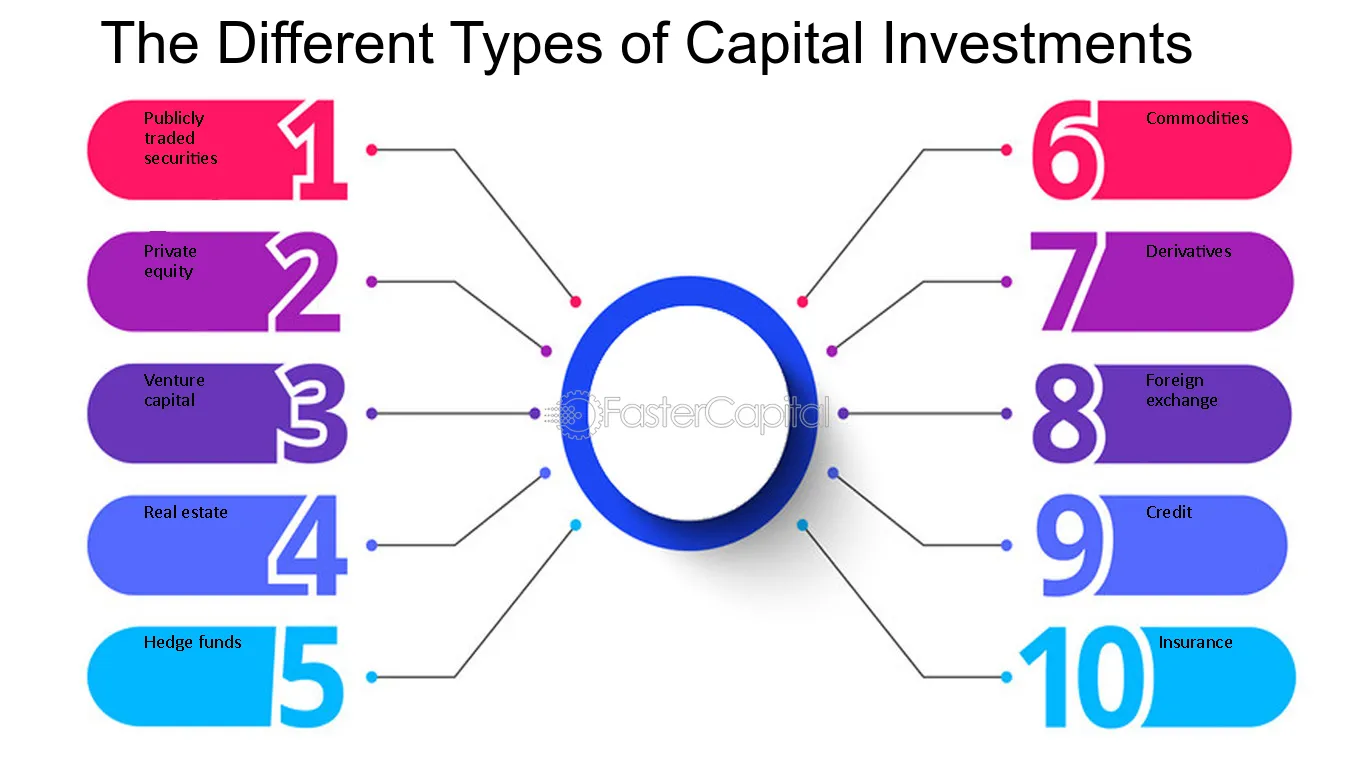

Types of Capital Investment

1. Equity Investments:

Equity investments involve buying shares or ownership stakes in a company. This type of investment gives you the opportunity to participate in the company’s profits and growth. It can be done through direct stock purchases or through mutual funds and exchange-traded funds (ETFs).

2. Debt Investments:

Debt investments involve lending money to a company or government entity in exchange for regular interest payments and the return of the principal amount at maturity. This type of investment includes bonds, treasury bills, and certificates of deposit (CDs). It is considered to be less risky compared to equity investments.

3. Real Estate Investments:

Real estate investments involve buying properties such as residential homes, commercial buildings, or land with the expectation of generating income through rental or appreciation. This type of investment can provide a steady cash flow and potential tax benefits.

Equity Investments

Equity investments are a type of capital investment where investors purchase shares of a company’s stock. By owning shares, investors become partial owners of the company and have the potential to earn profits through dividends and capital appreciation.

Equity investments offer investors the opportunity to participate in the growth and success of a company. When a company performs well, the value of its stock tends to increase, allowing investors to sell their shares at a higher price and make a profit. Additionally, some companies may distribute a portion of their profits to shareholders in the form of dividends.

There are different types of equity investments, including common stock and preferred stock. Common stock represents ownership in a company and typically carries voting rights, allowing shareholders to have a say in company decisions. Preferred stock, on the other hand, usually does not have voting rights but offers priority in receiving dividends and assets in the event of liquidation.

Overall, equity investments are a popular choice for investors looking to participate in the growth of companies and potentially earn profits through dividends and capital appreciation.

Debt Investments

Debt investments are a type of capital investment that involves lending money to individuals, businesses, or governments in exchange for regular interest payments and the return of the principal amount at maturity. This form of investment is considered less risky compared to equity investments, as it provides a fixed income stream and a predetermined repayment schedule.

There are various types of debt investments, including:

Bonds: Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. Investors who purchase bonds become creditors and receive periodic interest payments until the bond matures, at which point the principal amount is repaid.

Corporate Bonds: Corporate bonds are debt securities issued by companies to raise capital for various purposes, such as expansion or acquisitions. These bonds typically offer higher interest rates compared to government bonds, but they also carry a higher level of risk.

Bank Loans: Bank loans are another form of debt investment, where individuals or businesses borrow money from banks or financial institutions. These loans come with an agreed-upon interest rate and repayment schedule.

Real Estate Investments

Real estate investments involve purchasing, owning, managing, renting, or selling properties such as land, residential buildings, commercial buildings, or industrial properties. This type of investment can be highly lucrative and is often considered a long-term strategy for building wealth.

Real estate investments offer several advantages. Firstly, they provide a steady stream of income through rental payments. Additionally, real estate properties tend to appreciate in value over time, allowing investors to make a profit when selling the property. Furthermore, real estate investments can provide tax benefits, such as deductions for mortgage interest and property taxes.

There are different ways to invest in real estate. One option is to purchase properties directly and become a landlord, renting out the property to tenants. This requires active management and maintenance of the property but can provide a consistent income stream. Another option is to invest in real estate investment trusts (REITs), which are companies that own and manage income-generating real estate properties. REITs allow investors to passively invest in real estate and receive dividends from the rental income.

Investing in real estate requires careful research and analysis. Factors such as location, market trends, property condition, and rental demand should be considered. It is important to assess the potential risks and rewards before making any investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.