What is Cost of Equity?

The cost of equity is a financial metric that measures the return required by an investor to hold a company’s stock. It represents the compensation investors demand for taking on the risk of investing in a particular company. The cost of equity is an important concept in finance and is used in various financial calculations and decision-making processes.

Definition and Explanation

The cost of equity is the rate of return that an investor expects to earn from an investment in a company’s stock. It is the minimum return that investors require to compensate for the risk associated with investing in the company. The cost of equity is influenced by various factors, including the company’s financial performance, industry conditions, and market expectations.

Importance and Use

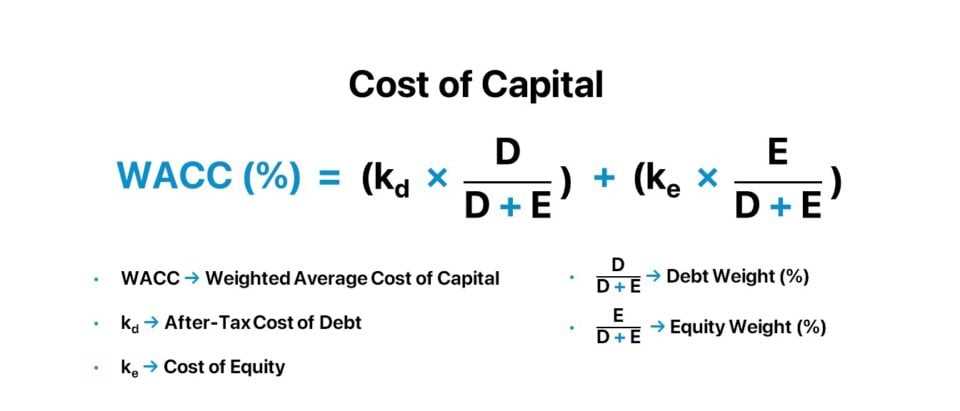

The cost of equity is an important metric for both investors and companies. For investors, it helps in determining whether an investment in a particular company’s stock is worthwhile. It provides a benchmark for evaluating the potential returns and risks associated with the investment. For companies, the cost of equity is used in calculating the company’s cost of capital, which is essential for making investment decisions and determining the optimal capital structure.

How to Calculate Cost of Equity?

Formula and Calculation

The formula for calculating the cost of equity using the CAPM is as follows:

Where:

- Risk-Free Rate is the return on a risk-free investment, such as a government bond.

- Beta measures the sensitivity of a company’s stock price to changes in the overall market.

- Market Return is the average return of the market.

Let’s say the risk-free rate is 3%, the company’s beta is 1.5, and the market return is 8%. Using the formula, the cost of equity would be:

Therefore, the cost of equity for this company would be 10.5%.

Definition and Explanation

The cost of equity is a financial metric that represents the return required by investors to hold a company’s stock. It is the minimum rate of return that a company must generate to compensate its shareholders for the risk they assume by investing in the company’s equity.

Equity represents the ownership stake in a company, and shareholders expect to be rewarded for taking on the risk associated with investing in the company’s stock. The cost of equity is a way to quantify this expected return.

There are several factors that contribute to the cost of equity. One of the main factors is the risk-free rate of return, which represents the return that investors could earn by investing in a risk-free asset, such as government bonds. The risk-free rate serves as a benchmark for the minimum return that investors would expect from a risky investment like stocks.

In addition to the risk-free rate, the cost of equity also takes into account the company’s beta, which measures the stock’s sensitivity to market movements. A higher beta indicates a higher level of risk and therefore a higher cost of equity.

Other factors that may influence the cost of equity include the company’s financial leverage, growth prospects, and industry risk. Companies with higher levels of debt may have a higher cost of equity due to the increased financial risk. Similarly, companies operating in volatile industries may have a higher cost of equity due to the higher level of uncertainty.

Overall, the cost of equity is an important metric for both companies and investors. Companies need to be aware of their cost of equity in order to determine the minimum return they need to generate to attract investors. Investors, on the other hand, use the cost of equity to assess the potential return and risk of investing in a particular company’s stock.

