What is Reinvestment Rate?

The reinvestment rate is a financial concept that refers to the rate at which the cash flows generated by an investment are reinvested back into the same investment or other investments. It is an important factor to consider when evaluating the overall return on an investment.

Definition and Explanation

The reinvestment rate is the rate at which the cash flows generated by an investment are reinvested. When an investment generates cash flows, such as interest payments or dividends, these cash flows can be reinvested back into the same investment or other investments. The reinvestment rate determines the rate at which these cash flows are reinvested.

The reinvestment rate is an important concept in finance because it affects the overall return on an investment. If the reinvestment rate is high, the investor can earn additional returns by reinvesting the cash flows at a higher rate. On the other hand, if the reinvestment rate is low, the investor may not be able to earn as much on the reinvested cash flows.

Importance and Benefits

The reinvestment rate is important because it can significantly impact the overall return on an investment. By reinvesting cash flows at a higher rate, investors can compound their returns over time and potentially earn higher profits. Additionally, the reinvestment rate allows investors to take advantage of new investment opportunities that may arise.

Furthermore, the reinvestment rate can help investors to mitigate risk. By diversifying their investments and reinvesting cash flows into different assets or securities, investors can spread their risk and potentially reduce the impact of any single investment performing poorly.

Example of Reinvestment Rate

For example, let’s say an investor has a bond that pays an annual interest rate of 5%. If the investor chooses to reinvest the interest payments at a rate of 4%, the reinvestment rate would be 4%. This means that the investor is earning a lower rate on the reinvested interest payments compared to the original bond’s interest rate.

Calculating Reinvestment Rate

The reinvestment rate can be calculated by dividing the future value of the reinvested cash flows by the present value of the original investment. This calculation takes into account the time value of money and allows investors to determine the rate at which their cash flows are being reinvested.

Impact on Investment Returns

Risk Associated with Reinvestment Rate

There are some risks associated with the reinvestment rate. One risk is that the reinvestment rate may not be as high as expected, resulting in lower overall returns. Additionally, the reinvestment rate may fluctuate over time, making it difficult for investors to predict and plan for future returns.

Furthermore, the reinvestment rate may be influenced by external factors such as changes in interest rates or market conditions. These factors can impact the availability of investment opportunities and the rate at which cash flows can be reinvested.

Overall, while the reinvestment rate can offer potential benefits and opportunities for investors, it is important to carefully assess and manage the associated risks.

Definition and Explanation

The reinvestment rate is a financial concept that refers to the rate at which the cash flows generated from an investment are reinvested. It represents the return on investment that can be achieved by reinvesting the cash flows at a certain rate. The reinvestment rate is an important factor to consider when evaluating the potential returns of an investment.

When an investment generates cash flows, such as interest payments or dividends, these cash flows can be reinvested to generate additional returns. The reinvestment rate determines the rate at which these cash flows are reinvested. A higher reinvestment rate means that the cash flows are reinvested at a higher rate, resulting in higher returns.

The reinvestment rate is influenced by various factors, including the prevailing interest rates in the market, the investment’s maturity, and the investor’s risk tolerance. It is important to consider the reinvestment rate when making investment decisions, as it can have a significant impact on the overall returns of an investment.

For example, let’s say an investor has a bond that pays an annual interest rate of 5%. If the investor chooses to reinvest the interest payments at a reinvestment rate of 3%, the total return on the investment will be higher compared to reinvesting at a lower rate.

It is important to note that the reinvestment rate also carries some level of risk. The actual rate at which the cash flows can be reinvested may be lower than expected due to changes in market conditions or other factors. Therefore, it is important for investors to carefully consider the potential risks associated with the reinvestment rate when making investment decisions.

Importance and Benefits of Reinvestment Rate

The reinvestment rate is a crucial factor to consider when making investment decisions, especially in fixed income trading. It refers to the rate at which the income generated from an investment is reinvested back into the same or different investment vehicles.

