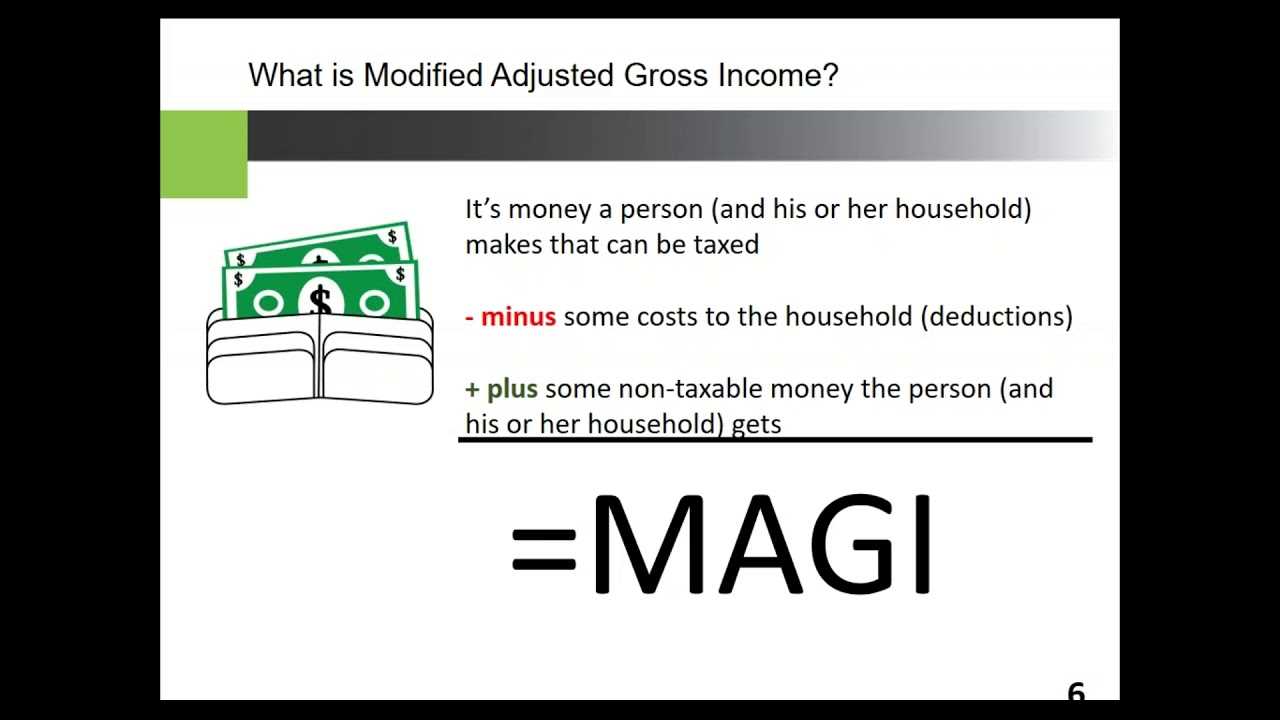

What is Modified Adjusted Gross Income (MAGI)?

Modified Adjusted Gross Income (MAGI) is a term used in the United States tax system to determine eligibility for certain tax benefits and subsidies. It is an important calculation that takes into account various sources of income and deductions to arrive at a modified version of an individual’s adjusted gross income (AGI).

MAGI is used to determine eligibility for a range of tax benefits and subsidies, including deductions, credits, and exemptions. Some examples of tax benefits that may be affected by MAGI include the premium tax credit for health insurance, the deduction for student loan interest, and the eligibility for certain retirement savings plans.

