Maintenance Margin: Definition and Comparison

The maintenance margin is a term used in trading to refer to the minimum amount of funds that a trader must maintain in their margin account to keep their positions open. It is a requirement set by the broker to ensure that the trader has enough funds to cover any potential losses.

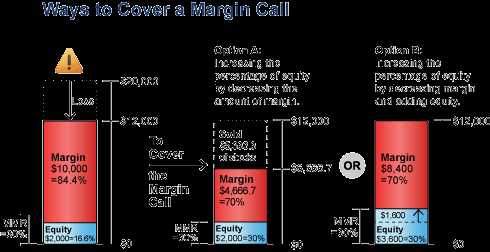

When a trader opens a margin account, they are essentially borrowing money from the broker to trade larger positions than their account balance would allow. The maintenance margin is a percentage of the total value of the positions held in the margin account. If the value of the positions drops below this percentage, the trader will receive a margin call from the broker, requiring them to deposit additional funds to bring the account back up to the maintenance margin level.

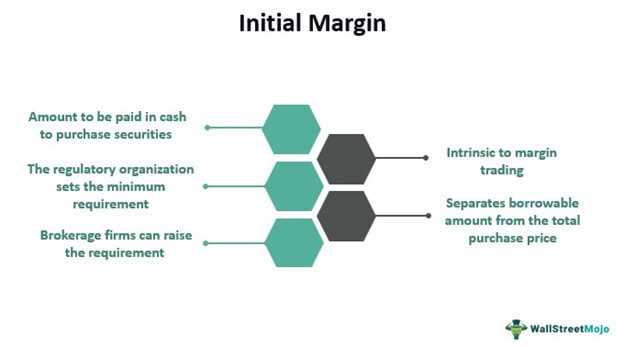

It is important to note that the maintenance margin is different from the initial margin, which is the amount of funds required to open a position. The initial margin is typically lower than the maintenance margin, as it only needs to cover potential losses during the initial stages of the trade.

Comparison to Margin Accounts:

- In a margin account, the trader can borrow funds from the broker to open larger positions.

- The maintenance margin is the minimum amount of funds required to keep the positions open.

- If the value of the positions drops below the maintenance margin, the trader will receive a margin call.

- The trader must deposit additional funds to bring the account back up to the maintenance margin level.

- The maintenance margin is different from the initial margin, which is the amount required to open a position.

Maintenance Margin Definition

The maintenance margin is a term used in trading to refer to the minimum amount of funds or securities that a trader must maintain in their account in order to keep their positions open. It is a requirement set by the broker or exchange to ensure that traders have enough capital to cover potential losses.

When a trader opens a margin account, they are essentially borrowing money from the broker to trade larger positions than their available capital allows. The maintenance margin is a percentage of the total value of the positions held in the account. If the value of the positions falls below the maintenance margin level, the trader will receive a margin call from the broker.

The maintenance margin serves as a safeguard for both the trader and the broker. It helps to ensure that traders have enough capital to cover potential losses and reduces the risk of default. For brokers, it helps to protect them from losses in the event that a trader is unable to meet their obligations.

Maintenance Margin vs Margin Accounts

Maintenance Margin Definition

Maintenance margin refers to the minimum amount of equity that must be maintained in a margin account in order to keep a position open. It is set by the broker and is typically a percentage of the total value of the position. If the equity in the account falls below the maintenance margin level, the trader may receive a margin call and be required to deposit additional funds to bring the account back up to the required level.

The purpose of the maintenance margin is to protect both the trader and the broker from excessive losses. By requiring a minimum level of equity to be maintained, the broker ensures that the trader has enough funds to cover potential losses and reduces the risk of default.

Maintenance Margin vs Margin Accounts

A margin account, on the other hand, is a type of brokerage account that allows traders to borrow funds from the broker to trade larger positions than they could with their own capital. It is a form of leverage that can amplify both gains and losses.

While maintenance margin is a requirement specific to margin accounts, it is not the only factor that determines the amount of leverage available. The initial margin requirement, which is the percentage of the position value that must be deposited as collateral when opening a position, also plays a role.

Margin accounts offer traders the opportunity to increase their potential profits by trading larger positions, but they also come with increased risks. If the market moves against the trader, losses can exceed the initial investment, resulting in a margin call.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.