What is Discounted Cash Flow (DCF)?

Discounted Cash Flow (DCF) is a financial valuation method used to determine the value of an investment based on its expected future cash flows. It takes into account the time value of money, which means that a dollar received in the future is worth less than a dollar received today.

DCF is commonly used in investment analysis and capital budgeting to assess the profitability and feasibility of a project or investment. By discounting the projected cash flows to their present value, DCF provides a more accurate measure of the investment’s worth.

How does DCF work?

The basic principle of DCF is that the value of an investment is equal to the present value of its expected future cash flows. To calculate the present value, the future cash flows are discounted using a discount rate, which reflects the time value of money and the risk associated with the investment.

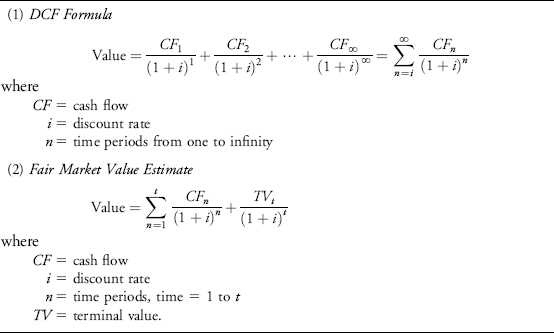

The formula for DCF is:

DCF = CF1 / (1 + r)1 + CF2 / (1 + r)2 + … + CFn / (1 + r)n

Where:

- DCF is the discounted cash flow

- CF1, CF2, …, CFn are the expected future cash flows

- r is the discount rate

By discounting each cash flow back to its present value and summing them up, DCF provides a single value that represents the investment’s worth. If the calculated DCF is higher than the initial investment, the project or investment is considered profitable.

DCF analysis allows investors to compare the value of different investment opportunities and make informed decisions based on their expected returns and risks. It also helps in determining the fair value of a company’s stock by estimating its future cash flows and discounting them to the present.

Overall, Discounted Cash Flow (DCF) is a powerful financial tool that helps investors and analysts evaluate the value of an investment based on its expected future cash flows. By considering the time value of money, DCF provides a more accurate measure of an investment’s worth and assists in making informed investment decisions.

Definition and Explanation

Discounted Cash Flow (DCF) is a financial valuation method used to determine the value of an investment or a company by estimating the future cash flows it will generate and discounting them back to their present value. It is based on the concept that a dollar received in the future is worth less than a dollar received today.

The DCF analysis takes into account the time value of money, which recognizes that the value of money changes over time due to factors such as inflation and the opportunity cost of investing in alternative investments. By discounting the future cash flows, DCF provides a more accurate and realistic assessment of the value of an investment.

The DCF formula is based on the principle that the present value of future cash flows can be calculated by dividing each cash flow by a discount rate. The discount rate is typically the weighted average cost of capital (WACC), which represents the required rate of return for investors.

DCF analysis is commonly used in investment banking, corporate finance, and private equity to evaluate the attractiveness of an investment opportunity or to determine the value of a company for mergers and acquisitions. It allows investors and analysts to make informed decisions based on the projected cash flows and their present value.

Overall, Discounted Cash Flow (DCF) is a powerful financial tool that provides a systematic approach to valuing investments and companies. By considering the time value of money, it helps investors and analysts make more accurate and informed decisions about potential investments.

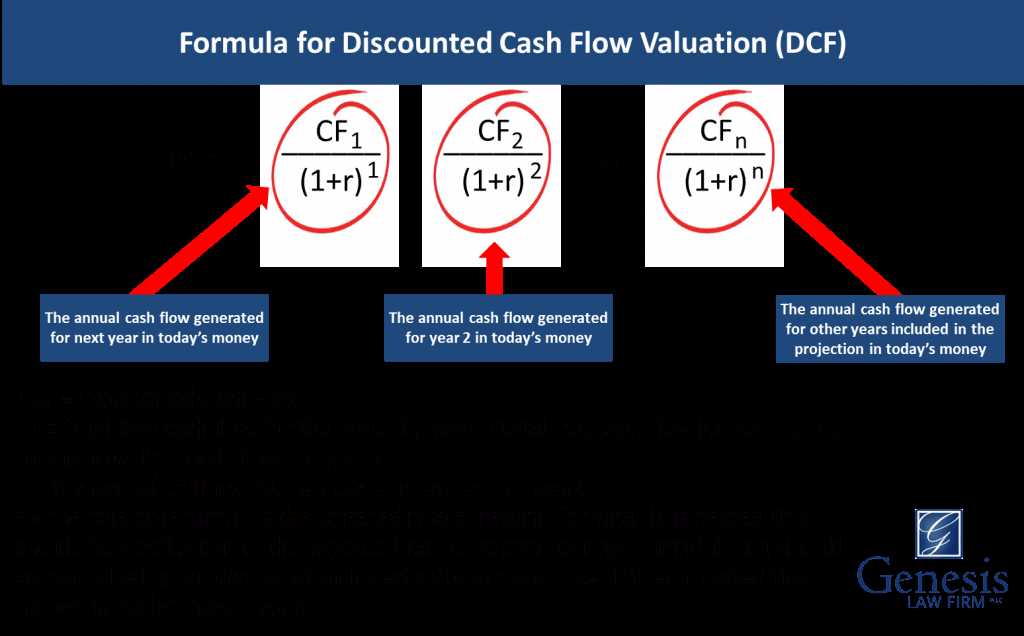

Formula for Discounted Cash Flow (DCF)

The formula for calculating the discounted cash flow (DCF) is a commonly used method in finance to determine the value of an investment or business. It takes into account the time value of money, which means that a dollar received in the future is worth less than a dollar received today.

