Exploring Financial Ratios and Their Importance

Financial ratios are essential tools used by investors, analysts, and businesses to assess the financial health and performance of a company. These ratios provide valuable insights into various aspects of a company’s operations, profitability, liquidity, and solvency.

There are several types of financial ratios that can be calculated and analyzed. Some of the most commonly used financial ratios include:

- Liquidity ratios: These ratios measure a company’s ability to meet its short-term obligations. Examples include the current ratio and the quick ratio.

- Profitability ratios: These ratios assess a company’s ability to generate profits. Examples include the gross profit margin, net profit margin, and return on investment.

- Debt ratios: These ratios evaluate a company’s leverage and its ability to meet its long-term obligations. Examples include the debt-to-equity ratio and the interest coverage ratio.

- Efficiency ratios: These ratios measure how effectively a company utilizes its assets and resources. Examples include the inventory turnover ratio and the asset turnover ratio.

Financial ratios are important because they provide a standardized way to compare companies within the same industry or sector. By analyzing these ratios, investors and analysts can make informed decisions about investing in a particular company or comparing it to its competitors.

Financial ratios also help businesses identify areas of strength and weakness. For example, a low liquidity ratio may indicate that a company is struggling to meet its short-term obligations, while a high debt ratio may suggest that a company is heavily reliant on borrowed funds.

Furthermore, financial ratios can be used to track a company’s performance over time. By comparing ratios from different periods, businesses can identify trends and make adjustments to improve their financial position.

Overall, financial ratios play a crucial role in assessing a company’s financial health and performance. They provide valuable insights into various aspects of a company’s operations and help investors, analysts, and businesses make informed decisions.

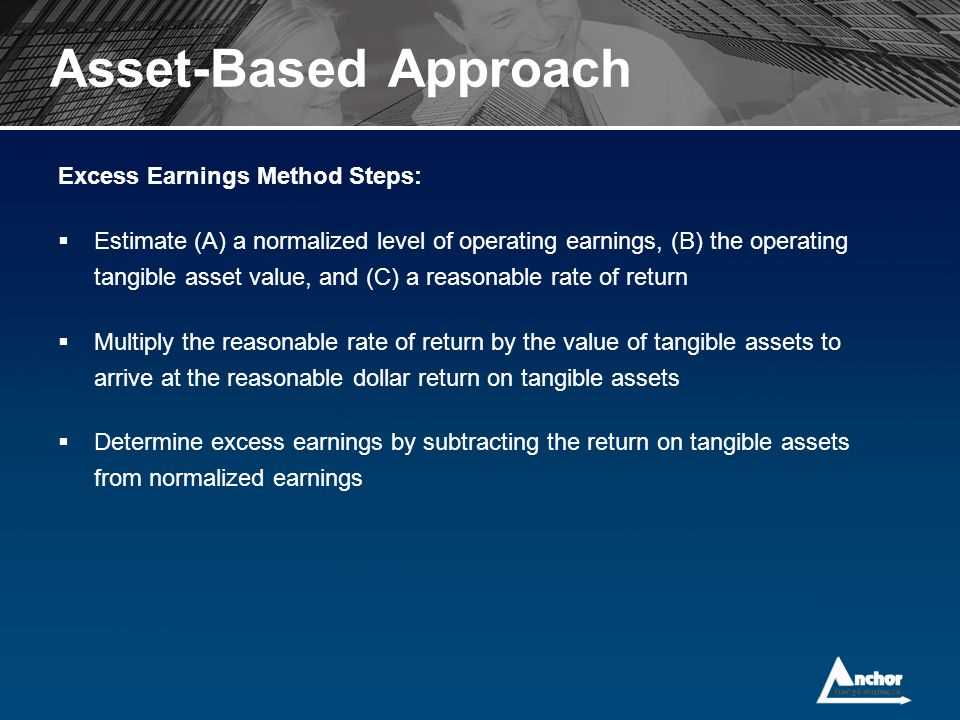

Key Considerations for Asset-Based Approach Calculations

When using the asset-based approach to calculate the value of a company, there are several key considerations that need to be taken into account. These considerations can greatly impact the accuracy and reliability of the valuation. Here are some important factors to consider:

1. Quality of Assets

The quality of a company’s assets is a crucial factor in determining its value. High-quality assets, such as cash, marketable securities, and valuable intellectual property, are more easily converted into cash and are therefore more valuable. On the other hand, low-quality assets, such as obsolete inventory or outdated equipment, may have limited value and can negatively impact the overall valuation.

2. Asset Valuation Methodology

There are various methodologies that can be used to value different types of assets. It is important to carefully select the appropriate valuation methodology for each asset category. For example, real estate assets may be valued using the market approach, while intangible assets may require the income approach. Using the wrong valuation methodology can lead to inaccurate results.

3. Asset Adjustments

When calculating the value of a company’s assets, it is often necessary to make adjustments to the reported values. These adjustments can include factors such as depreciation, obsolescence, or changes in market conditions. It is important to carefully analyze and document these adjustments to ensure the accuracy of the valuation.

4. Liabilities and Debt

5. Industry and Market Factors

The asset-based approach should also consider industry and market factors that can influence the value of a company’s assets. For example, economic conditions, industry trends, and competitive dynamics can all impact the value of certain assets. It is important to stay informed about these factors and adjust the valuation accordingly.

| Consideration | Description |

|---|---|

| Quality of Assets | The quality of a company’s assets can greatly impact its value. |

| Asset Valuation Methodology | Choosing the appropriate valuation methodology for each asset category is crucial. |

| Asset Adjustments | Adjustments to the reported values of assets may be necessary. |

| Liabilities and Debt | Consideration of a company’s liabilities and debt is important for accurate valuation. |

| Industry and Market Factors | Industry and market conditions can influence the value of assets. |

By carefully considering these key factors, a more accurate and reliable valuation can be obtained using the asset-based approach. It is important to conduct thorough research, gather relevant data, and seek professional advice when necessary to ensure the best possible results.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.