What is a Life Income Fund (LIF)?

A Life Income Fund (LIF) is a type of retirement savings vehicle that provides individuals with a steady income stream during their retirement years. It is designed to hold and manage the funds accumulated in a Registered Retirement Savings Plan (RRSP) or a Registered Pension Plan (RPP) after retirement.

The purpose of a Life Income Fund (LIF) is to provide retirees with a source of income that can be withdrawn on a regular basis. This income is typically used to cover living expenses and maintain a comfortable lifestyle during retirement.

LIFs are governed by specific regulations and guidelines set by the government to ensure that retirees have a sustainable income stream throughout their retirement years. These regulations vary by jurisdiction and may include rules regarding minimum and maximum withdrawal amounts, age restrictions, and investment options.

How Does a Life Income Fund (LIF) Work?

When an individual reaches the age of retirement and decides to convert their RRSP or RPP into a LIF, the funds are transferred from the original account into the LIF. The LIF is then managed by a financial institution or a licensed investment professional.

Once the funds are in the LIF, the retiree can choose from a variety of investment options to grow their savings. These options may include stocks, bonds, mutual funds, and other investment vehicles. The choice of investments depends on the retiree’s risk tolerance and financial goals.

Withdrawals from a LIF are subject to specific regulations and guidelines. The retiree must adhere to these rules to ensure that they do not deplete their savings too quickly and have a sustainable income stream throughout their retirement.

Exploring Withdrawal Options and Regulations

There may also be restrictions on the maximum annual withdrawal, which is the maximum amount that can be withdrawn from the LIF in a given year. These restrictions are in place to ensure that retirees do not exhaust their savings too quickly and have enough funds to support themselves throughout their retirement.

Additionally, some jurisdictions may allow retirees to make one-time withdrawals from their LIF for specific purposes, such as purchasing a home or paying for medical expenses. These withdrawals are subject to specific rules and regulations.

Benefits of Investing in a Life Income Fund (LIF)

Investing in a Life Income Fund (LIF) offers several benefits for retirees. These include:

- A steady income stream: A LIF provides retirees with a reliable source of income during their retirement years.

- Flexibility: Retirees have the flexibility to choose their investment options and manage their savings according to their financial goals and risk tolerance.

- Tax advantages: LIFs offer potential tax advantages, such as tax-deferred growth and the ability to split income with a spouse or partner.

- Control over withdrawals: Retirees have control over their withdrawal amounts, allowing them to manage their savings and expenses effectively.

Why Consider a LIF for Your Retirement Savings

A Life Income Fund (LIF) is a suitable option for individuals who want to ensure a steady income stream during their retirement years. By converting their RRSP or RPP into a LIF, retirees can have more control over their savings and make informed investment decisions based on their financial goals and risk tolerance.

Additionally, LIFs offer potential tax advantages and the flexibility to withdraw funds when needed, subject to specific regulations. This can provide retirees with peace of mind knowing that they have a sustainable income source and the ability to manage their expenses effectively.

Factors to Consider Before Choosing a Life Income Fund (LIF)

Before choosing a Life Income Fund (LIF), retirees should consider the following factors:

- Regulations and guidelines: It is essential to understand the specific regulations and guidelines governing LIFs in your jurisdiction to ensure compliance and avoid any penalties.

- Investment options: Evaluate the investment options available within the LIF to determine if they align with your financial goals and risk tolerance.

- Withdrawal restrictions: Consider the minimum and maximum withdrawal amounts and any restrictions on one-time withdrawals to ensure they meet your financial needs.

- Tax implications: Consult with a tax professional to understand the potential tax advantages and implications of investing in a LIF.

- Financial goals: Assess your financial goals for retirement and determine if a LIF aligns with your long-term plans.

By carefully considering these factors, retirees can make an informed decision about whether a Life Income Fund (LIF) is the right choice for their retirement savings.

A Life Income Fund (LIF) is a type of retirement income plan that allows individuals to convert their registered pension plan (RPP) or registered retirement savings plan (RRSP) into a stream of income during their retirement years. The purpose of a LIF is to provide retirees with a regular income while still allowing them to have some control over their investments.

Unlike other retirement income options, such as annuities, a LIF offers more flexibility and control over the investment portfolio. With a LIF, individuals can choose how their funds are invested, which can include a variety of investment options such as stocks, bonds, and mutual funds. This allows retirees to potentially earn higher returns on their investments compared to traditional fixed-income options.

Another important aspect of a LIF is that it has a maximum annual withdrawal limit, which is determined by government regulations. This limit ensures that retirees do not deplete their retirement savings too quickly and have a steady income throughout their retirement years.

One of the main benefits of a LIF is that it allows individuals to continue to grow their investments while receiving a regular income. This can be particularly advantageous for individuals who have a longer life expectancy or who want to leave a legacy for their loved ones.