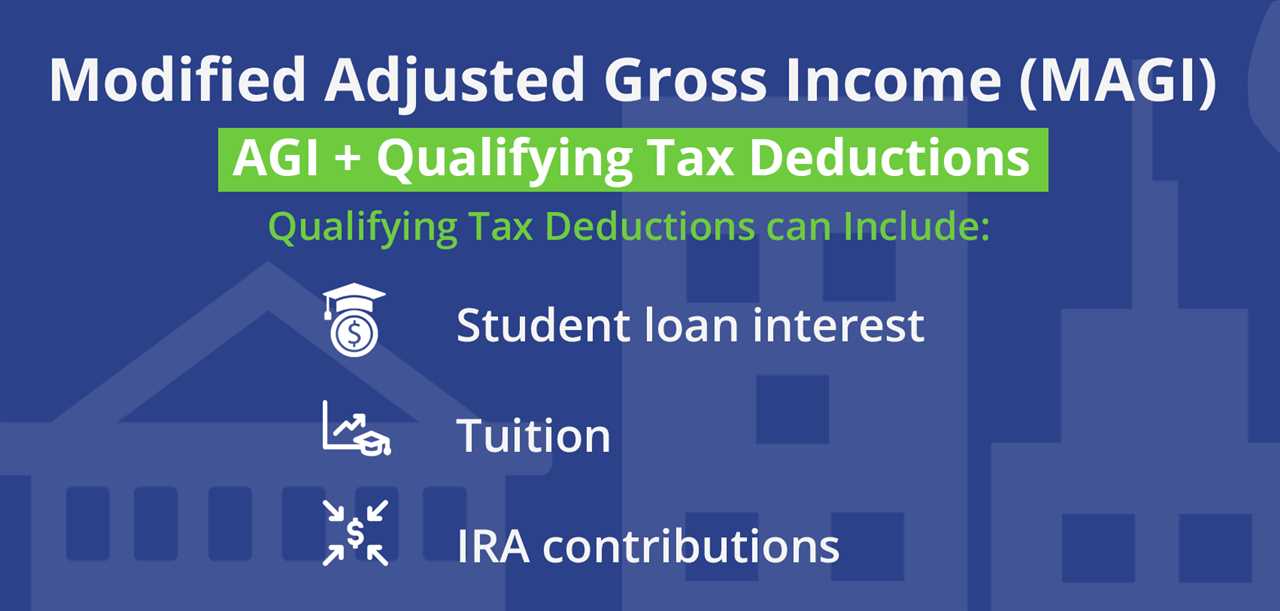

The calculation of MAGI involves adding back certain deductions to the AGI, such as student loan interest, tuition expenses, and certain self-employment expenses. It also includes adding in certain types of income that are not included in the AGI, such as tax-exempt interest and foreign earned income.

Once the MAGI is calculated, it is used to determine eligibility for specific tax benefits and subsidies. For example, if an individual’s MAGI falls within a certain income range, they may be eligible for a tax credit or deduction. On the other hand, if their MAGI exceeds a certain threshold, they may not be eligible for certain tax benefits.

It is important to note that the calculation of MAGI can be complex and may require the assistance of a tax professional. The IRS provides detailed instructions and worksheets to help individuals calculate their MAGI accurately.

| Advantages of MAGI | Disadvantages of MAGI |

|---|---|

| MAGI helps determine eligibility for tax benefits and subsidies. | The calculation of MAGI can be complex and time-consuming. |

| MAGI takes into account various sources of income and deductions. | Errors in calculating MAGI may result in incorrect eligibility determinations. |

| MAGI is used to ensure that tax benefits are targeted to those who need them most. | MAGI may limit access to certain tax benefits for individuals with higher incomes. |

Modified Adjusted Gross Income (MAGI) is a crucial financial metric that is used to determine eligibility for various government programs and benefits. It is calculated by adding certain deductions and exclusions to your Adjusted Gross Income (AGI).

MAGI is an important factor in determining eligibility for programs such as Medicaid, Children’s Health Insurance Program (CHIP), Premium Tax Credits for health insurance, and eligibility for certain deductions and credits on your federal income tax return.

The calculation of MAGI takes into account various sources of income, including wages, salaries, tips, self-employment income, rental income, interest, dividends, and retirement income. It also considers deductions such as student loan interest, alimony paid, and contributions to retirement accounts.

Calculating your MAGI accurately is crucial to ensure that you receive the benefits and tax credits you are entitled to. It is important to keep track of your income and deductions throughout the year to have an accurate estimate of your MAGI.

