What is a Margin Account?

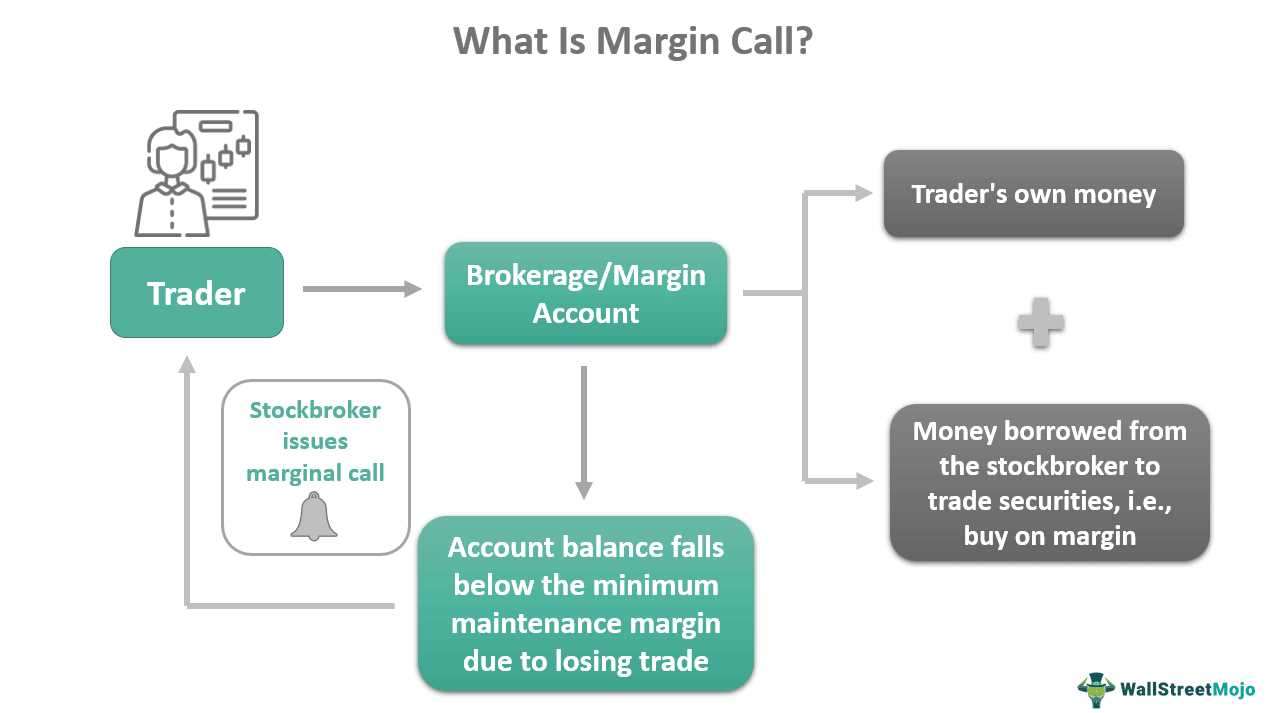

A margin account is a type of brokerage account that allows investors to borrow money to purchase securities. It is different from a cash account, where investors can only use the funds they have deposited to make trades.

With a margin account, investors can leverage their investments by borrowing money from the broker. This allows them to potentially increase their buying power and take advantage of investment opportunities that they may not have been able to afford otherwise.

Margin accounts are commonly used by experienced investors and traders who are looking to maximize their potential returns. They can be a powerful tool for increasing buying power and taking advantage of market opportunities, but they also come with additional risks and responsibilities.

Definition, How It Works, and Example

A margin account is a type of brokerage account that allows investors to borrow money to purchase securities. It is different from a cash account, where investors can only trade with the funds they have deposited.

Here’s an example to illustrate how a margin account works:

However, if the value of the stocks decreases to $8,000, the investor may receive a margin call from the broker. They would be required to deposit additional funds to meet the margin requirement, or the broker may sell some of the securities to cover the borrowed amount.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.