Why Cost of Capital Matters in Corporate Finance

The cost of capital is a crucial concept in corporate finance as it plays a significant role in decision-making processes for companies. It represents the minimum return rate that a company must earn on its investments to satisfy its investors and maintain the value of its stock.

Here are some reasons why the cost of capital matters in corporate finance:

- Investment Evaluation: The cost of capital is used to evaluate potential investment opportunities. By comparing the expected return of an investment to the cost of capital, companies can determine whether the investment is worthwhile. If the expected return exceeds the cost of capital, the investment is considered profitable.

- Capital Budgeting: The cost of capital is also essential in the capital budgeting process. It helps companies allocate their financial resources efficiently by identifying projects that generate returns higher than the cost of capital. This ensures that the company maximizes its value and profitability.

- Valuation: The cost of capital is used in valuation models to determine the present value of future cash flows. By discounting the expected cash flows at the cost of capital, companies can estimate the current value of their investments or projects. This is crucial for making investment decisions and assessing the overall value of the company.

Calculation of Cost of Capital

The cost of capital is a crucial metric in corporate finance as it helps companies determine the minimum return they need to generate on their investments to meet their financial obligations. Calculating the cost of capital involves determining the weighted average cost of all the sources of financing used by a company, including debt and equity.

Once the cost of debt and equity is determined, the next step is to determine the weight of each source of financing in the company’s capital structure. This is done by dividing the market value of each source by the total market value of the company’s capital structure.

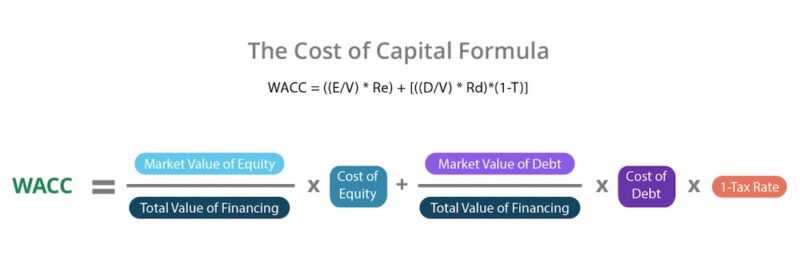

After determining the cost and weight of each source of financing, the final step is to calculate the weighted average cost of capital (WACC). This is done by multiplying the cost of debt by the weight of debt and adding it to the cost of equity multiplied by the weight of equity. The formula for calculating WACC is as follows:

WACC = (Cost of Debt x Weight of Debt) + (Cost of Equity x Weight of Equity)

The result of this calculation represents the minimum return that a company needs to generate on its investments to satisfy its investors and lenders. It is important for companies to regularly calculate their cost of capital to ensure that they are making sound financial decisions and maximizing shareholder value.

Components and Methods for Calculating Cost of Capital

The cost of capital is a crucial metric in corporate finance, as it helps companies determine the minimum return they need to generate on their investments to satisfy their investors and lenders. Calculating the cost of capital involves considering various components and using different methods. Here are some key components and methods used in calculating the cost of capital:

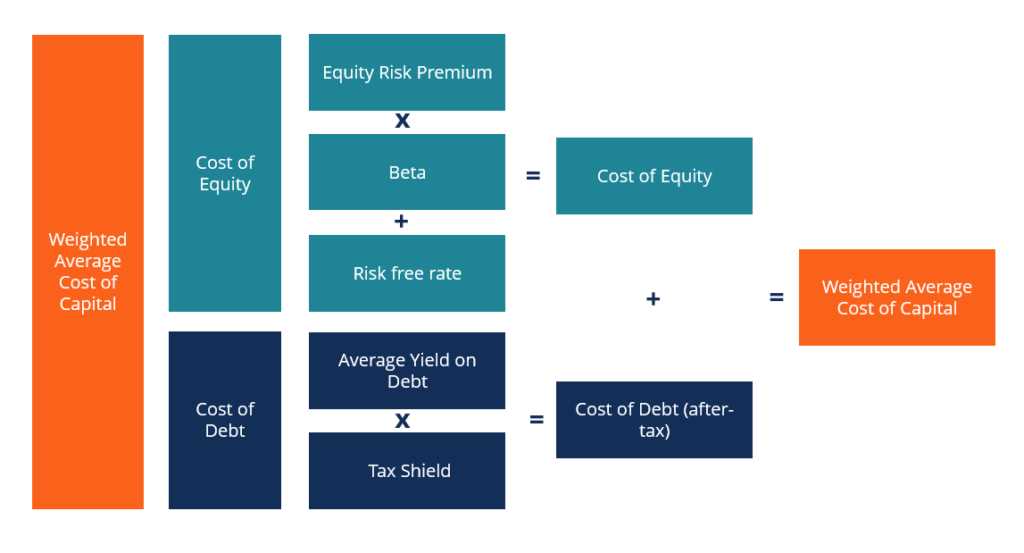

- Cost of Debt: This component represents the cost of borrowing money for a company. It is calculated by considering the interest rate on the company’s debt and any associated fees or expenses.

