The Bond Market and Debt Securities: A Comprehensive Guide

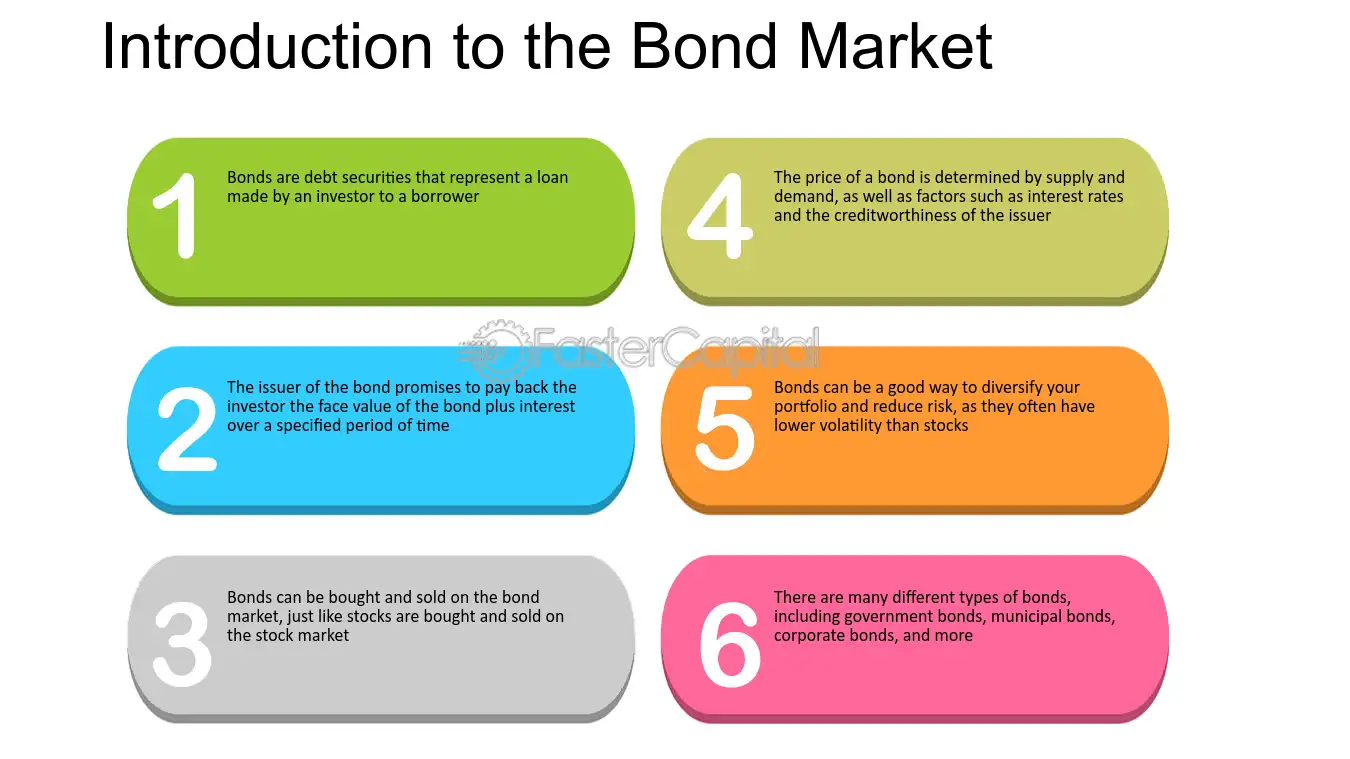

A debt security is a financial instrument that represents a loan made by an investor to a borrower. When an entity needs to raise funds, it can issue debt securities in the form of bonds. Bonds are essentially IOUs, where the issuer promises to repay the principal amount along with periodic interest payments to the bondholders.

The bond market is a marketplace where these debt securities are bought and sold. It provides a platform for investors to lend money to issuers in exchange for interest payments and the eventual return of their principal. The bond market is typically divided into two main segments: the primary market and the secondary market.

In the primary market, new bonds are issued and sold to investors for the first time. This is where issuers raise capital by selling their debt securities to interested buyers. The primary market is typically facilitated by investment banks or underwriters who help price the bonds and distribute them to investors.

