What is an Option Chain?

An option chain is a listing of all the available options contracts for a particular underlying asset, such as a stock or an index. It provides detailed information about each option contract, including its strike price, expiration date, and the price at which it can be bought or sold.

The option chain is a valuable tool for options traders and investors as it allows them to see the full range of available options for a given asset. It provides a snapshot of the market’s expectations for the future price movement of the underlying asset and can help traders make informed decisions about their options strategies.

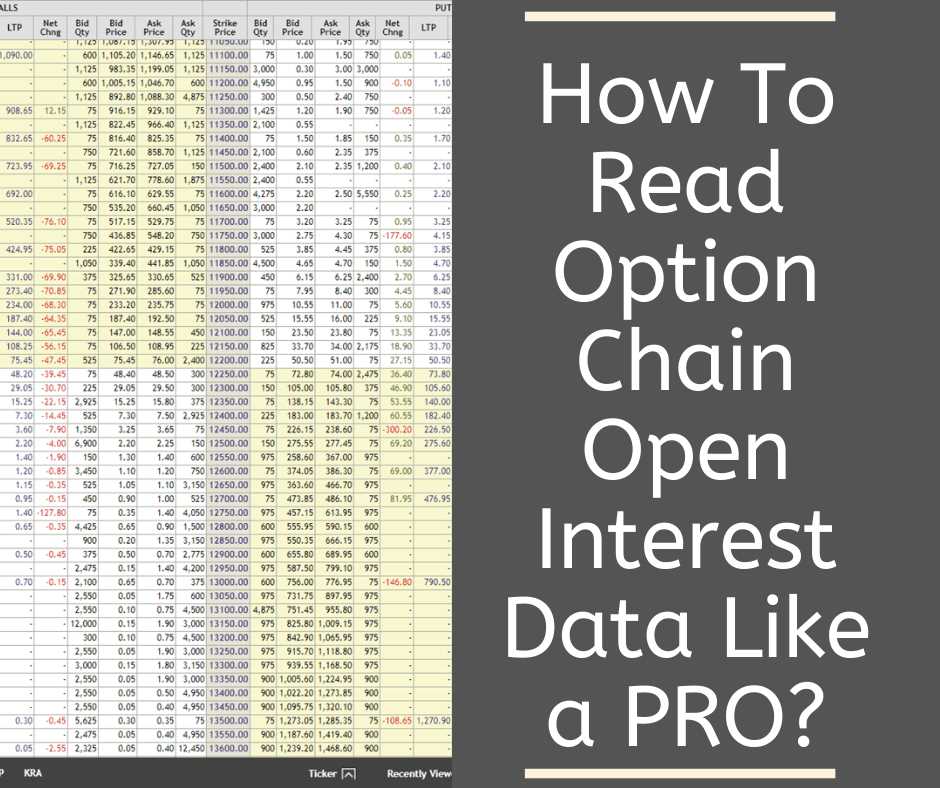

Option chains are typically displayed in a tabular format, with each row representing a different option contract. The columns of the table provide information about the contract’s strike price, expiration date, bid and ask prices, and other relevant data.

By analyzing the option chain, traders can gain insights into market sentiment and identify potential trading opportunities. They can compare the prices of different options contracts and evaluate their risk-reward profiles. For example, they may look for options with low premiums and high potential returns or options that provide downside protection.

Option chains are widely available on financial websites and trading platforms. They are updated in real-time to reflect the latest market data, allowing traders to stay informed about the current options market.