- Cost of Equity: The cost of equity represents the return required by the company’s shareholders. It is calculated by considering the company’s stock price, dividend payments, and the expected rate of return on similar investments.

- Weighted Average Cost of Capital (WACC): The WACC is a weighted average of the cost of debt and the cost of equity. It takes into account the proportion of debt and equity in a company’s capital structure. The WACC is often used as a benchmark for evaluating investment opportunities.

- Capital Asset Pricing Model (CAPM): The CAPM is a widely used method for estimating the cost of equity. It considers the risk-free rate of return, the company’s beta (a measure of its risk), and the expected market return.

- Dividend Discount Model (DDM): The DDM is another method for estimating the cost of equity. It calculates the present value of expected future dividends and assumes that the stock price reflects the discounted value of these dividends.

- Market Value of Debt and Equity: When calculating the cost of capital, it is important to use the market value of debt and equity rather than the book value. The market value reflects the current market conditions and provides a more accurate measure of the company’s capital structure.

By considering these components and using appropriate methods, companies can calculate their cost of capital and make informed decisions regarding their investments and financing. The cost of capital serves as a benchmark for evaluating the profitability of projects and helps companies determine whether they are generating sufficient returns to satisfy their investors and lenders.

Real-Life Example of Cost of Capital

Company XYZ

Imagine a company called XYZ that operates in the manufacturing industry. XYZ is considering a new project that requires a significant investment. Before proceeding with the project, XYZ wants to evaluate its cost of capital to determine if the project is financially viable.

To calculate the cost of capital, XYZ needs to consider various factors, including the cost of debt and the cost of equity. The cost of debt is the interest rate XYZ pays on its borrowed funds, while the cost of equity represents the return expected by the company’s shareholders.

XYZ’s cost of debt is 5% per annum, and the company has $1 million in outstanding debt. The cost of equity is estimated to be 10%, and the company’s market value of equity is $5 million.

Using these figures, XYZ can calculate its weighted average cost of capital (WACC). WACC is the average rate of return a company needs to earn to satisfy its investors and lenders. It is calculated by multiplying the cost of debt by the proportion of debt in the company’s capital structure and adding it to the cost of equity multiplied by the proportion of equity.

In XYZ’s case, let’s assume that the proportion of debt in its capital structure is 40% and the proportion of equity is 60%. The calculation would be as follows:

WACC = (Cost of Debt x Proportion of Debt) + (Cost of Equity x Proportion of Equity)

WACC = (0.05 x 0.4) + (0.1 x 0.6) = 0.02 + 0.06 = 0.08 or 8%

Therefore, XYZ’s weighted average cost of capital is 8%. This means that for the new project to be financially viable, it needs to generate a return higher than 8%.

By calculating the cost of capital, XYZ can evaluate the profitability of potential investments and make informed decisions. It provides a benchmark for determining the minimum return a project should generate to cover the cost of capital and satisfy investors and lenders.

How Companies Use Cost of Capital in Decision-Making

The cost of capital is a crucial factor that companies consider when making financial decisions. It provides a benchmark for evaluating the profitability and feasibility of various investment opportunities. Here are some ways in which companies use the cost of capital in decision-making:

- Capital Budgeting: When evaluating potential investment projects, companies compare the expected returns of the project with the cost of capital. If the expected returns are higher than the cost of capital, the project is considered financially viable and may be pursued.

- Project Selection: The cost of capital helps companies prioritize and select among different investment projects. Projects with higher expected returns relative to the cost of capital are typically given higher priority.

- Capital Structure: The cost of capital plays a role in determining the optimal capital structure for a company. By comparing the cost of debt and the cost of equity, companies can decide on the appropriate mix of debt and equity financing to minimize their overall cost of capital.

- Dividend Policy: The cost of capital also influences a company’s dividend policy. If the cost of capital is high, the company may choose to retain earnings and reinvest them in projects that generate higher returns, rather than paying them out as dividends.

- Merger and Acquisition Decisions: When considering mergers or acquisitions, companies assess the cost of capital of the target company. This helps determine the potential synergies and whether the acquisition will create value for shareholders.

- Valuation: The cost of capital is used in various valuation models, such as discounted cash flow (DCF) analysis, to determine the present value of future cash flows. This valuation is essential for making informed investment decisions.

- Performance Evaluation: Companies use the cost of capital as a benchmark to evaluate the performance of different business units or divisions. By comparing the return on investment (ROI) with the cost of capital, companies can identify areas of underperformance and take corrective actions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.