What is the Inverse Head and Shoulders Pattern?

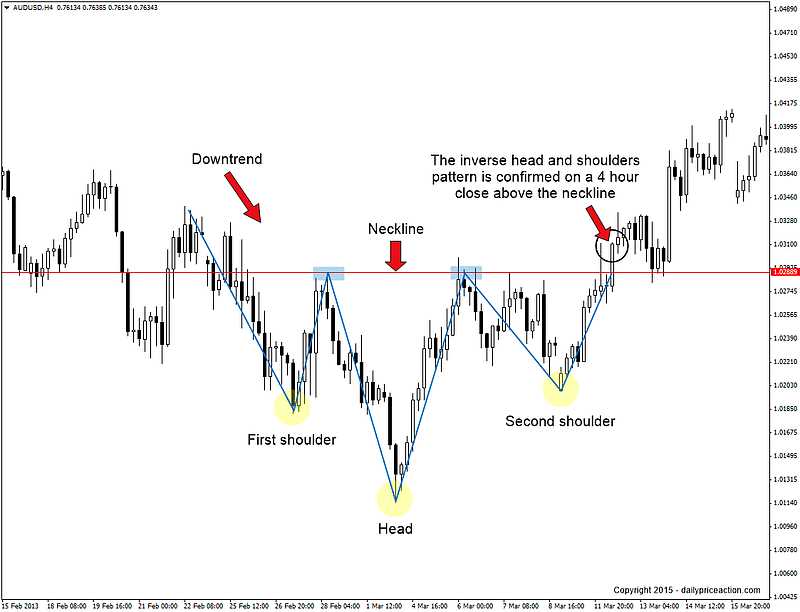

The Inverse Head and Shoulders pattern is a technical analysis pattern that is commonly used by traders to identify potential trend reversals. It is a bullish pattern that typically forms after a downtrend and indicates that the price may be ready to reverse and start moving upwards.

Traders look for the Inverse Head and Shoulders pattern because it suggests that the selling pressure is weakening and that buyers may be gaining control. This can be a signal that the price is about to reverse and start moving upwards.

It is important to note that the Inverse Head and Shoulders pattern is just one tool in a trader’s toolbox and should not be relied upon solely for making trading decisions. It is always recommended to use other technical analysis indicators and tools to confirm the pattern and to consider other factors such as market conditions and news events.

The Inverse Head and Shoulders pattern is a popular technical analysis pattern used by traders to identify potential trend reversals in the financial markets. It is considered a bullish pattern and is often used by traders to enter long positions.

What is the Inverse Head and Shoulders Pattern?

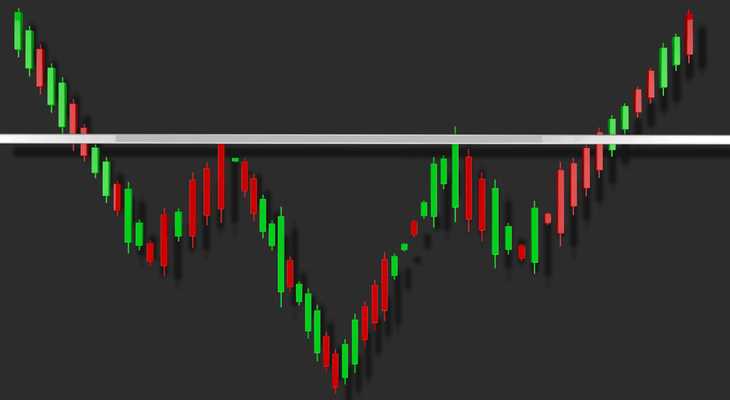

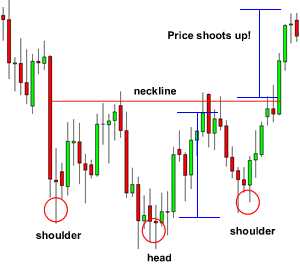

The Inverse Head and Shoulders pattern consists of three main components: the left shoulder, the head, and the right shoulder. These components resemble the shape of a head and shoulders, hence the name.

The left shoulder is formed when the price of an asset declines, reaches a low point, and then bounces back up. This low point is considered the support level. The subsequent rise in price forms the left shoulder.

The right shoulder is formed when the price declines once again, but this time it does not reach a lower low. Instead, it bounces back up and forms a higher low compared to the head. The subsequent rise in price forms the right shoulder.

Identifying the Inverse Head and Shoulders Pattern

To identify the Inverse Head and Shoulders pattern, traders look for the following characteristics:

- The left shoulder, head, and right shoulder should be clearly visible on a price chart.

- The neckline should connect the lows of the head and the shoulders.

- The breakout above the neckline should be accompanied by a significant increase in volume.

By identifying these characteristics, traders can confirm the presence of an Inverse Head and Shoulders pattern and anticipate a potential bullish trend reversal.

Identifying the Inverse Head and Shoulders Pattern

The inverse head and shoulders pattern is a technical analysis pattern that can indicate a potential bullish reversal in a market. It consists of three main components: the left shoulder, the head, and the right shoulder.

To identify the inverse head and shoulders pattern, traders look for the following characteristics:

| 1. Left Shoulder: | The left shoulder is formed when the price of an asset declines to a low point and then rises again. It is usually lower than the head. |

| 2. Head: | The head is formed when the price of an asset reaches a lower low than the left shoulder and then rises again. It is the lowest point in the pattern. |

| 3. Right Shoulder: |

Once these three components are identified, traders can draw a trendline called the neckline, which connects the highs of the left shoulder, head, and right shoulder. The neckline acts as a support level.

