Altcoin Explained: Advantages, Disadvantages, Types, and Future

Advantages of Altcoins

1. Diversification: Altcoins provide investors with a way to diversify their cryptocurrency holdings. By investing in different altcoins, investors can spread their risk and potentially increase their chances of earning profits.

2. Innovation: Altcoins often introduce new technologies and features that go beyond what Bitcoin offers. These innovations can include faster transaction times, enhanced privacy features, and improved scalability.

3. Lower entry barriers: Altcoins can be more accessible to the general public compared to Bitcoin. Some altcoins have lower transaction fees, making them more attractive for small transactions.

Disadvantages of Altcoins

1. Volatility: Altcoins tend to be more volatile than Bitcoin. Their prices can fluctuate significantly in short periods, making them riskier investments.

2. Lack of liquidity: Some altcoins may have lower trading volumes and liquidity compared to Bitcoin. This can make it more challenging to buy or sell altcoins at desired prices.

3. Regulatory risks: Altcoins may face regulatory challenges in certain jurisdictions. Governments around the world are still developing regulations for cryptocurrencies, and this uncertainty can impact the value and adoption of altcoins.

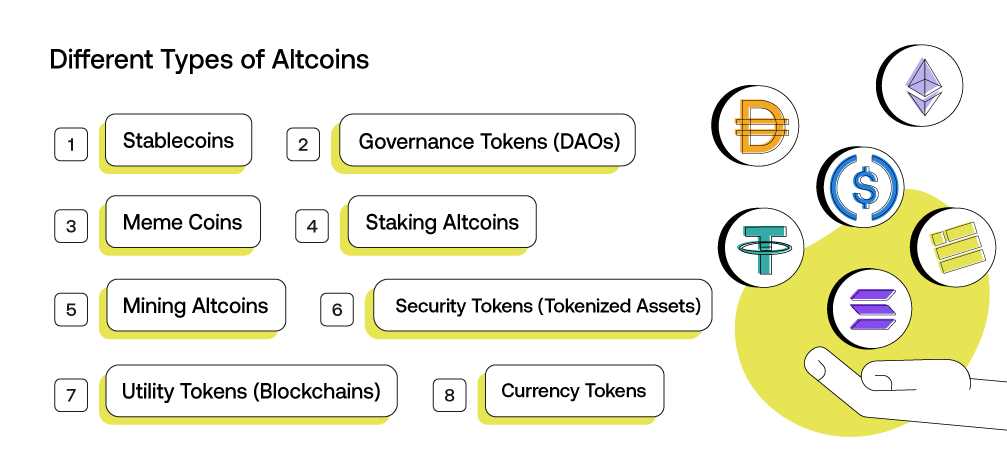

Types of Altcoins

There are various types of altcoins, each with its own unique characteristics. Some common types include:

| Type | Description |

|---|---|

| Bitcoin Forks | Altcoins that are created by forking the Bitcoin blockchain. |

| Platform Coins | Altcoins that serve as platforms for the development of decentralized applications (DApps). |

| Privacy Coins | Altcoins that focus on providing enhanced privacy and anonymity for transactions. |

| Stablecoins | Altcoins that are pegged to a stable asset, such as a fiat currency, to minimize price volatility. |

The Future of Altcoins

The future of altcoins is still uncertain, but they are likely to continue playing a significant role in the cryptocurrency market. As more individuals and businesses adopt cryptocurrencies, altcoins may gain more traction and become mainstream. However, regulatory challenges and market competition could also impact the future of altcoins.

The purpose of altcoins is to address some of the limitations or drawbacks of Bitcoin and offer additional functionalities. These alternative cryptocurrencies aim to improve upon the technology and provide users with more options and opportunities in the digital currency space.

