Digital Money: Exploring the World of Digital Currencies

The Rise of Digital Currencies

Blockchain is a distributed ledger technology that records all transactions made with a particular digital currency. This technology ensures transparency, security, and immutability, making it an ideal platform for digital currencies.

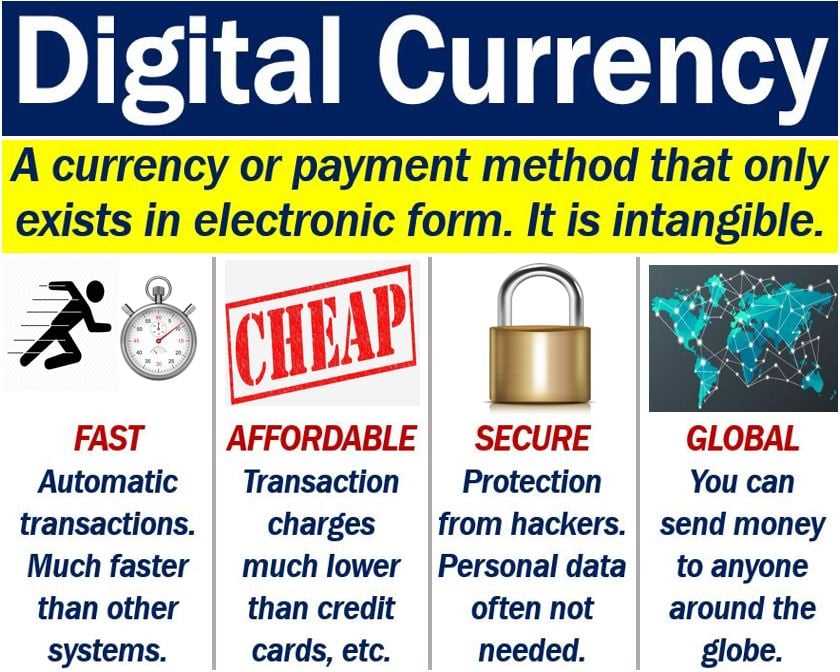

The Benefits of Digital Currencies

One of the main benefits of digital currencies is their ability to facilitate fast and low-cost transactions. Traditional banking systems often involve intermediaries, such as banks and payment processors, which can slow down the transfer of funds and increase transaction costs. With digital currencies, transactions can be completed in a matter of minutes, regardless of geographical location.

Another advantage of digital currencies is their potential to provide financial inclusion to the unbanked population. According to the World Bank, around 1.7 billion adults worldwide do not have access to a bank account. Digital currencies can offer these individuals a secure and accessible way to store and transfer money, opening up new opportunities for economic participation.

The Challenges and Future of Digital Currencies

While digital currencies offer numerous benefits, they also face several challenges. One of the main challenges is regulatory uncertainty. Governments around the world are still grappling with how to regulate digital currencies, which can lead to uncertainty and volatility in the market.

Looking to the future, digital currencies have the potential to transform various industries, including finance, supply chain management, and healthcare. As more businesses and individuals embrace digital currencies, the global economy will undergo significant changes, creating new opportunities and challenges along the way.

What is Cryptocurrency?

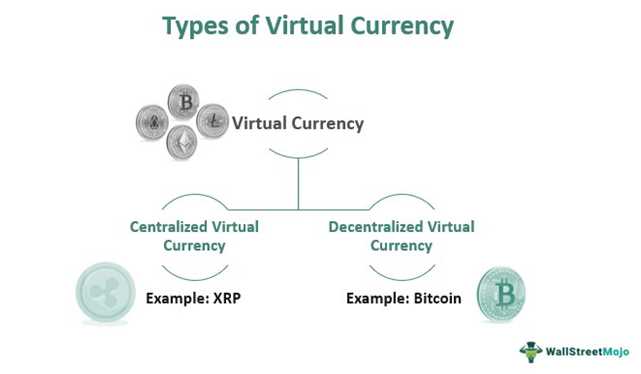

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies are decentralized and operate on a technology called blockchain.

How Does Cryptocurrency Work?

Cryptocurrencies work on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers. This network is decentralized, meaning there is no central authority or government controlling the currency.

Advantages of Cryptocurrency

There are several advantages to using cryptocurrency:

Decentralization: Cryptocurrencies are not controlled by any central authority, such as a government or bank. This makes them immune to government interference and manipulation.

Security: Cryptocurrencies use advanced cryptographic techniques to secure transactions and control the creation of new units. This makes them highly secure and resistant to fraud and hacking.

Privacy: Cryptocurrency transactions can be conducted with a certain level of anonymity, as users are identified by their digital wallet addresses rather than their personal information.

Global Accessibility: Cryptocurrencies can be accessed and used by anyone with an internet connection, regardless of their location or financial status.

Challenges and Risks

While cryptocurrency offers many advantages, there are also challenges and risks associated with its use:

Volatility: Cryptocurrency prices can be highly volatile, with significant price fluctuations occurring within short periods. This makes it a risky investment and a less stable store of value compared to traditional currencies.

Regulatory Uncertainty: Governments around the world are still grappling with how to regulate and tax cryptocurrencies. This regulatory uncertainty can create challenges for businesses and individuals using cryptocurrency.

Security Concerns: While cryptocurrencies are generally secure, there have been instances of hacking and theft. It is important for users to take precautions to protect their digital wallets and private keys.

The Future of Cryptocurrency

However, the future of cryptocurrency will also depend on how governments and regulatory bodies respond to its rise. Striking the right balance between innovation and regulation will be crucial in shaping the future of this digital currency revolution.

The Impact of Cryptocurrency on the Global Economy

Cryptocurrency has emerged as a disruptive force in the global economy, revolutionizing the way we think about money and financial transactions. Its impact has been felt across various sectors, from finance to technology, and it continues to shape the future of the global economy.

One of the key impacts of cryptocurrency on the global economy is its ability to provide financial inclusion to the unbanked and underbanked populations. Traditional banking systems often exclude individuals without access to traditional financial services, leaving them unable to participate fully in the global economy. Cryptocurrency, on the other hand, allows anyone with an internet connection to access and use digital currency, opening up new opportunities for financial empowerment and economic growth.

However, it is important to note that cryptocurrency also poses challenges and risks to the global economy. The volatility of cryptocurrency prices can lead to market instability and financial risks for investors. Additionally, the anonymity and lack of regulation in the cryptocurrency space can facilitate illicit activities, such as money laundering and tax evasion, which can have negative consequences for the global economy.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.