What is Investment Property?

Investment property refers to real estate that is purchased with the intention of generating income or profit. Unlike residential properties that are primarily used as a place to live, investment properties are acquired for the purpose of making money through rental income, capital appreciation, or both.

Definition and Explanation

Investment property can take various forms, including residential, commercial, industrial, or even vacant land. The key characteristic of an investment property is that it is not used as a primary residence by the owner.

Investors often purchase investment properties with the goal of generating rental income. This can be achieved by leasing the property to tenants who pay monthly rent. The rental income can provide a steady stream of cash flow and potentially cover the expenses associated with owning the property, such as mortgage payments, property taxes, insurance, and maintenance costs.

In addition to rental income, investment properties can also appreciate in value over time. This means that the property’s market price increases, allowing the investor to sell it for a profit in the future. Appreciation can be influenced by various factors, such as location, demand, economic conditions, and improvements made to the property.

Financing Investment Property

It is important for investors to carefully consider the financing options available to them and assess the potential risks and rewards. Working with a knowledgeable real estate agent or financial advisor can help investors navigate the complexities of financing investment properties.

Overall, investment properties can offer investors the opportunity to earn passive income, build wealth, and diversify their investment portfolio. However, it is crucial to conduct thorough research, due diligence, and analysis before investing in any property to ensure it aligns with one’s financial goals and risk tolerance.

Definition and Explanation

Investment property refers to a real estate property that is purchased with the intention of generating income or profit through rental income, capital appreciation, or both. It is different from a primary residence or a second home, as it is not primarily used for personal use but rather for investment purposes.

Characteristics of Investment Property

- Income Generation: The primary purpose of investment property is to generate income through rental payments from tenants. This can provide a steady stream of cash flow for the property owner.

- Capital Appreciation: Investment property also offers the potential for capital appreciation, which means the property’s value may increase over time. This can result in a profit if the property is sold in the future.

- Property Management: Investment property requires active management, including finding tenants, collecting rent, property maintenance, and dealing with any issues that may arise. Property owners can choose to manage the property themselves or hire a professional property management company.

Benefits of Investing in Property

Investing in property offers several benefits:

- Income Generation: Rental income from investment property can provide a steady source of cash flow, which can help cover mortgage payments, property expenses, and generate additional income.

- Portfolio Diversification: Property investment can diversify an investment portfolio, reducing risk by spreading investments across different asset classes.

- Tax Advantages: Property investors may benefit from various tax advantages, such as deductions for mortgage interest, property taxes, and depreciation.

- Potential for Appreciation: Property values have the potential to appreciate over time, allowing investors to build wealth through capital appreciation.

- Inflation Hedge: Real estate has historically been considered a good hedge against inflation, as property values and rental income tend to increase with inflation.

Investment property provides individuals with an opportunity to generate income, build wealth, and diversify their investment portfolios. It is important to carefully research and analyze potential investment properties to make informed decisions and maximize returns.

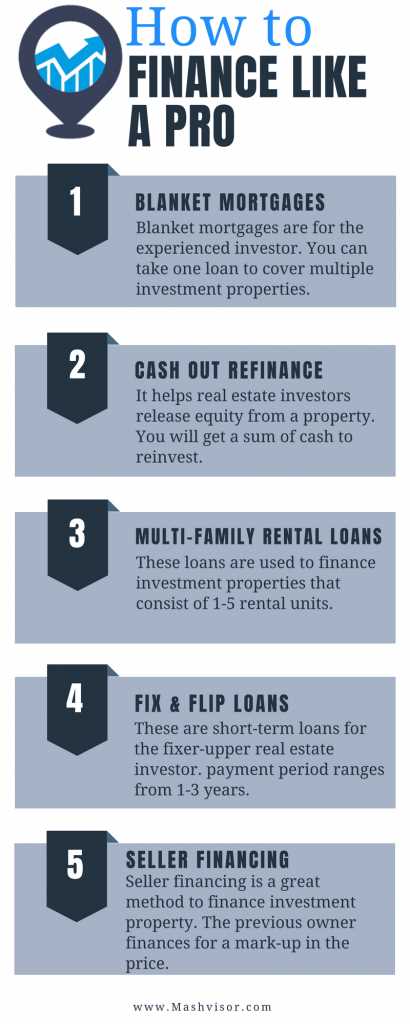

Financing Investment Property

Investing in property can be a lucrative venture, but it often requires financing to get started. There are various options available for financing investment property, each with its own advantages and considerations.

1. Traditional Mortgage: This is the most common option for financing investment property. It involves obtaining a loan from a bank or financial institution, with the property serving as collateral. The terms and interest rates will depend on factors such as credit history, down payment, and the property’s value.

2. Cash Purchase: If you have the funds available, buying the property outright can eliminate the need for financing. This can provide greater flexibility and potentially save on interest payments. However, it may tie up a significant amount of capital that could be used for other investments.

3. Hard Money Loans: These are short-term loans provided by private lenders or investors. They are typically used when traditional financing options are not available or when a quick closing is required. Hard money loans often have higher interest rates and fees, but they can be a valuable tool for acquiring investment property.

4. Seller Financing: In some cases, the property seller may be willing to finance the purchase themselves. This can be advantageous if you have difficulty obtaining traditional financing or if the seller offers favorable terms. However, it is important to thoroughly review and understand the terms of the agreement.

