What is Reinsurance?

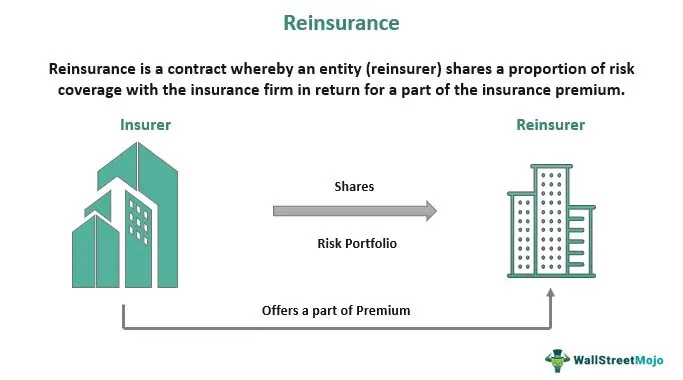

When an insurance company sells a policy to a policyholder, it assumes the risk associated with that policy. However, sometimes the risk can be too large for the insurance company to handle on its own. This is where reinsurance comes in. By transferring a portion of the risk to a reinsurer, the insurance company can protect itself from large losses and ensure its financial stability.

Reinsurance works on the principle of spreading risk. The reinsurer agrees to pay a portion of the claims made by the policyholders of the insurance company in exchange for a premium. This allows the insurance company to limit its exposure to losses and maintain its ability to pay claims.

Reinsurance can be thought of as a safety net for insurance companies. It provides them with the financial support they need to handle unexpected or catastrophic events. Without reinsurance, insurance companies would be at a higher risk of insolvency and would not be able to fulfill their obligations to policyholders.

Overall, reinsurance plays a vital role in the stability and sustainability of the insurance industry. It allows insurance companies to operate with confidence, knowing that they have the necessary resources to handle potential losses. Without reinsurance, the insurance industry would be much more vulnerable to financial instability.

Definition and Explanation

The concept of reinsurance is based on the principle of spreading risk. Insurance companies face the possibility of large claims that could potentially bankrupt them. By transferring a portion of their risk to a reinsurer, they can protect themselves from financial losses in the event of a catastrophic event or a large number of claims.

Reinsurance can be seen as insurance for insurance companies. It provides them with a safety net and helps them maintain their financial stability. Without reinsurance, insurance companies would be exposed to the full extent of the risks they insure, which could be financially devastating.

How does reinsurance work?

When an insurance company sells a policy, it collects premiums from the policyholders. These premiums are used to cover the cost of claims and other expenses. However, if a large claim or a series of claims exceeds the insurance company’s capacity to pay, reinsurance comes into play.

The insurance company transfers a portion of the risk to a reinsurer by entering into a reinsurance contract. The reinsurer agrees to pay a portion of the claims in exchange for a premium. This allows the insurance company to limit its exposure and protect its financial stability.

There are two main types of reinsurance: facultative reinsurance and treaty reinsurance. Facultative reinsurance is a case-by-case arrangement where the insurance company negotiates with the reinsurer for each individual policy. Treaty reinsurance, on the other hand, is a more general agreement that covers a specific type of risk or a portfolio of policies.

Importance of Reinsurance

Reinsurance plays a crucial role in the insurance industry, providing financial stability and risk management for insurance companies. It is an essential tool that helps insurers manage their exposure to large and catastrophic losses.

One of the main reasons why reinsurance is important is that it helps spread the risk across multiple insurers. Insurance companies often face the challenge of dealing with large claims that can exceed their capacity to pay. Reinsurance allows insurers to transfer a portion of the risk to reinsurers, who then share the financial burden.

Reinsurance also helps insurers maintain their financial strength and solvency. By transferring a portion of the risk, insurers can protect their capital and ensure they have sufficient funds to meet their policyholder obligations. This is especially important in the case of major disasters or events that can result in a high volume of claims.

Another benefit of reinsurance is that it allows insurers to expand their capacity and underwrite larger policies. By sharing the risk with reinsurers, insurers can take on more significant risks and offer coverage for higher policy limits. This enables insurers to attract larger clients and compete in the market more effectively.

