Unbundling: Definition

Unbundling refers to the process of separating a product or service into its individual components or features. In the context of corporate finance, unbundling involves breaking down a financial product or service into its constituent parts, allowing investors to choose and pay for only the specific components they need.

Unbundling in corporate finance is often seen in the context of investment research and advisory services. Traditionally, these services were bundled together, with investors paying a single fee for a package that included research reports, market analysis, and investment recommendations. However, with the rise of technology and the increasing availability of information, investors now have more options and can access research and analysis from various sources.

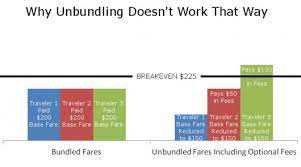

The concept of unbundling in corporate finance recognizes that not all investors require the same level or type of research and advisory services. By unbundling these services, investors have the flexibility to choose and pay for only the specific components that align with their investment strategies and needs. This allows for greater customization and cost efficiency in the investment process.

Unbundling can also promote competition and innovation in the corporate finance industry. When investors have more options and can choose from a range of research providers, it encourages providers to differentiate themselves and offer unique value propositions. This can lead to improved quality of research and advisory services, as providers strive to attract and retain clients.

In summary, unbundling in corporate finance refers to the process of separating a financial product or service into its individual components, allowing investors to choose and pay for only the specific components they need. It offers greater customization, cost efficiency, and promotes competition and innovation in the industry.

In the world of corporate finance, the concept of unbundling refers to the process of breaking down a bundled financial product or service into its individual components. This allows investors and consumers to choose and pay for only the specific components they need, rather than being forced to purchase a package deal.

Unbundling is a common practice in various industries, including telecommunications, insurance, and banking. It is often driven by regulatory changes or market demands for increased transparency and choice. By unbundling financial products and services, companies can offer greater flexibility and customization to their customers.

One of the key benefits of unbundling in corporate finance is the ability to tailor financial solutions to individual needs. For example, in the insurance industry, customers can choose to purchase only the coverage they require, rather than paying for a bundled package that includes unnecessary features. This not only saves money for the consumer but also allows insurance companies to better manage their risk exposure.

Another advantage of unbundling is the potential for increased competition. When financial products and services are bundled, it can create barriers to entry for new market participants. However, by unbundling, smaller players can enter the market and offer specialized products or services that cater to specific customer segments. This can lead to lower prices, improved quality, and increased innovation.

Furthermore, unbundling can enhance transparency and accountability in the corporate finance industry. By separating the different components of a financial product or service, it becomes easier for investors and regulators to understand and evaluate the risks and costs associated with each component. This can help prevent hidden fees or deceptive practices, promoting a more fair and efficient marketplace.

Unbundling: Working Mechanism

In the world of corporate finance, unbundling refers to the process of separating different components or services that were previously bundled together. This can involve breaking down a complex financial product or service into its individual parts, allowing investors or clients to choose and pay for only the specific components they need.

The working mechanism of unbundling involves several steps:

1. Identifying the bundled components

The first step in the unbundling process is to identify the components or services that are currently bundled together. This could include things like investment advice, research reports, trade execution, custody services, and more.

2. Evaluating the individual value

Once the bundled components are identified, each component is evaluated individually to determine its standalone value. This involves assessing the cost, quality, and importance of each component to the overall financial product or service.

3. Pricing and packaging

After evaluating the individual value of each component, the next step is to determine the pricing and packaging options for the unbundled components. This could involve offering different pricing tiers based on the specific components chosen, or creating customizable packages that allow clients to select the components they need.

4. Transparency and disclosure

5. Client choice and flexibility

One of the key benefits of unbundling is that it provides clients with greater choice and flexibility. By allowing clients to select and pay for only the components they need, they have more control over their investment strategy and can tailor it to their specific requirements. This can lead to more cost-effective solutions and better alignment with clients’ goals.

How Unbundling Works in the Corporate Finance Industry

In the corporate finance industry, unbundling refers to the process of separating different services or products that were previously bundled together. This can involve breaking down a comprehensive financial package into its individual components, such as investment management, advisory services, and custodial services.