Altcoins can serve various purposes, including:

| 1. Privacy and anonymity: | Some altcoins focus on enhancing privacy and anonymity features, allowing users to transact without revealing their identities or transaction details. |

| 2. Smart contracts and decentralized applications (DApps): | Other altcoins, like Ethereum, enable the creation and execution of smart contracts, which are self-executing agreements with predefined conditions. These altcoins provide a platform for developers to build decentralized applications (DApps) on top of their blockchain. |

| 3. Faster transaction speeds: | Some altcoins aim to improve transaction speeds and scalability compared to Bitcoin, which can sometimes experience network congestion and slower confirmation times. |

| 4. Governance and voting: | Certain altcoins incorporate governance mechanisms that allow token holders to participate in decision-making processes and vote on protocol upgrades or changes. |

| 5. Specific industry or use-case focus: | Some altcoins target specific industries or use-cases, such as supply chain management, healthcare, or decentralized finance (DeFi). These cryptocurrencies aim to solve specific problems or cater to specific needs within those industries. |

Overall, altcoins contribute to the diversity and innovation within the cryptocurrency ecosystem. They offer different features, use-cases, and value propositions, giving users more options and flexibility in their digital currency investments and transactions.

Advantages of Altcoins over Traditional Cryptocurrencies

Altcoins, or alternative cryptocurrencies, have gained significant attention in the digital currency market. While Bitcoin remains the most well-known and widely used cryptocurrency, altcoins offer several advantages over traditional cryptocurrencies. These advantages contribute to their growing popularity and adoption by investors and users alike.

Diversification

One of the key advantages of altcoins is the opportunity for diversification in the cryptocurrency market. While Bitcoin dominates the market, altcoins provide investors with a range of options to choose from. Each altcoin has its own unique features, technology, and potential for growth. By investing in a diverse portfolio of altcoins, investors can spread their risk and potentially achieve higher returns.

Innovation and Technology

Altcoins often introduce new and innovative technologies that address the limitations of traditional cryptocurrencies. These technologies can include improved scalability, faster transaction speeds, enhanced privacy features, and more efficient consensus mechanisms. By investing in altcoins, users can benefit from these advancements and contribute to the development and evolution of the cryptocurrency ecosystem.

For example, Ethereum, one of the most popular altcoins, introduced smart contracts, which allow for the creation and execution of decentralized applications (DApps). This innovation has opened up a wide range of possibilities for developers and businesses, revolutionizing industries such as finance, gaming, and supply chain management.

Lower Entry Barrier

Altcoins often have a lower entry barrier compared to Bitcoin. While the price of Bitcoin has reached significant heights, making it less affordable for some investors, many altcoins are available at lower prices. This allows individuals with limited capital to enter the cryptocurrency market and participate in its potential growth.

Community and Support

Altcoins often have dedicated communities and strong support from developers and enthusiasts. These communities provide valuable resources, such as forums, social media groups, and educational materials, which can help users navigate the altcoin ecosystem. Additionally, the support from developers ensures ongoing improvements, updates, and security enhancements for altcoins, enhancing their long-term viability.

Investment Opportunities

Disadvantages of Altcoins: Potential Risks and Challenges

1. Lack of Adoption

2. Volatility and Market Manipulation

Altcoins are generally more volatile than traditional cryptocurrencies like Bitcoin. Their prices can experience significant fluctuations, making them riskier investments. This volatility can be attributed to their lower market capitalization and liquidity compared to Bitcoin.

Furthermore, the altcoin market is susceptible to market manipulation. Pump and dump schemes, where individuals or groups artificially inflate the price of an altcoin and then sell off their holdings, are not uncommon. These manipulative practices can cause significant losses for unsuspecting investors.

3. Security Concerns

Additionally, altcoin wallets and exchanges may not have the same level of security measures in place as those catering to Bitcoin. This increases the risk of theft and loss of funds for altcoin users.

4. Regulatory Uncertainty

Some governments have imposed strict regulations on cryptocurrencies, while others have taken a more hands-off approach. This lack of uniformity can make it difficult for altcoin projects to operate globally and for users to navigate the legal and tax implications of using altcoins.

5. Lack of Scalability

Altcoins may struggle to achieve the same level of scalability as Bitcoin, which can limit their potential for widespread adoption and use in everyday transactions.