1. Maximizing Returns

One of the main benefits of considering the reinvestment rate is the potential to maximize returns on investment. By reinvesting the income generated from an investment, investors can take advantage of compounding returns. Compounding refers to the process of earning returns on both the initial investment and the accumulated earnings over time. This can significantly boost overall returns and help investors achieve their financial goals faster.

2. Mitigating Inflation Risk

Another important aspect of the reinvestment rate is its ability to mitigate inflation risk. Inflation erodes the purchasing power of money over time, and if the rate of return on an investment is lower than the inflation rate, the investor may experience a decrease in real value. By reinvesting the income at a rate that exceeds the inflation rate, investors can protect their investments from losing value and maintain their purchasing power.

3. Diversification Opportunities

The reinvestment rate also provides investors with opportunities for diversification. Instead of reinvesting the income back into the same investment, investors can choose to allocate the funds into different investment vehicles. This diversification can help spread the risk and potentially increase overall returns. By investing in different asset classes or industries, investors can reduce the impact of any single investment’s performance on their portfolio.

4. Long-Term Wealth Accumulation

Considering the reinvestment rate is essential for long-term wealth accumulation. By consistently reinvesting the income generated from investments, investors can harness the power of compounding returns over an extended period. This can lead to significant wealth accumulation and provide financial security for the future.

Example of Reinvestment Rate

To better understand the concept of reinvestment rate, let’s consider an example:

Suppose you have $10,000 to invest in a fixed income security that pays an annual interest rate of 5%. At the end of the first year, you will receive $500 in interest income. Now, you have two options:

As you can see from the example, the reinvestment rate plays a crucial role in determining the overall return on your investment. By reinvesting the interest income, you have the potential to earn additional income in subsequent years, leading to a higher overall return. On the other hand, if you do not reinvest the interest income, your overall return will be lower.

It is important to note that the reinvestment rate can vary depending on market conditions and the specific investment. Therefore, it is essential to carefully consider the potential risks and benefits associated with reinvesting the interest income.

Calculating Reinvestment Rate

The reinvestment rate can be calculated using the following formula:

The future value of the investment refers to the total value of the investment at the end of the investment period. The initial investment is the amount of money initially invested.

For example, let’s say an investor initially invests $10,000 in a bond that pays an annual interest rate of 5% and has a maturity period of 5 years. At the end of the 5-year period, the bond matures and the investor receives a total of $12,500, which includes both the initial investment and the interest earned.

Therefore, the reinvestment rate for this investment is 25%, indicating that the investor earned a 25% return on their initial investment over the 5-year period.

The reinvestment rate is an important metric for investors as it helps them evaluate the profitability of their investments and compare different investment options. A higher reinvestment rate indicates a higher return on investment, while a lower reinvestment rate indicates a lower return.

Impact on Investment Returns

The reinvestment rate plays a crucial role in determining the overall investment returns. When the reinvestment rate is high, it means that the interest or dividends earned from an investment can be reinvested at a higher rate, leading to higher returns over time. On the other hand, a low reinvestment rate means that the returns from an investment cannot be reinvested at a favorable rate, resulting in lower overall returns.

For example, let’s say an investor has a bond that pays an annual interest rate of 5%. If the reinvestment rate is also 5%, the investor can reinvest the interest earned at the same rate, resulting in a consistent return of 5% each year. However, if the reinvestment rate increases to 7%, the investor can now reinvest the interest at a higher rate, leading to a higher overall return.

Conversely, if the reinvestment rate decreases to 3%, the investor will earn less on the reinvested interest, resulting in a lower overall return. This highlights the importance of considering the reinvestment rate when evaluating the potential returns of an investment.

Furthermore, the impact of the reinvestment rate becomes more significant over longer investment horizons. Compounding plays a crucial role in generating wealth, and a higher reinvestment rate can significantly enhance the compounding effect. Over time, even a small difference in the reinvestment rate can lead to a substantial difference in the final investment returns.

