What is Fractional Reserve Banking?

Fractional reserve banking is a system used by commercial banks to create money and provide loans. It is based on the principle of keeping only a fraction of customer deposits as reserves, while lending out the rest of the money. This system allows banks to expand the money supply and stimulate economic growth.

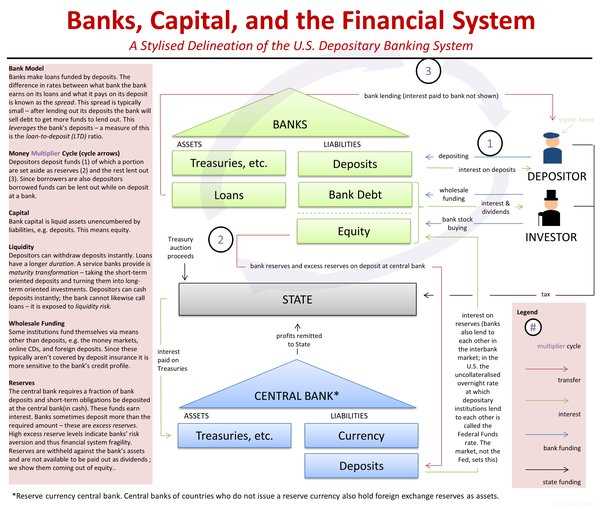

When individuals or businesses deposit money into a bank, the bank is required to keep a certain percentage of these deposits as reserves. The reserve requirement is set by the central bank and varies from country to country. The remaining portion of the deposits is available for the bank to lend out to borrowers.

When a bank makes a loan, the borrower receives the loan amount in their account, which they can then use to make purchases or investments. The bank records the loan as an asset on its balance sheet and the borrower’s deposit as a liability. This creates new money in the economy.

However, it is important to note that the money created through fractional reserve banking is not physical cash, but rather electronic or digital money. This money exists as numbers in bank accounts and can be transferred electronically.

One of the key features of fractional reserve banking is the ability of banks to create money through lending. This allows banks to stimulate economic activity by providing loans to individuals and businesses, which in turn can lead to increased spending, investment, and economic growth.

However, fractional reserve banking also carries risks. If a large number of depositors were to withdraw their money from a bank at the same time, the bank may not have enough reserves to meet these demands. This can lead to a bank run and potentially a financial crisis.

How Does Fractional Reserve Banking Work?

Fractional reserve banking is a system in which banks are required to hold only a fraction of their deposits as reserves, while the rest can be loaned out to borrowers. This system allows banks to create money through the process of lending.

Reserve Requirements

Central banks set reserve requirements, which are the minimum percentage of deposits that banks must hold as reserves. For example, if the reserve requirement is 10%, a bank must hold $10 in reserves for every $100 deposited.

Money Creation

Let’s say a bank receives a $100 deposit and the reserve requirement is 10%. The bank keeps $10 as reserves and lends out $90. The borrower then spends the $90, which eventually ends up in another bank. This bank keeps $9 as reserves and lends out $81. This process continues, with each bank keeping a fraction of the deposit as reserves and lending out the rest.

Risks and Limitations

Fractional reserve banking carries certain risks and limitations. One risk is the potential for bank runs, where depositors rush to withdraw their funds due to concerns about the bank’s solvency. If too many depositors withdraw their funds, the bank may not have enough reserves to meet the demand, leading to a financial crisis.

Another limitation is the possibility of excessive lending, which can lead to inflation and economic instability. If banks create too much money through lending, it can devalue the currency and erode purchasing power.

Regulation and Oversight

Central banks play a crucial role in regulating and overseeing fractional reserve banking. They monitor banks’ compliance with reserve requirements, conduct stress tests to assess their financial health, and provide liquidity support during times of financial stress.

Additionally, governments and regulatory bodies implement regulations to ensure the stability and integrity of the banking system. These regulations aim to prevent excessive risk-taking, promote transparency, and protect depositors’ funds.

The Role of Central Banks in Fractional Reserve Banking

Central banks play a crucial role in the functioning of fractional reserve banking systems. They are responsible for regulating and supervising commercial banks, ensuring the stability and integrity of the financial system.

Regulation and Supervision

One of the main roles of central banks is to regulate and supervise commercial banks that engage in fractional reserve banking. They set and enforce prudential regulations and standards to ensure that banks maintain adequate capital levels, manage risks effectively, and follow ethical business practices. This helps to protect depositors and maintain the stability of the banking system.

Central banks conduct regular inspections and audits of commercial banks to assess their financial health and compliance with regulations. They have the authority to impose penalties and sanctions on banks that fail to meet the required standards. By monitoring and supervising banks, central banks aim to prevent excessive risk-taking and maintain the overall soundness of the banking sector.

Monetary Policy Implementation

Central banks also play a crucial role in implementing monetary policy within the fractional reserve banking system. They have the authority to control the money supply and interest rates, which directly impact the lending and borrowing activities of commercial banks.

