What is a Loan Credit Default Swap (LCDS)?

A Loan Credit Default Swap (LCDS) is a financial derivative instrument that allows investors to protect themselves against the risk of default on a specific loan or a portfolio of loans. It is a type of credit default swap (CDS) that focuses specifically on loans rather than other types of debt.

LCDSs are typically used by banks, financial institutions, and hedge funds to manage their credit risk exposure. They provide a way for these entities to transfer the risk of default to other parties, such as insurance companies or other investors who are willing to take on the risk in exchange for a premium.

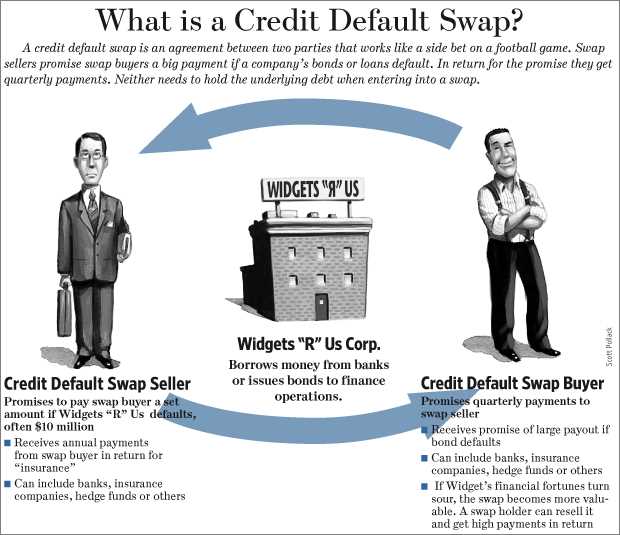

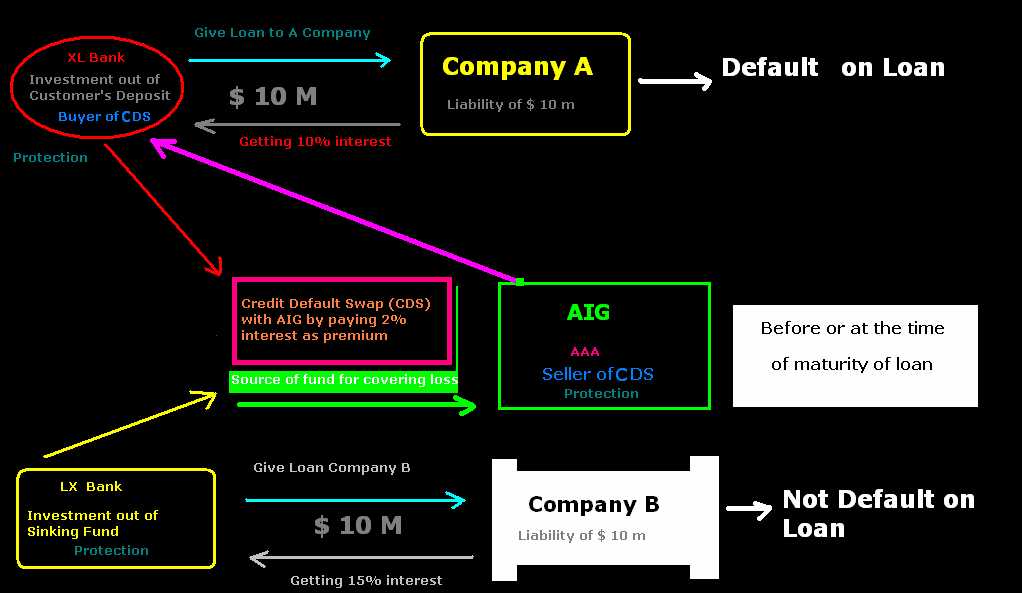

LCDSs work by creating a contract between two parties: the protection buyer and the protection seller. The protection buyer pays a premium to the protection seller in exchange for protection against the risk of default on the underlying loan or loans.

If a default event occurs, such as a missed payment or bankruptcy, the protection seller is obligated to pay the protection buyer the face value of the loan or the agreed-upon amount. This provides the protection buyer with compensation for the loss incurred due to the default.

