Authorized Stock Definition

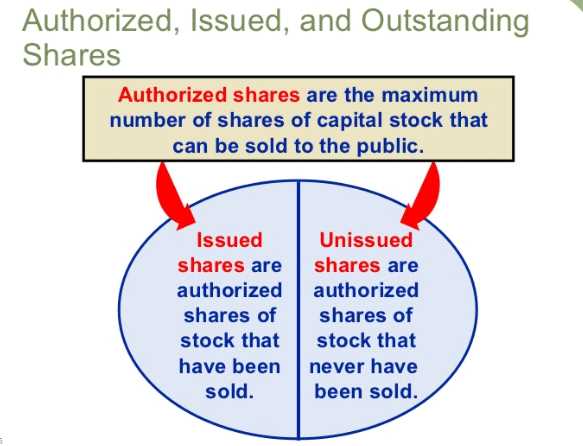

Authorized stock refers to the maximum number of shares that a company is legally allowed to issue to its shareholders. This number is determined and specified in the company’s articles of incorporation or its charter. The authorized stock represents the total number of shares that the company is authorized to issue, but it does not necessarily mean that all of these shares have been issued or are currently outstanding.

Authorized stock is an important concept in corporate finance and plays a crucial role in the governance and operations of a company. It sets the limit on the number of shares that can be issued by the company, which helps in controlling the ownership structure and dilution of existing shareholders.

When a company is formed, it specifies the number of authorized shares in its articles of incorporation. This number can be increased or decreased through a vote by the shareholders. The authorized stock can be divided into different classes or series, such as common stock and preferred stock, each with its own rights and privileges.

Example of Authorized Stock

Let’s consider an example to better understand authorized stock. Company ABC has 10,000 authorized shares of common stock. Out of these, it has issued 5,000 shares to its shareholders. This means that the company still has 5,000 authorized but unissued shares that it can potentially issue in the future.

The authorized stock provides flexibility to the company to raise additional capital by issuing new shares when needed. It also allows the company to issue different classes of stock, such as preferred stock with special rights, without the need for amending its articles of incorporation.

It is important to note that authorized stock does not represent the actual number of shares that are outstanding or held by shareholders. The number of issued shares represents the shares that have been issued and are currently held by shareholders.

Overall, authorized stock is a key aspect of a company’s capital structure and provides the framework for issuing and managing shares. It helps in maintaining control over ownership and facilitates future capital raising activities.

Authorized stock serves as a limit or cap on the number of shares that a company can issue. It is important for a company to have authorized stock because it provides flexibility for future financing and growth opportunities. By having a higher number of authorized shares, a company can easily raise capital by issuing additional shares to investors.

However, it is important to note that authorized stock does not necessarily mean that all of the shares will be issued or sold immediately. The company may choose to issue only a portion of the authorized shares initially and keep the remaining shares for future use.

Authorized Stock vs. Issued Stock

Authorized stock should not be confused with issued stock. While authorized stock represents the maximum number of shares a company can issue, issued stock refers to the actual number of shares that have been sold or distributed to shareholders.

