Mortgage Servicing Rights: Definition

Mortgage servicing rights (MSRs) refer to the contractual rights that a mortgage lender or servicer holds over a mortgage loan. These rights allow the lender or servicer to collect payments from borrowers, manage escrow accounts, and handle other administrative tasks related to the mortgage loan.

MSRs are typically sold or transferred between financial institutions, allowing lenders to generate additional revenue streams. When a mortgage loan is sold, the purchaser acquires the rights to service the loan, including collecting monthly payments and managing the borrower’s escrow account.

Key Features of Mortgage Servicing Rights

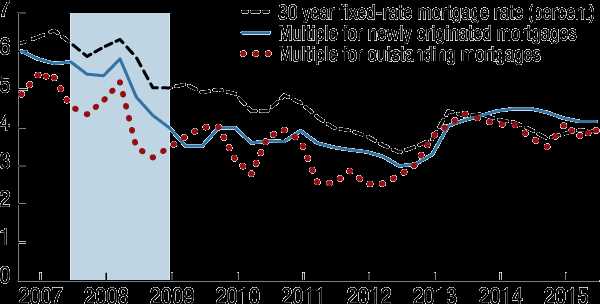

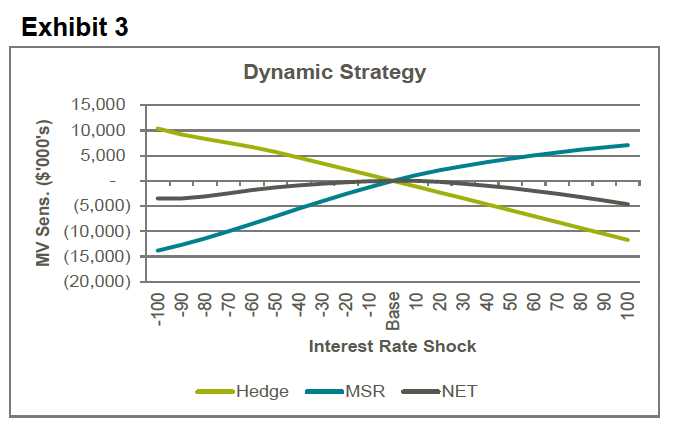

3. Risks: MSRs carry certain risks, including interest rate risk, prepayment risk, and credit risk. Changes in interest rates or borrower behavior can impact the value and profitability of MSRs.

Importance of Mortgage Servicing Rights

Mortgage servicing rights play a crucial role in the mortgage industry. They provide lenders and servicers with a source of revenue, allowing them to offset the costs associated with originating and servicing mortgage loans. Additionally, the transferability of MSRs enables financial institutions to optimize their portfolios and manage risk.

Overall, mortgage servicing rights are an essential component of the mortgage market, facilitating the efficient management of mortgage loans and ensuring the smooth flow of payments between borrowers and lenders.

What are Mortgage Servicing Rights?

Mortgage Servicing Rights (MSRs) are a financial asset that represents the right to service a mortgage loan. When a borrower takes out a mortgage, the loan is typically sold to an investor or a mortgage-backed securities (MBS) issuer. However, the servicing of the loan, including collecting payments, managing escrow accounts, and handling customer service, is often outsourced to a third-party servicer.

MSRs are created when a mortgage lender or originator sells the right to service a mortgage loan to another party. This transfer of servicing rights allows the lender to generate immediate cash flow by selling the rights to future mortgage payments. The buyer of the MSRs then assumes the responsibility for servicing the loan and receives a fee, typically a percentage of the outstanding loan balance, for their services.

MSRs can be a valuable asset for financial institutions and investors. They provide a steady stream of income through the servicing fees collected from borrowers. Additionally, MSRs can be bought and sold in the secondary market, allowing financial institutions to manage their portfolios and optimize their balance sheets.

Benefits of Mortgage Servicing Rights

There are several benefits associated with owning mortgage servicing rights:

- Income Generation: MSRs provide a consistent source of income through the collection of servicing fees from borrowers. This income can help offset the costs of originating and servicing mortgage loans.

- Portfolio Diversification: Owning MSRs allows financial institutions to diversify their portfolios by adding an asset class that is not directly tied to interest rate risk or credit risk. This can help mitigate the impact of market fluctuations on their overall portfolio performance.

- Liquidity: MSRs can be bought and sold in the secondary market, providing financial institutions with the ability to generate liquidity and optimize their balance sheets. This can be particularly useful during times of economic uncertainty or when capital needs to be deployed elsewhere.

- Risk Mitigation: By outsourcing the servicing of mortgage loans to third-party servicers, financial institutions can mitigate operational and compliance risks associated with loan servicing. This allows them to focus on their core competencies and reduce the potential for errors or regulatory violations.

Example of Mortgage Servicing Rights

Let’s take a closer look at an example to better understand what mortgage servicing rights (MSRs) are. Imagine you are a bank that originates mortgages for homebuyers. After closing the loans, you have the option to either keep servicing the loans yourself or sell the servicing rights to another company.

