Primary Market: Definition, Types, Examples, and Secondary Markets

Definition of the Primary Market:

Types of Primary Markets:

There are two main types of primary markets:

1. Initial Public Offering (IPO):

An IPO occurs when a private company decides to go public by offering its shares to the general public for the first time. In an IPO, the company hires investment banks to underwrite the offering and facilitate the sale of shares to investors. The shares are typically offered at a fixed price, and the company raises capital by selling a portion of its ownership to the public.

Examples of Primary Markets:

Some well-known examples of primary markets include:

– The New York Stock Exchange (NYSE): The NYSE is one of the largest stock exchanges in the world, where companies can list their shares for trading.

– Initial Public Offerings (IPOs): Companies like Facebook, Alibaba, and Uber have gone public through IPOs, raising billions of dollars in the primary market.

– Bond Issuances: Governments and corporations issue bonds in the primary market to raise funds for various projects or operations.

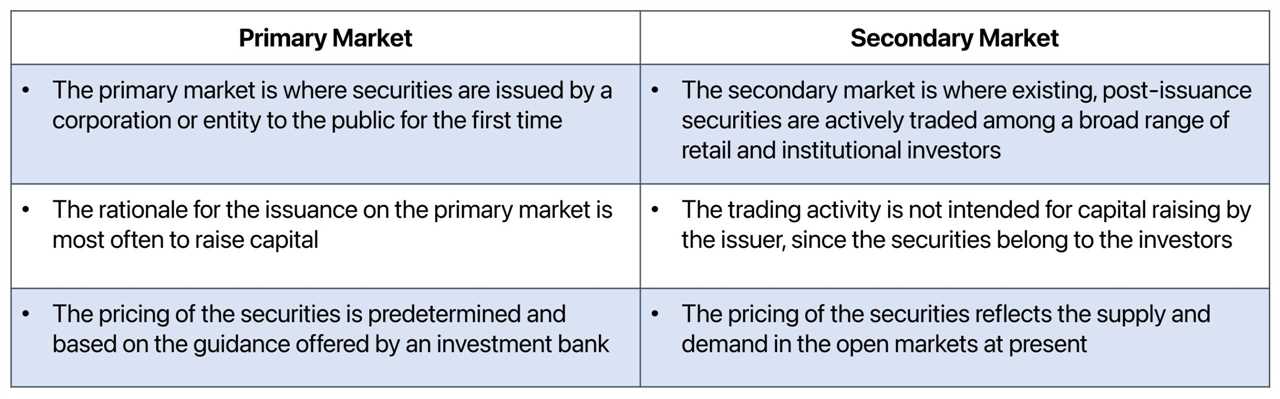

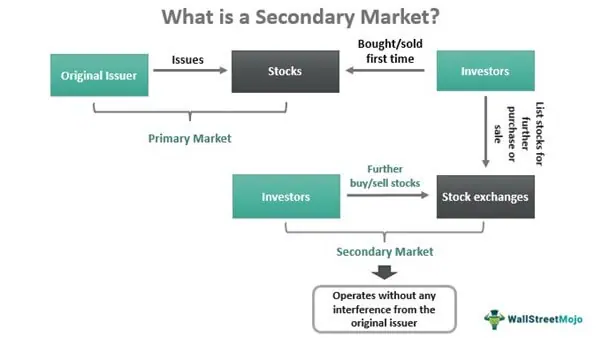

Secondary Markets and their Role:

Once the securities are sold in the primary market, they can be traded in the secondary market. The secondary market is where investors buy and sell securities among themselves, without the involvement of the issuing company or government. Examples of secondary markets include stock exchanges like NASDAQ and the London Stock Exchange. The secondary market provides liquidity to investors, allowing them to buy or sell securities at market-determined prices.

What is a Primary Market?

The primary market plays a crucial role in the economy as it allows companies and governments to raise funds for various purposes, such as expanding their operations, funding new projects, or paying off existing debts. It provides an avenue for investors to participate in the growth and development of these entities.

Types of Primary Markets

There are two main types of primary markets:

- Initial Public Offering (IPO): This is when a private company offers its shares to the public for the first time. It allows the company to raise capital and become publicly traded.

- Secondary Offering: This is when a company that is already publicly traded issues additional shares to raise more capital. This can be done through a rights issue, where existing shareholders are given the opportunity to purchase additional shares, or through a follow-on offering, where new shares are offered to the public.

