Overview of Kangaroo Bonds

Kangaroo Bonds are a unique type of bond that is issued in the Australian market by foreign entities. These bonds are denominated in Australian dollars, making them attractive to investors who want exposure to the Australian market without the need to convert their currency.

One of the key features of Kangaroo Bonds is that they offer a higher yield compared to similar bonds issued in other markets. This is due to the higher interest rates in Australia, which can provide investors with an attractive return on their investment.

Furthermore, Kangaroo Bonds are backed by the Australian government, which adds an extra layer of security for investors. This means that even in the event of a default by the issuing entity, investors can still expect to receive their principal and interest payments.

Overall, Kangaroo Bonds provide investors with an attractive investment opportunity in the Australian market. With their higher yield, diversification benefits, and government backing, these bonds can be a valuable addition to any investment portfolio.

Australia’s Unique Bond Market

Australia’s bond market is known for its unique characteristics and attractive investment opportunities. With a strong economy and stable political environment, Australia offers a favorable climate for bond investors.

One of the key features of Australia’s bond market is its diversity. The market offers a wide range of bond types, including government bonds, corporate bonds, and Kangaroo bonds. This diversity allows investors to choose bonds that align with their investment goals and risk tolerance.

Australia’s bond market is also known for its transparency and efficiency. The market is regulated by the Australian Securities and Investments Commission (ASIC), ensuring that investors have access to accurate and timely information. This transparency helps investors make informed decisions and reduces the risk of fraud or manipulation.

Furthermore, Australia’s bond market has a strong track record of performance. Over the years, Australian bonds have delivered competitive returns and provided a stable source of income for investors. This performance is driven by Australia’s strong economic fundamentals, including low inflation, low unemployment, and a robust financial system.

Investing in Australia’s bond market also offers diversification benefits. By adding Australian bonds to their portfolio, investors can reduce their exposure to risks associated with other asset classes, such as equities or real estate. This diversification can help improve the risk-adjusted returns of a portfolio and provide stability during market downturns.

Benefits

Investing in Kangaroo Bonds offers a range of benefits for investors:

- Diversification: Kangaroo Bonds provide an opportunity to diversify investment portfolios by adding exposure to the Australian bond market. This can help reduce risk and increase potential returns.

- Stable and Attractive Yields: Kangaroo Bonds typically offer competitive yields compared to other fixed income investments. The Australian bond market is known for its stability and attractive interest rates, making Kangaroo Bonds an appealing investment option.

- Access to Australian Dollar: Investing in Kangaroo Bonds allows investors to gain exposure to the Australian dollar, which can be beneficial for those looking to diversify their currency holdings.

- Strong Credit Quality: Australia is known for its strong credit quality, with a stable economy and a history of reliable debt repayment. Kangaroo Bonds are typically issued by reputable Australian issuers, providing investors with confidence in the creditworthiness of the bonds.

- Market Liquidity: The Kangaroo Bond market is highly liquid, offering investors the ability to buy and sell bonds with ease. This liquidity can enhance portfolio management and provide flexibility for investors.

- Tax Advantages: Depending on the investor’s jurisdiction, Kangaroo Bonds may offer tax advantages such as reduced withholding tax rates or exemptions, making them an attractive option for certain investors.

Overall, investing in Kangaroo Bonds can provide investors with diversification, stable yields, exposure to the Australian dollar, strong credit quality, market liquidity, and potential tax advantages. These benefits make Kangaroo Bonds a compelling choice for fixed income investors seeking attractive investment opportunities.

Attractive Investment Opportunities

One of the key advantages of investing in Kangaroo Bonds is the potential for higher yields compared to bonds issued in other markets. Australia’s stable economy and strong credit rating make it an attractive destination for foreign issuers, resulting in competitive interest rates for investors.

Furthermore, Kangaroo Bonds provide access to a wide range of sectors and industries, allowing investors to choose from a diverse set of investment options. Whether it’s infrastructure, energy, or financial services, there are plenty of opportunities to invest in sectors that align with your investment goals and risk appetite.

Benefits of Investing in Kangaroo Bonds

Investing in Kangaroo Bonds offers several benefits:

- Diversification: Kangaroo Bonds provide an opportunity to diversify your investment portfolio by adding exposure to the Australian market.

- Stable Economy: Australia’s strong economic fundamentals and political stability make it an attractive investment destination.

- Competitive Yields: Kangaroo Bonds often offer higher yields compared to bonds issued in other markets, providing potential for attractive returns.

- Access to Global Issuers: Kangaroo Bonds are issued by a wide range of international entities, allowing investors to access global investment opportunities.

- Risk Management: By investing in Kangaroo Bonds, investors can manage their risk exposure by diversifying across different sectors and issuers.