Once the bonds are issued in the primary market, they can be traded in the secondary market. The secondary market is where previously issued bonds are bought and sold between investors. This market provides liquidity to bondholders, allowing them to sell their bonds before they mature or buy additional bonds to add to their portfolios.

The bond market offers a wide range of debt securities with varying characteristics. Some common types of debt securities include government bonds, corporate bonds, municipal bonds, and mortgage-backed securities. Each type of bond carries its own set of risks and rewards, and investors should carefully consider their investment objectives and risk tolerance before investing in any particular bond.

Investing in bonds can offer several benefits to investors. Bonds are generally considered less risky than stocks and can provide a steady stream of income through interest payments. They can also serve as a diversification tool, helping to balance a portfolio and reduce overall risk. Additionally, bonds can be used to preserve capital and provide a safe haven during times of market volatility.

However, investing in bonds is not without risks. Interest rate risk, credit risk, and inflation risk are some of the key risks associated with bond investing. Interest rate risk refers to the potential for bond prices to decline when interest rates rise. Credit risk is the risk of default by the issuer, while inflation risk refers to the eroding purchasing power of fixed income payments over time.

What is a Bond?

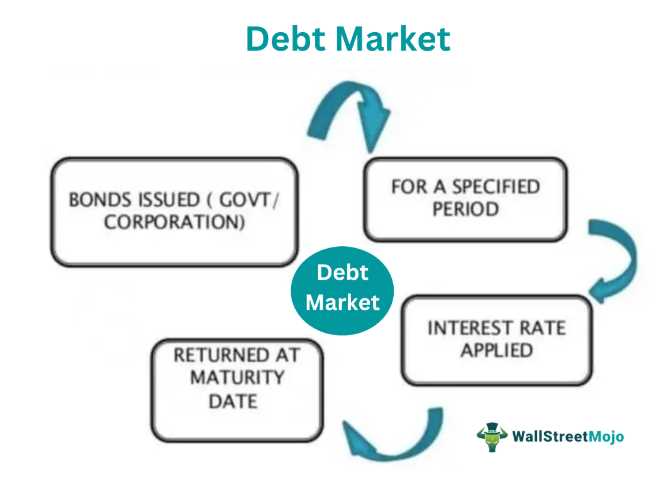

A bond is a debt security that represents a loan made by an investor to a borrower. When an entity issues a bond, it is essentially borrowing money from investors and promising to repay the principal amount, along with periodic interest payments, over a specified period of time. Bonds are considered fixed-income investments because they provide a fixed stream of income to investors.

How Does the Bond Market Work?

The bond market operates through the buying and selling of debt securities. When an entity, such as a government or corporation, needs to raise capital, it can issue bonds to investors. These bonds are then traded on the bond market, allowing investors to buy and sell them. The price of a bond is determined by various factors, including interest rates, credit ratings, and market demand.

The bond market is divided into two primary segments: the primary market and the secondary market. In the primary market, new bonds are issued and sold to investors through an underwriting process. In the secondary market, previously issued bonds are traded among investors. The secondary market provides liquidity to bond investors, allowing them to buy or sell bonds before their maturity date.

Why Invest in Bonds?

Risks and Considerations

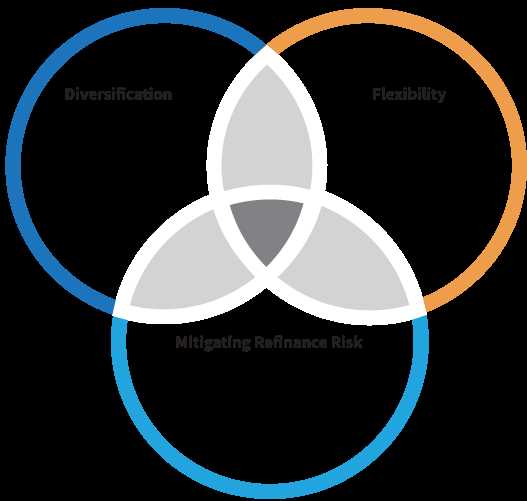

It is important for investors to carefully assess their risk tolerance and investment objectives before investing in bonds. Diversifying across different types of bonds and conducting thorough research on issuers can help mitigate some of the risks associated with bond investing.

| Advantages of Bond Investing | Risks of Bond Investing |

|---|---|

| Steady income stream | Interest rate risk |

| Lower volatility compared to stocks | Credit risk |

| Diversification benefits | Inflation risk |

| Capital preservation |

Types of Debt Securities

Debt securities are financial instruments that represent a loan made by an investor to a borrower. These securities are typically issued by governments, municipalities, corporations, and other entities to raise capital. They are considered fixed income investments because they provide a fixed stream of income to the investor.