How to Read and Interpret an Option Chain

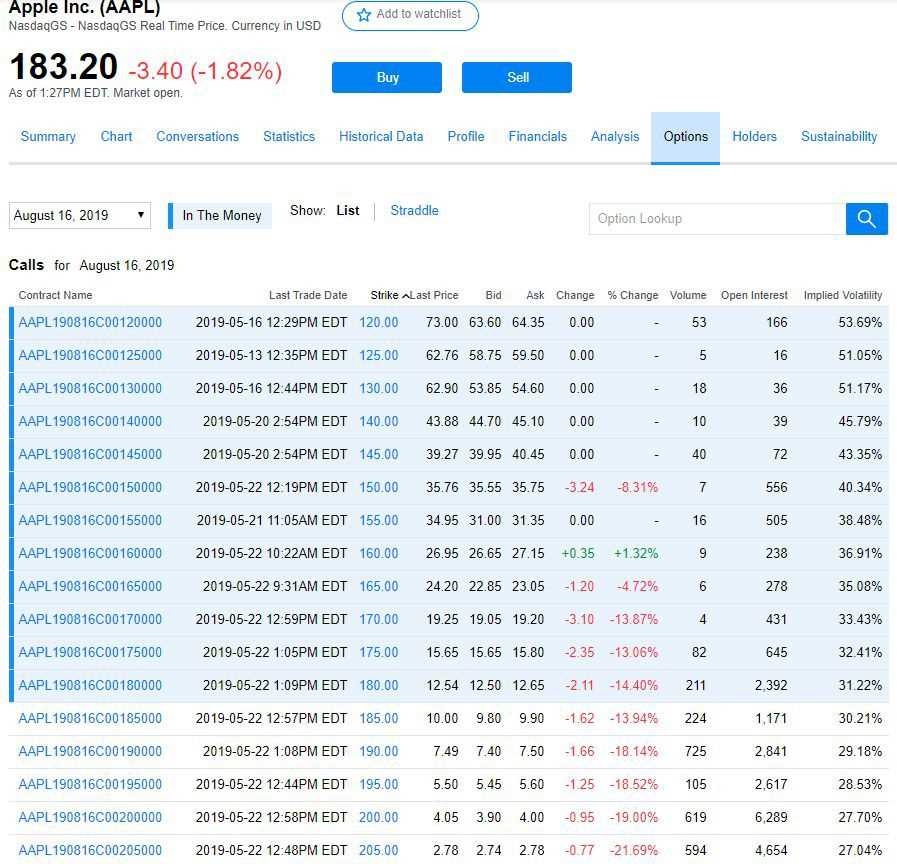

Reading and interpreting an option chain is essential for options traders and investors. It provides valuable information about the available options contracts for a particular underlying asset, such as stocks, indexes, or commodities. Here are the key steps to effectively read and interpret an option chain:

Step 1: Identify the Underlying Asset

The first step is to identify the underlying asset for which you want to analyze the option chain. This could be a specific stock, index, or commodity. The option chain will provide information about the available options contracts for that particular asset.

Step 2: Understand the Expiration Dates

Option contracts have expiration dates, which indicate the last date on which the contract can be exercised. The option chain will display different expiration dates, typically categorized into monthly or weekly options. It is important to understand the expiration dates and choose the one that aligns with your trading or investment strategy.

Step 3: Analyze the Strike Prices

The option chain will list various strike prices for both call and put options. The strike price is the predetermined price at which the underlying asset can be bought or sold if the option is exercised. It is crucial to analyze the strike prices and choose the one that matches your desired trading or investment strategy.

Step 4: Review the Option Prices

The option chain will display the prices of the available call and put options for each strike price and expiration date. These prices can provide insights into the market’s expectations for the underlying asset’s future price movements. Analyzing the option prices can help you determine the potential profitability and risk of different options contracts.

Step 5: Evaluate the Open Interest and Volume

The option chain will also provide information about the open interest and volume for each options contract. Open interest refers to the number of outstanding contracts, while volume indicates the number of contracts traded during a specific period. High open interest and volume can indicate increased liquidity and market interest in a particular options contract.

Step 6: Consider Implied Volatility

Implied volatility is a measure of the market’s expectations for the underlying asset’s future price volatility. The option chain will typically include the implied volatility for each options contract. High implied volatility can indicate higher option prices and potential trading opportunities, while low implied volatility may suggest limited trading opportunities.

Step 7: Compare Bid and Ask Prices

The option chain will display the bid and ask prices for each options contract. The bid price is the price at which buyers are willing to purchase the contract, while the ask price is the price at which sellers are willing to sell the contract. It is important to compare the bid and ask prices to determine the liquidity and potential transaction costs of different options contracts.

By following these steps and analyzing the information provided in the option chain, traders and investors can make informed decisions about their options trading or investment strategies. It is essential to regularly review and interpret the option chain to stay updated with the latest market information and potential trading opportunities.