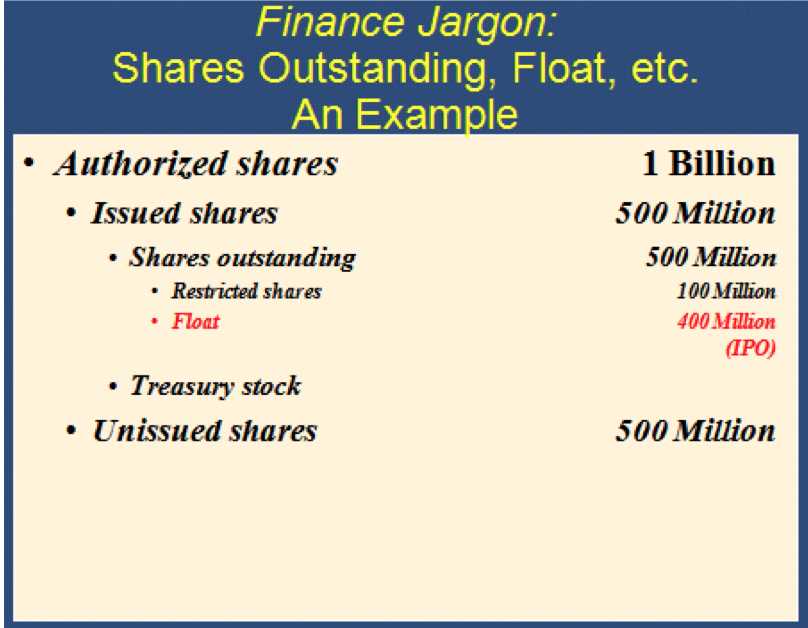

For example, if a company has 1,000,000 authorized shares but has only issued 500,000 shares to investors, then the issued stock would be 500,000 shares. The remaining 500,000 shares would still be part of the authorized stock and can be issued in the future if needed.

Authorized stock provides a company with flexibility and potential for future growth, while issued stock represents the actual number of shares that have been sold or distributed to shareholders.

Example of Authorized Stock

For example, let’s say a company’s articles of incorporation state that it has authorized stock of 1,000,000 shares. This means that the company can issue up to 1,000,000 shares to investors. However, it doesn’t mean that all of these shares have been issued or sold.

Authorized stock serves as a limit or cap on the number of shares a company can issue. It provides flexibility for the company to raise additional capital in the future by issuing more shares if needed. The authorized stock can be increased or decreased through a vote by the company’s board of directors and shareholders.

In summary, the example of authorized stock demonstrates the maximum number of shares that a company can issue, as stated in its articles of incorporation. It represents the company’s authority to sell shares to investors, but doesn’t necessarily mean that all of these shares have been issued or sold.

Issued Stock

Issued stock refers to the shares of a company’s stock that have been sold or allocated to investors. When a company decides to raise capital by offering shares to the public, it issues a certain number of shares, which become the issued stock. These shares represent ownership in the company and entitle the shareholders to certain rights, such as voting rights and a share of the company’s profits.

Issued stock is different from authorized stock, which is the maximum number of shares that a company is allowed to issue. The authorized stock represents the total number of shares that a company is legally permitted to offer to investors, while the issued stock is the actual number of shares that have been sold or allocated.

Importance of Issued Stock

The concept of issued stock is important because it helps investors understand the ownership structure of a company. By knowing the number of shares that have been issued, investors can determine the percentage of the company they own based on the number of shares they hold.

Issued stock also plays a role in determining a company’s market capitalization, which is the total value of a company’s outstanding shares. The market capitalization is calculated by multiplying the current market price of a company’s stock by the number of issued shares.

Conclusion

What is Issued Stock?

Issued stock refers to the number of shares that a company has actually sold or issued to shareholders. It represents the portion of authorized stock that has been distributed to investors. When a company decides to raise capital by selling shares, it issues those shares to investors in exchange for their investment.

Issued stock is an important metric for investors as it indicates the ownership stake they hold in a company. The number of issued shares determines the percentage of ownership and the voting rights that shareholders have in the company. Shareholders with a larger number of issued shares have a greater say in the company’s decision-making process.

Key Points about Issued Stock:

1. Ownership Stake: Issued stock represents the ownership stake that shareholders hold in a company. The more shares a shareholder owns, the larger their ownership stake and influence in the company.

2. Voting Rights: The number of issued shares determines the voting rights of shareholders. Shareholders with a larger number of issued shares have more voting power in the company’s decision-making process.

3. Dilution: When a company issues additional shares, it can dilute the ownership stake and voting rights of existing shareholders. This can happen when a company raises capital through a secondary offering or when it grants stock options to employees.

4. Market Capitalization: The market capitalization of a company is calculated by multiplying the current share price by the number of issued shares. It represents the total value of a company’s outstanding shares in the market.

5. Stock Price: The number of issued shares can affect the stock price. If a company has a large number of issued shares, each share represents a smaller ownership stake, which can impact the perceived value of the stock.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.