LCDSs are typically structured as over-the-counter (OTC) contracts, meaning they are privately negotiated between the two parties involved. This allows for greater flexibility in terms of contract terms and customization to meet the specific needs of the parties involved.

How LCDS Works

LCDSs are typically based on a reference entity, which is the borrower or group of borrowers whose loans are being protected. The reference entity can be a single company or a portfolio of loans, such as a group of corporate loans or mortgage-backed securities.

The protection buyer and protection seller agree on the terms of the contract, including the notional amount, premium payments, and the trigger events that would lead to a payout. Trigger events can include default, bankruptcy, or other specified credit events.

If a trigger event occurs, the protection buyer can submit a claim to the protection seller, who is then obligated to pay the agreed-upon amount. The protection seller may also have the option to deliver the underlying loan or loans to the protection buyer instead of making a cash payment.

Benefits of LCDS

LCDSs offer several benefits to investors and financial institutions. Firstly, they provide a way to hedge against the risk of default on specific loans or loan portfolios, allowing investors to protect themselves from potential losses.

Additionally, LCDSs can be used for speculative purposes, allowing investors to profit from changes in credit risk. By taking a position as a protection buyer or seller, investors can potentially earn a profit if the creditworthiness of the reference entity improves or deteriorates.

Furthermore, LCDSs provide liquidity to the market by allowing investors to trade the risk of default on loans. This can help to improve market efficiency and facilitate the flow of capital.

Risks Associated with LCDS

While LCDSs offer benefits, they also come with risks. One of the main risks is counterparty risk, which is the risk that the protection seller may not be able to fulfill their obligations in the event of a default. This risk can be mitigated by conducting thorough due diligence on the counterparty and using collateral or credit enhancement mechanisms.

There is also the risk of basis risk, which occurs when there is a mismatch between the reference entity and the underlying loan or loans. This can result in a discrepancy between the actual default risk and the risk priced into the LCDS contract.

Additionally, the complexity of LCDSs can make them difficult to understand and value accurately. This can lead to pricing errors and increased volatility in the market.

Overall, while LCDSs can be useful tools for managing credit risk, it is important for investors to carefully consider the risks involved and seek professional advice if needed.

A Loan Credit Default Swap (LCDS) is a financial derivative that allows investors to protect themselves against the risk of default on a specific loan or a group of loans. It is a type of credit default swap (CDS) that is specifically designed for loans.

LCDSs are typically used by banks, hedge funds, and other financial institutions to manage their credit risk exposure. They provide a way for investors to transfer the risk of default on a loan to another party, such as an insurance company or another investor.

When a borrower takes out a loan, the lender faces the risk that the borrower may default on the loan and fail to repay the principal and interest. By purchasing an LCDS, the lender can transfer this risk to another party. If the borrower defaults on the loan, the party that sold the LCDS will compensate the lender for the loss.

LCDSs are typically structured as over-the-counter (OTC) contracts, meaning that they are privately negotiated between two parties. The terms of the LCDS, including the reference loan or loans, the notional amount, the premium, and the maturity date, are all agreed upon between the buyer and the seller.

The notional amount of an LCDS represents the total value of the loan or loans that the contract is based on. The premium is the cost of the LCDS, which is paid by the buyer to the seller. The maturity date is the date on which the contract expires.

LCDSs can be used for various purposes, including hedging, speculation, and arbitrage. They allow investors to take a position on the creditworthiness of a borrower or a group of borrowers without actually owning the underlying loan or loans.

How LCDS Works

A Loan Credit Default Swap (LCDS) is a financial derivative that allows investors to hedge against the risk of default on a specific loan or a portfolio of loans. It works by transferring the credit risk associated with the loan to another party, typically a credit protection seller.

When an investor purchases an LCDS, they are essentially buying insurance against the possibility of default on the underlying loan. In exchange for regular premium payments, the credit protection seller agrees to compensate the investor in the event of a default.

The premium payments are typically based on the creditworthiness of the borrower and the perceived risk of default. If the borrower’s creditworthiness deteriorates, the premium payments may increase to reflect the higher risk. Conversely, if the borrower’s creditworthiness improves, the premium payments may decrease.

LCDS contracts are typically structured as credit default swaps (CDS) with a reference obligation, which is the specific loan or portfolio of loans. The contract specifies the terms of the swap, including the notional amount, maturity date, and the trigger event that would constitute a default.

