Lender of Last Resort Function and Examples

There are several examples of the lender of last resort function in action. One such example is the Federal Reserve’s response to the 2008 financial crisis. During this time, many banks and financial institutions were facing liquidity problems and were unable to access funds from other banks or the private market. The Federal Reserve stepped in and provided emergency loans and liquidity support to these institutions, helping to stabilize the financial system and prevent a complete collapse.

Another example is the European Central Bank’s role as a lender of last resort during the European debt crisis. As countries such as Greece, Portugal, and Ireland faced severe financial difficulties, their banking systems were at risk of collapse. The European Central Bank provided emergency funding to these countries’ central banks, ensuring that the banking systems remained solvent and preventing a wider financial crisis.

Role of the Federal Reserve as a Lender of Last Resort

Definition of Lender of Last Resort

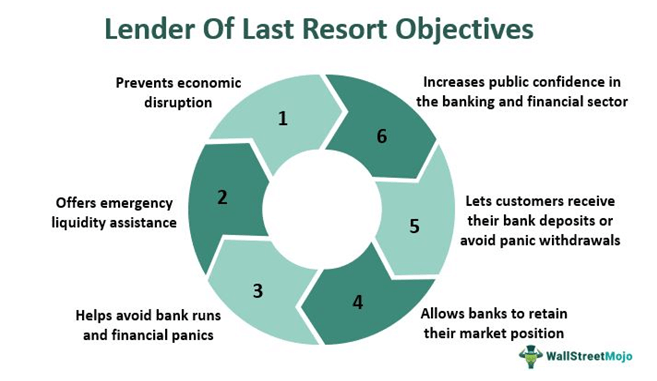

The lender of last resort is an institution, typically a central bank, that provides emergency liquidity to financial institutions that are experiencing severe funding difficulties. It acts as a backstop to prevent the collapse of these institutions and to maintain the overall stability of the financial system.

Responsibilities of the Federal Reserve as a Lender of Last Resort

The Federal Reserve has several key responsibilities when acting as a lender of last resort:

- Setting the Terms and Conditions: When providing emergency liquidity, the Federal Reserve sets the terms and conditions under which it will lend. This includes determining the interest rate charged, the collateral requirements, and any other conditions that must be met by the borrowing institution.

- Monitoring and Assessing Risk: The Federal Reserve closely monitors the financial health and stability of the institutions it provides liquidity to. It assesses the risk associated with each lending arrangement and takes appropriate measures to mitigate any potential risks to the overall financial system.

- Collaborating with Other Institutions: The Federal Reserve works closely with other regulatory agencies and central banks to coordinate efforts and ensure a consistent approach to providing liquidity support. This collaboration helps to enhance the effectiveness of the lender of last resort function and promote financial stability on a global scale.

Examples of the Federal Reserve as a Lender of Last Resort

Throughout its history, the Federal Reserve has played a crucial role as a lender of last resort during various financial crises. Some notable examples include:

| Financial Crisis | Year | Actions Taken |

|---|---|---|

| Great Depression | 1929-1933 | The Federal Reserve provided emergency liquidity to banks and implemented various measures to stabilize the financial system. |

| Global Financial Crisis | 2007-2009 | The Federal Reserve provided extensive liquidity support to banks and implemented unconventional monetary policy measures to mitigate the impact of the crisis. |

| COVID-19 Pandemic | 2020-present | The Federal Reserve implemented a range of emergency lending programs to support the functioning of financial markets and ensure the availability of credit to businesses and households. |

These examples highlight the critical role played by the Federal Reserve as a lender of last resort in times of financial turmoil. By providing emergency liquidity and taking appropriate measures to stabilize the financial system, the Federal Reserve helps to maintain confidence and prevent the escalation of financial crises.

Examples of the Lender of Last Resort Function

1. Financial Crisis of 2008

2. Long-Term Capital Management (LTCM) Crisis

In 1998, the collapse of the hedge fund Long-Term Capital Management (LTCM) posed a significant threat to the stability of the financial system. LTCM’s highly leveraged positions in the derivatives market led to massive losses, and its failure had the potential to trigger a widespread crisis. The Federal Reserve, along with other major financial institutions, intervened and provided emergency funding to prevent a systemic collapse. This action demonstrated the lender of last resort function in action.

3. European Debt Crisis

These examples highlight the importance of the lender of last resort function in maintaining financial stability. By providing emergency liquidity to financial institutions during times of crisis, central banks play a crucial role in preventing systemic collapses and maintaining confidence in the financial system.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.