However, it is important to note that a LIF also comes with certain restrictions and regulations. For example, there may be restrictions on when and how much individuals can withdraw from their LIF, as well as penalties for early withdrawals. Additionally, there may be limitations on the types of investments that can be held within a LIF.

In summary, a Life Income Fund (LIF) is a retirement income plan that allows individuals to convert their pension or retirement savings into a regular income stream. It offers flexibility and control over investments, while also providing a maximum annual withdrawal limit to ensure a steady income throughout retirement. However, it is important to understand and comply with the regulations and restrictions associated with a LIF.

How Does a Life Income Fund (LIF) Work?

A Life Income Fund (LIF) is a type of retirement income plan that allows individuals to convert their registered pension plan (RPP) or registered retirement savings plan (RRSP) into a stream of income during their retirement years. It is designed to provide individuals with a regular income while still maintaining some control over their investments.

When you contribute to a LIF, your funds are typically invested in a portfolio of assets such as stocks, bonds, and mutual funds. The income generated from these investments is then used to provide you with regular payments throughout your retirement.

Minimum and Maximum Withdrawals

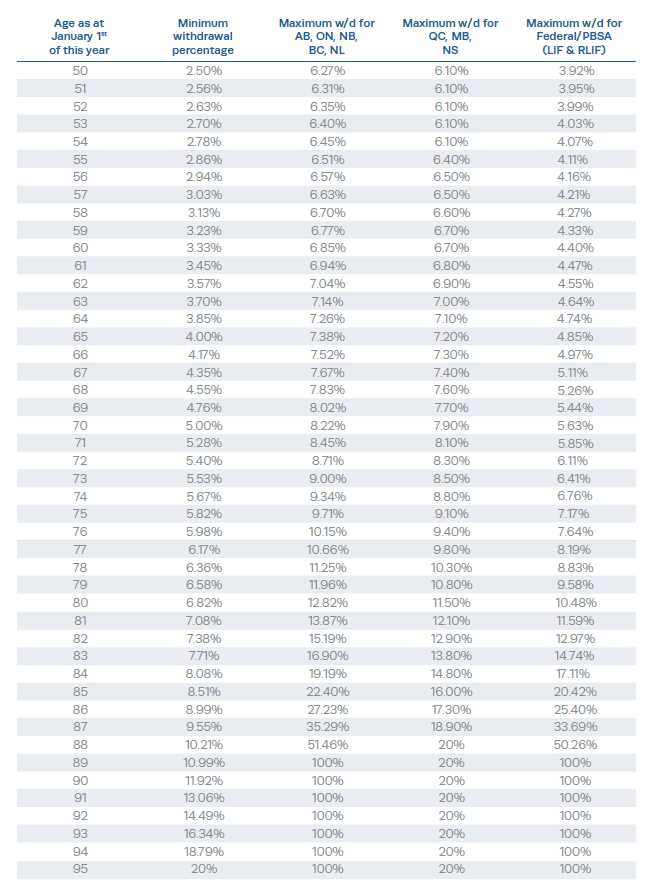

One of the key features of a LIF is that it imposes minimum and maximum withdrawal limits. The minimum withdrawal amount is determined by the government and is based on your age and the value of your LIF. This ensures that you receive a minimum amount of income each year.

The maximum withdrawal amount, on the other hand, is determined by a formula that takes into account your age, the value of your LIF, and the prevailing interest rates. This formula is designed to ensure that your LIF lasts throughout your retirement years.

Income Tax Considerations

Flexibility and Control

A LIF offers individuals flexibility and control over their retirement income. Unlike other retirement income options, such as annuities, a LIF allows you to choose how your funds are invested and how much income you receive each year within the minimum and maximum withdrawal limits.

This flexibility allows you to adjust your income based on your financial needs and market conditions. For example, if you need more income in a particular year, you can choose to withdraw more from your LIF. Conversely, if you have surplus income, you can choose to withdraw less.

Overall, a LIF provides individuals with a reliable and customizable source of income during their retirement years. It allows you to maintain control over your investments while still ensuring that you receive a minimum amount of income each year. Consider consulting with a financial advisor to determine if a LIF is the right retirement income option for you.

Exploring Withdrawal Options and Regulations

Minimum and Maximum Withdrawal Limits

One important aspect of a LIF is the minimum and maximum withdrawal limits that are set by the government. The minimum withdrawal amount is determined based on your age and the value of your LIF. This ensures that you receive a minimum income stream throughout your retirement years.

On the other hand, the maximum withdrawal limit is designed to prevent individuals from depleting their LIF too quickly. This limit is typically a percentage of the LIF’s value and varies depending on your age and the jurisdiction in which you reside.

Locked-In Funds and Unlocking Provisions

Tax Implications

Withdrawals from a LIF are subject to taxation, just like any other retirement income. The amount of tax you pay will depend on your total income for the year and the tax rates in your jurisdiction.

