TZero: The Meaning, History and Regulation of t0

What is t0?

History of TZero

TZero was founded in 2014 by Patrick Byrne, the CEO of Overstock.com. The company’s mission was to revolutionize the financial industry by leveraging blockchain technology. In 2015, TZero launched its first product, a platform for trading and settling securities using blockchain technology. Since then, TZero has continued to innovate and expand its offerings.

In 2017, TZero conducted an initial coin offering (ICO) to raise funds for further development. The ICO was a success, raising over $100 million in just a few hours. This demonstrated the market’s enthusiasm for TZero’s vision and technology.

Regulation of TZero

As with any financial platform, TZero is subject to regulation to ensure transparency and protect investors. TZero operates under the oversight of the U.S. Securities and Exchange Commission (SEC) and complies with securities laws. This regulatory framework helps to build trust and confidence in the platform.

TZero has also implemented robust security measures to protect user assets. The platform utilizes advanced encryption and multi-factor authentication to safeguard against unauthorized access. Additionally, TZero follows strict know-your-customer (KYC) and anti-money laundering (AML) procedures to prevent fraudulent activities.

Conclusion

TZero’s t0 token and blockchain platform have the potential to revolutionize the financial industry. By providing a secure and transparent way to trade and settle digital assets, TZero eliminates the need for intermediaries and simplifies the process of asset ownership transfer. With its strong regulatory framework and commitment to security, TZero is well-positioned to disrupt traditional financial systems and pave the way for a more efficient and inclusive future.

TZero is a groundbreaking blockchain platform that is revolutionizing the way financial transactions are conducted. Built on top of the Ethereum blockchain, TZero offers a secure and transparent environment for trading and settling digital assets.

One of the key features of TZero is its ability to tokenize traditional assets, such as stocks, bonds, and real estate. By representing these assets as digital tokens on the blockchain, TZero enables fractional ownership, making it easier for investors to buy and sell these assets.

But TZero is not just a platform for tokenizing assets. It also provides a wide range of other services, including a digital wallet for storing and managing tokens, a trading platform for buying and selling tokens, and a settlement system for securely transferring ownership of tokens.

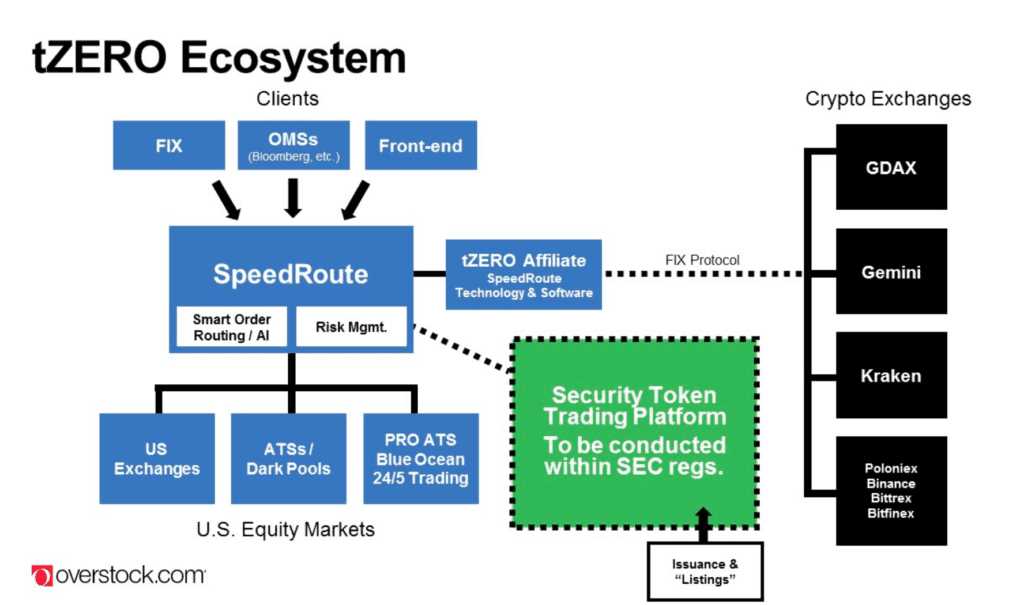

What sets TZero apart from other blockchain platforms is its focus on regulatory compliance. TZero has obtained several regulatory approvals, including a license from the U.S. Securities and Exchange Commission (SEC) to operate as an alternative trading system (ATS). This means that TZero is fully compliant with securities regulations, providing investors with a high level of protection.

Furthermore, TZero has implemented a robust security infrastructure to ensure the integrity of its platform. It uses advanced cryptographic techniques to secure transactions and protect user data. Additionally, TZero conducts regular audits and penetration tests to identify and fix any vulnerabilities in its system.

Overall, TZero is a game-changer in the financial industry. It is transforming the way assets are traded and bringing transparency and security to the market. With its innovative technology and regulatory compliance, TZero is paving the way for the future of finance.

The Evolution of TZero: From Concept to Reality

TZero, a revolutionary blockchain platform, has come a long way from its initial concept to becoming a reality in the financial industry. This article explores the journey of TZero and how it has transformed the way we think about investments and securities.

When TZero was first introduced, it was seen as a groundbreaking solution to the inefficiencies and limitations of traditional financial systems. The concept behind TZero was to create a decentralized platform that would enable the trading of securities using blockchain technology.

