What is Facultative Reinsurance?

Facultative reinsurance is a type of reinsurance where the insurer transfers a specific risk or a part of it to another insurer or reinsurer. Unlike treaty reinsurance, which covers a portfolio of risks, facultative reinsurance deals with individual risks on a case-by-case basis.

Facultative reinsurance is often used for large or complex risks that exceed the primary insurer’s capacity or expertise. It provides the primary insurer with the flexibility to select the specific risks it wants to transfer, as well as negotiate the terms and conditions of the reinsurance contract.

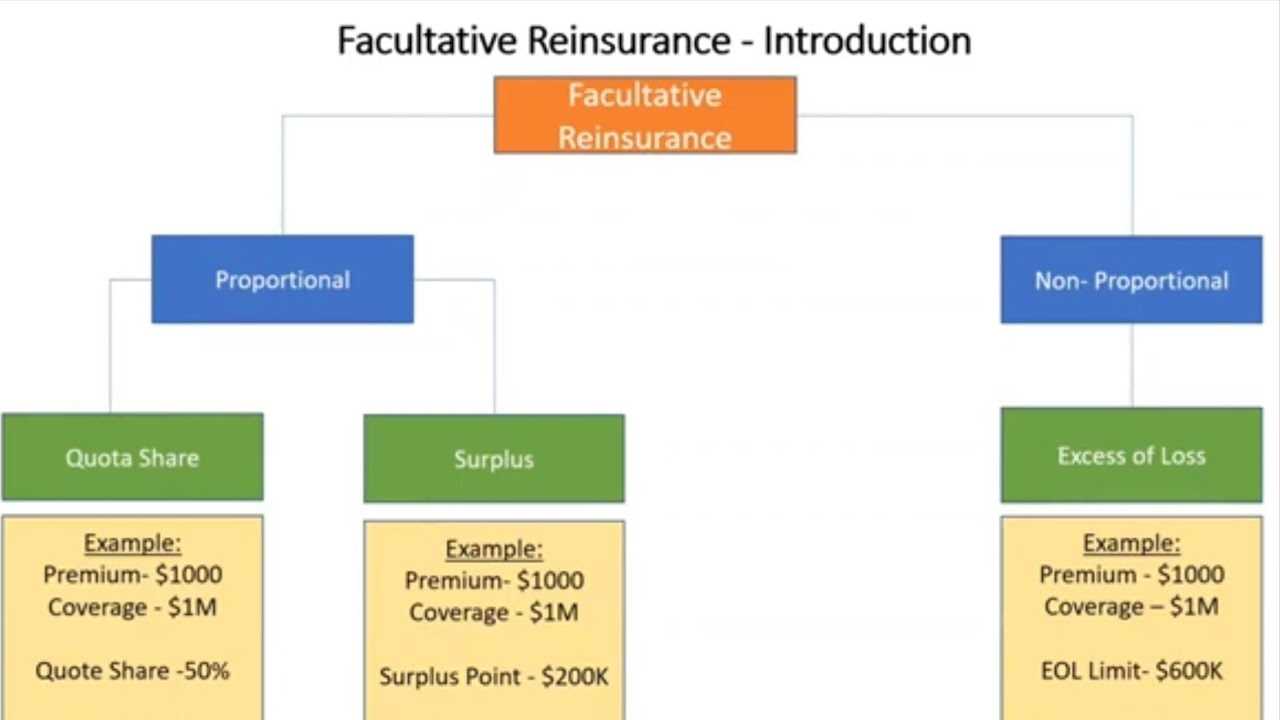

Facultative reinsurance can cover various types of risks, including property, liability, and specialty lines. It can be written on an excess of loss or proportional basis, depending on the primary insurer’s needs and the reinsurer’s appetite for risk.

In summary, facultative reinsurance is a valuable tool for primary insurers to manage their risk exposure and protect their financial stability. It allows them to transfer specific risks to reinsurers, providing them with additional capacity and expertise.

Definition of Facultative Reinsurance

Facultative reinsurance is a type of reinsurance that is purchased on an individual risk basis. Unlike treaty reinsurance, which provides coverage for a portfolio of risks, facultative reinsurance is specifically tailored to cover a single risk or a specific set of risks.

Facultative reinsurance is typically used when the primary insurer wants to transfer a portion of the risk associated with a particular policy or contract to a reinsurer. This can help the primary insurer manage its exposure to large losses and protect its financial stability.

How Does Facultative Reinsurance Work?

When a primary insurer wants to cede a risk to a reinsurer, it submits the details of the risk to the reinsurer for evaluation. The reinsurer then assesses the risk and determines whether or not to accept it. If the reinsurer accepts the risk, they will provide coverage for a specified portion of the risk, usually expressed as a percentage.

