What is EDGAR?

EDGAR (Electronic Data Gathering Analysis and Retrieval) is an online database maintained by the U.S. Securities and Exchange Commission (SEC). It is a comprehensive repository of financial reports, filings, and other information submitted by public companies, mutual funds, and other entities regulated by the SEC.

EDGAR was established in 1984 and has since become the primary source for accessing and analyzing corporate financial information. It provides investors, analysts, and the general public with free access to a vast amount of data, including annual and quarterly reports, registration statements, prospectuses, and other important filings.

The database is searchable and allows users to retrieve specific documents based on various criteria, such as company name, ticker symbol, filing type, and date range. It also offers advanced search options, including the ability to search for specific keywords within documents.

EDGAR plays a crucial role in promoting transparency and accountability in the financial markets. It enables investors to make informed decisions by providing them with timely and accurate information about the companies they are interested in. It also helps regulators monitor compliance with securities laws and regulations.

Overall, EDGAR is a valuable resource for anyone interested in researching and analyzing publicly traded companies. Its user-friendly interface and extensive collection of financial data make it an essential tool for investors, analysts, journalists, and other stakeholders in the financial industry.

| Key Features of EDGAR |

|---|

| Comprehensive database of financial reports and filings |

| Free and open access to the public |

| Searchable by various criteria |

| Advanced search options, including keyword search |

| Promotes transparency and accountability in the financial markets |

| Used by investors, analysts, regulators, and other stakeholders |

How does EDGAR work?

