What is Yield Basis?

Yield basis is a concept that is widely used in fixed income trading. It refers to the difference between the yield of a bond or other fixed income security and the yield of a benchmark security with a similar maturity. In simple terms, it is the spread or premium that investors demand for taking on the risk associated with a particular bond.

In fixed income trading, yield basis plays a crucial role in determining the attractiveness of a bond or security. It provides investors with an indication of the risk and return potential of a particular investment. A positive yield basis indicates that the bond is offering a higher yield compared to the benchmark security, making it more attractive to investors. Conversely, a negative yield basis suggests that the bond is offering a lower yield, which may make it less appealing.

The yield basis is influenced by various factors, including credit risk, liquidity, and market conditions. Bonds with higher credit risk or lower liquidity tend to have a higher yield basis, as investors require a higher return to compensate for the additional risk. On the other hand, bonds with lower credit risk or higher liquidity may have a lower yield basis.

How Does Yield Basis Work?

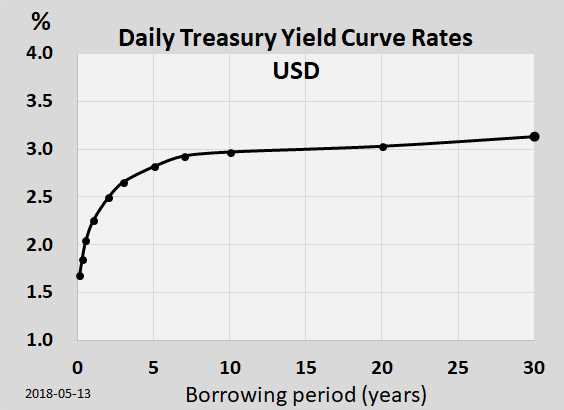

To calculate the yield basis, the yield of the bond or security in question is subtracted from the yield of the benchmark security with a similar maturity. The resulting value represents the yield basis, which can be expressed as a percentage or a basis point spread.

For example, if the yield of a bond is 3% and the yield of the benchmark security is 2%, the yield basis would be 1%. This means that the bond is offering a 1% higher yield compared to the benchmark security.

Traders and investors use the yield basis as a tool to evaluate the relative value of different fixed income securities. It helps them identify opportunities for arbitrage or to assess the risk and return potential of a particular investment.

An Overview of the Functionality of Yield Basis in Fixed Income Trading

The functionality of yield basis in fixed income trading can be summarized as follows:

| Functionality | Description |

|---|---|

| Relative Value Analysis | Yield basis helps traders and investors compare the attractiveness of different fixed income securities by considering their yield differentials. |

| Arbitrage Opportunities | Yield basis can highlight potential arbitrage opportunities where traders can exploit the price discrepancies between bonds with different yield bases. |

| Risk Assessment | By analyzing the yield basis, investors can assess the risk associated with a particular bond or security and make informed investment decisions. |

Benefits of Yield Basis in Fixed Income Trading

The use of yield basis in fixed income trading offers several benefits:

- Enhanced Decision Making: Yield basis provides traders and investors with valuable information to make informed decisions about the relative value and risk of different fixed income securities.

- Profit Opportunities: By identifying bonds with attractive yield bases, traders can capitalize on potential profit opportunities through buying or selling securities at favorable prices.

- Risk Management: Yield basis helps investors assess the risk associated with a particular bond or security, enabling them to manage their portfolio more effectively.

In fixed income trading, the concept of yield basis plays a crucial role in determining the relative value of different securities. Yield basis refers to the difference between the yield of a particular security and the yield of a benchmark security with similar characteristics.

When analyzing fixed income securities, investors and traders often compare the yield of a security to a benchmark, such as a government bond or a corporate bond with similar credit quality and maturity. This allows them to assess the relative attractiveness of the security in terms of its yield.

