What is Multi-Asset Class?

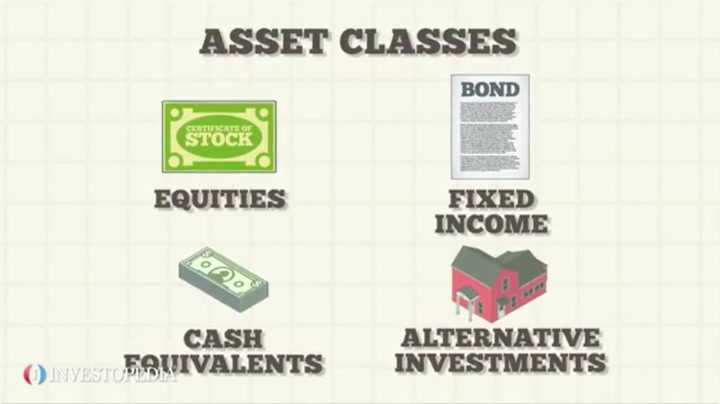

Multi-Asset Class refers to a type of investment strategy that involves diversifying a portfolio across multiple asset classes. Asset classes can include equities, bonds, commodities, real estate, and cash. The goal of multi-asset class investing is to reduce risk and increase potential returns by spreading investments across different types of assets.

Definition and Explanation

Multi-asset class investing is based on the principle of diversification, which is the practice of spreading investments across different assets to reduce the impact of any single investment on the overall portfolio. By investing in a mix of asset classes, investors can potentially benefit from the different risk and return characteristics of each asset class.

For example, equities have historically offered higher returns but also higher volatility, while bonds have provided more stable returns but lower potential for growth. By combining these asset classes, investors can potentially achieve a balance between risk and return.

Multi-asset class investing can be implemented through various types of funds, such as mutual funds, exchange-traded funds (ETFs), and closed-end funds. These funds are managed by professional portfolio managers who make investment decisions on behalf of the investors.

Types of Multi-Asset Class Funds

There are different types of multi-asset class funds, each with its own investment strategy and asset allocation. Some common types include:

- Income funds: These funds focus on generating regular income for investors by investing in a mix of fixed-income securities, such as bonds and dividend-paying stocks.

- Growth funds: These funds aim to achieve long-term capital appreciation by investing in a diversified portfolio of growth-oriented assets, such as stocks of companies with high growth potential.

These are just a few examples, and there are many other types of multi-asset class funds available to investors.

Benefits of Multi-Asset Class Investing

Multi-asset class investing offers several potential benefits for investors:

- Diversification: By investing in multiple asset classes, investors can reduce the impact of any single investment on their portfolio. This can help to mitigate risk and potentially improve overall portfolio performance.

- Potential for higher returns: By diversifying across different asset classes, investors can potentially benefit from the different risk and return characteristics of each asset class. This can help to enhance potential returns while managing risk.

- Flexibility: Multi-asset class funds provide investors with the flexibility to adjust their asset allocation based on their investment goals, risk tolerance, and market conditions. This can help investors to adapt their portfolios to changing market dynamics.

- Professional management: Multi-asset class funds are managed by professional portfolio managers who have expertise in asset allocation and investment selection. This can provide investors with access to professional investment management and potentially improve investment outcomes.

Overall, multi-asset class investing can be a valuable strategy for investors looking to achieve diversification, manage risk, and potentially enhance returns in their investment portfolios.

Definition and Explanation

Multi-asset class refers to a type of investment strategy that involves diversifying a portfolio across multiple asset classes, such as stocks, bonds, commodities, and real estate. This approach aims to reduce risk and enhance returns by spreading investments across different types of assets that have varying levels of risk and return potential.

By investing in multiple asset classes, investors can potentially benefit from the performance of different markets and sectors, as well as take advantage of the potential for lower correlation between asset classes. This means that when one asset class is performing poorly, another may be performing well, helping to offset losses and potentially increase overall portfolio returns.

Benefits of Multi-Asset Class Investing

There are several benefits to adopting a multi-asset class investment strategy:

Diversification:

Investing in multiple asset classes helps to spread risk and reduce the impact of any single investment or asset class on the overall portfolio. Diversification can help to smooth out volatility and potentially improve risk-adjusted returns.

By diversifying across different asset classes, investors can mitigate the risk of significant losses in the event of a downturn in a particular market or sector. This can help to protect the value of the portfolio and provide a more stable investment experience.

Enhanced Returns:

Investing in multiple asset classes allows investors to potentially benefit from the performance of different markets and sectors. By spreading investments across asset classes with varying levels of risk and return potential, investors can potentially achieve higher overall returns compared to investing in a single asset class.

Flexibility:

Multi-asset class investing provides flexibility in adapting to changing market conditions. By having exposure to different asset classes, investors can adjust their allocations based on their outlook for different markets and sectors, potentially taking advantage of opportunities and managing risks more effectively.

Types of Multi-Asset Class Funds

Multi-asset class funds are a type of investment fund that invests in a diverse range of asset classes, such as stocks, bonds, real estate, commodities, and more. These funds aim to provide investors with a diversified portfolio that can help reduce risk and potentially increase returns.