There are several types of debt securities, each with its own characteristics and risk profiles. Here are some of the most common types:

| Type of Debt Security | Description | Example |

|---|---|---|

| Treasury Bonds | Debt securities issued by the government to finance its operations and pay off existing debt. They are considered to be the safest type of debt security because they are backed by the full faith and credit of the government. | U.S. Treasury Bonds |

| Municipal Bonds | Debt securities issued by state and local governments to finance public projects such as schools, highways, and infrastructure. They are exempt from federal taxes and may also be exempt from state and local taxes. | California Municipal Bonds |

| Corporate Bonds | Debt securities issued by corporations to raise capital for various purposes, such as expanding operations, acquiring other companies, or refinancing existing debt. They offer higher yields than government bonds but also carry higher risks. | Apple Corporate Bonds |

| Convertible Bonds | Debt securities that can be converted into a specified number of shares of the issuer’s common stock. They offer the potential for capital appreciation if the stock price rises but also provide the downside protection of a fixed-income investment. | Google Convertible Bonds |

| Junk Bonds | High-yield debt securities issued by companies with lower credit ratings. They offer higher yields to compensate investors for the increased risk of default. Junk bonds are typically issued by companies in financial distress or with limited operating history. | XYZ Company Junk Bonds |

Investors can choose to invest in debt securities based on their investment objectives, risk tolerance, and desired level of income. Each type of debt security has its own advantages and disadvantages, so it is important to carefully evaluate the characteristics and risks before making an investment decision.

Investing in Bonds

Investing in bonds can be a smart way to diversify your investment portfolio and potentially earn a steady stream of income. Bonds are debt securities that are issued by governments, municipalities, and corporations to raise capital. When you invest in a bond, you are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity.

One of the key factors to consider when investing in bonds is the creditworthiness of the issuer. Credit ratings agencies, such as Standard & Poor’s and Moody’s, assign ratings to bonds based on the issuer’s ability to repay its debt. Bonds with higher credit ratings are generally considered less risky but may offer lower yields, while bonds with lower credit ratings may offer higher yields but come with increased risk.

Another important consideration is the interest rate environment. Bond prices and interest rates have an inverse relationship, meaning that when interest rates rise, bond prices tend to fall, and vice versa. This is because when interest rates go up, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive to investors.

Diversification is also key when investing in bonds. By spreading your investments across different types of bonds and issuers, you can reduce the impact of any single bond defaulting or experiencing financial difficulties. This can help to mitigate risk and potentially enhance returns.

Risks and Rewards of Bond Investing

Investing in bonds can offer both risks and rewards. It is important for investors to understand these factors before making any investment decisions.

Risks

- Interest Rate Risk: Bond prices are inversely related to interest rates. When interest rates rise, bond prices tend to fall, and vice versa. This risk is more significant for long-term bonds.

- Default Risk: There is a possibility that the issuer of a bond may default on its payments. This risk is higher for bonds issued by lower-rated companies or governments.

- Liquidity Risk: Some bonds may have limited trading activity, making it difficult to sell them at a desired price. This risk is more relevant for bonds with lower trading volumes.

- Reinvestment Risk: When a bond matures or pays a coupon, the investor needs to reinvest the proceeds at prevailing interest rates, which may be lower than the original rate.

- Inflation Risk: Inflation erodes the purchasing power of future bond payments, especially for fixed-rate bonds. If inflation rises, the real value of bond payments may decrease.

Rewards

- Income Generation: Bonds provide regular interest payments, which can be a stable source of income for investors.

- Preservation of Capital: Bonds are generally considered less risky than stocks, making them a suitable investment for capital preservation.

- Diversification: Bonds can help diversify an investment portfolio, reducing overall risk by balancing out the volatility of other asset classes.

- Tax Advantages: Some bonds, such as municipal bonds, offer tax advantages, such as exemption from federal income tax.

It is important for investors to assess their risk tolerance and investment goals before investing in bonds. Diversification and thorough research can help mitigate risks and enhance the potential rewards of bond investing.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.