What is Operating Expense Ratio?

Operating expenses are the costs incurred by a company in order to generate revenue and maintain its day-to-day operations. These expenses include items such as rent, utilities, salaries, advertising, and other general and administrative expenses.

Net sales revenue is the total revenue generated by a company after deducting any returns, allowances, and discounts. It represents the amount of money a company earns from its primary business activities.

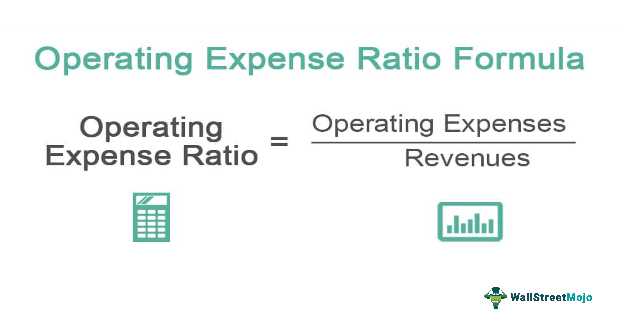

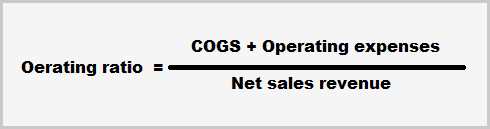

Calculating Operating Expense Ratio

To calculate the Operating Expense Ratio, you need to divide the total operating expenses by the net sales revenue and multiply the result by 100 to express it as a percentage. The formula is as follows:

Operating Expense Ratio = (Operating Expenses / Net Sales Revenue) * 100

For example, if a company has $500,000 in operating expenses and $1,000,000 in net sales revenue, the Operating Expense Ratio would be:

(500,000 / 1,000,000) * 100 = 50%

Importance of Operating Expense Ratio

The Operating Expense Ratio is an important financial metric for investors, analysts, and managers as it provides insights into a company’s cost structure and efficiency. A low OER indicates that a company is able to generate higher profits from its revenue, as it is effectively managing its operating expenses. On the other hand, a high OER may indicate inefficiencies or excessive spending, which can negatively impact a company’s profitability.

By analyzing the OER over time, investors and analysts can track a company’s ability to control costs and improve operational efficiency. It can also be used to compare the performance of different companies within the same industry or sector.

Interpreting Operating Expense Ratio

The interpretation of the Operating Expense Ratio depends on the industry and the company’s business model. Generally, a lower OER is considered favorable, as it indicates that a company is able to generate higher profits from its revenue. However, it is important to compare the OER with industry benchmarks and competitors to get a more accurate assessment.

For example, a company in a labor-intensive industry, such as manufacturing, may have a higher OER compared to a company in a technology-based industry, where the operating expenses are relatively lower. Therefore, it is crucial to consider the industry norms and the company’s specific circumstances when interpreting the OER.

Limitations of Operating Expense Ratio

While the Operating Expense Ratio provides valuable insights into a company’s cost structure, it has certain limitations that should be taken into consideration:

- The OER does not consider the company’s capital structure or financing costs. A company with high debt may have higher interest expenses, which can impact its profitability.

- The OER may vary significantly across industries and business models. Therefore, it is important to compare the ratio with industry benchmarks and competitors.

- The OER does not provide insights into the quality of a company’s operations or its ability to generate sustainable profits.

Despite these limitations, the Operating Expense Ratio remains a useful tool for evaluating a company’s operational efficiency and cost management. It can help investors and analysts make informed decisions and identify potential areas of improvement.

How to Calculate Operating Expense Ratio?

The operating expense ratio (OER) is a financial ratio that measures the efficiency of a company’s operations by comparing its operating expenses to its net sales. It is calculated by dividing the total operating expenses by the net sales and multiplying the result by 100 to express it as a percentage.

Formula for calculating operating expense ratio:

OER = (Operating Expenses / Net Sales) * 100

To calculate the operating expense ratio, you need to gather the necessary financial information from the company’s income statement. The operating expenses include all the costs incurred by the company to operate its business, such as rent, utilities, salaries, marketing expenses, and other administrative expenses. The net sales represent the total revenue generated by the company after deducting any discounts, returns, and allowances.

Once you have the operating expenses and net sales figures, you can plug them into the formula mentioned above to calculate the operating expense ratio. For example, if a company has operating expenses of $500,000 and net sales of $1,000,000, the operating expense ratio would be:

OER = ($500,000 / $1,000,000) * 100 = 50%

It is important to note that the operating expense ratio should be interpreted in the context of the industry and the company’s specific circumstances. Different industries may have different benchmarks for what is considered a good or bad operating expense ratio. Additionally, changes in the operating expense ratio over time can provide insights into the company’s financial health and operational efficiency.

| Operating Expenses | Net Sales | Operating Expense Ratio |

|---|---|---|

| $500,000 | $1,000,000 | 50% |

Importance of Operating Expense Ratio

The operating expense ratio (OER) is a key financial ratio that provides insights into the efficiency and profitability of a company’s operations. It is an important metric for investors, analysts, and managers to assess the financial health and performance of a business.

