Expense Ratio: Definition, Formula, Components, Example

An expense ratio is a financial ratio that measures the percentage of a company’s total expenses to its total revenue. It is used to assess the efficiency and profitability of a business by analyzing its cost structure.

Definition:

The expense ratio is a metric used in financial analysis to evaluate the efficiency of a company’s operations. It is calculated by dividing the total expenses of a company by its total revenue and multiplying the result by 100 to express it as a percentage.

Formula:

The formula to calculate the expense ratio is:

Expense Ratio = (Total Expenses / Total Revenue) * 100

Components:

The components of the expense ratio include all the expenses incurred by a company, such as operating expenses, administrative expenses, and selling expenses. These expenses are subtracted from the total revenue to calculate the net income or profit of the company.

Example:

Let’s consider an example to understand the calculation of the expense ratio. Company XYZ has total expenses of $500,000 and total revenue of $1,000,000. Using the formula mentioned above, we can calculate the expense ratio as follows:

Expense Ratio = (500,000 / 1,000,000) * 100 = 50%

This means that Company XYZ’s expenses account for 50% of its total revenue. A lower expense ratio indicates better cost management and higher profitability.

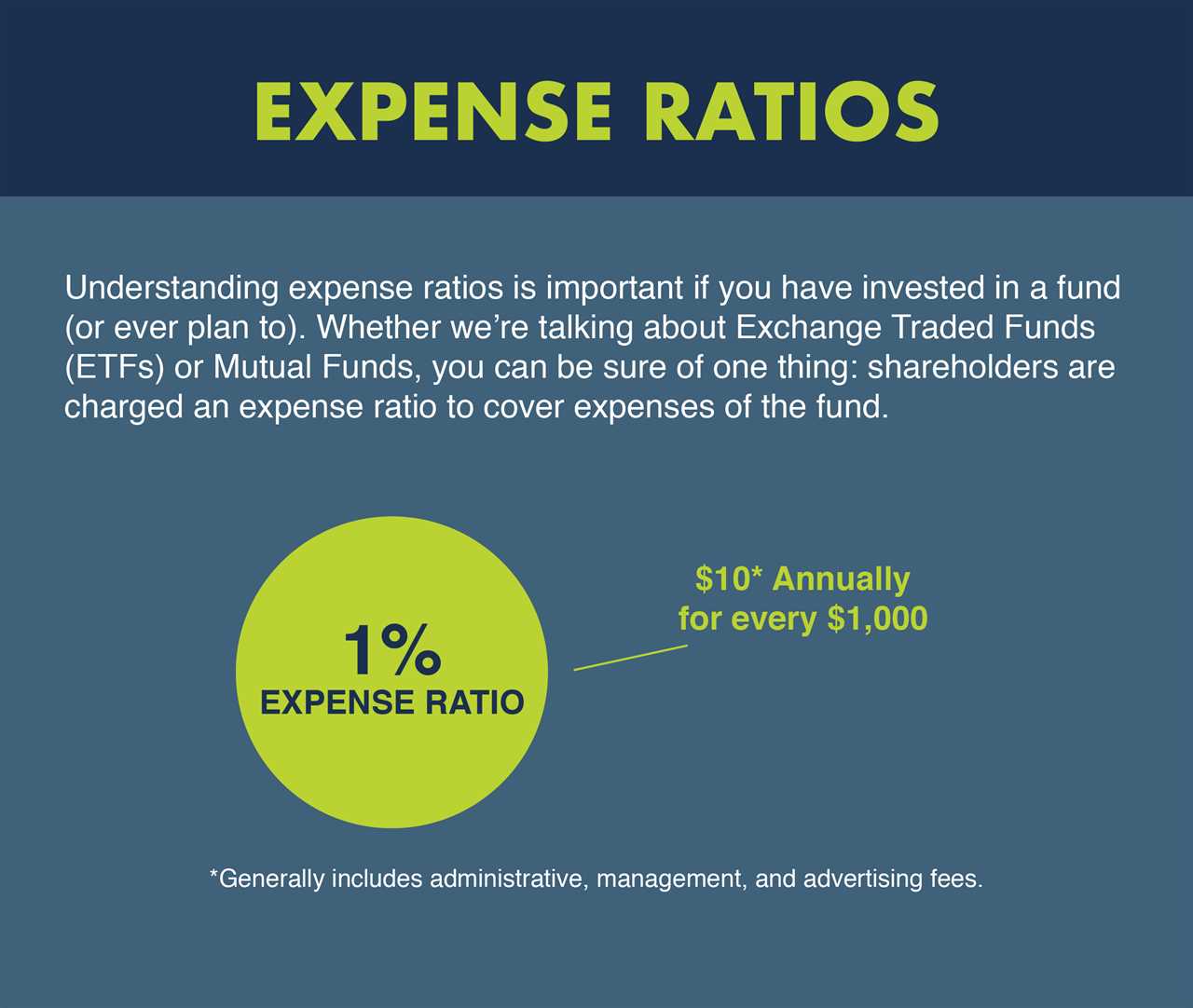

What is Expense Ratio?

