What is Electronic Federal Tax Payment System (EFTPS)?

The Electronic Federal Tax Payment System (EFTPS) is a free, secure, and convenient way for individuals and businesses to pay their federal taxes electronically. It is offered by the U.S. Department of the Treasury and allows taxpayers to make tax payments online or over the phone.

EFTPS was established to provide a more efficient and streamlined method of tax payment, eliminating the need for paper checks and reducing the risk of errors or delays in processing. It is available to both individuals and businesses, including corporations, partnerships, and sole proprietors.

With EFTPS, taxpayers can schedule their tax payments in advance, ensuring that they are paid on time and avoiding any penalties or interest charges. Payments can be made for a variety of federal taxes, including income tax, employment tax, estimated tax payments, and excise tax.

To use EFTPS, taxpayers must enroll in the system and receive a unique Personal Identification Number (PIN). Once enrolled, they can access their account online or by phone to make payments, view payment history, and manage their tax obligations.

EFTPS offers several benefits to taxpayers. It provides a secure and encrypted platform for making tax payments, protecting sensitive financial information. It also provides a convenient way to track and manage tax payments, with access to payment history and confirmation receipts.

In summary, the Electronic Federal Tax Payment System (EFTPS) is a reliable and efficient method for individuals and businesses to pay their federal taxes electronically. It offers convenience, security, and peace of mind, ensuring that tax payments are made on time and accurately.

Overview of EFTPS

The Electronic Federal Tax Payment System (EFTPS) is a secure and convenient way for businesses and individuals to pay their federal taxes electronically. It is a free service provided by the U.S. Department of the Treasury and allows taxpayers to make tax payments online or over the phone.

EFTPS offers several benefits to taxpayers. First and foremost, it provides a secure method of payment. All transactions made through EFTPS are encrypted and authenticated, ensuring the confidentiality and integrity of the information exchanged. This helps protect taxpayers’ sensitive financial data from unauthorized access or fraud.

Another advantage of EFTPS is its convenience. Taxpayers can schedule their tax payments in advance, allowing them to plan and budget accordingly. They can also choose to make one-time payments or set up recurring payments, making it easier to stay on top of their tax obligations throughout the year.

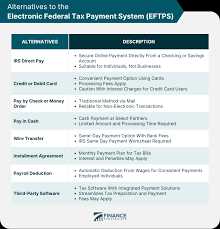

EFTPS also offers flexibility in terms of payment options. Taxpayers can choose to pay their taxes using either the EFTPS website or the EFTPS Voice Response System (EFTPS-VR). The website allows users to make payments online, view their payment history, and receive email notifications. The EFTPS-VR, on the other hand, allows users to make payments over the phone by following the prompts provided.

In addition to these features, EFTPS provides taxpayers with a range of reporting options. Users can access their payment history and view their payment details online or request a summary report for a specific period. This makes it easy to track and reconcile tax payments, simplifying the tax filing process.

Overall, the Electronic Federal Tax Payment System (EFTPS) is a reliable and efficient way for taxpayers to fulfill their federal tax obligations. It offers secure and convenient payment options, flexibility in scheduling payments, and access to detailed payment information. By utilizing EFTPS, taxpayers can streamline their tax payment process and ensure compliance with federal tax laws.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.