between the interest income generated by a financial institution and the interest expenses it incurs. It is a crucial indicator of a bank’s profitability and efficiency in managing its interest-bearing assets and liabilities.

Net interest rate spread is calculated by subtracting the average interest rate paid on liabilities from the average interest rate earned on assets. The resulting figure represents the net interest income, which is a key component of a bank’s overall profitability.

Importance of Net Interest Rate Spread

The net interest rate spread is an important metric for both banks and investors. For banks, it provides insight into their ability to generate income from their lending activities and manage their interest rate risk. A wider net interest rate spread indicates that a bank is earning more interest income than it is paying in interest expenses, which is a positive sign of profitability.

Investors also pay close attention to the net interest rate spread when evaluating a bank’s financial health and performance. A wider spread suggests that a bank is effectively utilizing its assets to generate income and may be more capable of withstanding economic downturns or fluctuations in interest rates.

Furthermore, the net interest rate spread can be used as a benchmark for comparing the performance of different banks or financial institutions. It allows investors and analysts to assess the relative profitability and efficiency of these institutions and make informed investment decisions.

Factors Affecting Net Interest Rate Spread

Several factors can influence the net interest rate spread of a financial institution. One of the primary factors is the interest rate environment. When interest rates are low, banks may struggle to generate sufficient interest income to cover their interest expenses, resulting in a narrower spread. Conversely, in a high-interest-rate environment, banks may benefit from a wider spread.

The composition of a bank’s assets and liabilities can also impact its net interest rate spread. For example, if a bank has a higher proportion of low-yielding assets or high-cost liabilities, it may experience a narrower spread. On the other hand, a bank with a higher proportion of high-yielding assets or low-cost liabilities may enjoy a wider spread.

In addition, the competitive landscape and market conditions can affect a bank’s net interest rate spread. Increased competition among banks can lead to lower interest rates and narrower spreads, while a less competitive market may allow banks to charge higher interest rates and widen their spreads.

Calculating Net Interest Rate Spread

The net interest rate spread is a key financial metric used in profit analysis. It measures the difference between the interest earned on loans and investments and the interest paid on deposits and borrowings. Calculating the net interest rate spread allows financial institutions to assess their profitability and manage their interest rate risk.

To calculate the net interest rate spread, follow these steps:

Step 1: Determine Interest Income

Start by identifying all sources of interest income, such as loans, investments, and other interest-earning assets. Sum up the interest earned from each source to obtain the total interest income.

Step 2: Calculate Interest Expense

Next, determine all sources of interest expense, including deposits, borrowings, and other interest-bearing liabilities. Add up the interest paid on each source to find the total interest expense.

Step 3: Subtract Interest Expense from Interest Income

Subtract the total interest expense from the total interest income. The result is the net interest income.

Step 4: Divide Net Interest Income by Average Interest-Earning Assets

To calculate the net interest rate spread, divide the net interest income by the average interest-earning assets. This ratio provides a measure of the profitability of a financial institution’s interest-earning activities.

A positive net interest rate spread indicates that the institution is earning more interest income than it is paying in interest expenses, resulting in a profitable operation. Conversely, a negative net interest rate spread suggests that the institution is paying more in interest expenses than it is earning in interest income, indicating potential financial challenges.

Financial institutions closely monitor their net interest rate spread to assess their profitability and make informed decisions regarding their interest rate risk. By analyzing this metric, they can identify opportunities to increase interest income, manage interest expenses, and optimize their overall profitability.

Importance of Net Interest Rate Spread in Profit Analysis

The net interest rate spread is a crucial metric in profit analysis for financial institutions. It measures the difference between the interest earned on assets and the interest paid on liabilities, such as deposits or borrowings. This spread indicates the profitability of a financial institution’s core lending and borrowing activities.

A positive net interest rate spread signifies that the institution is earning more interest income from its assets than it is paying out in interest on its liabilities. This indicates a healthy profit margin and a strong financial position. It allows the institution to cover operating expenses, loan losses, and still generate a profit.

On the other hand, a negative net interest rate spread indicates that the institution is paying out more in interest on its liabilities than it is earning on its assets. This can be a cause for concern as it suggests that the institution’s interest expenses are higher than its interest income, potentially leading to losses or reduced profitability.

Furthermore, the net interest rate spread provides insights into the institution’s risk profile. A wider spread indicates a higher potential for profit, but it also suggests a higher level of risk. This is because a wider spread often results from charging higher interest rates on loans and investments, which may attract riskier borrowers. Therefore, financial institutions must strike a balance between maximizing profit and managing risk.

Overall, the net interest rate spread is a key indicator of a financial institution’s profitability and risk management. By analyzing this metric, institutions can identify areas of improvement, optimize their interest rate strategies, and make informed decisions to enhance their financial performance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.