The expense ratio is a financial ratio that measures the percentage of a fund’s total assets that are used to cover its operating expenses. It is a key metric used by investors to evaluate the cost-efficiency of a mutual fund or an exchange-traded fund (ETF).

The expense ratio is calculated by dividing the total operating expenses of the fund by its average net assets. Operating expenses include management fees, administrative fees, legal fees, marketing expenses, and other costs associated with running the fund. Average net assets are calculated by taking the average of the fund’s net assets at the beginning and end of a specific period.

Components of Expense Ratio

The expense ratio consists of several components, including:

- Management Fees: These are fees paid to the fund manager for managing the fund’s portfolio and making investment decisions.

- Administrative Fees: These are fees associated with the administrative and operational aspects of running the fund, such as record-keeping, accounting, and legal services.

- Marketing Expenses: These are expenses related to marketing and promoting the fund, including advertising, sales commissions, and distribution costs.

- Other Expenses: This category includes any additional expenses not covered by the above components, such as custodian fees, audit fees, and regulatory fees.

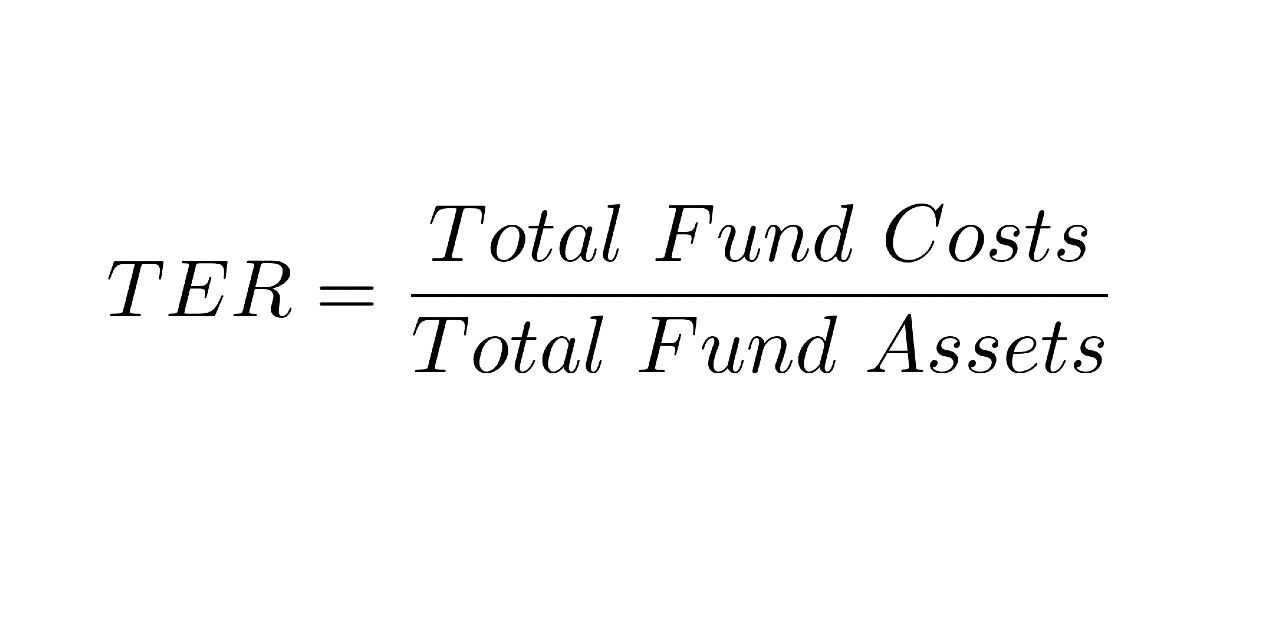

Formula for Calculating Expense Ratio

The expense ratio is calculated using the following formula:

| Expense Ratio | = | Total Operating Expenses | / | Average Net Assets |

For example, if a fund has total operating expenses of $1 million and average net assets of $100 million, the expense ratio would be 1% ($1 million / $100 million).

Components and Formula of Expense Ratio

The expense ratio is a financial ratio that measures the percentage of a mutual fund’s total assets that are used to cover the fund’s operating expenses. It is an important metric for investors to consider when evaluating the cost-effectiveness of a mutual fund.

The expense ratio is calculated by dividing the fund’s total operating expenses by its average net assets. The formula for calculating the expense ratio is as follows:

Expense Ratio = Total Operating Expenses / Average Net Assets

The components of the expense ratio include:

- Total Operating Expenses: These are the costs incurred by the mutual fund for managing and administering the fund. They can include fees paid to the fund manager, administrative expenses, legal and auditing fees, and other operational costs.

- Average Net Assets: This is the average value of the fund’s net assets over a specific period of time. Net assets are calculated by subtracting the fund’s liabilities from its total assets.