Overall, reinsurance is a critical component of the insurance industry, providing stability, risk management, and financial protection for insurers. It helps insurers mitigate their exposure to large losses, maintain their financial strength, and access expertise and capacity from reinsurers. Without reinsurance, insurers would face significant challenges in managing their risks and ensuring their long-term viability.

Types of Reinsurance

1. Proportional Reinsurance: This type of reinsurance involves sharing both the premiums and losses between the insurer and the reinsurer. The reinsurer takes on a percentage of the risk and pays a corresponding percentage of the claims. Proportional reinsurance can be further divided into two subcategories:

| Subcategory | Description |

|---|---|

| Quota Share | The insurer and the reinsurer agree to share the risk and premiums based on a predetermined percentage. For example, if the quota share is 50%, the reinsurer will cover 50% of the premiums and claims. |

| Surplus Share |

| Type | Description |

|---|---|

| Excess of Loss | |

| Stop Loss | The reinsurer agrees to cover claims that exceed a certain percentage of the insurer’s loss ratio. This type of reinsurance provides protection against unexpected spikes in claims. |

3. Facultative Reinsurance: Facultative reinsurance is a type of reinsurance that is negotiated on a case-by-case basis. It is typically used for large or complex risks that cannot be covered by standard reinsurance treaties. Facultative reinsurance allows insurers to transfer specific risks to reinsurers, providing them with additional capacity and expertise.

4. Treaty Reinsurance: Treaty reinsurance is a type of reinsurance that is based on a contractual agreement between the insurer and the reinsurer. It provides coverage for a specified period and a defined set of risks. Treaty reinsurance is often used for standard risks that can be covered by pre-negotiated terms and conditions.

Facultative Reinsurance

Facultative reinsurance is a type of reinsurance where each individual risk is assessed and underwritten separately. Unlike treaty reinsurance, which covers a portfolio of risks, facultative reinsurance is specific to a single risk or a group of risks.

Facultative reinsurance is typically used for high-value or complex risks that exceed the capacity or expertise of the primary insurer. It allows the insurer to transfer a portion of the risk to a reinsurer, who will then assume a share of the liability in exchange for a premium.

How it Works

When a primary insurer receives an application for insurance coverage that falls outside their risk appetite or exceeds their capacity, they may seek facultative reinsurance. The primary insurer will assess the risk and determine the portion they are willing to retain and the portion they want to cede to a reinsurer.

The primary insurer will then approach one or more reinsurers to negotiate the terms of the facultative reinsurance agreement. The reinsurer will evaluate the risk and determine if they are willing to accept it. If accepted, the reinsurer will provide a quote for the premium they will charge to assume the risk.

If the primary insurer accepts the reinsurer’s quote, they will enter into a facultative reinsurance agreement. The primary insurer will retain a portion of the risk and transfer the remaining portion to the reinsurer. In the event of a claim, the primary insurer will handle the claim up to their retention limit, and the reinsurer will be responsible for any amount exceeding that limit.

Advantages and Disadvantages

Facultative reinsurance offers several advantages to primary insurers. It allows them to manage their risk exposure by transferring a portion of the risk to a reinsurer. It also provides access to additional capacity and expertise for high-value or complex risks. Additionally, facultative reinsurance allows primary insurers to offer coverage to clients that would otherwise be outside their risk appetite or capacity.

However, facultative reinsurance can be more expensive than treaty reinsurance, as each risk is individually underwritten and priced. It also requires more administrative effort, as each facultative reinsurance agreement needs to be negotiated separately. Furthermore, facultative reinsurance may not be available for certain risks if reinsurers are not willing to accept them.

Conclusion

Facultative reinsurance is an important tool for primary insurers to manage their risk exposure and access additional capacity and expertise. It allows insurers to offer coverage for high-value or complex risks that exceed their capacity or expertise. While it may have some drawbacks, the benefits of facultative reinsurance make it a valuable component of the reinsurance industry.