After years of research and development, TZero finally launched its platform, offering investors a new way to trade and invest in securities. The platform leverages blockchain technology to provide a transparent and secure environment for buying and selling securities.

With TZero, investors can now access a wide range of investment opportunities that were previously inaccessible or limited by traditional financial systems. The platform allows for fractional ownership, making it easier for individuals to diversify their portfolios and invest in a variety of assets.

Furthermore, TZero has also introduced the concept of tokenization, which allows for the representation of real-world assets as digital tokens on the blockchain. This opens up new possibilities for asset ownership and liquidity, as tokens can be easily traded and transferred between parties.

The evolution of TZero has not only transformed the way we think about investments but has also had a significant impact on the financial industry as a whole. It has disrupted traditional systems and has paved the way for a more inclusive and efficient financial ecosystem.

The Significance of TZero in the Financial Industry

TZero is a revolutionary blockchain platform that has a significant impact on the financial industry. With its innovative technology and unique features, TZero is transforming the way financial transactions are conducted, offering increased efficiency, transparency, and security.

Efficiency

One of the key benefits of TZero is its ability to streamline and automate financial processes. By utilizing blockchain technology, TZero eliminates the need for intermediaries, such as brokers and clearinghouses, reducing costs and increasing the speed of transactions. This increased efficiency allows for faster settlement times and reduces the risk of errors or delays.

Transparency

TZero provides a transparent and auditable ledger of all financial transactions. This transparency ensures that all parties involved have access to the same information, reducing the risk of fraud or manipulation. Additionally, TZero’s blockchain technology allows for real-time tracking and verification of assets, providing a higher level of trust and confidence in the financial system.

Security

With its decentralized and encrypted nature, TZero offers enhanced security for financial transactions. The use of blockchain technology ensures that all transactions are recorded and verified by multiple participants, making it nearly impossible to alter or tamper with the data. This high level of security mitigates the risk of hacking or unauthorized access, providing a safer environment for financial transactions.

Regulatory Framework for TZero: Ensuring Transparency and Security

As a revolutionary blockchain platform, TZero operates within a regulatory framework that is designed to ensure transparency and security in the financial industry. This framework is essential for maintaining trust and confidence among investors, as well as protecting against fraudulent activities.

The Role of Regulatory Bodies

Regulatory bodies play a crucial role in overseeing the operations of TZero and other similar platforms. They are responsible for setting and enforcing rules and regulations that govern the issuance and trading of digital securities. These bodies include the Securities and Exchange Commission (SEC) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and other regulatory authorities around the world.

These regulatory bodies work to protect investors by ensuring that TZero and other platforms comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. They also monitor the platform’s activities to prevent market manipulation and insider trading.

Transparency and Reporting Requirements

TZero is required to provide regular reports to regulatory bodies, disclosing information about its operations, financial performance, and compliance with regulations. These reports help ensure transparency and accountability, allowing regulators to assess the platform’s adherence to the rules and take appropriate actions if necessary.

Additionally, TZero is required to implement robust systems and processes to prevent unauthorized access to sensitive investor information. This includes implementing strong cybersecurity measures to protect against hacking and data breaches.

Investor Protection and Dispute Resolution

The regulatory framework for TZero also includes provisions for investor protection and dispute resolution. In the event of any disputes or grievances, investors have the right to seek recourse through established legal channels. This ensures that investors have a means to address any issues or concerns they may have, further enhancing trust and confidence in the platform.

International Cooperation and Harmonization

Given the global nature of TZero and other blockchain platforms, international cooperation and harmonization of regulations are crucial. Regulatory bodies around the world are working together to develop consistent standards and guidelines for digital securities, ensuring a level playing field for all participants and facilitating cross-border transactions.

TZero’s Impact on Investment Strategies and Education

TZero, a revolutionary blockchain platform, has had a significant impact on investment strategies and education in the financial industry. With its innovative technology and transparent approach, TZero has transformed the way investments are made and taught.

One of the key impacts of TZero on investment strategies is the democratization of access to investment opportunities. Traditionally, investing in certain assets, such as private companies or real estate, was limited to wealthy individuals or institutional investors. However, TZero has opened up these opportunities to a wider range of investors through its tokenization process.

Through tokenization, TZero converts assets into digital tokens that can be bought and sold on its platform. This allows investors of all sizes to participate in previously inaccessible markets. For example, a retail investor can now invest in a startup or a commercial property alongside institutional investors, leveling the playing field and providing more opportunities for diversification.

Furthermore, TZero’s platform provides increased transparency and security in investment transactions. By utilizing blockchain technology, TZero ensures that all transactions are recorded on an immutable ledger, eliminating the need for intermediaries and reducing the risk of fraud or manipulation. This increased transparency and security give investors more confidence in their investment decisions and encourage more participation in the market.

In addition to its impact on investment strategies, TZero has also revolutionized education in the financial industry. Through its platform, TZero provides educational resources and tools that help investors understand the complexities of blockchain technology and investment opportunities. This empowers individuals to make informed decisions and take advantage of the benefits offered by TZero.

TZero’s impact on education extends beyond individual investors. It has also influenced academic institutions and professional organizations to incorporate blockchain and tokenization into their curricula and training programs. This ensures that future generations of investors and financial professionals are equipped with the knowledge and skills needed to navigate the evolving landscape of the financial industry.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.