What is a Margin Call?

When the value of the securities in a margin account declines, the equity in the account decreases. If the equity falls below the maintenance margin level, the broker will issue a margin call to the investor. The margin call requires the investor to deposit additional funds or securities into the account to restore the equity to the required level.

Margin calls are an important risk management tool for brokers and financial institutions to protect themselves from potential losses. They help ensure that investors maintain sufficient equity in their margin accounts to cover potential losses and reduce the risk of default.

It is important for investors to understand the risks associated with margin trading and to carefully monitor the value of their securities to avoid margin calls. They should also have a plan in place to respond to margin calls, such as having additional funds or securities readily available to meet the requirements.

Definition and Explanation

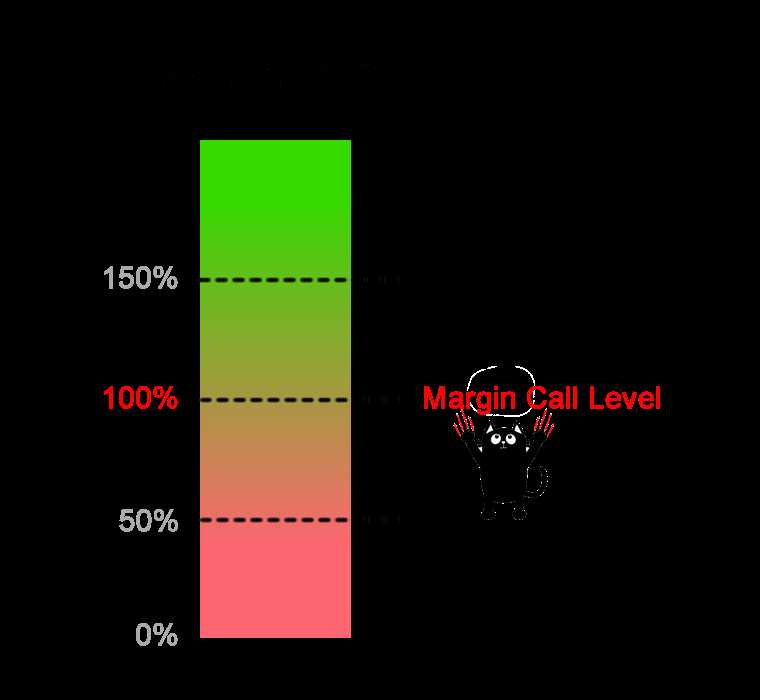

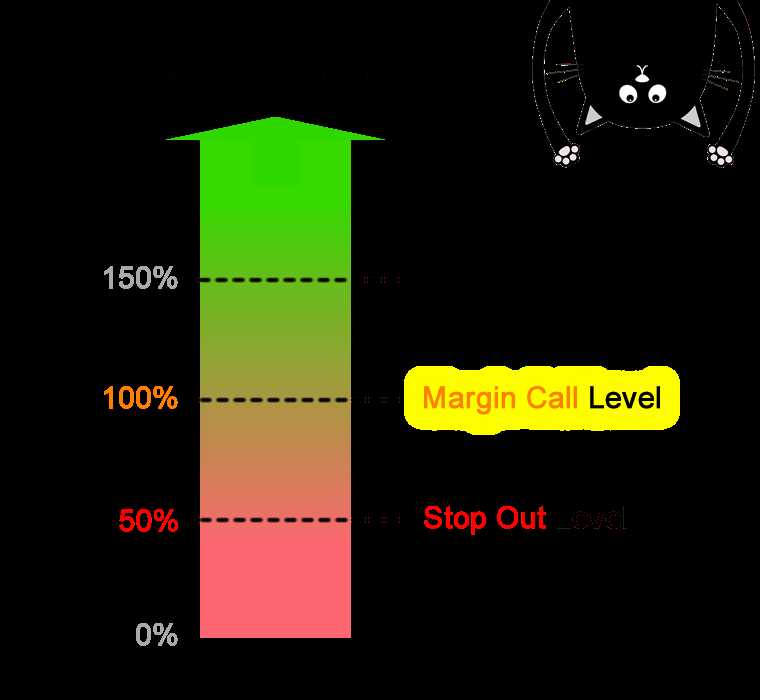

Margin accounts are used by investors to borrow money from a broker to purchase securities. The initial margin is the amount of money or securities that the investor must deposit into the account to open a position. The maintenance margin is a lower threshold set by the broker to ensure that the investor has enough equity in the account to cover potential losses.

