Definition and Explanation of Basis Risk in Stock Trading

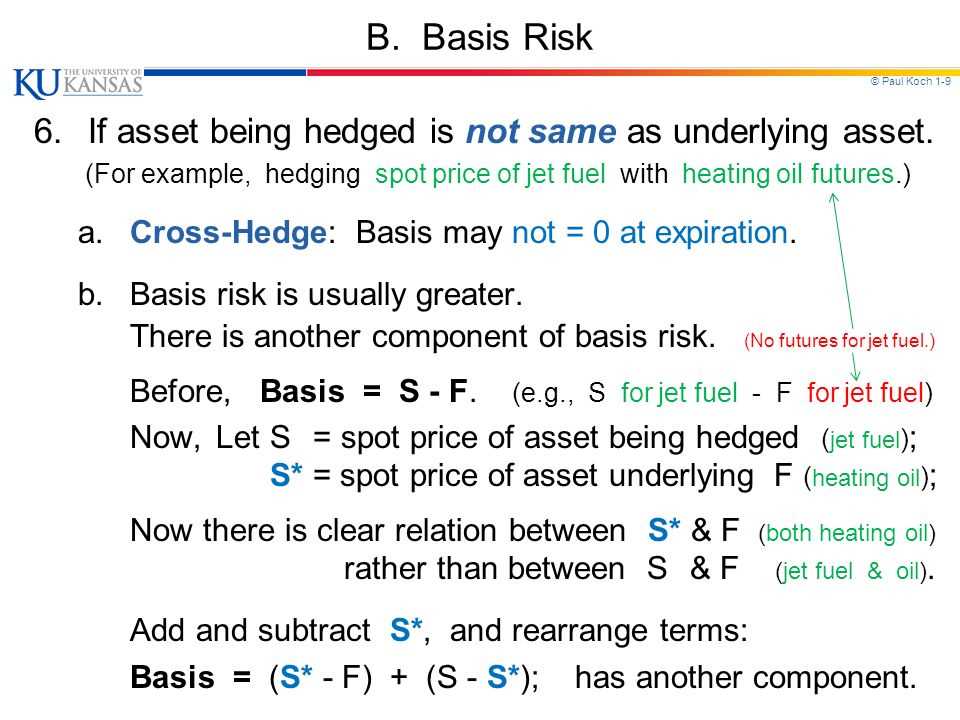

In stock trading, basis risk refers to the potential for a discrepancy or deviation between the price of a stock or security and its corresponding futures contract. This risk arises due to various factors such as market conditions, supply and demand dynamics, and other external influences.

When an investor or trader enters into a futures contract to hedge their position in a particular stock or security, they do so with the expectation that the price of the futures contract will closely track the price of the underlying asset. However, due to basis risk, there is no guarantee that the prices will move in perfect synchronization.

Basis risk occurs because the price of a futures contract is influenced by a variety of factors, including interest rates, dividends, storage costs, and market sentiment. These factors can cause the price of the futures contract to deviate from the price of the underlying asset, resulting in basis risk.

For example, let’s say an investor holds a significant position in a particular stock and wants to hedge against potential price fluctuations. They decide to enter into a futures contract on that stock to offset any potential losses. However, if the price of the futures contract does not closely track the price of the stock, the investor may not achieve the desired level of protection, and basis risk comes into play.

Types of Basis Risk

There are several types of basis risk that can occur in stock trading:

- Temporary Basis Risk: This type of basis risk occurs when there is a temporary discrepancy between the price of the stock and the futures contract. It may be caused by short-term market fluctuations or other temporary factors.

- Permanent Basis Risk: Permanent basis risk refers to a long-term deviation between the price of the stock and the futures contract. This can be caused by fundamental changes in the market or other structural factors.

- Basis Risk due to Delivery Location: In some cases, the location where the futures contract is settled may differ from the location of the underlying asset. This can result in basis risk if there are transportation costs or other logistical issues involved.

- Basis Risk due to Time: Basis risk can also arise due to differences in the expiration dates of the futures contract and the underlying asset. This can result in a mismatch in pricing and potential basis risk.

It is important for traders and investors to be aware of basis risk and understand its potential impact on their hedging strategies. By carefully monitoring and managing basis risk, traders can minimize potential losses and optimize their trading strategies.

Types of Basis Risk in Stock Trading

In stock trading, basis risk refers to the potential for a discrepancy between the price of a derivative contract and the underlying asset it is based on. This discrepancy can arise due to various factors, including market conditions, timing, and liquidity.

1. Price Basis Risk

Price basis risk occurs when there is a difference in the price of the derivative contract and the underlying asset. This can be caused by fluctuations in supply and demand, changes in market conditions, or other factors that affect the pricing of the asset. Traders need to be aware of price basis risk as it can impact their profitability and investment decisions.

2. Time Basis Risk

Time basis risk arises from the difference in the expiration dates of the derivative contract and the underlying asset. This can occur when the derivative contract expires before the underlying asset, or vice versa. Traders need to consider time basis risk when planning their trading strategies and managing their positions to avoid potential losses.

3. Delivery Basis Risk

Delivery basis risk occurs when there is a discrepancy between the delivery terms of the derivative contract and the underlying asset. This can happen when there are differences in the quality, quantity, or location of the asset specified in the contract. Traders should carefully evaluate the delivery basis risk to ensure that the terms of the contract align with their trading objectives and expectations.

4. Counterparty Basis Risk

Counterparty basis risk refers to the potential risk associated with the counterparty in a derivative contract. This can arise when the counterparty fails to fulfill their obligations or defaults on the contract. Traders should assess the creditworthiness and reliability of the counterparty to mitigate counterparty basis risk and protect their investments.

Formula for Calculating Basis Risk in Stock Trading

In stock trading, basis risk refers to the potential loss that can occur due to the difference between the price of a futures contract and the price of the underlying asset. This risk arises because the value of the futures contract may not perfectly track the price movements of the underlying asset.

The formula for calculating basis risk is as follows:

Where:

- Futures Price is the price at which the futures contract is trading in the market.

- Spot Price is the current price of the underlying asset.

By subtracting the spot price from the futures price, we can determine the basis risk. A positive basis risk indicates that the futures price is higher than the spot price, while a negative basis risk indicates that the futures price is lower than the spot price.

It is important to note that basis risk can vary depending on the specific futures contract and the underlying asset being traded. Different factors such as supply and demand dynamics, market expectations, and economic conditions can influence the basis risk.

Overall, the formula for calculating basis risk provides a quantitative measure of the potential deviation between the futures price and the spot price. By monitoring and analyzing basis risk, traders can better assess the risk-reward profile of their trading strategies and adjust their positions accordingly.

Examples of Basis Risk in Stock Trading Strategies

Example 1: Hedging with Futures Contracts

One common strategy used by traders to hedge against price fluctuations is to use futures contracts. For example, let’s say an investor holds a portfolio of stocks and wants to protect against a potential decline in the market. They decide to sell futures contracts on an index that closely tracks their portfolio.

Example 2: Trading Options

Another example of basis risk in stock trading is when traders use options contracts. Options give traders the right, but not the obligation, to buy or sell a stock at a predetermined price within a specific timeframe.

Let’s say a trader purchases a call option on a stock they believe will increase in value. However, if the underlying stock price does not move as expected, the option may expire worthless, resulting in a loss for the trader.

Example 3: Currency Risk

Basis risk can also occur in currency trading. When trading foreign currencies, traders are exposed to exchange rate fluctuations. For example, if a trader buys a currency pair expecting the base currency to appreciate against the quote currency, but the exchange rate moves in the opposite direction, the trader may experience losses.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.