Importance and Use

The cost of equity is an important financial metric that is used by investors, analysts, and companies to evaluate the attractiveness of an investment opportunity. It is a key component in determining the required rate of return for equity investors.

Investors use the cost of equity to assess the potential return on their investment in a particular company. By comparing the cost of equity to the expected return, investors can determine whether the investment is likely to be profitable. A higher cost of equity indicates a higher level of risk, which may make the investment less attractive.

Analysts use the cost of equity to determine the value of a company’s stock. By estimating the cost of equity, analysts can calculate the present value of the expected future cash flows associated with the stock. This valuation can be used to make investment recommendations or to compare the value of different stocks.

Overall, the cost of equity is a crucial tool for investors, analysts, and companies to assess the attractiveness and value of investment opportunities. It provides valuable insights into the risk and return associated with equity investments and helps guide financial decision-making.

How to Calculate Cost of Equity?

The cost of equity is an important metric used by investors and financial analysts to determine the return required by shareholders for their investment in a company. It represents the rate of return that an investor expects to earn on an investment in the company’s stock.

Formula and Calculation

There are several methods to calculate the cost of equity, but one commonly used formula is the Capital Asset Pricing Model (CAPM). The CAPM formula is as follows:

The components of the formula are as follows:

- Risk-Free Rate: This is the rate of return on a risk-free investment, such as a government bond. It represents the minimum return an investor expects to earn without taking on any additional risk.

- Beta: Beta measures the sensitivity of a stock’s returns to the overall market returns. It represents the level of systematic risk associated with the stock.

To calculate the cost of equity using the CAPM formula, you need to determine the risk-free rate, beta, and market return. Once you have these values, you can plug them into the formula to calculate the cost of equity.

Example Calculation

Let’s say the risk-free rate is 2%, the beta of a stock is 1.5, and the market return is 8%. Using the CAPM formula, the cost of equity would be:

Therefore, the cost of equity for this stock would be 11%. This means that investors would expect to earn a return of 11% on their investment in the stock to compensate them for the level of risk associated with the stock.

Formula and Calculation

The cost of equity can be calculated using the following formula:

Cost of Equity = (Dividends per Share / Current Stock Price) + Growth Rate

The formula takes into account two main components: dividends per share and the growth rate. Dividends per share refer to the amount of money that a company pays out to its shareholders in the form of dividends. The current stock price is the market value of a single share of the company’s stock.

The growth rate represents the expected rate at which the company’s earnings and dividends are expected to grow in the future. It is an important factor in determining the cost of equity, as investors expect a higher return on their investment if the company is expected to grow at a faster rate.

Once you have the dividends per share, current stock price, and growth rate, you can plug these values into the formula to calculate the cost of equity. The result will be a percentage that represents the return that investors require for holding the company’s stock.

For example, let’s say a company has dividends per share of $2, a current stock price of $50, and a growth rate of 5%. Using the formula, the cost of equity would be calculated as follows:

Cost of Equity = ($2 / $50) + 0.05 = 0.04 + 0.05 = 0.09 or 9%

This means that investors would require a 9% return on their investment in order to hold the company’s stock.

Example Calculation

Let’s consider a hypothetical company, XYZ Corporation, to understand how to calculate the cost of equity. XYZ Corporation has a current stock price of $50 per share and pays an annual dividend of $2 per share. The dividend is expected to grow at a rate of 5% per year.

Step 1: Calculate the Dividend Growth Rate

To calculate the dividend growth rate, we use the formula:

Step 2: Calculate the Cost of Equity

The cost of equity can be calculated using the formula:

Cost of Equity = (Dividend / Stock Price) + Dividend Growth Rate

Cost of Equity = ($2 / $50) + 0.05 = 0.04 + 0.05 = 0.09 or 9%

Therefore, the cost of equity for XYZ Corporation is 9%. This means that investors would expect a 9% return on their investment in XYZ Corporation’s stock to compensate for the risk associated with the investment.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.