Benefits of Investing in a Life Income Fund (LIF)

Investing in a Life Income Fund (LIF) offers several benefits for individuals looking to secure their retirement savings. Here are some key advantages of investing in a LIF:

1. Flexibility in Withdrawals

One of the main benefits of a LIF is the flexibility it offers in terms of withdrawals. Unlike other retirement savings options, such as Registered Retirement Savings Plans (RRSPs) or Registered Retirement Income Funds (RRIFs), a LIF allows individuals to choose the amount and frequency of their withdrawals within certain limits set by the government. This flexibility can be particularly useful for individuals who want to manage their cash flow during retirement.

2. Potential for Investment Growth

A LIF allows individuals to invest their retirement savings in a variety of investment options, such as stocks, bonds, and mutual funds. This provides the potential for investment growth over time, which can help individuals maintain the purchasing power of their savings and potentially generate additional income during retirement.

3. Income for Life

4. Tax Advantages

Investing in a LIF can also offer tax advantages. While contributions to a LIF are not tax-deductible, the investment growth within the fund is tax-sheltered, meaning individuals do not have to pay taxes on the earnings until they make withdrawals. This can help individuals minimize their tax liability during retirement.

5. Estate Planning

A LIF can also be a useful tool for estate planning. Individuals can designate beneficiaries for their LIF, ensuring that any remaining funds in the account are transferred to their loved ones upon their death. This can help individuals pass on their wealth to the next generation and provide financial security for their family members.

Why Consider a LIF for Your Retirement Savings

As you plan for your retirement, it is essential to consider various investment options that can provide you with a stable income stream. One such option is a Life Income Fund (LIF). A LIF allows you to convert your retirement savings into a source of income that can support you throughout your retirement years.

There are several reasons why you should consider a LIF for your retirement savings:

| 1. Flexibility: | A LIF offers flexibility in terms of how much income you can withdraw each year. This allows you to adjust your withdrawals based on your financial needs and goals. |

| 2. Tax Efficiency: | With a LIF, you can benefit from tax deferral on your investment earnings. This means that you won’t have to pay taxes on the growth of your investments until you make withdrawals. |

| 3. Investment Control: | When you invest in a LIF, you have control over how your funds are invested. This gives you the opportunity to choose investments that align with your risk tolerance and investment objectives. |

| 4. Regular Income: | A LIF provides you with a regular income stream that can help cover your living expenses during retirement. This can give you peace of mind knowing that you have a stable source of income. |

| 5. Estate Planning: | A LIF allows you to designate beneficiaries who will receive the remaining funds in your account upon your death. This ensures that your loved ones are taken care of and can inherit your retirement savings. |

Overall, a LIF can be a valuable tool for managing your retirement savings and ensuring a comfortable retirement. It offers flexibility, tax efficiency, investment control, regular income, and estate planning benefits. Consider speaking with a financial advisor to determine if a LIF is the right choice for your retirement goals and financial situation.

Factors to Consider Before Choosing a Life Income Fund (LIF)

When planning for retirement, it is important to consider various factors before choosing a Life Income Fund (LIF). A LIF is a type of retirement income vehicle that allows individuals to receive regular payments from their retirement savings. However, before making a decision, it is crucial to evaluate the following factors:

1. Age and Retirement Goals

One of the first factors to consider is your age and retirement goals. Different LIF options have different age restrictions and withdrawal rules. It is important to choose a LIF that aligns with your retirement timeline and financial goals.

2. Risk Tolerance

Another important factor to consider is your risk tolerance. LIFs offer various investment options, ranging from conservative to aggressive. It is essential to assess your comfort level with market fluctuations and choose an investment strategy that aligns with your risk tolerance.

3. Income Needs

Consider your income needs during retirement. Evaluate your current expenses and estimate your future expenses to determine how much income you will require from your LIF. This will help you choose a LIF that offers the flexibility and payout options that meet your income needs.

4. Tax Implications

5. Investment Options

Consider the investment options available within the LIF. Some LIFs offer a wide range of investment choices, including stocks, bonds, and mutual funds. Evaluate the investment options and choose a LIF that aligns with your investment preferences and financial goals.

6. Withdrawal Restrictions

Understand the withdrawal restrictions associated with the LIF. Some LIFs have minimum and maximum withdrawal limits, while others have restrictions on when and how much you can withdraw. Consider your cash flow needs and choose a LIF that provides the flexibility you require.

7. Fees and Expenses

8. Professional Advice

Consider seeking professional advice before choosing a LIF. A financial advisor can provide valuable insights and help you navigate the complexities of retirement planning. They can assess your individual circumstances and provide personalized recommendations based on your unique needs and goals.

By carefully considering these factors, you can make an informed decision when choosing a Life Income Fund (LIF) that aligns with your retirement goals and financial needs.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.