Income Categories for MAGI Calculation

When calculating your Modified Adjusted Gross Income (MAGI), it is important to understand the different income categories that are considered. These categories help determine which sources of income should be included in the calculation.

1. Earned Income: This category includes income from wages, salaries, tips, and self-employment. It is important to include all sources of earned income, including any side jobs or freelance work.

2. Unearned Income: Unearned income refers to income that is not earned through work. This includes income from investments, such as interest, dividends, and capital gains. It also includes income from rental properties, royalties, and pensions.

3. Taxable Social Security Benefits: If you receive Social Security benefits, a portion of these benefits may be taxable. This taxable amount should be included in your MAGI calculation.

4. Foreign Earned Income: If you earn income from working abroad, it may be subject to special rules and exclusions. This income should also be included in your MAGI calculation.

5. Self-Employment Income: If you are self-employed, you must include your net self-employment income in your MAGI calculation. This includes income from freelancing, consulting, or running your own business.

6. Alimony Received: If you receive alimony payments, these payments should be included in your MAGI calculation. However, if you pay alimony, it is not included in your MAGI.

7. Rental Income: If you earn income from renting out property, such as a house or apartment, this income should be included in your MAGI calculation. This includes both residential and commercial rental properties.

By considering all of these income categories and including the appropriate sources of income in your MAGI calculation, you can accurately determine your Modified Adjusted Gross Income. This is important for various purposes, such as determining eligibility for certain tax credits, subsidies, or government assistance programs.

Exploring Different Sources of Income for MAGI Calculation

When calculating Modified Adjusted Gross Income (MAGI), it is important to consider various sources of income. MAGI takes into account different types of income and adjusts them to determine eligibility for certain deductions, credits, and benefits.

Here are some common sources of income that are considered when calculating MAGI:

- Earned Income: This includes wages, salaries, tips, and self-employment income. It is important to report all earned income, including income from part-time jobs or freelance work.

- Unearned Income: This includes income from investments, such as interest, dividends, and capital gains. It also includes rental income, royalties, and certain types of retirement income.

- Retirement Income: Income from retirement accounts, such as 401(k) plans, traditional IRAs, and pensions, is included in MAGI calculations. However, certain distributions from Roth IRAs may be excluded.

- Social Security Benefits: Social Security benefits are generally included in MAGI calculations, but a portion of the benefits may be excluded depending on the individual’s income level.

- Alimony: Alimony received is considered part of MAGI, while alimony paid may be deducted from MAGI.

- Capital Gains: Profits from the sale of assets, such as stocks, bonds, and real estate, are included in MAGI calculations.

- Business Income: Income from a sole proprietorship, partnership, or S corporation is considered when calculating MAGI.

- Foreign Income: Income earned from foreign sources may also be included in MAGI calculations, depending on the individual’s tax residency status.

It is important to note that not all types of income are included in MAGI calculations. For example, certain types of tax-exempt income, such as interest from municipal bonds, are excluded from MAGI.

By considering all relevant sources of income, individuals can accurately calculate their MAGI and determine their eligibility for various tax benefits, subsidies, and assistance programs.

How to Calculate MAGI

Calculating your Modified Adjusted Gross Income (MAGI) is an essential step in determining your eligibility for various tax benefits and government assistance programs. MAGI takes into account different sources of income and certain deductions to provide a more accurate representation of your financial situation.

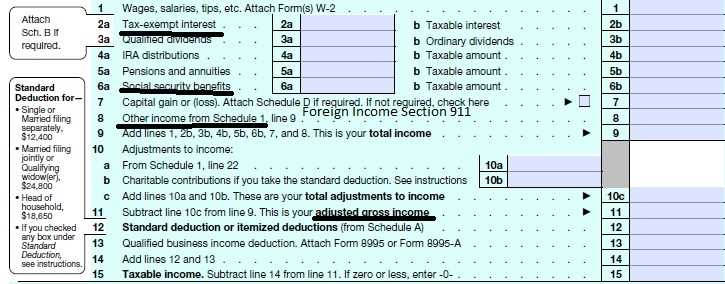

Step 1: Start with Adjusted Gross Income (AGI)

To calculate MAGI, you first need to determine your Adjusted Gross Income (AGI). AGI is your total income from all sources, including wages, self-employment income, rental income, and investment income, minus specific deductions such as student loan interest or contributions to retirement accounts.