Unbundling allows companies to choose and pay for only the specific services they require, rather than being forced to purchase a bundled package that includes services they may not need. This gives companies more flexibility and control over their financial operations.

One example of how unbundling works in the corporate finance industry is in the investment management sector. Traditionally, investment management firms would offer bundled services that included investment advice, portfolio management, and custodial services. However, with the rise of technology and increased competition, companies now have the option to unbundle these services.

For instance, a company may choose to hire a separate investment advisor to provide advice on their investment strategy, while using a different firm for portfolio management and custodial services. This allows the company to select the best providers for each specific service, based on their expertise and cost-effectiveness.

Unbundling also promotes transparency in the corporate finance industry. By separating services and pricing them individually, companies can easily compare prices and evaluate the value they are receiving for each service. This encourages competition among service providers and can lead to lower costs for companies.

Furthermore, unbundling can foster innovation in the corporate finance industry. As companies have more options to choose from and can tailor their financial services to their specific needs, it encourages service providers to develop new and specialized offerings. This can lead to the introduction of innovative financial products and services that better meet the evolving needs of companies.

The Benefits of Unbundling in Corporate Finance

Unbundling, in the context of corporate finance, refers to the process of separating various services or products that were previously bundled together. This practice has gained popularity in recent years due to its numerous benefits for both companies and investors.

1. Enhanced Transparency

One of the key advantages of unbundling in corporate finance is the increased transparency it provides. By separating different services or products, companies can clearly disclose the costs associated with each component. This transparency allows investors to make more informed decisions and better understand the value they are receiving.

2. Improved Flexibility

Unbundling also offers companies greater flexibility in managing their financial operations. By unbundling services, companies can choose to outsource certain functions to specialized providers, allowing them to focus on their core competencies. This flexibility can lead to cost savings and improved efficiency.

3. Customization and Choice

Unbundling provides investors with the opportunity to customize their investment portfolios according to their specific preferences and risk tolerance. Instead of being limited to bundled products, investors can select individual components that align with their investment goals. This customization allows for greater diversification and the ability to tailor investments to meet specific needs.

4. Increased Competition

Unbundling promotes competition within the corporate finance industry. By separating services, companies can choose from a wider range of providers, fostering competition and driving innovation. This competition can lead to improved service quality, lower costs, and better overall outcomes for investors.

5. Regulatory Compliance

Unbundling can also help companies comply with regulatory requirements. In some jurisdictions, regulators may require companies to unbundle certain services to ensure fair and transparent pricing. By adhering to these regulations, companies can avoid potential legal issues and maintain trust with investors.

The Advantages of Unbundling in Corporate Finance

Unbundling, as a concept in corporate finance, offers several advantages that can greatly benefit businesses. By breaking down complex financial services into separate components, companies can gain more control over their financial operations and make more informed decisions. Here are some key advantages of unbundling in corporate finance:

- Increased transparency: Unbundling allows businesses to clearly see the costs associated with each financial service they use. This transparency helps in identifying any unnecessary or expensive services and enables companies to negotiate better deals with service providers.

- Cost savings: Unbundling allows businesses to choose only the specific financial services they need, eliminating the need for bundled packages that often include unnecessary services. This can result in significant cost savings for companies, especially smaller ones with limited budgets.

- Customization: Unbundling gives companies the flexibility to tailor their financial services to their specific needs. They can select the services that align with their business goals and strategies, rather than being forced to accept a one-size-fits-all package.

- Improved efficiency: By unbundling financial services, companies can streamline their operations and focus on the areas that are most critical to their success. This can lead to improved efficiency and productivity, as resources are allocated more effectively.

- Access to specialized expertise: Unbundling allows businesses to work with specialized service providers who excel in specific areas of finance. This gives them access to expert knowledge and skills that can help optimize their financial strategies and decision-making.

- Reduced risk: Unbundling can help mitigate risks by allowing companies to diversify their service providers. Relying on a single provider for all financial services can expose businesses to significant risks if that provider fails or underperforms. By unbundling, companies can spread their risk across multiple providers.

- Enhanced innovation: Unbundling encourages competition among service providers, driving innovation in the financial industry. Providers are motivated to offer more specialized and efficient services to attract clients, leading to continuous improvement and advancement in the field.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.