When the value of the securities in the margin account decreases and falls below the maintenance margin, the broker issues a margin call. This is done to protect the broker from losses and to ensure that the investor has sufficient funds to cover their obligations. The investor is then required to deposit additional funds or securities into the account to bring the equity back above the maintenance margin.

Key Points:

- A margin call occurs when the value of securities in a margin account falls below the maintenance margin.

- Investors are required to deposit additional funds or securities to cover the potential losses.

- Margin calls are a risk management tool used by brokers to protect themselves and ensure the financial stability of the investor.

It is important for investors to understand the concept of margin calls and the potential risks involved when trading on margin. Proper risk management and monitoring of the margin account can help investors avoid margin calls and protect their investments.

How Does a Margin Call Work?

Definition and Explanation

If the value of the investments in the margin account falls below the minimum margin requirement, the investor will receive a margin call. The broker will notify the investor that they need to deposit additional funds into the account to bring it back to the required level. Failure to meet the margin call may result in the broker liquidating some or all of the investor’s positions to cover the outstanding debt.

Process and Mechanics

When a margin call is issued, the investor typically has a certain amount of time to deposit the required funds. This time frame is determined by the broker and may vary depending on the specific circumstances. The investor can deposit additional cash or securities into the margin account to meet the margin call.

Once the required funds are deposited, the margin account will be brought back to the required level, and the margin call will be resolved. If the investor fails to meet the margin call within the specified time frame, the broker may take action to protect their interests by liquidating the investor’s positions.

Examples of Margin Calls

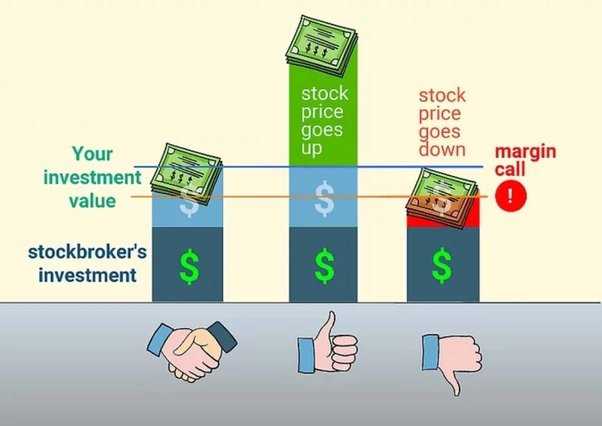

Let’s consider an example to illustrate how a margin call works. Suppose an investor opens a margin account with a broker and deposits $10,000. The broker has a minimum margin requirement of 50%, meaning the investor can borrow up to $10,000 to make investments.

The investor decides to purchase $20,000 worth of stocks using the borrowed funds. Initially, the value of the stocks increases to $25,000, and the margin account is in good standing. However, if the value of the stocks falls to $15,000, below the minimum margin requirement of $20,000 (50% of the total value), a margin call will be issued.

The investor will then need to deposit additional funds into the margin account to bring it back to the required level. If the investor fails to do so within the specified time frame, the broker may sell some or all of the stocks to cover the outstanding debt.

Tips for Dealing with Margin Calls

Dealing with margin calls can be stressful, but there are some tips that can help investors manage them effectively:

- Monitor the margin account regularly to ensure it stays above the minimum margin requirement.

- Set stop-loss orders to limit potential losses and reduce the likelihood of a margin call.

- Have a contingency plan in place in case a margin call occurs, such as having additional funds readily available.

- Stay informed about market conditions and the performance of investments to make informed decisions.

- Consider diversifying the portfolio to reduce the risk of a margin call.

By following these tips, investors can better manage the risk associated with margin calls and protect their investments.

Process and Mechanics

When a margin call occurs, it means that the investor’s account has fallen below the required margin level set by the broker. This happens when the value of the securities held in the account decreases, or when the amount borrowed against those securities increases.

Once a margin call is triggered, the broker will typically notify the investor and request additional funds to bring the account back to the required margin level. The investor will have a certain period of time, usually a few days, to meet the margin call.

