Loan Modification Overview

A loan modification is a process that allows borrowers to make changes to the terms of their existing mortgage loan. This can be a helpful solution for homeowners who are struggling to make their monthly mortgage payments and are at risk of foreclosure. By modifying the loan, borrowers can potentially lower their interest rate, extend the repayment term, or change other terms of the loan to make it more affordable.

Why Consider a Loan Modification?

There are several reasons why homeowners may consider a loan modification:

- Financial Hardship: If a homeowner is experiencing financial hardship, such as a job loss, medical emergency, or divorce, a loan modification can provide relief by reducing the monthly mortgage payment.

- Prevent Foreclosure: A loan modification can help homeowners avoid foreclosure by making their mortgage payments more manageable.

- Improve Loan Terms: Borrowers may also consider a loan modification to improve the terms of their loan, such as reducing the interest rate or changing from an adjustable-rate mortgage to a fixed-rate mortgage.

The Loan Modification Process

The loan modification process typically involves the following steps:

- Financial Assessment: The borrower will need to provide financial documentation to the lender, including income, expenses, and assets.

- Application Submission: The borrower will need to complete a loan modification application, which may include forms and supporting documents.

- Review and Evaluation: The lender will review the borrower’s application and financial documents to determine eligibility for a loan modification.

- Negotiation: If the borrower is eligible, the lender will negotiate new loan terms, such as a lower interest rate or extended repayment period.

- Approval and Implementation: Once the new loan terms are agreed upon, the borrower will need to sign the modified loan agreement and begin making payments according to the new terms.

Overall, a loan modification can be a valuable option for homeowners facing financial difficulties and can provide an opportunity to make their mortgage more affordable and sustainable in the long term.