The formula for DCF is:

DCF = CF1 / (1+r)1 + CF2 / (1+r)2 + … + CFn / (1+r)n

Where:

- DCF is the discounted cash flow

- CF1, CF2, …, CFn are the expected cash flows for each period

- r is the discount rate, which represents the rate of return required by an investor to invest in the project

The formula calculates the present value of all future cash flows by discounting them back to their present value. Each cash flow is divided by (1+r)t, where t is the number of periods into the future the cash flow occurs. The discounted cash flows are then summed to get the total present value.

By calculating the discounted cash flow, investors can determine whether an investment is undervalued or overvalued. If the DCF is higher than the current market price, the investment may be considered undervalued and potentially a good investment. On the other hand, if the DCF is lower than the market price, the investment may be considered overvalued and not a good investment.

Overall, the DCF formula is a powerful tool for valuing investments and businesses, as it takes into account the time value of money and provides a more accurate representation of their true value.

How to Calculate DCF

Calculating the Discounted Cash Flow (DCF) is an important financial analysis method that helps determine the present value of future cash flows. It is commonly used in valuation and investment decision-making processes. Here are the steps to calculate DCF:

- Estimate future cash flows: The first step is to estimate the cash flows that the investment or project is expected to generate over a specific period of time. These cash flows can include revenues, expenses, and other financial metrics.

- Determine the discount rate: The discount rate is the rate of return that an investor or company requires to invest in a particular project or investment. It takes into account the risk and opportunity cost of the investment. The discount rate is usually based on the company’s cost of capital or the investor’s required rate of return.

- Calculate the present value: Once the future cash flows and discount rate are determined, the next step is to calculate the present value of each cash flow. This is done by dividing each cash flow by (1 + discount rate) raised to the power of the period in which the cash flow is expected to occur. The present value of each cash flow is then summed up to get the total present value.

- Subtract the initial investment: If there is an initial investment required for the project or investment, it should be subtracted from the total present value calculated in the previous step. This gives the net present value (NPV) of the investment.

It is important to note that the accuracy of the DCF calculation depends on the accuracy of the estimated cash flows and the discount rate used. Therefore, it is crucial to conduct thorough research and analysis to ensure reliable inputs for the DCF calculation.

Examples of Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow (DCF) analysis is a financial valuation method that helps determine the value of an investment by estimating the future cash flows it will generate and discounting them back to their present value. This analysis is commonly used by investors, analysts, and financial professionals to make informed decisions about potential investments.

Example 1: Real Estate Investment

Let’s say you are considering purchasing a rental property. To determine if it is a good investment, you can perform a DCF analysis. First, estimate the future cash flows the property is expected to generate, including rental income and potential resale value. Next, determine the appropriate discount rate, which accounts for the time value of money and the risk associated with the investment. Finally, discount the projected cash flows back to their present value using the discount rate. If the present value of the cash flows is higher than the purchase price of the property, it may be a good investment.

Example 2: Business Valuation

DCF analysis can also be used to value a business. Let’s say you are considering acquiring a small company. To determine its value, you can perform a DCF analysis. Start by estimating the future cash flows the business is expected to generate, taking into account factors such as revenue growth, operating expenses, and capital expenditures. Then, determine an appropriate discount rate based on the risk associated with the industry and the company’s specific circumstances. Finally, discount the projected cash flows back to their present value using the discount rate. If the present value of the cash flows is higher than the acquisition cost, it may be a favorable investment.

Example 3: Stock Valuation

DCF analysis can also be applied to value stocks. Let’s say you are considering investing in a company’s stock. To determine if it is undervalued or overvalued, you can perform a DCF analysis. Start by estimating the future cash flows the company is expected to generate, considering factors such as revenue growth, profit margins, and capital expenditures. Then, determine an appropriate discount rate based on the company’s risk profile and the overall market conditions. Finally, discount the projected cash flows back to their present value using the discount rate. If the present value of the cash flows is higher than the current stock price, it may indicate that the stock is undervalued.

| Advantages of DCF Analysis | Disadvantages of DCF Analysis |

|---|---|

| – Provides a comprehensive valuation of an investment | – Requires accurate estimation of future cash flows |

| – Incorporates the time value of money | – Sensitivity to changes in discount rate |

| – Allows for comparison of different investments | – Relies on assumptions and projections |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.