Monte Carlo Simulation: A Comprehensive Guide

History of Monte Carlo Simulation

The name “Monte Carlo” originates from the famous casino city in Monaco, known for its luxurious casinos. The technique was first introduced by scientists Stanislaw Ulam and Nicholas Metropolis during World War II while working on the Manhattan Project. They used the method to solve complex mathematical problems related to nuclear reactions.

Since then, Monte Carlo Simulation has evolved and found applications in various fields. It has become an indispensable tool for decision-making, risk analysis, and optimization in finance, engineering, physics, and many other disciplines.

Working Mechanism of Monte Carlo Simulation

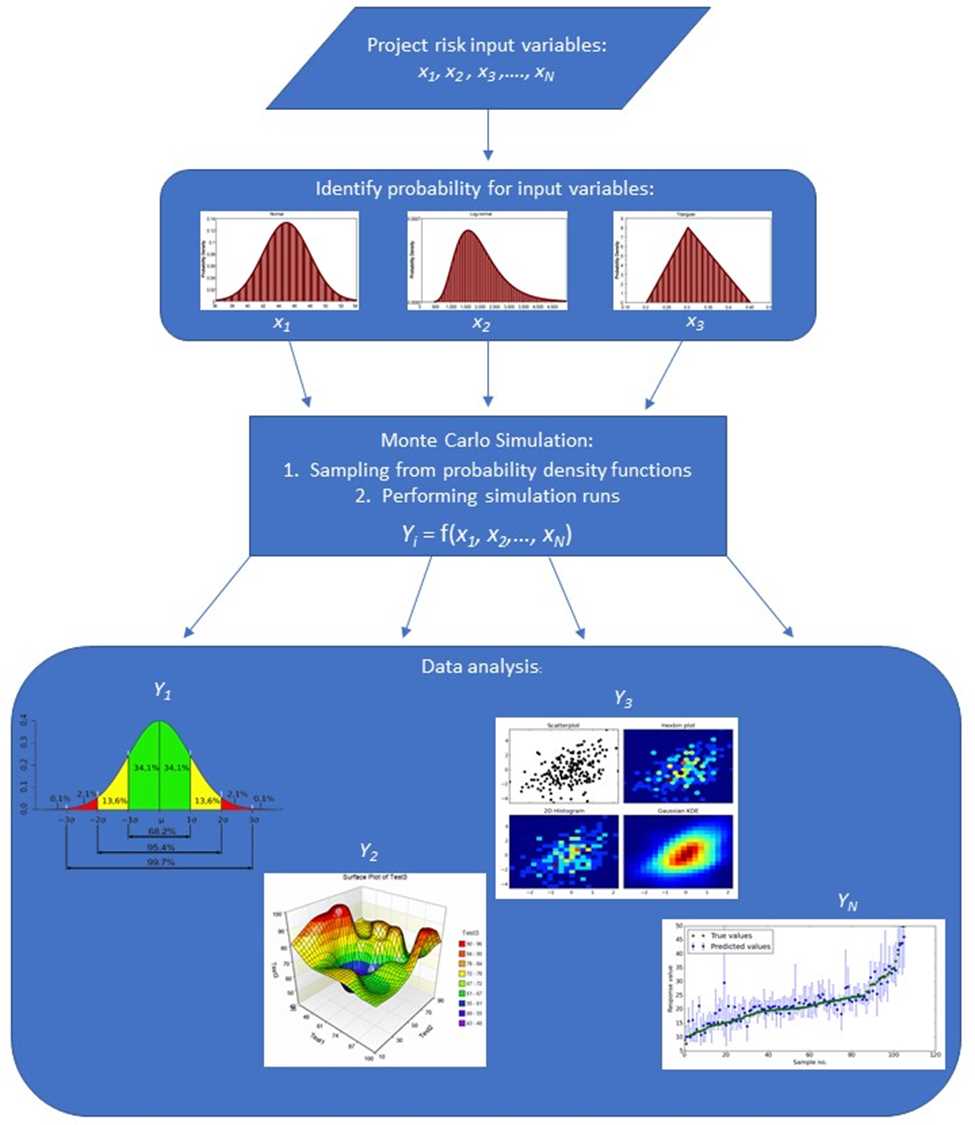

The working mechanism of Monte Carlo Simulation involves generating random samples from probability distributions to simulate the behavior of a system or model. It follows these steps:

- Define the problem: Clearly define the problem and identify the variables of interest.

- Model the problem: Develop a mathematical or computational model that represents the system under study.

- Generate random samples: Randomly generate samples from the probability distributions of the variables in the model.

- Analyze the results: Perform simulations using the generated samples and analyze the outcomes to draw conclusions and make informed decisions.

By repeating the simulation process with a large number of random samples, Monte Carlo Simulation provides a statistical approximation of the system’s behavior and allows for the assessment of various scenarios and uncertainties.

Essential Steps of Monte Carlo Simulation

1. Define the problem: Clearly define the problem statement and the objectives of the simulation.

2. Identify variables: Identify the variables that affect the system and determine their probability distributions.

3. Generate random samples: Randomly generate samples from the identified probability distributions.

4. Perform simulations: Use the generated samples to perform simulations and analyze the results.

Financial Analysis of Monte Carlo Simulation

Monte Carlo Simulation is widely used in financial analysis to assess the risk and uncertainty associated with investment portfolios, option pricing, and other financial instruments. It allows for the evaluation of different investment strategies, the estimation of potential returns and losses, and the identification of optimal portfolio allocations.