Investing in Kangaroo Bonds

Additionally, it’s advisable to consult with a financial advisor who can provide guidance based on your individual investment goals and risk tolerance. They can help you navigate the Kangaroo Bond market and identify investment opportunities that align with your investment strategy.

| Key Points | Benefits |

|---|---|

| Higher yields | Potential for attractive returns |

| Diversification | Manage risk exposure |

| Access to global issuers | Invest in a wide range of sectors |

Overall, Kangaroo Bonds offer attractive investment opportunities for investors looking to diversify their portfolios and access the Australian bond market. With competitive yields, diverse investment options, and the potential for attractive returns, Kangaroo Bonds are worth considering for both domestic and international investors.

Diversification and Risk Management

With Kangaroo Bonds, investors can gain exposure to the Australian bond market, which is known for its stability and strong credit ratings. This allows investors to diversify their bond portfolio and reduce the risk associated with investing in a single country’s bond market.

Overall, investing in Kangaroo Bonds can provide investors with the benefits of diversification and risk management. By adding Kangaroo Bonds to your investment portfolio, you can potentially enhance your returns while reducing your risk exposure.

Market Trends

The Kangaroo bond market has been experiencing significant growth in recent years, making it an attractive investment option for both domestic and international investors. Here are some of the key market trends:

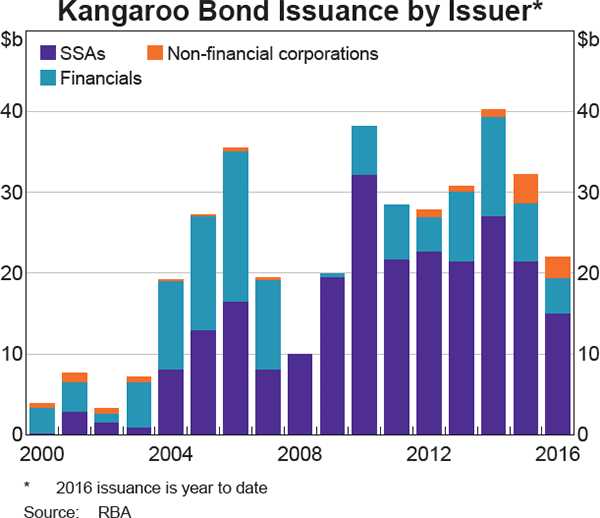

1. Increasing Issuance

The issuance of Kangaroo bonds has been on the rise, with both Australian and international issuers tapping into this market. This growth can be attributed to the favorable market conditions, attractive yields, and the increasing demand for Australian debt securities.

2. Diversification of Investors

The Kangaroo bond market has attracted a diverse range of investors, including sovereign wealth funds, pension funds, insurance companies, and asset managers. This diversification of investors has helped to increase liquidity and deepen the market, making it more attractive for issuers and investors alike.

3. Growing Interest from Asian Investors

4. Green and Social Bonds

There has been a growing trend of issuers tapping into the Kangaroo bond market to raise funds for green and social projects. This aligns with the increasing focus on sustainable and socially responsible investing, and provides investors with an opportunity to support environmentally friendly and socially impactful initiatives.

5. Innovation and New Structures

The Kangaroo bond market has seen innovation in terms of new structures and products being introduced. For example, there has been an increase in the issuance of floating-rate Kangaroo bonds, which provide investors with exposure to Australian interest rates. This innovation helps to cater to the evolving needs and preferences of investors.

Growth of Kangaroo Bonds

Kangaroo Bonds have experienced significant growth in recent years, making them an attractive investment option for both domestic and international investors. The term “Kangaroo Bonds” refers to foreign bonds issued in the Australian market by non-Australian entities.

One of the main reasons for the growth of Kangaroo Bonds is the stability and strength of the Australian economy. Australia has a strong financial system, a stable political environment, and a well-regulated bond market, which makes it an ideal destination for foreign issuers looking to raise capital.

Another factor contributing to the growth of Kangaroo Bonds is the attractive interest rates offered by these bonds. Australia’s interest rates have historically been higher than those in other developed countries, making Kangaroo Bonds an appealing investment option for investors seeking higher yields.

In addition, Kangaroo Bonds offer diversification benefits to investors. By investing in bonds denominated in Australian dollars, investors can diversify their portfolios and reduce their exposure to other currencies. This can help manage risk and provide stability to investment portfolios.

Investment Opportunities

The growth of Kangaroo Bonds has also resulted in an increase in investment opportunities for both domestic and international investors. With a wide range of issuers and maturities available, investors have the flexibility to choose bonds that align with their investment goals and risk appetite.

Furthermore, Kangaroo Bonds provide access to a diverse range of sectors and industries. From government bonds to corporate bonds, investors can find opportunities in various sectors such as banking, energy, infrastructure, and more.

Overall, the growth of Kangaroo Bonds is a testament to the attractiveness of the Australian bond market and the opportunities it offers to investors. With its stable economy, attractive interest rates, and diversification benefits, Kangaroo Bonds are an excellent option for investors looking to expand their portfolios and achieve their investment objectives.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.