For this example, let’s say you decide to sell the servicing rights to XYZ Mortgage Servicing Company. By doing so, you transfer the responsibility of collecting payments, managing escrow accounts, and handling any delinquencies or defaults to XYZ Mortgage Servicing Company.

This means that as a bank, you no longer have to allocate resources to service the loans and can focus on other aspects of your business. In return, XYZ Mortgage Servicing Company pays you a fee for the rights to service the loans.

Overall, selling the mortgage servicing rights allows banks to generate additional revenue and reduce operational costs, while specialized servicing companies like XYZ Mortgage Servicing Company can focus on providing efficient and effective loan servicing to borrowers.

Case Study: XYZ Bank

XYZ Bank is a leading financial institution that has been in the mortgage servicing industry for over 30 years. With a strong reputation for providing excellent customer service and innovative solutions, XYZ Bank has become a trusted partner for homeowners and investors alike.

Overview

XYZ Bank offers a wide range of mortgage servicing solutions to meet the needs of its diverse client base. From loan administration to escrow management, XYZ Bank’s comprehensive suite of services ensures that homeowners receive the support they need throughout the life of their mortgage.

One of the key strengths of XYZ Bank is its advanced technology platform, which allows for efficient and accurate processing of mortgage payments, escrow analysis, and investor reporting. This technology, combined with the expertise of XYZ Bank’s dedicated team of mortgage servicing professionals, ensures that homeowners receive the highest level of service and support.

Benefits

By partnering with XYZ Bank for their mortgage servicing needs, homeowners can benefit from a number of advantages:

| 1. Enhanced Customer Service | XYZ Bank’s team of experienced professionals is available to assist homeowners with any questions or concerns they may have regarding their mortgage. Whether it’s a simple inquiry or a complex issue, XYZ Bank is committed to providing prompt and personalized service. |

| 2. Streamlined Processes | XYZ Bank’s advanced technology platform automates many of the mortgage servicing processes, resulting in faster and more efficient service. This means that homeowners can expect timely and accurate processing of their mortgage payments and other related tasks. |

| 3. Compliance and Risk Management | XYZ Bank has a strong focus on compliance and risk management, ensuring that all mortgage servicing activities are conducted in accordance with industry regulations and best practices. This commitment to compliance helps protect homeowners and investors from potential risks and ensures the integrity of the mortgage servicing process. |

| 4. Financial Stability | As a leading financial institution, XYZ Bank has a strong financial foundation and a proven track record of stability. This provides homeowners with peace of mind, knowing that their mortgage servicing needs are being handled by a trusted and reliable partner. |

Historical Overview of Mortgage Servicing Rights

Mortgage servicing rights (MSRs) have a long and fascinating history that dates back to the early days of the mortgage industry. The concept of MSRs emerged in the United States in the 1960s as a way for lenders to manage the administrative tasks associated with mortgage loans.

Initially, MSRs were primarily held by small savings and loan associations, who found it more efficient to outsource the servicing of their mortgage loans to specialized companies. These companies would handle tasks such as collecting monthly payments, managing escrow accounts, and handling delinquencies and foreclosures.

Over time, the market for MSRs grew, and larger financial institutions began to acquire them as a way to diversify their revenue streams. This led to the emergence of specialized mortgage servicing companies that focused solely on managing MSRs.

In the 1980s and 1990s, the mortgage industry underwent significant changes, with the rise of securitization and the secondary market for mortgage loans. This had a profound impact on the MSR market, as investors began to recognize the value of MSRs as an asset class.

Origins and Evolution

The origins of mortgage servicing rights can be traced back to the early 20th century when the mortgage industry began to grow rapidly. As more people sought to purchase homes, banks and other financial institutions started offering mortgage loans to meet the demand.

Over the years, mortgage servicing rights have evolved to become a valuable asset for financial institutions. In the past, mortgage loans were typically held by the originating lender until they were paid off. However, with the development of the secondary mortgage market, lenders realized that they could sell the rights to service these loans to other investors.

Benefits of Mortgage Servicing Rights

- Steady Cash Flow: Owning MSRs can provide a consistent and predictable cash flow stream. As borrowers make their monthly mortgage payments, a portion of those payments goes towards servicing fees, which are collected by the owner of the MSRs.

- Long-Term Investment: MSRs are typically long-term investments, as mortgages are often held by borrowers for many years. This can provide investors with a stable income stream over an extended period.

- Low Correlation: MSRs have historically exhibited a low correlation with other asset classes, such as stocks and bonds. This means that owning MSRs can help to diversify an investment portfolio and potentially reduce overall portfolio volatility.

- Opportunity for Capital Appreciation: In addition to the steady cash flow generated by MSRs, there is also the potential for capital appreciation. As interest rates change and the value of mortgage servicing rights fluctuates, investors may be able to sell their MSRs at a higher price than they initially paid.

- Tax Advantages: Depending on the jurisdiction, owning MSRs may offer certain tax advantages. For example, in some cases, the income generated from MSRs may be eligible for favorable tax treatment, such as being taxed at a lower rate or being eligible for certain deductions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.