Types of Altcoins: A Comprehensive Overview

Altcoins, or alternative cryptocurrencies, have gained significant popularity in recent years. While Bitcoin remains the dominant player in the cryptocurrency market, altcoins offer a wide range of unique features and functionalities that cater to different needs and preferences. Here are some of the most common types of altcoins:

1. Litecoin (LTC)

2. Ethereum (ETH)

Ethereum is a decentralized platform that enables the creation and execution of smart contracts. It was proposed by Vitalik Buterin in 2013 and launched in 2015. Ethereum introduced the concept of programmable blockchain, allowing developers to build decentralized applications (DApps) and issue their own tokens through Initial Coin Offerings (ICOs). It has become a popular choice for developers and businesses looking to leverage blockchain technology.

3. Ripple (XRP)

Ripple is both a digital payment protocol and a cryptocurrency. It aims to enable fast, low-cost international money transfers and remittances. Unlike Bitcoin and Ethereum, Ripple does not rely on mining and has a fixed supply of 100 billion XRP tokens. It has gained traction among financial institutions and banks due to its focus on facilitating cross-border transactions.

4. Cardano (ADA)

Cardano is a blockchain platform that aims to provide a more secure and sustainable infrastructure for the development of decentralized applications. It utilizes a unique proof-of-stake consensus algorithm called Ouroboros, which aims to be more energy-efficient compared to traditional proof-of-work algorithms. Cardano also emphasizes peer-reviewed research and academic collaboration to ensure the reliability and security of its platform.

5. Monero (XMR)

Monero is a privacy-focused cryptocurrency that aims to provide anonymous and untraceable transactions. It utilizes advanced cryptographic techniques such as ring signatures, stealth addresses, and confidential transactions to obfuscate the sender, recipient, and transaction amount. Monero has gained popularity among individuals who value privacy and fungibility in their transactions.

6. Stellar (XLM)

Stellar is a blockchain platform designed for fast and low-cost cross-border payments. It aims to connect financial institutions, payment systems, and individuals to facilitate seamless money transfers. Stellar’s native cryptocurrency, Lumens (XLM), serves as a bridge currency, allowing for the quick conversion of different fiat currencies. It has gained recognition for its partnerships with major companies and organizations in the financial industry.

These are just a few examples of the many altcoins available in the market. Each altcoin has its own unique features, use cases, and target audience. It is important to conduct thorough research and due diligence before investing in any altcoin to understand its potential risks and rewards.

The Future of Altcoins: Trends and Predictions

1. Increased Adoption

One of the key trends in the future of altcoins is increased adoption. As more people become familiar with cryptocurrencies and blockchain technology, the demand for alternative coins is expected to rise. This is particularly true in countries with unstable economies or limited access to traditional banking services.

Altcoins offer a decentralized and accessible financial system that can empower individuals and communities. With the growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs), altcoins are likely to play a significant role in the future of the digital economy.

2. Specialized Use Cases

Another trend in the future of altcoins is the emergence of specialized use cases. While Bitcoin remains the dominant cryptocurrency, altcoins are designed to address specific needs and challenges. For example, some altcoins focus on privacy and anonymity, while others aim to improve scalability and transaction speed.

As blockchain technology continues to advance, we can expect to see more altcoins catering to niche markets and industries. These specialized coins may offer unique features and functionalities that are not available in traditional cryptocurrencies, making them attractive to specific user groups.

3. Regulatory Challenges

Regulatory actions can have a significant impact on the future of altcoins. Stricter regulations may limit their growth and adoption, while more favorable regulations could provide a boost to the altcoin market. Finding the right balance between innovation and consumer protection will be crucial for the future of altcoins.

4. Technological Advancements

Technological advancements will also shape the future of altcoins. As blockchain technology evolves, altcoins may benefit from improved scalability, interoperability, and security. These advancements could make altcoins more efficient and user-friendly, attracting a broader audience.

Additionally, emerging technologies such as artificial intelligence and the Internet of Things (IoT) could create new opportunities for altcoins. For example, altcoins could be used to facilitate machine-to-machine transactions or enable decentralized autonomous organizations (DAOs).

5. Market Consolidation

Market consolidation can bring stability and credibility to the altcoin market. It can also lead to increased competition among the remaining altcoins, driving innovation and improvement.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.