5. Partnerships: Another option for financing investment property is to form a partnership with other investors. This can allow for shared costs and risks, as well as access to additional capital. However, it is crucial to have a clear partnership agreement in place to outline responsibilities, profit sharing, and exit strategies.

6. Home Equity Loans: If you already own a property with equity, you may be able to use a home equity loan to finance your investment property. This involves borrowing against the value of your existing property to fund the purchase. It is important to carefully consider the risks and potential impact on your personal finances.

When financing investment property, it is essential to carefully evaluate your options and consider factors such as interest rates, loan terms, and potential risks. Consulting with a financial advisor or real estate professional can help you make informed decisions and maximize your investment potential.

Options and Strategies for Financing Investment Property

1. Traditional Mortgage

A traditional mortgage is one of the most common ways to finance an investment property. With a traditional mortgage, you borrow money from a lender to purchase the property and then make regular payments over a set period of time. The interest rate and terms of the loan will depend on your creditworthiness and the current market conditions.

2. Cash Purchase

If you have enough cash on hand, you may choose to purchase the investment property outright. This eliminates the need for financing and allows you to avoid interest payments. However, tying up a large amount of capital in a single property may limit your ability to invest in other opportunities.

3. Hard Money Loan

A hard money loan is a short-term, high-interest loan that is typically used by real estate investors who need quick access to funds. These loans are secured by the value of the property rather than the borrower’s creditworthiness. Hard money loans are a viable option for investors who may not qualify for traditional financing or need to close a deal quickly.

4. Seller Financing

5. Partnerships

Investing in property through partnerships is another strategy for financing investment property. By pooling resources with other investors, you can access larger amounts of capital and spread the risk. Partnerships can take various forms, such as joint ventures or limited partnerships, and the terms of the partnership should be clearly defined in a legal agreement.

Types of Investment Property

Residential Property

Residential properties are the most common type of investment property. These properties include single-family homes, apartments, condominiums, townhouses, and vacation rentals. Investing in residential properties can provide a steady income stream through rental payments and potential appreciation in value over time.

Commercial Property

Commercial properties are properties that are used for business purposes. This can include office buildings, retail spaces, warehouses, and industrial properties. Investing in commercial properties can offer higher rental income and longer lease terms compared to residential properties. However, commercial properties may also have higher maintenance costs and require more management.

Multi-Family Property

Multi-family properties are residential properties that have multiple units, such as duplexes, triplexes, and apartment buildings. Investing in multi-family properties can provide multiple income streams from the rental units, which can help diversify your investment portfolio. Additionally, multi-family properties can offer economies of scale in terms of management and maintenance.

Vacation Property

Industrial Property

Industrial properties are properties that are used for manufacturing, storage, and distribution purposes. These properties can include warehouses, factories, and distribution centers. Investing in industrial properties can provide stable rental income from long-term leases with industrial tenants. However, industrial properties may require specialized knowledge and maintenance.

Types of Investment Property

1. Residential Property:

Residential properties include houses, apartments, condominiums, and townhouses. Investing in residential property can provide a steady rental income and the potential for long-term appreciation.

2. Commercial Property:

Commercial properties include office buildings, retail spaces, warehouses, and industrial properties. Investing in commercial property can offer higher rental yields and the opportunity for capital gains.

3. Vacation Property:

Vacation properties, such as beach houses or mountain cabins, can be a great investment for generating rental income during peak tourist seasons. They can also provide a personal getaway for you and your family.

4. Mixed-Use Property:

Mixed-use properties combine residential and commercial spaces in a single building. This type of investment property can provide diversification and multiple income streams.

5. Real Estate Investment Trusts (REITs):

REITs are investment vehicles that allow you to invest in a portfolio of income-generating real estate properties. They offer the benefits of real estate investing without the need for direct property ownership.

6. Land:

Investing in land can be a long-term strategy, as its value tends to appreciate over time. Land can be used for various purposes, such as residential development, agriculture, or commercial projects.

Benefits of Investing in Property

Investing in property can offer numerous benefits for individuals looking to grow their wealth and secure their financial future. Here are some key advantages of investing in property:

1. Potential for Appreciation

Property values have historically increased over time, providing investors with the potential for long-term appreciation. By purchasing property in a desirable location and holding onto it for an extended period, investors can benefit from the appreciation of their investment.

2. Passive Income

Rental properties can generate a steady stream of passive income. By renting out the property, investors can earn rental income that can be used to cover mortgage payments, property maintenance costs, and generate additional cash flow.

3. Diversification

Investing in property allows individuals to diversify their investment portfolio. Real estate is a tangible asset that can provide a hedge against inflation and economic downturns. By diversifying their investments, individuals can reduce risk and potentially increase returns.

4. Tax Benefits

Investing in property offers various tax advantages. Property owners can deduct mortgage interest, property taxes, and certain expenses related to property maintenance and management. Additionally, investors may benefit from tax breaks such as depreciation deductions.

5. Control over Investment

Unlike other investment options, investing in property provides individuals with a high level of control over their investment. Property owners can make strategic decisions regarding property management, renovations, and rental rates, allowing them to maximize their returns.

6. Leverage

Property investment allows individuals to leverage their capital. By using borrowed funds, such as a mortgage, investors can purchase properties that they may not be able to afford outright. This leverage can amplify returns and increase the potential for wealth creation.

Overall, investing in property can be a lucrative and rewarding venture. However, it is essential to conduct thorough research, seek professional advice, and carefully consider the risks and rewards before making any investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.