Financial Exposure: Definition and Importance

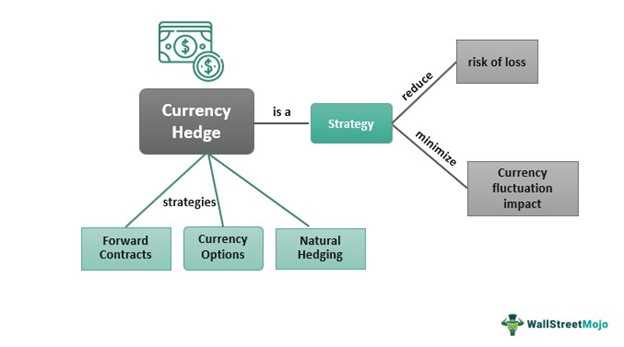

By identifying and quantifying financial exposure, companies can take appropriate measures to mitigate the risks. This may involve implementing hedging strategies, such as using financial instruments like futures contracts or options, to protect against adverse movements in financial variables.

Managing financial exposure also helps companies make informed decisions and develop effective risk management strategies. It allows them to assess the potential impact of different scenarios and adjust their operations accordingly. This can help companies navigate through uncertain economic conditions and maintain stability in their financial performance.

In summary, financial exposure is an important concept in risk management and financial decision-making. It is essential for companies, investors, and lenders to understand and manage their financial exposure to mitigate risks, make informed decisions, and maintain financial stability.

There are several factors that contribute to financial exposure:

- Foreign exchange exposure: This refers to the risk that arises from fluctuations in exchange rates. Companies that engage in international trade or have foreign operations are exposed to currency risk. For example, if a company imports goods from another country and the value of the local currency depreciates, the cost of importing those goods will increase.

- Interest rate exposure: This refers to the risk that arises from changes in interest rates. Companies that have variable-rate debt or investments that are sensitive to interest rate changes are exposed to interest rate risk. For example, if a company has borrowed money at a variable interest rate and interest rates increase, the cost of servicing the debt will also increase.

- Commodity price exposure: This refers to the risk that arises from changes in commodity prices. Companies that are involved in industries such as oil, gas, metals, and agriculture are exposed to commodity price risk. For example, if a company is in the oil industry and the price of oil decreases, its revenue and profitability may be negatively affected.

Managing financial exposure requires a comprehensive approach that includes regular monitoring of financial variables, analyzing the impact of potential changes, and implementing risk management strategies. It is important to assess the potential impact of financial exposure on cash flows, profitability, and overall financial health.

Importance of Managing Financial Exposure

Managing financial exposure is crucial for individuals, businesses, and investors to mitigate risks and protect their financial well-being. Here are some reasons why managing financial exposure is important:

- Risk Mitigation: By managing financial exposure, individuals and businesses can reduce the potential negative impact of market fluctuations, currency exchange rate fluctuations, interest rate changes, and other financial risks. This helps protect their assets and investments from significant losses.

- Competitive Advantage: Proper management of financial exposure can give businesses a competitive advantage. By identifying and managing risks, businesses can adapt to changing market conditions, make strategic decisions, and seize opportunities that their competitors may overlook. This can lead to increased profitability and long-term success.

- Compliance with Regulations: Many industries and jurisdictions have regulations and requirements related to financial exposure management. By effectively managing financial exposure, individuals and businesses can ensure compliance with these regulations, avoid penalties, and maintain a good reputation.

- Investor Confidence: Investors are more likely to invest in individuals or businesses that demonstrate effective financial exposure management. By proactively managing risks and implementing risk management strategies, individuals and businesses can attract and retain investors, build trust, and enhance their reputation in the financial market.

How Financial Exposure Works

Financial exposure refers to the potential risk and impact that changes in financial variables can have on a company’s financial position. It is important for businesses to understand how financial exposure works in order to effectively manage and mitigate risks.

Financial exposure can arise from various factors, including fluctuations in interest rates, exchange rates, commodity prices, and market conditions. These factors can significantly impact a company’s revenues, costs, and profitability.

Managing financial exposure involves identifying and quantifying the potential risks, and implementing strategies to mitigate them. One common strategy is hedging, which involves using financial instruments such as derivatives to offset the impact of adverse changes in financial variables.

For example, a company that has significant exposure to fluctuations in commodity prices may enter into futures contracts to lock in prices and reduce the risk of price volatility. Similarly, a company with foreign currency exposure may use currency forwards or options to hedge against exchange rate fluctuations.

By hedging their financial exposure, companies can reduce the potential impact of adverse changes in financial variables on their financial position. However, it is important to note that hedging strategies also come with their own risks and costs.

In addition to hedging, companies can also manage financial exposure by diversifying their operations and revenue streams. By operating in multiple markets and industries, companies can reduce their reliance on a single market or product, thereby reducing their exposure to specific risks.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.