NAV Return Definition Calculation

The Net Asset Value (NAV) return is a calculation used to determine the performance of a mutual fund. It is a measure of the change in the value of the fund’s assets over a specific period of time. The NAV return is often used by investors to evaluate the performance of a mutual fund and compare it to other investment options.

To calculate the NAV return, you need to know the starting NAV and the ending NAV of the mutual fund. The NAV is calculated by dividing the total value of the fund’s assets by the number of outstanding shares. The starting NAV is the NAV at the beginning of the period, and the ending NAV is the NAV at the end of the period.

Once you have the starting and ending NAV, you can calculate the NAV return using the following formula:

The result is usually expressed as a percentage. A positive NAV return indicates that the value of the fund’s assets has increased over the period, while a negative NAV return indicates a decrease in value.

By calculating and analyzing the NAV return, investors can gain insights into the performance of a mutual fund and make informed decisions about their investment strategies.

Net asset value represents the total value of a mutual fund’s assets minus its liabilities. It is calculated by dividing the total value of the fund’s assets by the number of outstanding shares. NAV return is expressed as a percentage and is often used by investors to assess the fund’s performance relative to a benchmark or other funds in the same category.

Calculating NAV Return

To calculate NAV return, the following formula is used:

| NAV Return | = |

|---|

Where:

- NAVend is the net asset value at the end of the period

- NAVstart is the net asset value at the start of the period

The resulting NAV return percentage indicates the fund’s performance over the specified time period. A positive NAV return indicates a gain in the fund’s value, while a negative NAV return indicates a loss.

Interpreting NAV Return

NAV return provides investors with insights into the fund’s ability to generate returns. It is important to compare the NAV return of a mutual fund to its benchmark or other funds in the same category to assess its relative performance. A higher NAV return than the benchmark or peers suggests that the fund has outperformed, while a lower NAV return indicates underperformance.

Investors should also consider the consistency of the fund’s NAV return over time. A fund that consistently delivers positive NAV returns may be considered more reliable and less volatile compared to a fund with fluctuating returns.

Market Return

The market return refers to the overall performance of the financial market. It is a measure of the change in the value of an investment portfolio or index over a specific time period. Market return is often used as a benchmark to evaluate the performance of individual investments or mutual funds.

Investors and fund managers analyze the market return to assess the overall health and trends of the market. A positive market return indicates that the market is performing well and investors are making profits. Conversely, a negative market return suggests a decline in market value and potential losses for investors.

Market return is influenced by various factors, including economic conditions, political events, and investor sentiment. It can fluctuate daily, monthly, or annually, depending on the performance of the underlying assets.

When comparing the performance of individual investments or mutual funds to the market return, investors can determine whether their investments are outperforming or underperforming the market. This analysis helps investors make informed decisions about their investment strategies and portfolio allocations.

It is important to note that market return is not guaranteed and can be volatile. Past performance is not indicative of future results, and investors should consider their risk tolerance and investment goals before making any investment decisions.

Analyzing the performance of the market

Another important aspect to consider when analyzing the performance of the market is the volatility. Volatility refers to the degree of fluctuation in the market prices. High volatility indicates that the market is experiencing significant price swings, while low volatility suggests a more stable market.

Additionally, it is crucial to analyze the market’s performance relative to other investment options. This can be done by comparing the market returns to the returns of other asset classes, such as bonds or real estate. By doing so, investors can assess whether the market is outperforming or underperforming other investment options.

Furthermore, analyzing the performance of the market involves examining various market indicators, such as price-to-earnings ratios, dividend yields, and earnings growth rates. These indicators can provide insights into the valuation and profitability of the market, helping investors make informed investment decisions.