By calculating the expense ratio, investors can assess the impact of the fund’s operating expenses on their investment returns. A higher expense ratio indicates higher costs, which can eat into the fund’s returns over time. Therefore, it is generally advisable for investors to choose mutual funds with lower expense ratios.

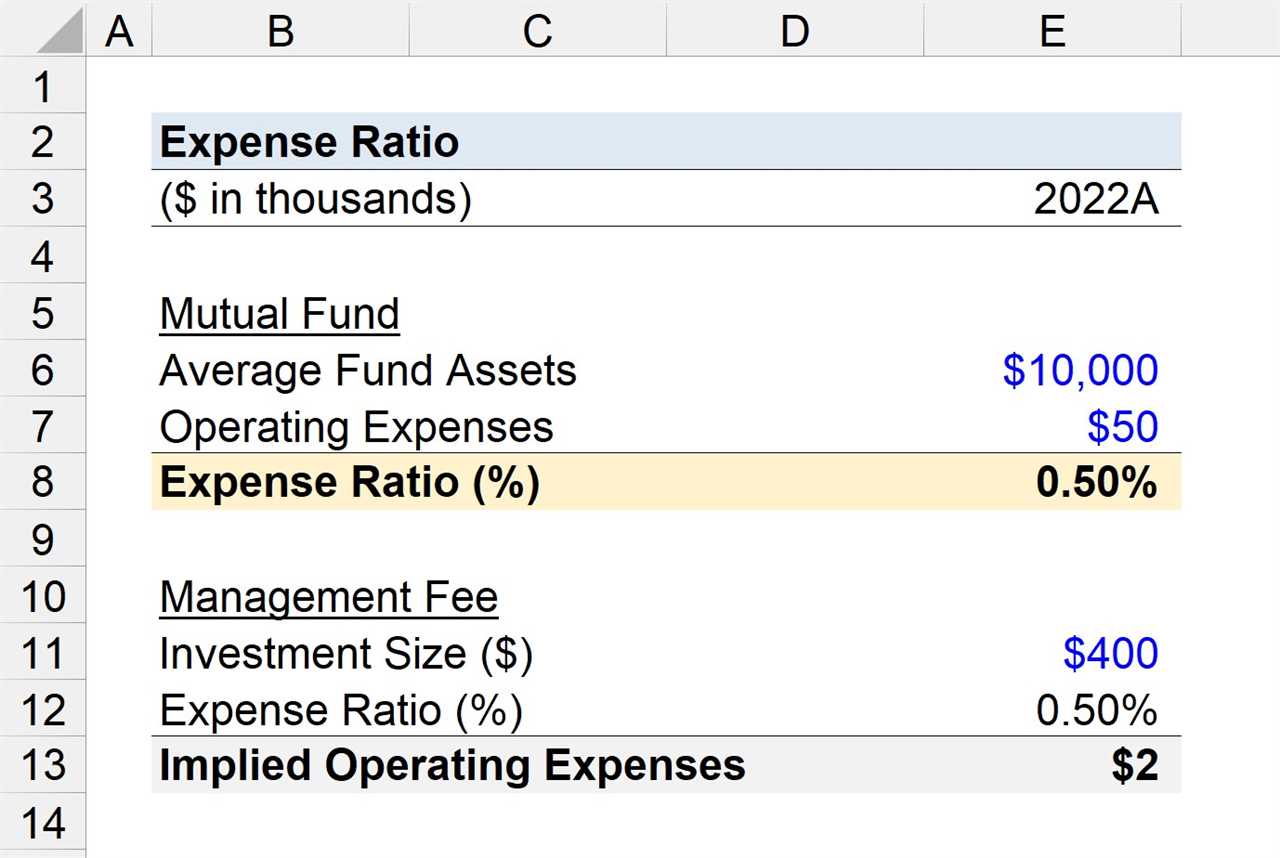

For example, let’s say a mutual fund has total operating expenses of $500,000 and average net assets of $10 million. The expense ratio would be calculated as follows:

Expense Ratio = $500,000 / $10,000,000 = 0.05 or 5%

Example of Expense Ratio Calculation

Let’s consider an example to understand how to calculate the expense ratio. Suppose we have a mutual fund with total annual expenses of $100,000. The fund’s average net assets for the year are $10 million.

Step 1: Calculate the Expense Ratio

The expense ratio is calculated by dividing the total annual expenses by the average net assets.

Expense Ratio = Total Annual Expenses / Average Net Assets

Expense Ratio = $100,000 / $10,000,000 = 0.01 or 1%

Step 2: Interpretation

The expense ratio of 1% indicates that for every $1 invested in the mutual fund, $0.01 is used to cover the fund’s expenses.

Step 3: Comparison

It is important to compare the expense ratio of a mutual fund with similar funds in the industry. A lower expense ratio is generally preferred as it means a higher portion of the investor’s money is being invested rather than being used to cover expenses.

By calculating the expense ratio, investors can make informed decisions about which mutual funds to invest in based on their cost-effectiveness and potential returns.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.