The mechanics of a margin call involve calculating the amount of funds needed to bring the account back to the required margin level. This calculation takes into account the current value of the securities held in the account, the amount borrowed against those securities, and the margin requirement set by the broker.

For example, let’s say an investor has $10,000 worth of securities in their account and has borrowed $5,000 against those securities. The broker has set a margin requirement of 50%. This means that the investor’s account must maintain a minimum equity of $7,500 (50% of $15,000) to avoid a margin call.

Examples of Margin Calls

Margin calls can occur in various situations and can have different outcomes depending on the circumstances. Here are a few examples of margin calls to help you understand how they work:

Example 1: Stock Trading

Example 2: Forex Trading

In forex trading, margin calls can also occur. Let’s say you have a trading account with a leverage ratio of 100:1, and you decide to buy 1 lot of EUR/USD at 1.2000, which requires a margin of $1,000. If the exchange rate drops to 1.1900, the value of your position will decrease, and your equity will decrease accordingly. If your equity falls below the margin requirement of $1,000, you will receive a margin call from your broker, asking you to deposit additional funds to cover the losses or reduce your position size.

These are just a couple of examples of how margin calls can occur in different trading scenarios. It is important to understand the mechanics of margin calls and the potential risks involved when trading on margin. Proper risk management and monitoring of your account’s margin level are crucial to avoid margin calls and potential liquidation of your positions.

Real-Life Scenarios

1. Stock Market Crash

During a stock market crash, the value of stocks can plummet rapidly. If you have leveraged positions or borrowed money to invest in stocks, a significant drop in stock prices can trigger a margin call. This is because the value of your collateral (the stocks) decreases, and the broker may require additional funds to cover the potential losses.

2. Forex Trading

In forex trading, margin calls can occur when the value of the currency pair you are trading moves against your position. If the losses on your trade exceed the available margin, the broker may issue a margin call to request additional funds.

To prevent margin calls in forex trading, it is crucial to have a solid risk management strategy in place. This includes setting stop-loss orders, using proper leverage, and avoiding overexposure to a single currency pair.

3. Real Estate Investments

Margin calls can also happen in real estate investments, particularly when using margin loans to finance the purchase of properties. If the value of the property declines significantly, the lender may issue a margin call to protect their investment.

To mitigate the risk of a margin call in real estate investments, it is important to carefully evaluate the property’s value and market conditions before taking on a margin loan. Having a contingency plan and maintaining a healthy cash reserve can also help in case of unexpected market fluctuations.

Tips for Dealing with Margin Calls

Margin calls can be a stressful and challenging situation for traders, but with the right approach, they can be managed effectively. Here are some tips to help you deal with margin calls:

- Understand the risks: Before entering into any margin trading, it is crucial to fully understand the risks involved. Make sure you are aware of the potential losses and have a clear risk management strategy in place.

- Monitor your positions: Regularly monitor your positions and keep track of your margin requirements. This will help you stay on top of your trades and avoid unexpected margin calls.

- Set stop-loss orders: Implementing stop-loss orders can help limit your losses and protect your account from excessive margin calls. Set appropriate stop-loss levels based on your risk tolerance and trading strategy.

- Manage your leverage: Be cautious when using leverage in your trades. Higher leverage increases the risk of margin calls. Consider using lower leverage ratios to reduce the likelihood of margin calls.

- Maintain sufficient margin: Ensure that you have enough margin in your account to cover potential losses. Avoid overleveraging and keep a buffer to handle market fluctuations.

- Stay informed: Stay updated with market news, economic events, and any other factors that may impact your trades. Being well-informed can help you make better trading decisions and avoid margin calls.

- Seek professional advice: If you are unsure about managing margin calls or need assistance, consider seeking advice from a financial professional or an experienced trader. They can provide guidance and help you navigate through challenging situations.

- Learn from your mistakes: If you do experience a margin call, take it as a learning opportunity. Analyze what went wrong, identify any mistakes, and make adjustments to your trading strategy to avoid similar situations in the future.

Remember, margin calls are a part of trading, and it is essential to approach them with a calm and rational mindset. By following these tips and being proactive in managing your trades, you can minimize the impact of margin calls and improve your overall trading performance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.