Central banks use various tools, such as open market operations, reserve requirements, and discount rates, to influence the availability and cost of credit in the economy. By adjusting these tools, central banks can stimulate or restrain economic activity, manage inflation, and promote financial stability.

Lender of Last Resort

In times of financial distress or liquidity shortages, central banks act as lenders of last resort to commercial banks. They provide emergency funding and liquidity support to banks that are experiencing difficulties in meeting their short-term obligations.

This role is crucial in preventing bank runs and systemic banking crises. By providing liquidity, central banks help to restore confidence in the banking system and prevent the spread of financial contagion.

Financial Stability and Crisis Management

Central banks are also responsible for maintaining financial stability and managing financial crises. They monitor and analyze the overall health of the financial system, identify potential risks and vulnerabilities, and take appropriate measures to mitigate them.

In times of crisis, central banks may provide additional support to troubled banks, implement emergency measures, and coordinate with other regulatory authorities to stabilize the financial system. They play a key role in crisis management and ensuring the resilience of the banking sector.

Advantages and Disadvantages of Fractional Reserve Banking

Advantages

- Liquidity: Fractional reserve banking allows banks to create money through the process of lending. This increases the overall liquidity in the economy, making it easier for businesses and individuals to access credit and meet their financial needs.

- Economic Growth: By providing credit to businesses and individuals, fractional reserve banking stimulates economic growth. It allows for investment in new projects, expansion of existing businesses, and consumption of goods and services. This leads to job creation and increased prosperity.

- Interest Income: Banks earn interest income on the loans they make, which contributes to their profitability. This income allows banks to cover their operating expenses, provide returns to shareholders, and maintain stability in the financial system.

- Financial Intermediation: Fractional reserve banking facilitates the flow of funds from savers to borrowers. It acts as a financial intermediary, connecting those who have excess funds with those who need funds for investment or consumption purposes. This intermediation process helps allocate resources efficiently in the economy.

Disadvantages

- Boom and Bust Cycles: Fractional reserve banking can contribute to boom and bust cycles in the economy. When banks create excessive credit, it can lead to an unsustainable expansion of economic activity, which eventually results in a financial crisis and recession. This instability can have negative consequences for businesses and individuals.

- Systemic Risk: Fractional reserve banking creates the potential for systemic risk. If a significant number of depositors lose confidence in the banking system and rush to withdraw their funds, it can lead to a bank run or a financial panic. This can destabilize the entire financial system and have severe economic consequences.

- Inflation: The creation of money through fractional reserve banking can contribute to inflationary pressures in the economy. When banks lend out more money than they have in reserves, it increases the money supply, which can lead to rising prices and a decrease in the purchasing power of money.

- Unequal Distribution of Wealth: Fractional reserve banking can exacerbate income and wealth inequality. The ability of banks to create money through lending benefits those who have access to credit, while those without access may struggle to meet their financial needs. This can widen the wealth gap between different segments of society.

Overall, fractional reserve banking has its advantages in terms of increasing liquidity, stimulating economic growth, and facilitating financial intermediation. However, it also has its disadvantages, including the potential for boom and bust cycles, systemic risk, inflation, and unequal distribution of wealth. It is important for policymakers and regulators to strike a balance between the benefits and risks of this banking system to ensure stability and promote sustainable economic development.

The Impact of Fractional Reserve Banking on the Economy

Fractional reserve banking is a system that has a significant impact on the economy. While it has its advantages, it also poses risks and challenges that can affect the stability and health of the financial system.

One of the main impacts of fractional reserve banking is its ability to create money. When banks lend out more money than they hold in reserves, they effectively create new money in the economy. This can stimulate economic growth and increase the money supply, which can lead to increased spending and investment.

However, this money creation process also has its drawbacks. It can lead to inflation if the money supply grows faster than the production of goods and services in the economy. This can erode the purchasing power of individuals and businesses and create economic instability.

Another impact of fractional reserve banking is its role in the creation of credit. Banks are able to lend out more money than they have in deposits, which allows them to expand credit and provide financing to individuals and businesses. This can stimulate economic activity and promote investment and growth.

However, this expansion of credit can also lead to financial instability. If banks make risky loans that are not repaid, it can lead to a banking crisis and a contraction of credit. This can have a negative impact on the economy, leading to a decrease in spending and investment, and potentially causing a recession.

Fractional reserve banking also plays a role in the transmission of monetary policy. Central banks use tools such as interest rates to control the money supply and influence economic activity. By adjusting interest rates, central banks can encourage or discourage borrowing and spending, which can affect inflation and economic growth.

However, the effectiveness of monetary policy can be limited by the fractional reserve banking system. If banks are not willing or able to lend, changes in interest rates may have a limited impact on the economy. This can make it more challenging for central banks to achieve their policy objectives.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.