In the event of a default on the underlying loan, the credit protection seller is obligated to pay the investor the agreed-upon amount, which is typically the face value of the loan minus any recovery value. The investor can then use this payment to offset their losses from the default.

LCDS can be used by a variety of market participants, including banks, hedge funds, and insurance companies, to manage their credit risk exposure. They provide a way to transfer and diversify credit risk, allowing investors to mitigate the potential losses associated with default.

Example

Let’s say an investor holds a portfolio of loans and is concerned about the risk of default. They can enter into an LCDS contract with a credit protection seller, agreeing to pay regular premium payments in exchange for protection against default on the loans.

If one of the loans in the portfolio defaults, the credit protection seller is obligated to pay the investor the agreed-upon amount. This payment can help offset the losses incurred from the default, providing the investor with some level of protection.

Conclusion

Benefits of Loan Credit Default Swaps (LCDS)

Loan Credit Default Swaps (LCDS) offer several benefits to market participants, including:

- Hedging: LCDS provide a way for investors to hedge against the risk of default on loans. By purchasing LCDS, investors can protect themselves from potential losses in case the borrower defaults on the underlying loan.

- Portfolio Diversification: LCDS allow investors to diversify their portfolios by adding exposure to credit risk. This can be particularly attractive for investors looking to enhance their returns or manage their overall risk profile.

- Liquidity: LCDS can enhance market liquidity by providing an additional avenue for trading credit risk. This can be beneficial for both buyers and sellers, as it increases the ease with which they can enter or exit positions.

- Price Discovery: LCDS can contribute to price discovery in the loan market by providing a transparent and tradable instrument that reflects market sentiment regarding credit risk. This can help market participants assess the fair value of loans and make more informed investment decisions.

- Customization: LCDS offer flexibility in terms of contract design and can be tailored to meet the specific needs of market participants. This allows investors to manage their exposure to credit risk in a way that aligns with their investment objectives and risk appetite.

- Efficiency: LCDS can enhance the efficiency of the loan market by facilitating the transfer of credit risk from lenders to investors who are better equipped to manage it. This can free up capital for lenders, allowing them to extend more credit to borrowers and stimulate economic growth.

Overall, Loan Credit Default Swaps (LCDS) provide a range of benefits that can help market participants manage credit risk, enhance portfolio performance, and contribute to the efficient functioning of the loan market.

Risks Associated with LCDS

While Loan Credit Default Swaps (LCDS) can provide various benefits, they also come with certain risks that investors should be aware of. These risks include:

- Counterparty Risk: One of the main risks associated with LCDS is counterparty risk. This refers to the risk that the party on the other side of the LCDS contract may default on their obligations. If the counterparty defaults, the investor may not receive the payments they are entitled to.

- Liquidity Risk: LCDS can also be subject to liquidity risk. This means that there may not be enough buyers or sellers in the market to facilitate the trading of LCDS contracts. In illiquid markets, investors may have difficulty buying or selling LCDS contracts at fair prices.

- Market Risk: LCDS are influenced by market conditions and factors that can affect the value of the underlying loans. Changes in interest rates, credit spreads, or overall market sentiment can impact the value of LCDS contracts. Investors may experience losses if the market moves against their positions.

- Legal and Regulatory Risk: LCDS are subject to legal and regulatory risks. Changes in laws or regulations governing LCDS contracts can impact their value and the ability of investors to enforce their rights. It is important for investors to stay informed about any legal or regulatory changes that may affect their LCDS investments.

- Basis Risk: Basis risk refers to the risk that the LCDS contract may not perfectly hedge the investor’s exposure to the underlying loans. This can occur due to differences in the reference entity, maturity, or other contract terms. Basis risk can result in losses if the LCDS contract does not provide the desired level of protection.

- Default Correlation Risk: LCDS are also exposed to default correlation risk. This refers to the risk that multiple loans within a portfolio may default at the same time, leading to higher-than-expected losses. Default correlation risk can be difficult to predict and manage, and it can impact the overall performance of LCDS contracts.

Investors should carefully consider these risks before investing in LCDS. It is important to conduct thorough research, assess one’s risk tolerance, and consult with financial professionals to make informed investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.