Lease Payments: Definition, Contract Terms, Types of Leases

Lease payments are an important aspect of any lease agreement. They refer to the regular payments made by the lessee to the lessor in exchange for the use of a property or asset. These payments are typically made on a monthly basis and are outlined in the lease contract.

Definition of Lease Payments

Contract Terms for Lease Payments

The contract terms for lease payments vary depending on the specific agreement between the lessee and lessor. These terms typically include the amount of the lease payments, the frequency of payment, the duration of the lease, and any penalties or late fees for missed or delayed payments.

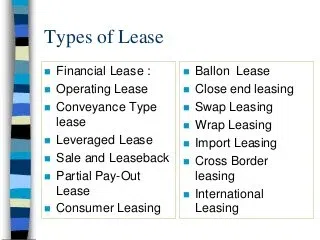

Types of Leases

There are different types of leases that may impact the structure and terms of lease payments. Some common types of leases include:

- Operating Lease: This type of lease allows the lessee to use an asset for a specific period of time without assuming ownership. Lease payments are typically lower compared to other types of leases.

- Finance Lease: In a finance lease, the lessee assumes ownership of the asset at the end of the lease term. Lease payments are structured to cover the cost of the asset and may be higher compared to operating leases.

Definition of Lease Payments

Lease payments refer to the regular payments made by a lessee to a lessor in exchange for the use of a property or asset. This contractual agreement allows the lessee to have temporary possession and control over the property, while the lessor retains ownership.

Lease payments are typically outlined in a lease agreement, which specifies the amount, frequency, and duration of the payments. The payment terms may vary depending on the type of lease and the negotiated terms between the parties involved.

Lease payments are an essential component of leasing arrangements, allowing businesses and individuals to access assets and properties without the need for upfront capital investment. By making regular lease payments, lessees can enjoy the benefits of using the leased property while preserving their cash flow and financial flexibility.

| Advantages of Lease Payments | Disadvantages of Lease Payments |

|---|---|

| Preserves cash flow | May be more expensive in the long run compared to purchasing |

| Provides flexibility to upgrade or change assets | Does not provide ownership or equity in the leased property |

| Allows for tax benefits, such as deducting lease payments as business expenses | May be subject to penalties or additional fees for early termination |

Contract Terms for Lease Payments

When entering into a lease agreement, it is important to understand the contract terms for lease payments. These terms outline the financial obligations and responsibilities of both the lessor (the owner of the property) and the lessee (the individual or business renting the property).

1. Rent Amount

The rent amount is the agreed-upon sum that the lessee must pay to the lessor in exchange for the use of the property. It is typically paid on a monthly basis, but can also be paid quarterly or annually, depending on the terms of the lease agreement.

2. Payment Schedule

The payment schedule specifies when the lease payments are due. It may outline specific due dates or provide a general timeframe, such as “due on the first of each month.” It is important for the lessee to adhere to the payment schedule to avoid any late fees or penalties.

3. Late Payment Penalties

In the event that the lessee fails to make the lease payments on time, the lease agreement may include provisions for late payment penalties. These penalties can vary, but may include additional fees or an increased interest rate on the outstanding balance.

4. Security Deposit

Many lease agreements require the lessee to provide a security deposit upfront. This deposit acts as a form of insurance for the lessor in case of any damage to the property or unpaid rent. The terms of the lease should outline the amount of the security deposit and any conditions for its return at the end of the lease term.

5. Renewal Options

Some lease agreements may include options for renewal at the end of the initial lease term. These renewal options outline the terms and conditions for extending the lease, including any changes to the rent amount or payment schedule. It is important for both parties to review and agree upon these renewal options before signing the lease agreement.

Types of Leases

1. Operating Lease

An operating lease is a short-term lease agreement where the lessee (the business) pays only for the use of the asset during the lease term. This type of lease is commonly used for equipment or vehicles that have a limited useful life. The lessor (the owner of the asset) retains ownership and is responsible for maintenance and repairs.

Operating leases are often more flexible than other types of leases, allowing businesses to upgrade or replace assets easily. They also typically have lower monthly payments compared to other lease types.

2. Finance Lease

Finance leases are commonly used for assets that have a longer useful life, such as buildings or machinery. They often have higher monthly payments compared to operating leases, but they provide the lessee with more control and ownership-like benefits.

3. Sale and Leaseback

A sale and leaseback arrangement involves a business selling an asset to a lessor and then leasing it back for a specified period. This type of lease allows businesses to free up capital tied to the asset while still retaining its use.

Sale and leaseback arrangements are often used for real estate or large equipment. They can provide businesses with immediate cash flow and tax benefits, while still allowing them to use the asset for their operations.

BUSINESS ESSENTIALS: Types of Leases

1. Operating Lease: An operating lease is a short-term lease agreement where the lessee does not assume ownership of the leased asset. This type of lease is commonly used for equipment or vehicles that have a shorter useful life. Operating leases are typically less expensive and offer more flexibility compared to other types of leases.

3. Sale and Leaseback: A sale and leaseback arrangement involves selling an asset to a lessor and then leasing it back from them. This type of lease is commonly used by businesses that want to free up capital tied up in assets. It allows the business to continue using the asset while also generating cash flow from the lease payments.

4. Single Net Lease: In a single net lease, the lessee is responsible for paying the base rent as well as a portion of the property taxes. The lessor is responsible for all other expenses, such as insurance and maintenance. This type of lease is commonly used for commercial real estate properties.

5. Double Net Lease: A double net lease is similar to a single net lease, but the lessee is also responsible for paying a portion of the property’s insurance in addition to the base rent and property taxes. The lessor is still responsible for maintenance and other expenses.

6. Triple Net Lease: In a triple net lease, the lessee is responsible for paying the base rent as well as all expenses related to the property, including property taxes, insurance, and maintenance. This type of lease is commonly used for commercial properties, such as retail stores or office buildings.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.