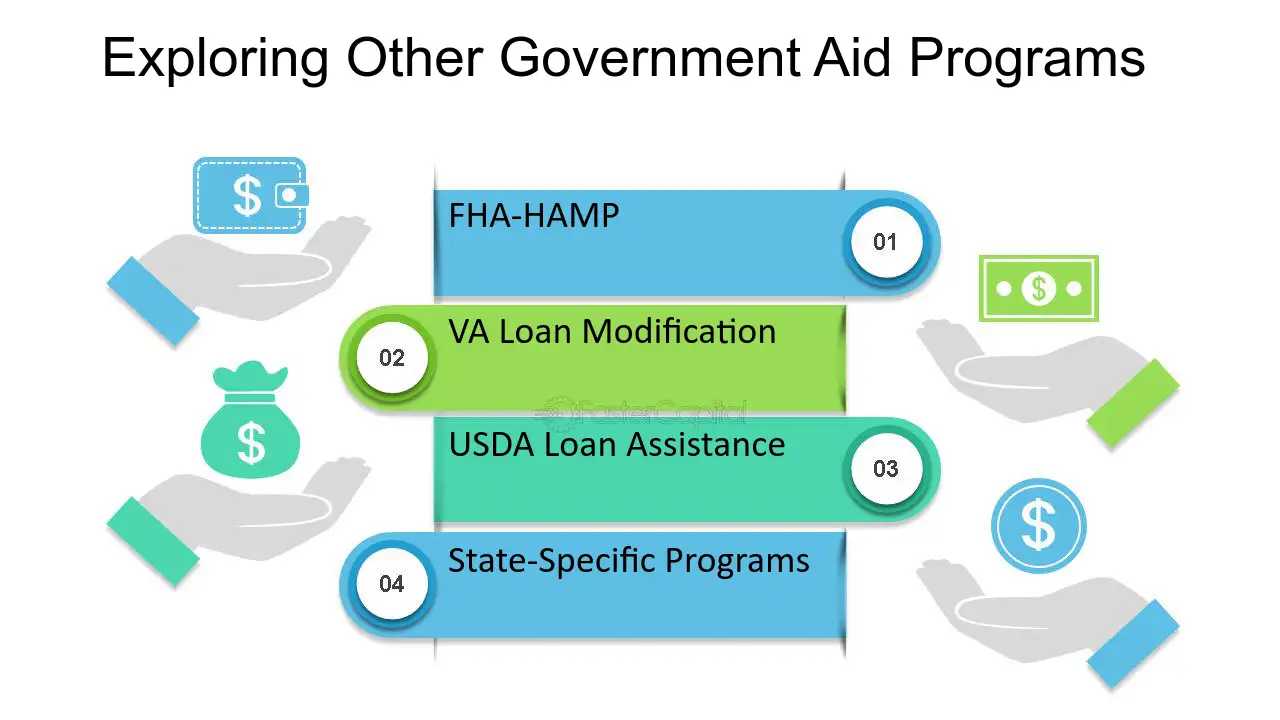

Government Programs

Government programs are an essential part of the loan modification process. These programs are designed to help homeowners who are struggling to make their mortgage payments. They provide various options and incentives to make the loan more affordable and prevent foreclosure.

There are several government programs available for loan modification:

- Home Affordable Modification Program (HAMP): This program is aimed at homeowners who are facing financial hardship and are unable to afford their current mortgage payments. HAMP provides loan modifications that lower monthly payments to a more affordable level.

- Principal Reduction Alternative (PRA): PRA is a program that helps homeowners who owe more on their mortgage than their home is worth. It provides a reduction in the principal balance of the loan, making it more manageable for the homeowner.

- Home Affordable Refinance Program (HARP): HARP is designed for homeowners who are current on their mortgage payments but are unable to refinance due to a decline in the value of their home. It allows them to refinance their mortgage at a lower interest rate.

- Federal Housing Administration (FHA) Loan Modification: This program is available for homeowners with FHA-insured loans. It provides options for loan modifications to make the mortgage more affordable.

- Veterans Affairs (VA) Loan Modification: VA loan modification programs are available for veterans and active-duty military personnel who are struggling to make their mortgage payments. These programs offer various options to modify the loan terms and make it more affordable.

Each government program has its own eligibility requirements and guidelines. Homeowners should research and understand the specific program that best suits their needs and financial situation. It is important to gather all the necessary documentation and submit a complete application to increase the chances of approval.

Government programs play a crucial role in helping homeowners avoid foreclosure and stay in their homes. They provide valuable options and resources to make the loan modification process more accessible and successful.

Application for Loan Modification

When facing financial difficulties, applying for a loan modification can be a viable solution to help homeowners avoid foreclosure and make their mortgage payments more affordable. The application process involves several steps and requires the submission of various documents.

1. Contact your lender: The first step in applying for a loan modification is to contact your lender and express your interest in the program. They will provide you with the necessary forms and information to start the application process.

2. Gather required documents: To complete the application, you will need to gather certain documents, including proof of income, bank statements, tax returns, and a hardship letter explaining your financial situation. Make sure to provide accurate and up-to-date information to increase your chances of approval.

3. Complete the application forms: Fill out the application forms provided by your lender. These forms will require you to provide detailed information about your financial situation, including your income, expenses, assets, and liabilities. Be thorough and honest when completing the forms.

4. Submit the application: Once you have completed all the necessary forms and gathered the required documents, submit your application to your lender. Make sure to keep copies of all the documents for your records.

5. Follow up with your lender: After submitting your application, it is important to follow up with your lender to ensure that they have received it and to inquire about the status of your application. Stay in regular communication with your lender throughout the process.

6. Await a decision: The lender will review your application and make a decision based on your financial situation and eligibility for the loan modification program. This process may take some time, so it is important to be patient.

7. Review the terms: If your application is approved, the lender will provide you with the terms of the loan modification. Review these terms carefully to ensure that they are acceptable to you and will help you achieve your financial goals.

8. Sign the agreement: If you agree to the terms of the loan modification, sign the agreement and return it to your lender. This will finalize the process and officially modify your loan terms.

9. Make timely payments: Once the loan modification is in effect, it is crucial to make your mortgage payments on time and in full. Failure to do so may result in the termination of the loan modification and potential foreclosure.

Applying for a loan modification can be a complex process, but it can provide much-needed relief for homeowners facing financial hardship. By following the steps outlined above and providing accurate information, you can increase your chances of obtaining a loan modification and achieving a more affordable mortgage payment.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.