Examples of Primary Markets

Some examples of primary markets include:

- The New York Stock Exchange (NYSE): Companies can list their shares on the NYSE through an IPO or a secondary offering.

- The bond market: Governments and corporations can issue new bonds to raise capital.

- Crowdfunding platforms: Startups and small businesses can raise funds from individual investors through online platforms.

These examples illustrate the diverse range of primary markets that exist, catering to different types of securities and investors.

Overall, the primary market serves as a vital component of the financial system, facilitating the flow of capital between issuers and investors. It provides opportunities for companies and governments to raise funds and for investors to participate in the growth of these entities.

Types of Primary Markets

In the financial world, the primary market is where new securities are issued and sold for the first time. There are several types of primary markets, each catering to different types of securities and investors. Let’s take a closer look at some of the most common types:

- Initial Public Offering (IPO): This is perhaps the most well-known type of primary market. An IPO occurs when a private company decides to go public and offer its shares to the general public for the first time. This is often a significant event for the company and can attract a lot of attention from investors.

- Private Placement: In contrast to an IPO, a private placement involves the sale of securities to a select group of investors. This method is typically used by smaller companies or those looking to raise capital without going through the extensive regulatory requirements associated with an IPO.

- Debt Issuance: Primary markets are not limited to equity securities. Companies and governments can also issue debt securities, such as bonds, in the primary market. These securities represent loans that investors make to the issuer, who promises to repay the principal amount along with periodic interest payments.

- Rights Issue: A rights issue allows existing shareholders of a company to purchase additional shares at a discounted price. This type of primary market offering gives shareholders the opportunity to maintain their proportional ownership in the company and potentially increase their investment.

- Preferential Allotment: This type of primary market offering is similar to a rights issue, but instead of offering shares to existing shareholders, the company offers them to a specific group of investors. This can include strategic investors, institutional investors, or other entities that the company wants to bring on board.

These are just a few examples of the types of primary markets that exist. Each type serves a specific purpose and caters to different types of securities and investors. The primary market plays a crucial role in the financial ecosystem by providing companies and governments with a means to raise capital and investors with opportunities to invest in new securities.

Examples of Primary Markets

In the primary market, various types of securities are issued and sold to investors for the first time. Here are some examples of primary markets:

1. Initial Public Offerings (IPOs)

An IPO occurs when a company decides to go public and issue its shares to the general public for the first time. This is a significant event for both the company and potential investors. Companies usually hire investment banks to underwrite the IPO and help with the process of selling the shares to the public. Examples of well-known IPOs include Facebook, Alibaba, and Uber.

2. Bond Issuance

Government entities, municipalities, and corporations often issue bonds in the primary market to raise capital. Investors can purchase these bonds, which represent a loan to the issuer, and receive periodic interest payments until the bond matures. Examples of bond issuances include U.S. Treasury bonds, corporate bonds from companies like Apple or Microsoft, and municipal bonds issued by cities or states.

3. Rights Issues

In a rights issue, existing shareholders of a company are given the opportunity to purchase additional shares at a discounted price. This allows the company to raise additional capital without diluting the ownership of existing shareholders. Rights issues are often used by companies to fund expansion plans or pay off debt. Examples of rights issues include those conducted by companies like Tesla and Amazon.

4. Private Placements

Private placements involve the sale of securities to a select group of investors, such as institutional investors or accredited individuals. These offerings are not available to the general public and are often used by companies that do not want to go through the process of an IPO. Private placements can include the issuance of equity or debt securities. Examples of private placements include investments made by venture capital firms in startups or institutional investors purchasing corporate bonds directly from the issuer.

These are just a few examples of primary markets and the types of securities that are issued in them. The primary market plays a crucial role in facilitating the initial sale of securities and raising capital for companies and other entities.

Secondary Markets and their Role

In the world of finance, secondary markets play a crucial role in providing liquidity and facilitating the buying and selling of financial instruments that were originally issued in the primary market. These markets allow investors to trade securities such as stocks, bonds, and derivatives after they have been issued and initially sold in the primary market.

Secondary markets provide a platform for investors to buy and sell securities based on their current market value, rather than the initial offering price. This allows for price discovery and ensures that securities are traded at fair and competitive prices. It also enables investors to exit their investments and realize their gains or losses.

Secondary markets also contribute to the overall efficiency of the financial system. By providing a platform for trading securities, these markets help allocate capital to its most productive uses. They enable investors to diversify their portfolios and manage risk by allowing them to buy and sell a wide range of securities. This promotes competition and fosters innovation in the financial markets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.