Key Components of an Option Chain

An option chain is a powerful tool that provides a wealth of information for traders and investors. It consists of several key components that help users understand the options market and make informed decisions. Here are the main components of an option chain:

1. Strike Price

The strike price is the price at which the option can be exercised. It is the predetermined price at which the underlying asset can be bought or sold. In an option chain, the strike prices are listed in ascending order, with the at-the-money strike price usually displayed in the middle.

2. Call Options

3. Put Options

4. Expiration Date

5. Open Interest

Open interest refers to the total number of outstanding option contracts for a particular strike price and expiration date. It indicates the level of market participation and can provide insights into the liquidity and popularity of a specific option contract.

6. Volume

The volume represents the total number of option contracts traded during a given period. It is an essential metric for assessing the liquidity and activity level of a particular option contract. Higher volume generally indicates greater market interest and tighter bid-ask spreads.

By analyzing these key components of an option chain, traders and investors can gain valuable insights into the options market. They can identify potential trading opportunities, assess market sentiment, and make informed decisions based on the available data.

Analyzing Option Chain Data

When analyzing option chain data, it is important to understand the various components and factors that can affect the pricing and performance of options. Here are some key points to consider:

1. Strike Price

The strike price is the price at which the option can be exercised. It is important to analyze the strike prices available in the option chain to determine the range of prices at which you can buy or sell the underlying asset.

2. Option Type

Options can be either call options or put options. Call options give the holder the right to buy the underlying asset at the strike price, while put options give the holder the right to sell the underlying asset at the strike price. Analyzing the option types available in the option chain can help you determine the direction of the market sentiment.

3. Option Expiration

Options have expiration dates, after which they become worthless. Analyzing the option expiration dates in the option chain can help you determine the time frame for your investment strategy. Short-term traders may focus on options with near-term expiration dates, while long-term investors may look for options with longer expiration dates.

4. Option Volume and Open Interest

Option volume refers to the number of contracts traded in a given period, while open interest refers to the total number of outstanding contracts. Analyzing the option volume and open interest in the option chain can provide insights into the liquidity and popularity of certain options. Higher volume and open interest can indicate increased market activity and potentially tighter bid-ask spreads.

5. Implied Volatility

Implied volatility is a measure of the market’s expectation of future price fluctuations. It is an important factor in determining the price of options. Analyzing the implied volatility levels in the option chain can help you assess the market’s perception of the underlying asset’s volatility and potential price movements.

6. Bid and Ask Prices

By analyzing these key components of an option chain, you can gain valuable insights into the market sentiment, liquidity, and potential profitability of options. This information can help you make informed investment decisions and develop effective trading strategies.

Using Option Chain for Investment Strategies

Identifying Potential Opportunities

One of the key ways to use the option chain for investment strategies is to identify potential opportunities. By analyzing the option chain, you can determine which options have the highest volume and open interest, indicating that they are actively traded and have a high level of market interest.

You can also look for options with a tight bid-ask spread, which indicates that there is a liquid market for those options. This can be important when entering or exiting a position, as a wide bid-ask spread can result in slippage and higher trading costs.

The option chain can also provide insights into market sentiment. By analyzing the ratio of call options to put options, you can get a sense of whether investors are bullish or bearish on a particular stock or index. A high ratio of call options to put options suggests bullish sentiment, while a high ratio of put options to call options suggests bearish sentiment.

Additionally, you can analyze the open interest at different strike prices to see where the majority of market participants believe the stock or index will move. High open interest at a particular strike price can indicate a level of support or resistance, as market participants may have significant positions at that price.

Developing Options Strategies

The option chain can also be used to develop options strategies. By analyzing the available options and their premiums, you can identify potential strategies such as covered calls, protective puts, or straddles.

For example, if you own a stock and want to generate additional income, you can sell call options against your position. By analyzing the option chain, you can identify the strike price and expiration date that will provide the highest premium while still allowing you to retain ownership of the stock.

Similarly, if you are expecting a significant move in a stock or index, you can use the option chain to identify potential straddle opportunities. A straddle involves buying both a call option and a put option at the same strike price and expiration date. By analyzing the option chain, you can identify the strike price and expiration date that will provide the most cost-effective straddle.

Conclusion

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.