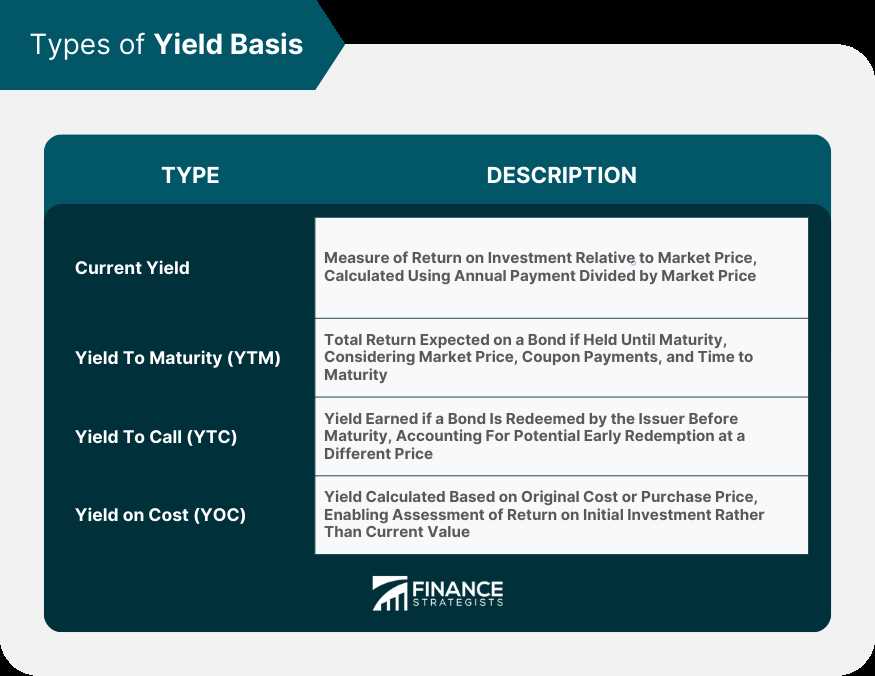

The yield basis can be expressed in terms of yield spread or yield ratio. Yield spread refers to the difference in yields between the security and the benchmark, while yield ratio is the ratio of the yield of the security to the yield of the benchmark.

By comparing the yield basis of different securities, investors can identify opportunities for arbitrage or relative value trading. If the yield basis of a security is higher than the benchmark, it may be considered undervalued and present a buying opportunity. Conversely, if the yield basis is lower, it may indicate that the security is overvalued and could be a selling opportunity.

Moreover, yield basis can also be used to assess the credit risk of a security. If the yield basis of a corporate bond is higher than that of a government bond with similar maturity, it may indicate that the market perceives the corporate bond as riskier.

How Does Yield Basis Work?

Calculation of Yield Basis

Interpreting Yield Basis

A positive yield basis indicates that the security being analyzed has a higher yield than the benchmark security. This suggests that the security may be undervalued and presents an opportunity for investors to earn a higher return. Conversely, a negative yield basis suggests that the security is overvalued compared to the benchmark security.

Traders use yield basis to identify relative value opportunities in the fixed income market. By comparing the yield basis of different securities, they can determine which securities offer the best risk-adjusted returns. This information is crucial for constructing a well-diversified portfolio and optimizing investment performance.

Yield basis also helps traders assess the credit risk of a security. If the yield basis is significantly higher than the benchmark yield, it may indicate that the security carries a higher level of credit risk. This information can be used to make informed decisions about the risk-reward tradeoff of investing in a particular security.

In addition, yield basis can be used to analyze the impact of changes in market conditions on the relative value of securities. For example, if the yield on the benchmark security increases, while the yield on the security being analyzed remains unchanged, the yield basis would widen. This suggests that the security being analyzed has become relatively more attractive compared to the benchmark security.

An Overview of the Functionality of Yield Basis in Fixed Income Trading

In fixed income trading, the concept of yield basis plays a crucial role in determining the relative value of different securities. Yield basis refers to the difference between the yield of a particular security and the yield of a benchmark security with a similar risk profile and maturity.

The functionality of yield basis lies in its ability to provide traders and investors with valuable insights into the market conditions and the pricing of fixed income securities. By comparing the yield of a security to a benchmark, traders can assess whether the security is overvalued or undervalued.

When the yield basis is positive, it indicates that the security is offering a higher yield compared to the benchmark. This suggests that the security may be undervalued and presents an opportunity for traders to buy the security at a relatively lower price. On the other hand, a negative yield basis suggests that the security is offering a lower yield compared to the benchmark, indicating that it may be overvalued.

Furthermore, yield basis can also be used to assess the overall market sentiment and investor risk appetite. A widening yield basis indicates that investors are demanding higher yields for taking on additional risk, signaling a pessimistic market sentiment. Conversely, a narrowing yield basis suggests that investors are willing to accept lower yields, indicating a more optimistic market sentiment.

Benefits of Yield Basis in Fixed Income Trading

Yield basis plays a crucial role in fixed income trading, providing several benefits to market participants. Here are some of the key advantages:

- Comparison of Securities: Yield basis allows traders and investors to compare different fixed income securities effectively. By calculating the yield basis, market participants can determine the relative value of various bonds and make informed investment decisions.

- Identifying Market Trends: Monitoring changes in yield basis can help traders identify market trends and make predictions about future interest rate movements. By analyzing the yield basis over time, market participants can gain insights into market sentiment and adjust their trading strategies accordingly.

- Assessing Risk and Return: Yield basis provides a useful tool for assessing the risk and return characteristics of fixed income securities. By comparing the yield basis of different bonds, investors can evaluate the potential risk-adjusted returns and make informed decisions based on their risk appetite.

- Opportunity for Arbitrage: Yield basis discrepancies between similar fixed income securities can create arbitrage opportunities. Traders can exploit these price differences by buying the undervalued security and selling the overvalued security, aiming to profit from the convergence of yields.

- Hedging Strategies: Yield basis can be used in hedging strategies to manage interest rate risk. By taking offsetting positions in securities with different yield bases, traders can mitigate the impact of interest rate fluctuations on their portfolios and potentially enhance risk-adjusted returns.

- Portfolio Optimization: Yield basis analysis can assist in optimizing fixed income portfolios. By considering the yield basis of various securities, investors can construct portfolios that achieve desired risk and return objectives, taking into account factors such as duration, credit quality, and yield curve positioning.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.