Benefits of Facultative Reinsurance

Facultative reinsurance offers several benefits to primary insurers. Firstly, it allows them to transfer a portion of the risk associated with a particular policy or contract to a reinsurer, reducing their exposure to large losses. This can help primary insurers maintain their financial stability and protect their policyholders.

Secondly, facultative reinsurance provides primary insurers with access to additional underwriting expertise and capacity. Reinsurers often have specialized knowledge and resources that can help primary insurers assess and manage risks more effectively.

Finally, facultative reinsurance can provide primary insurers with flexibility in managing their risk portfolios. They can choose to cede risks on a case-by-case basis, allowing them to tailor their reinsurance coverage to their specific needs and objectives.

Comparison with Treaty Reinsurance

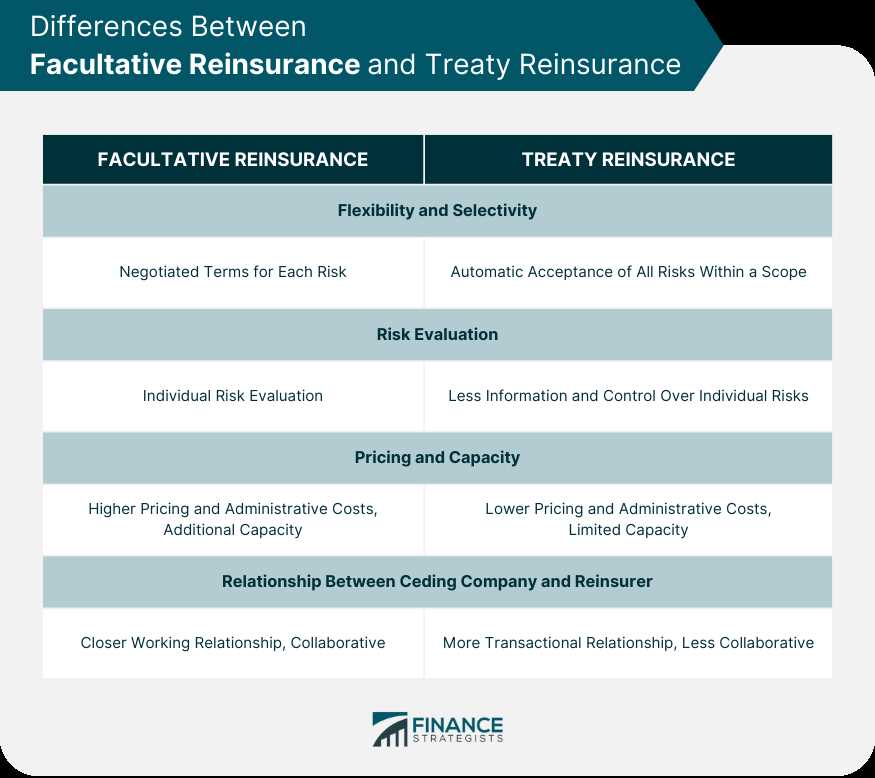

Facultative reinsurance and treaty reinsurance are two common types of reinsurance contracts used in the insurance industry. While both serve the purpose of transferring risk from the primary insurer to the reinsurer, there are significant differences between the two.

1. Scope of Coverage:

In treaty reinsurance, the primary insurer transfers a predetermined portion of its risks to the reinsurer. This means that all policies falling within the agreed scope are automatically reinsured. On the other hand, facultative reinsurance is more specific and case-by-case. It allows the primary insurer to choose which individual risks they want to transfer to the reinsurer.

2. Flexibility:

Treaty reinsurance offers more flexibility to the primary insurer as it covers a wide range of policies and risks. The primary insurer does not need to negotiate terms and conditions for each individual risk. In contrast, facultative reinsurance allows the primary insurer to tailor the terms and conditions of the reinsurance contract to the specific risk being transferred. This flexibility can be beneficial in cases where the risk is unique or requires special underwriting.

3. Pricing:

Treaty reinsurance is generally priced based on aggregate loss experience and exposure, taking into account the entire portfolio of risks covered under the treaty. Facultative reinsurance, on the other hand, is priced on a case-by-case basis, considering the specific characteristics and risks of each individual policy. This means that facultative reinsurance may have higher pricing compared to treaty reinsurance, especially for high-risk or unique policies.

4. Retention:

5. Relationship:

Treaty reinsurance is typically a long-term arrangement between the primary insurer and the reinsurer, covering a broad range of policies over an extended period. Facultative reinsurance, on the other hand, is more transactional and based on individual risks. The primary insurer and the reinsurer negotiate terms and conditions for each facultative reinsurance contract separately.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.