History of Monte Carlo Simulation

The name “Monte Carlo” refers to the famous casino in Monaco, which is known for its games of chance and randomness. The method was named after the casino because it relies on the use of random numbers to simulate the behavior of a system.

Although the origins of Monte Carlo Simulation can be traced back to the Manhattan Project, its applications have expanded far beyond the field of nuclear physics. Today, it is widely used in various fields such as finance, engineering, physics, and computer science.

Monte Carlo Simulation gained popularity in the financial industry in the 1970s when it was used to model the behavior of financial markets and calculate the value of complex financial instruments. It allowed traders and investors to assess the risk and potential returns of their investments by simulating thousands or even millions of possible scenarios.

Over the years, Monte Carlo Simulation has evolved and become more sophisticated. With the advancements in computing power and statistical techniques, it is now possible to simulate complex systems with high accuracy and precision.

Working Mechanism of Monte Carlo Simulation

Monte Carlo Simulation is a powerful statistical tool used in various fields to analyze and predict outcomes based on probability distributions. Its working mechanism involves the following steps:

1. Define the Problem

The first step in Monte Carlo Simulation is to clearly define the problem or question you want to answer. This could be anything from estimating the probability of a certain event occurring to simulating the performance of a financial portfolio.

2. Define the Variables

Next, you need to identify the variables that will be involved in the simulation. These variables can be either deterministic (with fixed values) or probabilistic (with probability distributions).

3. Generate Random Numbers

In order to simulate the uncertain nature of the variables, random numbers are generated. These random numbers are drawn from the specified probability distributions of the variables.

4. Perform Simulations

Once the random numbers are generated, the simulation is performed by repeatedly sampling the variables and calculating the outcome based on the defined problem. This is done a large number of times to obtain a statistically significant result.

5. Analyze the Results

After performing the simulations, the results are analyzed to draw conclusions and make predictions. This can involve calculating summary statistics, creating visualizations, or conducting sensitivity analyses to understand the impact of different variables on the outcomes.

6. Validate and Refine

Finally, the Monte Carlo Simulation results should be validated and refined by comparing them with real-world data or other analytical methods. This helps ensure the accuracy and reliability of the simulation.

In summary, Monte Carlo Simulation works by defining the problem, identifying variables, generating random numbers, performing simulations, analyzing the results, and validating the findings. It is a versatile and powerful tool that can be applied to a wide range of problems in finance, engineering, and other fields.

Essential Steps of Monte Carlo Simulation

Monte Carlo simulation is a powerful tool used in various fields, including finance, engineering, and science. It allows for the analysis of complex systems by generating random samples and simulating their behavior. In financial analysis, Monte Carlo simulation is particularly useful for assessing risk and uncertainty.

Step 1: Define the Problem

The first step in Monte Carlo simulation is to clearly define the problem you want to analyze. This involves identifying the variables and parameters that will be used in the simulation. For example, if you are analyzing the performance of a stock portfolio, the variables could include the expected returns of different stocks and the correlation between them.

Step 2: Define the Probability Distributions

Once the problem is defined, the next step is to determine the probability distributions for the variables. Probability distributions describe the likelihood of different outcomes. Commonly used distributions include the normal distribution, which is often used to model stock returns, and the uniform distribution, which is used when there is no prior knowledge about the variable’s distribution.

Step 3: Generate Random Samples

Step 4: Perform the Simulation

Once the random samples are generated, the simulation is performed by applying the defined problem model to each sample. This involves calculating the values of the variables and parameters based on the random samples. For example, in a financial analysis, the simulation could involve calculating the portfolio returns for each sample based on the randomly generated stock returns.

Step 5: Analyze the Results

Overall, the essential steps of Monte Carlo simulation involve defining the problem, determining the probability distributions, generating random samples, performing the simulation, and analyzing the results. By following these steps, analysts can gain valuable insights into the behavior and potential outcomes of complex systems, making informed decisions and managing risks effectively.

Financial Analysis of Monte Carlo Simulation

Monte Carlo simulation is a powerful tool that can be used for financial analysis in various industries. By using random sampling and probability distributions, it allows analysts to model and simulate different scenarios to assess the potential outcomes of a financial decision.

One of the key applications of Monte Carlo simulation in financial analysis is risk assessment. By incorporating uncertainty and variability into the model, analysts can evaluate the potential risks associated with an investment or business decision. This can help in making informed decisions and managing risk effectively.

Another important aspect of financial analysis using Monte Carlo simulation is the calculation of expected values and probabilities. By running multiple simulations, analysts can calculate the average outcome and the probability of achieving certain financial goals. This can provide valuable insights into the potential profitability and success of a project or investment.

Furthermore, Monte Carlo simulation can be used for portfolio optimization and asset allocation. By simulating different investment scenarios and considering various risk factors, analysts can determine the optimal allocation of assets to maximize returns while minimizing risks. This can be particularly useful in the field of investment management.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.