Traders often wait for the price to break above the neckline to confirm the inverse head and shoulders pattern. This breakout is seen as a bullish signal, indicating that the price may continue to rise.

Interpreting the Inverse Head and Shoulders Pattern

When analyzing the inverse head and shoulders pattern, it is important to understand the various components and their significance. This pattern consists of three main parts: the left shoulder, the head, and the right shoulder.

The neckline is a horizontal line that connects the high points of the left shoulder, head, and right shoulder. It acts as a resistance level that the price needs to break above in order to confirm the pattern. Once the price breaks above the neckline, it is a signal that the pattern is complete and a bullish reversal is likely to occur.

Traders often use various technical indicators to confirm the validity of the inverse head and shoulders pattern. These indicators may include volume analysis, trend lines, and moving averages. Additionally, traders may also look for other chart patterns or candlestick formations that support the bullish reversal signaled by the inverse head and shoulders pattern.

It is important to note that the inverse head and shoulders pattern is not always a reliable indicator of a bullish reversal. Therefore, it is crucial to consider other factors such as market conditions, overall trend, and fundamental analysis before making any trading decisions based solely on this pattern.

Trading Strategies for the Inverse Head and Shoulders Pattern

The inverse head and shoulders pattern is a bullish reversal pattern that can be used to identify potential buying opportunities in the market. Traders can use various strategies to trade this pattern effectively.

1. Confirm the Pattern

Before entering a trade, it is important to confirm the presence of the inverse head and shoulders pattern. This can be done by analyzing the price action and volume. Look for a clear left shoulder, a lower low forming the head, and a higher low forming the right shoulder. Additionally, volume should be higher during the formation of the head compared to the shoulders.

2. Wait for Breakout

Once the pattern is confirmed, traders should wait for a breakout above the neckline. The neckline is a horizontal line connecting the highs of the left shoulder, head, and right shoulder. A breakout above the neckline indicates a potential bullish move. Traders can enter a long position once the breakout occurs.

3. Set Stop-Loss and Take-Profit Levels

It is important to set stop-loss and take-profit levels to manage risk and protect profits. The stop-loss level should be placed below the right shoulder, while the take-profit level can be set based on the projected target of the pattern. This can be calculated by measuring the distance from the head to the neckline and adding it to the breakout level.

4. Consider Additional Confirmation Signals

Traders can consider using additional confirmation signals to increase the probability of a successful trade. This can include analyzing other technical indicators such as moving averages, trendlines, or oscillators. If these indicators align with the bullish bias of the inverse head and shoulders pattern, it can provide further confidence in the trade.

Overall, trading the inverse head and shoulders pattern requires patience and careful analysis. By confirming the pattern, waiting for a breakout, setting appropriate stop-loss and take-profit levels, and considering additional confirmation signals, traders can increase their chances of success when trading this pattern.

Entering a Trade with the Inverse Head and Shoulders Pattern

Once you have identified the inverse head and shoulders pattern on a chart, you can consider entering a trade. This pattern is typically seen as a bullish reversal signal, indicating that the price may be about to rise.

Confirmation

Before entering a trade, it is important to wait for confirmation that the pattern is valid. This confirmation can come in the form of a breakout above the neckline of the pattern. The neckline is a horizontal line that connects the highs of the two shoulders. A breakout above this line indicates that the buyers have taken control and the price is likely to continue rising.

It is recommended to wait for a candlestick to close above the neckline before entering a trade. This helps to ensure that the breakout is genuine and not a false signal.

Entry Point

Once the pattern is confirmed, you can consider entering a trade. The entry point is typically just above the breakout point, as this is where the price is likely to gain momentum and continue rising. You can set a buy order slightly above the neckline to enter the trade.

It is important to note that the inverse head and shoulders pattern is not always a guarantee of a successful trade. It is still important to use proper risk management techniques and consider other factors such as market conditions and overall trend before entering a trade.

Remember to always set a stop-loss order to protect your capital in case the trade goes against you. You can also consider setting a take-profit level to secure your profits once the price reaches a certain target.

Overall, entering a trade with the inverse head and shoulders pattern requires patience, confirmation, and careful consideration of risk management. By following these guidelines, you can increase your chances of a successful trade.

Setting Stop-Loss and Take-Profit Levels

When trading with the Inverse Head and Shoulders pattern, it is crucial to set stop-loss and take-profit levels to manage risk and maximize potential profits.

Stop-loss level: A stop-loss order is placed below the neckline of the pattern. This level acts as a safety net to limit potential losses if the trade goes against you. By setting a stop-loss level, you can protect your capital and minimize the impact of a losing trade.

Take-profit level: A take-profit order is placed at a predetermined price level that represents your profit target. This level is typically set at the distance between the neckline and the highest point of the pattern. By setting a take-profit level, you can secure your profits and exit the trade once your target is reached.

It is important to note that the stop-loss and take-profit levels should be based on your risk tolerance and trading strategy. You should consider factors such as market volatility, timeframes, and overall market conditions when determining these levels.

Remember, setting stop-loss and take-profit levels is essential for risk management and ensuring consistent profitability in your trading. It is crucial to stick to your predetermined levels and not let emotions dictate your decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.