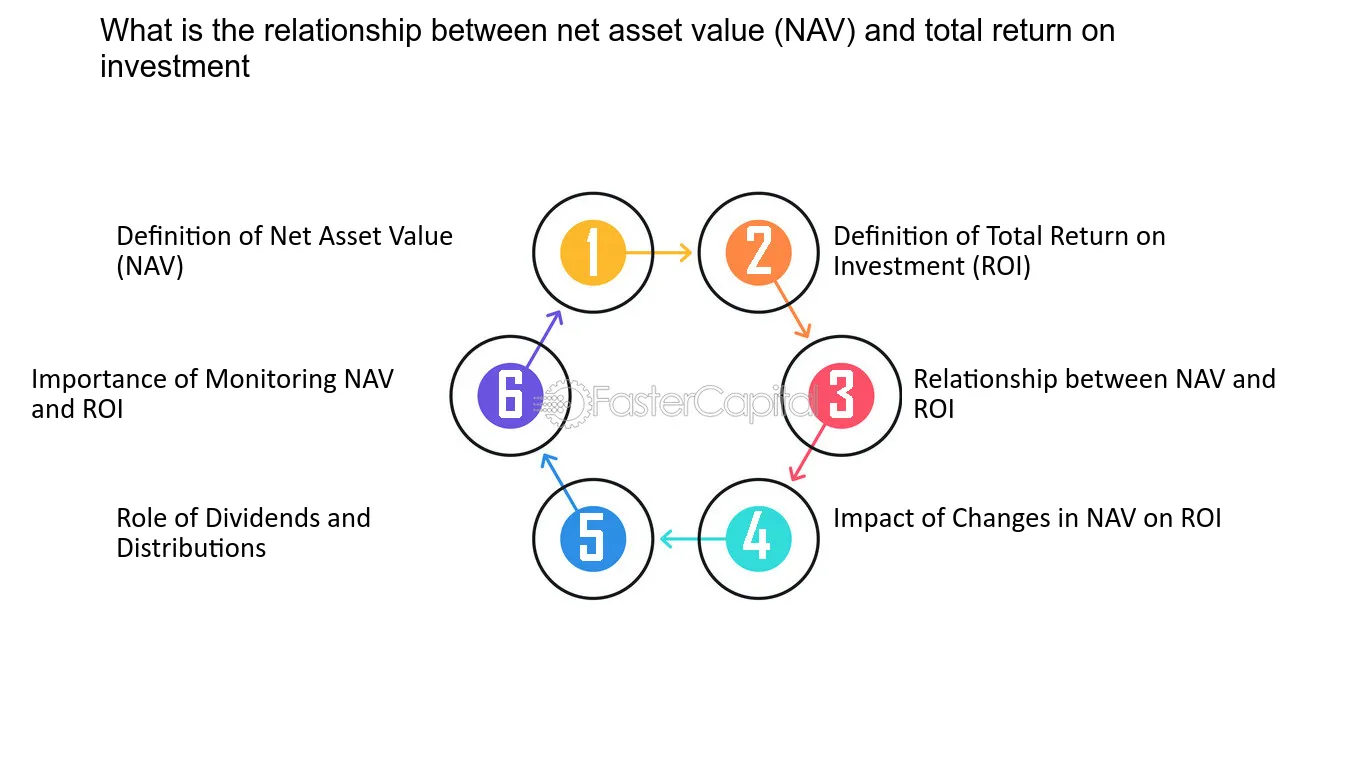

Comparison: NAV Return vs Market Return

NAV Return Definition Calculation

Market Return

Market Return, on the other hand, is a measure of the overall performance of the market or a specific benchmark index. It represents the change in the value of the market or index over a given period of time.

Market Return is usually calculated by taking the difference between the ending value of the market or index and the beginning value, and then dividing it by the beginning value.

Analyzing the performance of the market

Before comparing NAV Return and Market Return, it is important to analyze the performance of the market. This can be done by looking at various factors such as economic indicators, industry trends, and geopolitical events.

Comparison: NAV Return vs Market Return

While both NAV Return and Market Return provide valuable information about the performance of mutual funds, there are some key differences between them.

NAV Return focuses specifically on the performance of a mutual fund, taking into account the changes in its net asset value. It provides investors with an indication of how well the fund has performed over a specific period of time.

On the other hand, Market Return provides a broader view of the overall market performance or the performance of a specific benchmark index. It helps investors understand how the market as a whole or a specific sector has performed.

However, it is important to note that past performance is not indicative of future results. Investors should consider other factors such as risk tolerance, investment objectives, and fees before making investment decisions.

Calculating and comparing the returns

To calculate and compare the returns of a mutual fund, investors can look at the NAV Return and compare it to the Market Return. If the NAV Return is higher than the Market Return, it suggests that the mutual fund has outperformed the market.

However, it is important to consider the time period and the benchmark index used for comparison. Different benchmarks may have different levels of risk and return, so it is essential to choose an appropriate benchmark for comparison.

Calculating and Comparing the Returns

To calculate the NAV return of a mutual fund, you need to know the net asset value (NAV) at the beginning and end of a specific period. The NAV return is calculated by dividing the difference between the ending NAV and the beginning NAV by the beginning NAV. This calculation gives you the percentage change in the NAV over the period.

Comparing the NAV return and market return can provide valuable insights into the performance of a mutual fund. If the NAV return is higher than the market return, it indicates that the fund has outperformed the market. Conversely, if the NAV return is lower than the market return, it suggests that the fund has underperformed compared to the overall market.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.