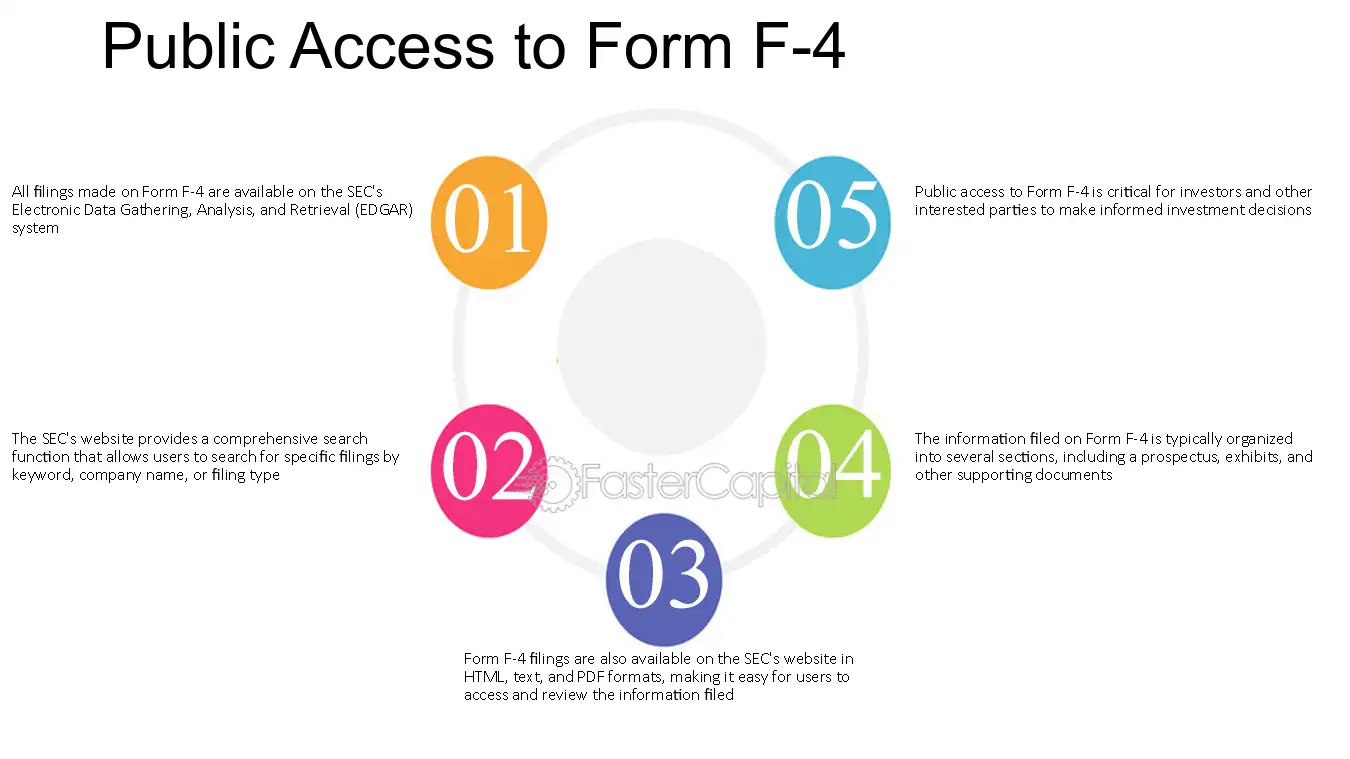

EDGAR, which stands for Electronic Data Gathering Analysis and Retrieval, is an online database that allows users to access and search for financial information submitted by companies to the United States Securities and Exchange Commission (SEC). It is a comprehensive system that provides public access to corporate filings, including annual reports, quarterly reports, and other important financial documents.

EDGAR works by collecting, organizing, and storing financial information submitted by companies in a standardized format. Companies are required by law to submit their financial statements and other relevant documents to the SEC, and EDGAR is the platform that makes this information available to the public.

When a company submits a filing to the SEC, it is reviewed for compliance and then processed by EDGAR. The information is converted into a machine-readable format and made available for public access. Users can search for specific filings using various search criteria, such as company name, ticker symbol, or specific document types.

EDGAR also provides tools for analyzing and comparing financial data. Users can access financial statements, footnotes, and other disclosures, as well as download the data for further analysis. The system also offers advanced search capabilities, allowing users to search for specific keywords or phrases within filings.

Overall, EDGAR plays a crucial role in promoting transparency and accountability in the financial markets. It provides investors, analysts, and the general public with easy access to important financial information, helping them make informed decisions and ensuring the integrity of the securities market.

Benefits of using EDGAR

Electronic Data Gathering Analysis and Retrieval (EDGAR) offers several benefits for users in the financial industry:

1. Access to a vast database: EDGAR provides access to a comprehensive collection of public company filings, including annual reports, quarterly reports, and other financial statements. This extensive database allows users to quickly and easily retrieve relevant information about companies and their financial activities.

2. Timely and up-to-date information: EDGAR ensures that the information available is current and accurate. Filings are required to be submitted to the system within specific timeframes, ensuring that users have access to the most recent financial data and disclosures.

3. Search and retrieval capabilities: EDGAR offers powerful search and retrieval capabilities, allowing users to find specific information within filings. Users can search by company name, ticker symbol, filing type, or specific keywords, making it easy to locate the desired information efficiently.

4. Transparency and accountability: EDGAR promotes transparency in the financial markets by making company filings readily available to the public. This allows investors, analysts, and other stakeholders to access the same information, ensuring a level playing field and fostering trust in the financial system.

5. Cost-effective access: EDGAR provides free access to its database, making it an affordable resource for users. This accessibility eliminates the need for expensive subscriptions or paid services, democratizing access to financial information.

6. Regulatory compliance: EDGAR is a regulatory requirement for companies filing with the U.S. Securities and Exchange Commission (SEC). By using EDGAR, companies ensure compliance with disclosure obligations and regulatory standards, reducing the risk of penalties or legal issues.

Overall, EDGAR is a valuable tool for financial professionals, investors, and researchers, offering easy access to a wealth of financial information, promoting transparency, and facilitating regulatory compliance.

FAQ about EDGAR

Here are some frequently asked questions about EDGAR:

1. What is EDGAR?

EDGAR stands for Electronic Data Gathering Analysis and Retrieval. It is an online database maintained by the U.S. Securities and Exchange Commission (SEC) that provides access to public company filings.

2. What types of filings can be found on EDGAR?

EDGAR contains a wide range of filings, including annual reports, quarterly reports, proxy statements, registration statements, and other forms submitted by public companies to the SEC.

3. How can I access EDGAR?

EDGAR can be accessed for free through the SEC’s website. Simply visit the SEC’s EDGAR search page and enter the name of the company or the ticker symbol to find the desired filings.

4. Can I download the filings from EDGAR?

Yes, EDGAR allows users to download filings in various formats, such as HTML, PDF, and XBRL. This makes it easy to view, analyze, and save the information for further reference.

5. Is there a fee to use EDGAR?

No, there is no fee to access and use EDGAR. It is a free resource provided by the SEC to promote transparency and facilitate public access to corporate financial information.

Overall, EDGAR is a valuable tool for investors, researchers, and anyone interested in accessing and analyzing public company filings. Its user-friendly interface and extensive database make it an essential resource in the world of finance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.