Step 2: Add Back Certain Deductions

After calculating your AGI, you need to add back certain deductions to arrive at your MAGI. These deductions may include student loan interest deductions, tuition and fees deductions, or foreign housing deductions. Adding back these deductions will increase your MAGI.

Step 3: Include Excluded Income

Next, you need to include any income that was excluded from your AGI. This can include tax-exempt interest, foreign earned income, or certain Social Security benefits. Including this excluded income will also increase your MAGI.

Step 4: Determine Eligibility for Specific Programs

Once you have calculated your MAGI, you can use it to determine your eligibility for various tax benefits and government assistance programs. For example, MAGI is used to determine eligibility for premium tax credits under the Affordable Care Act, eligibility for certain deductions or credits, and eligibility for programs like Medicaid or the Children’s Health Insurance Program (CHIP).

Step-by-Step Guide to Determine Your Modified Adjusted Gross Income

Calculating your Modified Adjusted Gross Income (MAGI) is an important step in determining your eligibility for various tax benefits and subsidies. Here is a step-by-step guide to help you determine your MAGI:

Step 1: Start with your Adjusted Gross Income (AGI)

Your AGI is the total income you report on your federal tax return after subtracting certain deductions. It includes income from sources such as wages, self-employment earnings, rental income, and investment income.

Step 2: Add back certain deductions

Next, you need to add back certain deductions that were subtracted from your AGI. These deductions may include student loan interest, tuition and fees deduction, and foreign housing exclusion, among others. Consult the IRS guidelines or a tax professional to determine which deductions should be added back.

Step 3: Include tax-exempt income

You also need to include any tax-exempt income you received during the tax year. This may include interest from municipal bonds, certain Social Security benefits, and qualified distributions from Roth IRAs.

Step 4: Determine if you qualify for any MAGI-related adjustments

There are certain adjustments that can be made to your MAGI if you meet specific criteria. For example, if you made contributions to a Health Savings Account (HSA) or a Traditional IRA, you may be eligible for an adjustment to your MAGI.

Step 5: Calculate your MAGI

Once you have accounted for all the necessary adjustments, deductions, and tax-exempt income, you can calculate your MAGI by adding all these amounts together. Your MAGI will be the final result of this calculation.

It is important to note that the specific rules and calculations for determining MAGI may vary depending on the purpose for which it is being used. For example, MAGI calculations for determining eligibility for Medicaid or subsidies under the Affordable Care Act may have different rules compared to MAGI calculations for tax purposes.

Consult the appropriate guidelines or seek professional advice to ensure you are calculating your MAGI correctly for your specific situation.

Using MAGI for Tax Purposes

Why is MAGI important for tax purposes?

MAGI is used to determine your eligibility for certain tax deductions, credits, and exemptions. It helps the Internal Revenue Service (IRS) assess your financial situation and determine the appropriate tax treatment for you. By accurately calculating your MAGI, you can ensure that you are taking advantage of all available tax benefits.

How is MAGI used for tax purposes?

MAGI is used in various tax calculations, including:

| Tax Deductions | Tax Credits | Tax Exemptions |

|---|---|---|

| Many tax deductions, such as student loan interest deduction and self-employed health insurance deduction, have income limits based on MAGI. By knowing your MAGI, you can determine if you qualify for these deductions. |

How to calculate MAGI for tax purposes?

To calculate your MAGI, you need to start with your Adjusted Gross Income (AGI) and make certain modifications. The specific modifications depend on the tax benefits or credits you are applying for. The IRS provides detailed instructions and worksheets to help you calculate your MAGI accurately.

It is important to note that the calculation of MAGI can be complex, especially if you have multiple sources of income or if you are eligible for various tax benefits. In such cases, it may be beneficial to seek the assistance of a tax professional to ensure accurate calculation.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.