Treaty Reinsurance: Definition, Types, and How It Works

Definition and Explanation

Treaty reinsurance is a contractual arrangement where the ceding company transfers a portion of its insurance liabilities to the reinsurer. The reinsurer agrees to indemnify the ceding company for losses incurred within the terms of the treaty. This allows the ceding company to reduce its exposure to risk and protect its financial stability.

Treaty reinsurance is typically used for large volumes of similar risks, such as property, casualty, or life insurance policies. It provides a more efficient and cost-effective way for insurance companies to manage their risk exposure compared to facultative reinsurance.

Importance of Treaty Reinsurance

Treaty reinsurance plays a crucial role in the insurance industry by providing stability and financial protection to insurance companies. It allows insurers to spread their risk across multiple reinsurers, reducing the impact of large losses and ensuring their ability to pay claims.

By transferring a portion of their risk to reinsurers, insurance companies can also free up capital that can be used for other business purposes, such as expanding their operations or investing in new products and services.

Types of Treaty Reinsurance

There are several types of treaty reinsurance agreements, including:

- Quota Share Reinsurance: The ceding company and the reinsurer share the premiums and losses in a predetermined proportion.

Each type of treaty reinsurance has its own advantages and considerations, depending on the specific needs and risk appetite of the ceding company.

How Treaty Reinsurance Works

When a ceding company enters into a treaty reinsurance agreement, it provides the reinsurer with detailed information about the risks it wants to transfer. This includes policy details, premium amounts, and loss history.

Based on this information, the reinsurer assesses the risks and determines the premium rates for providing coverage. The ceding company pays the reinsurer the agreed-upon premiums, and in return, the reinsurer assumes a portion of the insurance liabilities.

In the event of a claim, the ceding company first pays the claim up to its retention limit. If the claim exceeds this limit, the reinsurer reimburses the ceding company for the remaining amount, up to the coverage limit specified in the treaty.

Treaty reinsurance agreements are typically long-term contracts, often lasting for multiple years. They are subject to periodic reviews and adjustments based on changes in the ceding company’s risk profile and the overall market conditions.

How Reinsurance Works

Reinsurance is a crucial component of the insurance industry, providing a way for insurance companies to manage their risk and protect themselves from large losses. Here is a detailed explanation of how reinsurance works:

- Identification of Risks: Insurance companies first identify the risks they want to transfer to a reinsurer. These risks can include natural disasters, accidents, or other events that could result in significant financial losses.

- Selection of Reinsurer: Once the risks are identified, insurance companies select a reinsurer to transfer these risks to. The selection process involves evaluating the reinsurer’s financial stability, expertise in the specific type of risk, and the terms and conditions of the reinsurance contract.

- Reinsurance Contract: The insurance company and the reinsurer enter into a reinsurance contract, which outlines the terms and conditions of the agreement. This contract specifies the amount of risk being transferred, the premium to be paid by the insurance company, and the coverage provided by the reinsurer.

- Premium Payments: The insurance company pays a premium to the reinsurer based on the amount of risk being transferred. This premium is typically a percentage of the insurance company’s premium income from the policies being reinsured.

- Claims Handling: In the event of a covered loss, the insurance company handles the claims process with the policyholder. If the loss exceeds a certain threshold specified in the reinsurance contract, the insurance company can then make a claim to the reinsurer for reimbursement.

- Reimbursement by Reinsurer: If the claim is accepted by the reinsurer, they will reimburse the insurance company for the agreed-upon portion of the loss. This helps the insurance company manage their financial exposure and maintain their solvency.

- Risk Transfer: Through the reinsurance process, the insurance company effectively transfers a portion of their risk to the reinsurer. This allows the insurance company to protect its balance sheet and ensure that it has sufficient funds to pay claims.

- Monitoring and Review: The insurance company and the reinsurer regularly monitor and review the reinsurance arrangement to ensure that it remains effective and meets the needs of both parties. Adjustments may be made to the reinsurance contract as necessary.

Overall, reinsurance plays a vital role in the insurance industry by providing a mechanism for managing risk and ensuring the financial stability of insurance companies. By transferring a portion of their risk to reinsurers, insurance companies can protect themselves from large losses and continue to provide coverage to policyholders.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.