Risk Associated with Reinvestment Rate

The reinvestment rate is an important concept in fixed income trading and investing. It refers to the rate at which the cash flows from an investment, such as interest payments or dividends, are reinvested to generate additional income. While the reinvestment rate can provide benefits and opportunities for investors, it also carries certain risks that need to be considered.

1. Interest Rate Risk

One of the main risks associated with the reinvestment rate is interest rate risk. Interest rates can fluctuate over time, and when they decrease, the reinvestment rate may be lower than expected. This can result in lower returns on the reinvested cash flows and overall lower investment returns.

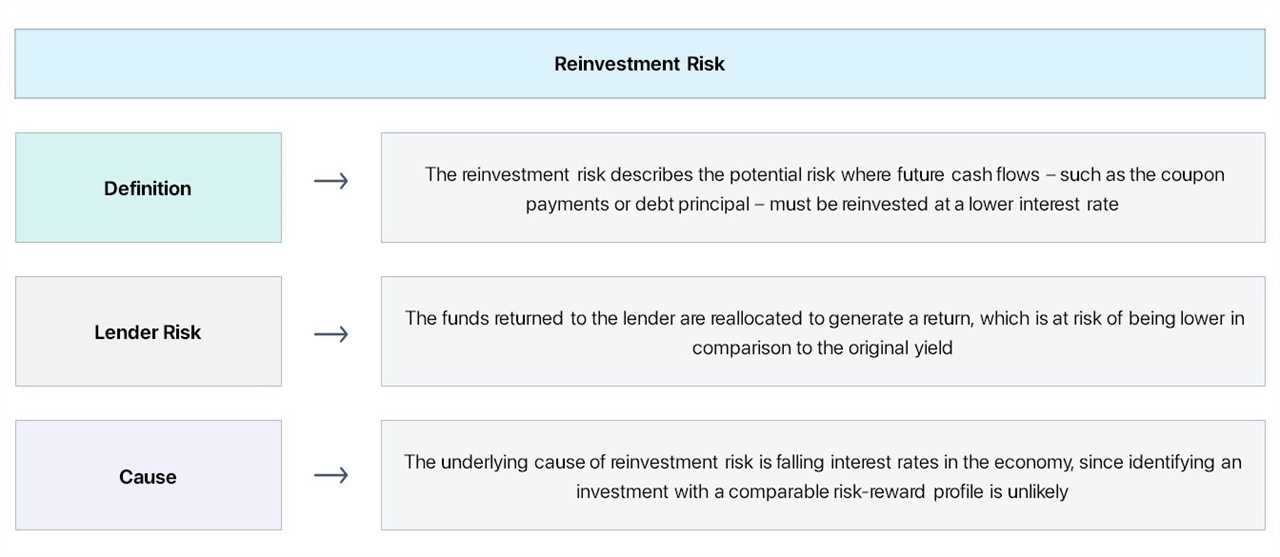

2. Reinvestment Risk

Reinvestment risk refers to the risk that the cash flows from an investment cannot be reinvested at the same rate or a higher rate. This can happen due to changes in market conditions, creditworthiness of issuers, or other factors. If the reinvestment rate is lower than expected, it can lead to lower investment returns and affect the overall performance of the investment.

3. Inflation Risk

Inflation risk is another risk associated with the reinvestment rate. If the reinvestment rate does not keep up with inflation, the purchasing power of the reinvested cash flows may decrease over time. This can erode the real value of the investment and result in lower returns in terms of purchasing power.

4. Liquidity Risk

Liquidity risk refers to the risk that the reinvested cash flows cannot be easily converted into cash when needed. If the reinvestment options are limited or illiquid, it can be challenging to access the funds or take advantage of other investment opportunities. This can limit the flexibility and potential returns of the investment.

Overall, while the reinvestment rate can provide opportunities for additional income and growth, it is important to consider the associated risks. Investors should carefully assess the interest rate risk, reinvestment risk, inflation risk, and liquidity risk when making investment decisions. Diversification, thorough research, and regular monitoring can help mitigate these risks and optimize the investment returns.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.