There are several types of multi-asset class funds, each with its own investment strategy and risk profile:

1. Balanced Funds:

2. Target Date Funds:

3. Global Allocation Funds:

Global allocation funds invest in a mix of domestic and international stocks, bonds, and cash. These funds aim to provide broad diversification across different geographic regions and asset classes.

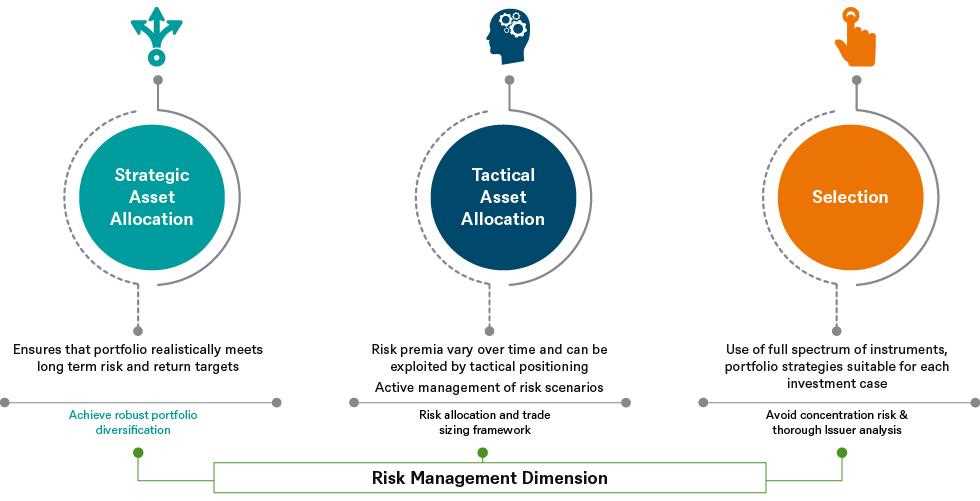

4. Tactical Asset Allocation Funds:

Tactical asset allocation funds have the flexibility to adjust their asset allocation based on market conditions. They may shift their investments between different asset classes to take advantage of opportunities or reduce risk.

5. Income Funds:

Income funds focus on generating regular income for investors through investments in fixed-income securities, such as bonds and dividend-paying stocks. These funds may have a higher allocation to bonds and other income-generating assets.

6. Growth Funds:

Growth funds primarily invest in stocks of companies that have the potential for above-average growth. These funds are suitable for investors who are willing to take on more risk in exchange for the potential for higher returns.

Types of Multi-Asset Class Funds

Multi-asset class funds are investment vehicles that provide exposure to a diversified portfolio of assets across different asset classes. These funds can include a combination of equity funds, bond funds, real estate funds, and other types of funds.

1. Equity Funds: These funds invest in stocks of companies across various sectors and regions. They offer the potential for capital appreciation and can be a good option for investors seeking long-term growth.

3. Real Estate Funds: Real estate funds invest in properties such as residential, commercial, and industrial real estate. These funds offer the potential for income through rental payments and capital appreciation through property value appreciation.

4. Commodity Funds: Commodity funds invest in physical commodities such as gold, silver, oil, and agricultural products. These funds provide exposure to the commodity markets and can be used as a hedge against inflation or as a diversification tool.

7. Alternative Investment Funds: Alternative investment funds include hedge funds, private equity funds, and venture capital funds. These funds invest in non-traditional assets and strategies and can provide diversification and potential higher returns, but they also come with higher risk.

By investing in multi-asset class funds, investors can benefit from diversification across different asset classes, which can help reduce risk and potentially enhance returns. It is important for investors to carefully consider their investment objectives, risk tolerance, and time horizon before investing in any specific multi-asset class fund.

Benefits of Multi-Asset Class Investing

Multi-asset class investing offers several benefits to investors. By diversifying across different asset classes, investors can potentially reduce risk and increase their chances of achieving their financial goals. Here are some key benefits of multi-asset class investing:

1. Risk Diversification

One of the main advantages of multi-asset class investing is risk diversification. By spreading investments across different asset classes, such as equities, bonds, and commodities, investors can reduce the impact of any single investment on their overall portfolio. This diversification helps to mitigate the risk of significant losses in case one asset class underperforms.

2. Potential for Higher Returns

Multi-asset class investing also offers the potential for higher returns. By investing in a mix of asset classes, investors can take advantage of different market cycles and capture opportunities for growth. For example, during periods of economic expansion, equities may outperform bonds, while during economic downturns, bonds may provide more stability. By having exposure to both asset classes, investors can potentially benefit from the best of both worlds.

3. Flexibility and Adaptability

Another benefit of multi-asset class investing is the flexibility and adaptability it provides. As market conditions change, the performance of different asset classes can vary. By having a diversified portfolio, investors can adjust their allocations to take advantage of these changing dynamics. This flexibility allows investors to navigate different market environments and potentially enhance their overall returns.

4. Simplified Portfolio Management

Managing a multi-asset class portfolio can also simplify the overall investment process. Instead of having to select and monitor individual investments across different asset classes, investors can rely on professional portfolio managers who specialize in multi-asset class investing. These managers have the expertise and resources to make informed investment decisions and actively manage the portfolio to optimize returns.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.