Assessing Risk Tolerance

Assessing your risk tolerance is a crucial step in determining the appropriate investment strategy for your target-date fund. Risk tolerance refers to your ability and willingness to take on investment risk. It is important to understand your risk tolerance as it will help you make informed decisions about the level of risk you are comfortable with.

There are several factors to consider when assessing your risk tolerance:

1. Time Horizon

Your time horizon is the length of time you have until you will need to start withdrawing funds from your target-date fund. Generally, the longer your time horizon, the more risk you can afford to take on. This is because you have more time to recover from any potential losses and benefit from the potential growth of your investments.

2. Financial Goals

Your financial goals also play a significant role in determining your risk tolerance. If you have specific financial goals that require a certain level of return, you may need to take on more risk to achieve those goals. On the other hand, if you have more flexible goals or a longer time horizon, you may be able to tolerate a lower level of risk.

It is important to note that while taking on more risk can potentially lead to higher returns, it also increases the likelihood of experiencing losses. Therefore, it is essential to strike a balance between risk and potential reward based on your risk tolerance and financial goals.

3. Personal Comfort

Your personal comfort with investment risk is another factor to consider. Some individuals are naturally more risk-averse and prefer to take on lower levels of risk, even if it means potentially lower returns. Others may be more comfortable with higher levels of risk and are willing to accept the possibility of greater losses in exchange for the potential for higher returns.

Providing an Example

Scenario:

Imagine you are a 30-year-old investor who plans to retire at the age of 65. You have a moderate risk tolerance and want to invest in a target-date fund that aligns with your retirement goals.

Investment Strategy:

You decide to invest in a target-date fund with a target date of 2055, which is approximately 35 years from now. This fund is designed for investors who plan to retire around that time.

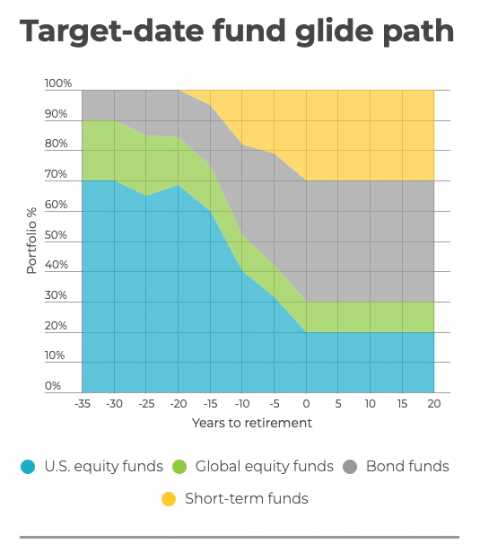

Asset Allocation:

For example, after 10 years, the asset allocation may change to 80% equities, 15% fixed income, and 5% cash. After 20 years, it may further shift to 70% equities, 25% fixed income, and 5% cash.

Risk Management:

The target-date fund’s asset allocation is designed to manage risk based on the investor’s time horizon. By gradually reducing the equity allocation and increasing the fixed income and cash allocation, the fund aims to protect the investor’s capital as retirement approaches.

Guide to Mutual Funds

A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is managed by a professional fund manager. Mutual funds are a popular choice for individual investors because they offer diversification, professional management, and ease of investing.

When investing in mutual funds, it is important to understand the different types of funds available and how they align with your investment goals and risk tolerance. This guide will provide an overview of mutual funds, including the benefits and risks associated with investing in them.

There are several types of mutual funds to choose from, including equity funds, bond funds, money market funds, and target-date funds. Equity funds invest primarily in stocks, while bond funds invest in fixed-income securities such as government or corporate bonds. Money market funds invest in short-term, low-risk securities such as Treasury bills.

When selecting a mutual fund, it is important to consider your risk tolerance. Risk tolerance refers to your ability to withstand fluctuations in the value of your investments. If you have a high risk tolerance, you may be comfortable with a more aggressive investment strategy that includes a higher allocation to stocks. On the other hand, if you have a low risk tolerance, you may prefer a more conservative strategy with a higher allocation to fixed-income securities.

Guide to Mutual Funds

Investing in mutual funds can be a smart way to grow your wealth and achieve your financial goals. Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, and other securities. They are managed by professional fund managers who make investment decisions on behalf of the investors.

Assessing your risk tolerance is an important step in determining whether a target-date fund is right for you. Risk tolerance refers to your ability and willingness to take on investment risk. If you have a high risk tolerance, you may be comfortable with a target-date fund that has a higher allocation to stocks, which tend to be more volatile but offer higher potential returns. On the other hand, if you have a low risk tolerance, you may prefer a target-date fund with a more conservative allocation that focuses more on bonds and other fixed-income securities.

It’s also important to consider your investment time horizon when choosing a target-date fund. The target retirement date of the fund should align with your own retirement goals. If you have a longer time horizon, you may be able to tolerate more short-term volatility and benefit from the potential long-term growth of stocks. If you have a shorter time horizon, you may want to choose a target-date fund with a more conservative allocation to protect your investment from market downturns.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.