1. Measure of Efficiency

The OER measures the efficiency of a company’s operations by comparing its operating expenses to its net sales or revenue. A lower OER indicates that a company is able to control its expenses effectively and generate higher profits from its operations. On the other hand, a higher OER may suggest inefficiencies in managing costs, which can negatively impact profitability.

2. Benchmarking

The OER can be used as a benchmarking tool to compare a company’s performance against its industry peers. By analyzing the OER of similar companies, investors and analysts can identify outliers and evaluate the relative efficiency of different businesses within the same sector. This information can help in making investment decisions and identifying potential investment opportunities.

3. Cost Control

The OER highlights the importance of cost control for a company. By monitoring and analyzing the OER, management can identify areas of high expenses and implement strategies to reduce costs. This can include negotiating better deals with suppliers, streamlining operations, and improving efficiency. Effective cost control can lead to higher profitability and improved financial performance.

4. Profitability Indicator

The OER is also a profitability indicator as it shows the proportion of revenue that is consumed by operating expenses. A lower OER indicates a higher profit margin, which is desirable for investors and shareholders. It shows that the company is able to generate more profit from each dollar of revenue. On the other hand, a higher OER suggests lower profitability and may raise concerns about the company’s ability to generate sustainable profits.

Overall, the operating expense ratio is an important financial metric that provides valuable insights into a company’s efficiency, cost control, and profitability. By analyzing and interpreting the OER, investors, analysts, and managers can make informed decisions and assess the financial health and performance of a business.

Interpreting Operating Expense Ratio

The operating expense ratio (OER) is a financial metric that provides insight into a company’s efficiency and profitability. It measures the proportion of a company’s revenue that is used to cover operating expenses. A lower OER indicates that a company is more efficient in managing its expenses and generating profit.

To interpret the operating expense ratio, it is important to compare it with industry benchmarks and historical data. A high OER may indicate that a company is spending a significant portion of its revenue on operating expenses, which can negatively impact its profitability. On the other hand, a low OER may suggest that a company is effectively controlling its expenses and maximizing its profit margins.

Industry Comparison

Comparing a company’s OER with industry averages can provide valuable insights into its competitive position. If a company’s OER is higher than the industry average, it may indicate that the company is less efficient in managing its expenses compared to its competitors. Conversely, a lower OER than the industry average may suggest that the company has a competitive advantage in terms of cost control.

Trend Analysis

An analysis of the OER over time can help identify trends and patterns in a company’s expense management. If the OER is consistently increasing, it may indicate that the company is experiencing rising expenses relative to its revenue, which could be a cause for concern. Conversely, a decreasing OER may suggest that the company is becoming more efficient in managing its expenses.

Other Financial Ratios

Overall, interpreting the operating expense ratio requires a holistic analysis of a company’s financial performance, industry benchmarks, and historical data. It provides valuable insights into a company’s expense management and can help identify areas for improvement and optimization.

Limitations of Operating Expense Ratio

The operating expense ratio (OER) is a useful financial ratio for analyzing the efficiency and profitability of a company. However, it is important to recognize its limitations and consider other factors when evaluating a company’s financial health.

1. Industry Comparison: The OER may vary significantly across different industries. Comparing the OER of a company in one industry to that of a company in another industry may not provide an accurate assessment of their performance. It is important to consider industry norms and benchmarks when interpreting the OER.

2. Size of the Company: The OER may also be influenced by the size of the company. Larger companies may have higher operating expenses due to their scale of operations. Comparing the OER of a small company to that of a large company may not be meaningful without considering their respective sizes.

4. Different Accounting Methods: Companies may use different accounting methods, which can affect the calculation of operating expenses. For example, some companies may include certain expenses as part of cost of goods sold, while others may classify them as operating expenses. These variations in accounting methods can make it difficult to compare OERs across companies.

5. Seasonal Variations: Some industries may experience seasonal variations in their operating expenses. For example, retail companies may have higher expenses during the holiday season. Analyzing the OER without considering these seasonal variations may lead to inaccurate conclusions about a company’s financial performance.

6. One-time Events: The OER may be affected by one-time events, such as mergers, acquisitions, or restructuring activities. These events can significantly impact a company’s operating expenses in a particular period. It is important to consider the context and timing of such events when interpreting the OER.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.