What is Discount Margin (DM)?

Discount Margin (DM) is a financial term used in the fixed income market to measure the additional yield that an investor can earn by purchasing a bond at a price below its face value. It represents the compensation for the risk associated with the bond’s credit quality, liquidity, and market conditions.

When a bond is issued, it typically has a fixed coupon rate, which is the annual interest rate paid to the bondholder. However, the market value of the bond may fluctuate over time due to changes in interest rates, credit risk, or other factors. If the market price of the bond is lower than its face value, it is said to be trading at a discount.

The discount margin is the difference between the bond’s market yield and its yield to maturity. The market yield is the current interest rate at which the bond is trading in the market, while the yield to maturity is the total return that an investor can expect to earn if they hold the bond until it matures.

The discount margin is an important metric for investors because it helps them assess the potential return and risk of investing in a bond. A higher discount margin indicates a higher potential return, but also a higher level of risk. Conversely, a lower discount margin implies a lower potential return, but also a lower level of risk.

To calculate the discount margin, investors need to know the bond’s market price, coupon rate, yield to maturity, and the time remaining until maturity. This information can be used in a mathematical formula to determine the discount margin.

| Variable | Definition |

|---|---|

| Market Price | The current market price of the bond. |

| Coupon Rate | The fixed annual interest rate paid to the bondholder. |

| Yield to Maturity | The total return that an investor can expect to earn if they hold the bond until it matures. |

| Time to Maturity | The remaining time until the bond reaches its maturity date. |

By plugging these variables into the formula, investors can calculate the discount margin and use it as a tool for evaluating the attractiveness of a bond investment.

Definition and Explanation

The discount margin (DM) is a financial metric used in fixed income investments to determine the additional yield that an investor receives when purchasing a bond at a price below its face value. It is a measure of the risk associated with the bond and compensates the investor for the potential loss in value due to credit risk or other factors.

When a bond is issued, it has a stated face value, which is the amount that the issuer promises to repay the bondholder at maturity. However, bonds can be bought and sold in the secondary market at prices that are different from their face value. If a bond is trading below its face value, it is said to be trading at a discount.

The discount margin is calculated by subtracting the bond’s market price from its face value and dividing the result by the bond’s market price. This calculation provides a percentage that represents the additional yield an investor would receive if they purchased the bond at its market price.

The discount margin is an important metric for investors because it helps them assess the risk and potential return of a bond investment. A higher discount margin indicates a higher yield and potentially higher risk, while a lower discount margin indicates a lower yield and potentially lower risk.

Factors Affecting Discount Margin

Several factors can affect the discount margin of a bond:

1. Credit Risk: Bonds issued by companies or governments with lower credit ratings generally have higher discount margins to compensate for the increased risk of default.

2. Market Conditions: Changes in interest rates or market conditions can affect the discount margin of a bond. If interest rates rise, the price of existing bonds may decrease, leading to higher discount margins.

3. Time to Maturity: Bonds with longer maturities generally have higher discount margins because there is more time for market conditions to change and affect the bond’s value.

4. Liquidity: Bonds that are less liquid, meaning they are not easily bought or sold in the market, may have higher discount margins to compensate investors for the lack of liquidity.

Overall, the discount margin is a useful tool for investors to evaluate the risk and potential return of a bond investment. By considering factors such as credit risk, market conditions, time to maturity, and liquidity, investors can make informed decisions about whether to purchase a bond and at what price.

When Does Discount Margin Apply?

The discount margin (DM) is a financial metric that is commonly used in fixed income securities, such as bonds. It is used to calculate the additional yield that an investor would require to invest in a bond with a lower credit rating or a bond that carries a higher level of risk.

The discount margin applies in situations where there is a difference in credit quality or risk between two bonds with similar characteristics, such as maturity and coupon rate. It is particularly relevant when comparing bonds that are issued by the same issuer but have different credit ratings.

Why is the Discount Margin Important?

The discount margin is important because it provides investors with a way to compare the relative value of different bonds. By calculating the discount margin, investors can determine whether a bond is offering an attractive yield compared to other bonds with similar characteristics.

For example, if an investor is considering two bonds with the same maturity and coupon rate, but one has a higher credit rating than the other, the discount margin can help determine if the higher-rated bond is offering enough additional yield to compensate for the lower credit quality.

How is the Discount Margin Calculated?

The discount margin is calculated by subtracting the present value of the bond’s cash flows from its market price and dividing the result by the present value of the cash flows. The formula for calculating the discount margin is as follows:

By calculating the discount margin, investors can determine the additional yield that they would require to invest in a bond with a lower credit rating or a bond that carries a higher level of risk.

Overall, the discount margin is an important metric for investors to consider when evaluating fixed income securities. It provides a way to compare the relative value of different bonds and helps investors make informed investment decisions.

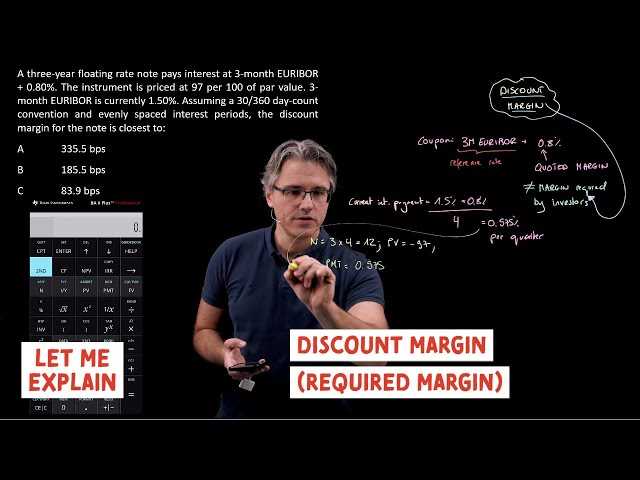

How to Calculate Discount Margin?

Calculating the discount margin (DM) is an important step in fixed income analysis. The discount margin represents the additional yield that an investor receives above the risk-free rate to compensate for the credit risk associated with a bond or other fixed income security.

To calculate the discount margin, you need to follow these steps:

- Obtain the market price of the bond or fixed income security.

- Determine the cash flows associated with the security, including the periodic coupon payments and the final principal repayment.

- Estimate the risk-free rate, which is typically represented by the yield on a government bond with a similar maturity.

- Use a financial calculator or spreadsheet software to discount the cash flows back to their present value using the risk-free rate.

- Adjust the discount rate until the present value of the cash flows matches the market price of the security. This adjusted discount rate is the discount margin.

It is important to note that calculating the discount margin requires some assumptions and estimations. The accuracy of the calculation depends on the accuracy of the market price, cash flow projections, and the risk-free rate estimation.

By calculating the discount margin, investors can compare the potential returns of different fixed income securities and make informed investment decisions based on their risk appetite and return expectations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.