Private Placements: A Comprehensive Guide

Private placements are a popular method for companies to raise capital without going through the traditional public offering process. In a private placement, a company sells securities to a select group of investors, such as institutional investors, accredited investors, or high net worth individuals.

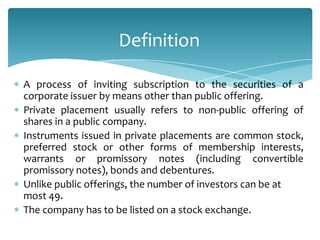

Definition of Private Placements

A private placement is a capital raising method where a company offers securities to a specific group of investors, bypassing the need for a public offering. It is a way for companies to raise funds without having to comply with the extensive regulations and disclosure requirements associated with public offerings.

Example of Private Placements

Let’s say Company XYZ is a startup looking to raise funds to expand its operations. Instead of going public and offering its shares to the general public, Company XYZ decides to conduct a private placement. It approaches a group of venture capital firms and high net worth individuals who are interested in investing in startups. Company XYZ offers them shares of its company in exchange for their investment.

Pros of Private Placements

Private placements offer several advantages for companies:

- Flexibility: Private placements allow companies to negotiate the terms of the investment directly with the investors, giving them more flexibility compared to public offerings.

- Efficiency: Private placements can be completed more quickly and with less paperwork compared to public offerings, allowing companies to raise funds in a timely manner.

Cons of Private Placements

While private placements have their advantages, they also have some drawbacks:

- Lack of Liquidity: Securities sold in private placements are not easily tradable, making it difficult for investors to sell their shares if they need to exit their investment.

- Regulatory Compliance: Although private placements have fewer regulatory requirements compared to public offerings, companies still need to comply with certain regulations and restrictions.

Overall, private placements can be an effective method for companies to raise capital and maintain control over their operations. However, it is important for companies to carefully consider the pros and cons before deciding to pursue a private placement.

Definition, Example, Pros and Cons

Private placements are a type of securities offering where companies sell their shares or other securities directly to a select group of investors, rather than through a public offering. This method of raising capital is often used by startups and small businesses to attract investment from private individuals, venture capitalists, or institutional investors.

Definition

A private placement is a transaction in which a company sells securities to a limited number of investors without registering the offering with the Securities and Exchange Commission (SEC). This exemption from registration allows companies to raise capital more quickly and with less regulatory burden compared to public offerings.

Example

For example, let’s say a technology startup is looking to raise funds to develop a new product. Instead of going through the lengthy and expensive process of conducting an initial public offering (IPO), the company decides to pursue a private placement. They approach a group of venture capitalists and high-net-worth individuals who have expressed interest in investing in the technology sector. The company offers them shares of its stock at a discounted price, allowing them to become shareholders and providing the necessary funds for product development.

Pros and Cons

Private placements offer several advantages for both companies and investors. For companies, private placements provide a faster and more cost-effective way to raise capital compared to public offerings. They also allow companies to maintain greater control over their operations and avoid the intense scrutiny that comes with being a publicly traded company.

Investors, on the other hand, benefit from private placements by gaining access to investment opportunities that may not be available to the general public. They also have the potential to earn higher returns on their investments, as private placements often involve companies in their early stages of growth.

However, private placements also come with certain risks and disadvantages. Since these offerings are not registered with the SEC, investors may have limited information about the company’s financials and operations. Additionally, private placements are typically illiquid, meaning that investors may have difficulty selling their securities if they need to access their funds quickly.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.