What is a Direct Stock Purchase Plan?

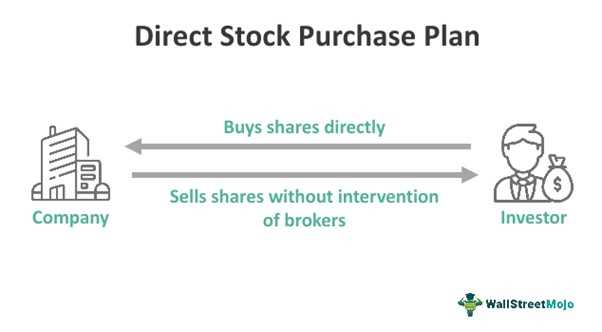

A Direct Stock Purchase Plan (DSPP) is a program offered by some publicly traded companies that allows individual investors to purchase shares of the company’s stock directly from the company, bypassing the need to use a broker or other intermediary. This can be an attractive option for investors who want to invest in a specific company and have a long-term investment strategy.

How does a DSPP work?

When a company offers a DSPP, it sets up a plan that allows individual investors to purchase shares of its stock directly from the company. Investors can typically enroll in the plan online or through paper enrollment forms provided by the company. Once enrolled, investors can make regular contributions to the plan, which are used to purchase additional shares of the company’s stock on their behalf.

Why invest in a DSPP?

There are several potential benefits to investing in a DSPP. First, it allows investors to directly own shares of a specific company, which can be appealing for those who have a strong belief in the company’s long-term prospects. Additionally, DSPPs often have lower fees compared to traditional brokerage accounts, which can help investors save money on transaction costs.

Furthermore, DSPPs can provide a convenient way for investors to build a diversified portfolio. By investing in multiple DSPPs, investors can spread their risk across different companies and industries. This can be especially beneficial for those who want to invest in specific sectors or industries that may not be well-represented in traditional index funds or ETFs.

Lastly, DSPPs can be a valuable tool for long-term investors. By regularly contributing to a DSPP, investors can take advantage of dollar-cost averaging, which can help smooth out the impact of short-term market fluctuations. This can be particularly advantageous for investors who are focused on long-term wealth accumulation.

Benefits of Investing in DSPPs

Direct Stock Purchase Plans (DSPPs) offer several benefits to investors looking to build their investment portfolio. Here are some key advantages of investing in DSPPs:

1. Cost Savings

DSPPs allow investors to purchase stocks directly from the company, eliminating the need for a broker. This can result in significant cost savings as investors can avoid paying brokerage fees and commissions.

2. Lower Minimum Investment

Many DSPPs have lower minimum investment requirements compared to traditional stock purchases. This makes it more accessible for individual investors to start investing in stocks, even with limited funds.

3. Dividend Reinvestment

DSPPs often offer the option to automatically reinvest dividends back into additional shares of the company’s stock. This can help investors compound their returns over time and potentially increase their overall investment value.

4. Direct Ownership

By participating in a DSPP, investors become direct owners of the company’s stock. This can provide a sense of pride and ownership in the company’s success, as well as potential voting rights and the ability to participate in shareholder meetings.

5. Dollar-Cost Averaging

6. Educational Opportunities

Investing in DSPPs can provide educational opportunities for investors to learn more about the stock market and the companies they invest in. Many DSPPs offer educational materials, annual reports, and shareholder updates, allowing investors to stay informed and engaged.

Overall, DSPPs offer a convenient and cost-effective way for individual investors to participate in the stock market and potentially benefit from the long-term growth of the companies they invest in.

How to Participate in a DSPP

Participating in a Direct Stock Purchase Plan (DSPP) is a straightforward process that allows individual investors to buy stocks directly from a company without going through a broker. Here are the steps to participate in a DSPP:

1. Research and Choose a Company

2. Determine Eligibility

Check if you are eligible to participate in the company’s DSPP. Some companies may have specific requirements, such as being a current shareholder or a resident of a certain country. Review the eligibility criteria provided by the company to ensure that you meet the requirements.

3. Enroll in the DSPP

Once you have chosen a company and determined your eligibility, you need to enroll in the DSPP. Visit the company’s investor relations website or contact their transfer agent to obtain the necessary enrollment forms. Fill out the forms accurately and provide any required documentation.

4. Choose an Investment Amount

Decide how much money you want to invest in the DSPP. Some companies may have minimum investment requirements, so make sure to check the details. You can choose to make a one-time investment or set up recurring investments at regular intervals.

5. Set Up Payment Method

Select a payment method for your investments. Most DSPPs offer options such as electronic funds transfer (EFT), automatic bank drafts, or check payments. Choose the option that suits you best and follow the instructions provided by the company to set up the payment method.

6. Review and Confirm

Before finalizing your participation in the DSPP, review all the information you have provided and ensure its accuracy. Double-check the investment amount, payment method, and any other details. Once you are satisfied, confirm your enrollment in the DSPP.

7. Monitor Your Investments

After enrolling in the DSPP, it is important to monitor your investments regularly. Keep track of the company’s performance, industry news, and any updates provided by the company. This will help you make informed decisions about your investments and stay updated on any changes or opportunities.

Participating in a DSPP can be a convenient and cost-effective way to invest in stocks directly. By following these steps, you can start building your investment portfolio and potentially benefit from the long-term growth of the company you have chosen.

Things to Consider Before Investing in DSPPs

Before deciding to invest in a Direct Stock Purchase Plan (DSPP), there are several important factors to consider:

1. Financial Goals and Risk Tolerance

It is crucial to assess your financial goals and risk tolerance before investing in DSPPs. DSPPs may not be suitable for all investors, especially those with a low tolerance for risk. Consider your investment objectives, time horizon, and willingness to accept potential losses.

2. Company Research

3. Fees and Expenses

DSPPs may have fees and expenses associated with them. These can include enrollment fees, transaction fees, and ongoing administrative fees. It is important to carefully review the fee structure and understand how it may impact your investment returns. Compare the fees of different DSPPs to find the most cost-effective option.

4. Diversification

Investing in a single company through a DSPP can be risky, as it lacks diversification. Diversification helps to spread risk by investing in a variety of assets. Consider whether you have a well-diversified investment portfolio outside of the DSPP and if the investment aligns with your overall asset allocation strategy.

5. Tax Implications

Understand the tax implications of investing in DSPPs. Dividends received through DSPPs may be subject to taxes, and selling shares may trigger capital gains taxes. Consult with a tax professional to understand the tax implications and how they may affect your overall tax strategy.

6. Liquidity

DSPPs may have restrictions on selling shares, which can limit liquidity. Consider whether you may need access to your investment funds in the short term and if the lack of liquidity aligns with your financial needs.

By carefully considering these factors, you can make an informed decision about whether investing in a DSPP is right for you. It is always recommended to consult with a financial advisor or investment professional before making any investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.