Boom And Bust Cycle: Definition

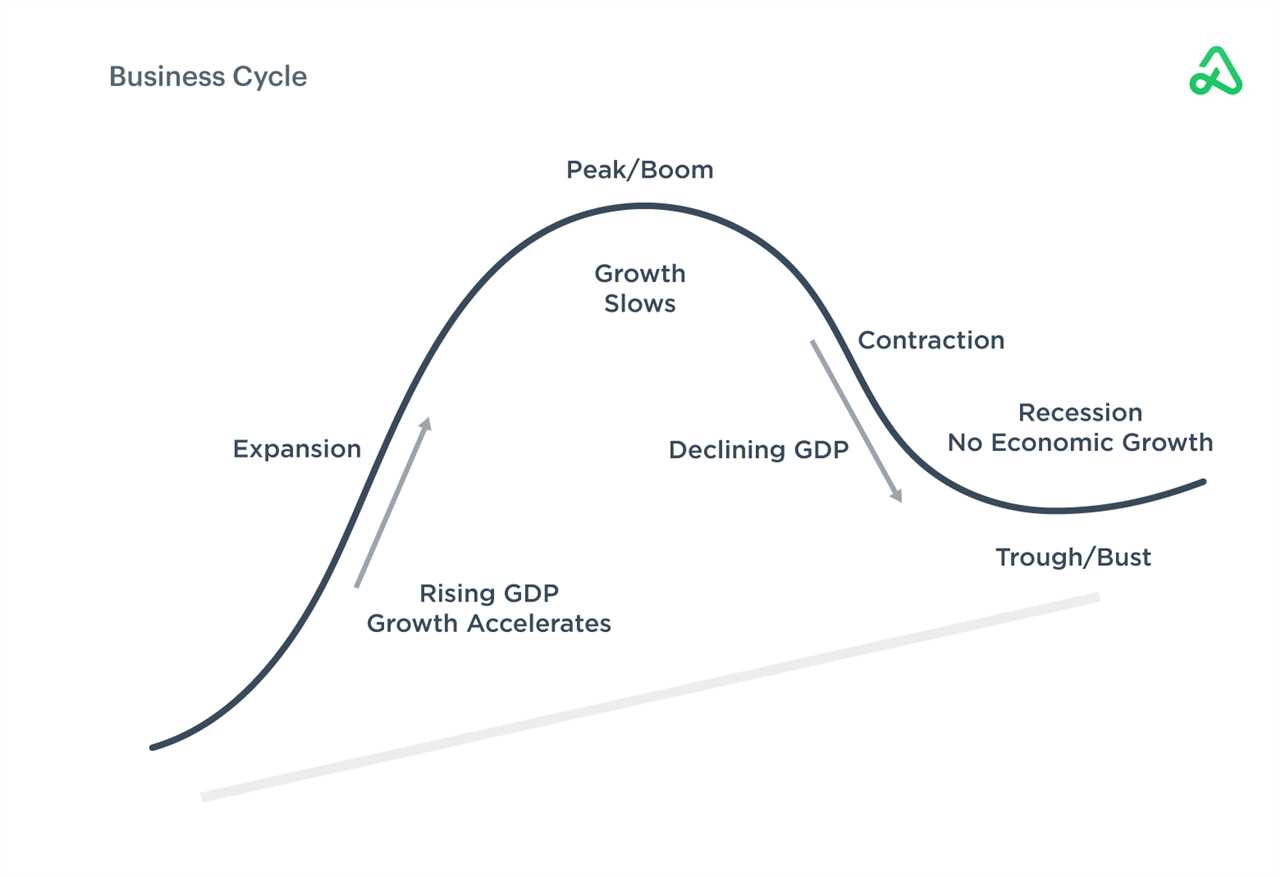

The boom and bust cycle is a recurring pattern in macroeconomics where an economy experiences periods of rapid expansion (boom) followed by periods of contraction (bust). This cycle is characterized by fluctuations in economic activity, including changes in GDP, employment rates, and investment levels.

Causes of the Boom and Bust Cycle

There are several factors that contribute to the boom and bust cycle. One major cause is excessive optimism and speculation in the market. During a boom, investors become overly optimistic about the future and start to take on more risk, leading to inflated asset prices. Eventually, this optimism fades, and investors realize that the market is overvalued, triggering a decline in prices and a bust.

Effects of the Boom and Bust Cycle

The boom and bust cycle can have significant effects on individuals, businesses, and the overall economy. During a boom, businesses may experience increased profits and expansion opportunities, while individuals may see higher wages and increased job opportunities. However, during a bust, businesses may struggle to stay afloat, leading to layoffs and reduced consumer spending. Individuals may also experience job losses and a decrease in income.

Additionally, the boom and bust cycle can lead to financial instability. When asset prices decline rapidly during a bust, investors may experience significant losses, which can have a ripple effect throughout the financial system. This can lead to a decrease in consumer and business confidence, further exacerbating the economic downturn.

Historical Examples of the Boom and Bust Cycle

How the Boom and Bust Cycle Works and Its History

During a boom, the economy experiences high levels of economic activity, including increased consumer spending, business investment, and job creation. This is often accompanied by rising asset prices, such as stocks and real estate, as well as increased borrowing and lending. As a result, the overall economic output, or gross domestic product (GDP), expands rapidly.

During a bust, economic activity slows down, leading to a decline in consumer spending, business investment, and job losses. Asset prices, such as stocks and real estate, also decline as investors sell off their holdings. This can lead to a downward spiral as businesses cut back on production and lay off workers, further exacerbating the economic downturn.

The boom and bust cycle has a long history and has been observed in economies around the world. One of the most famous examples is the Great Depression of the 1930s, which was characterized by a severe economic contraction following a period of rapid growth in the 1920s. The dot-com bubble of the late 1990s and the housing market crash of 2008 are more recent examples of boom and bust cycles.

Government policies can play a role in influencing the boom and bust cycle. For example, central banks can use monetary policy tools, such as interest rate adjustments, to try to stabilize the economy and mitigate the severity of booms and busts. Additionally, fiscal policy measures, such as government spending and taxation, can also impact the cycle.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.