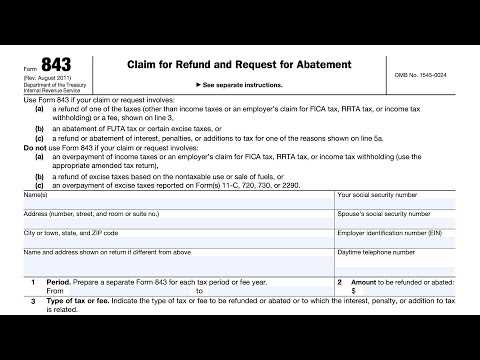

What is Form 843?

This form is typically used when a taxpayer believes they have overpaid their taxes or have been assessed penalties or interest that they believe should be waived or reduced. It allows taxpayers to provide detailed information about the specific tax, penalty, or interest they are seeking a refund or abatement for.

Form 843 can be used to request a refund or abatement for various types of taxes, including income tax, employment tax, excise tax, and estate and gift tax. It can also be used to request a refund or abatement for penalties and interest assessed on these taxes.

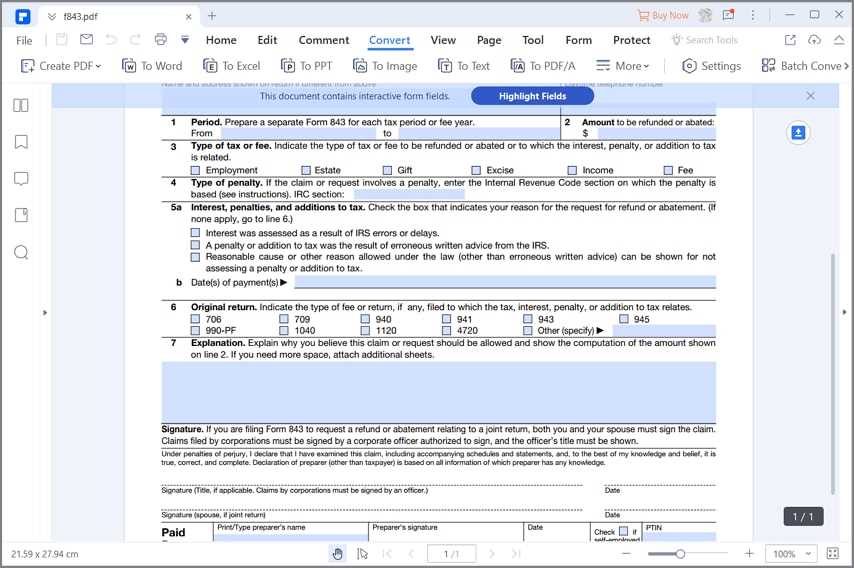

When filling out Form 843, taxpayers are required to provide their personal information, including their name, address, and taxpayer identification number. They must also provide detailed information about the tax, penalty, or interest they are seeking a refund or abatement for, including the tax period, the amount paid, and the reason for the request.

It is important to note that filing Form 843 does not guarantee that a refund or abatement will be granted. The IRS will review the request and make a determination based on the information provided. If additional documentation or supporting evidence is needed, the IRS may request it from the taxpayer.

Overall, Form 843 is a valuable tool for taxpayers who believe they have overpaid their taxes or have been assessed penalties or interest that they believe should be refunded or abated. By providing detailed information and supporting documentation, taxpayers can increase their chances of receiving a favorable outcome from the IRS.

The purpose of Form 843 is to provide taxpayers with a formal process to seek relief from certain tax liabilities. It allows individuals and businesses to claim a refund or request the abatement of penalties or interest that they believe were assessed in error or were excessive. This form is particularly useful in situations where taxpayers have overpaid their taxes or have been penalized for reasons beyond their control.

When filing Form 843, taxpayers must provide detailed information about the tax period, the type of tax being claimed, and the specific reason for the refund or abatement request. They must also include supporting documentation, such as financial statements, invoices, or other evidence to substantiate their claim. It is important to note that the IRS may request additional information or documentation to support the request, so it is crucial to provide accurate and complete information.

| Key Points to Remember: |

|---|

| – Form 843 is used to request a refund or abatement of certain taxes, penalties, or interest. |

| – It is filed with the IRS and can be used for various types of taxes. |

| – The purpose of Form 843 is to provide taxpayers with a formal process to seek relief from certain tax liabilities. |

| – Detailed information and supporting documentation are required when filing Form 843. |

| – Consultation with a tax professional or the IRS may be necessary for guidance on completing the form. |

When and How to File Form 843

Form 843: Claim for Refund and Request for Abatement is an important document that allows taxpayers to request a refund or abatement of certain taxes, penalties, and interest. If you believe that you have overpaid your taxes or have been assessed penalties or interest incorrectly, filing Form 843 can help you seek relief.

Here are some key points to keep in mind when filing Form 843:

| 1. Determine eligibility: | Before filing Form 843, make sure you are eligible for a refund or abatement. This form is typically used for income taxes, employment taxes, and certain excise taxes. Check the instructions provided by the IRS or consult a tax professional to determine if you meet the eligibility criteria. |

| 2. Gather supporting documentation: | When filing Form 843, it is important to provide supporting documentation to substantiate your claim. This may include copies of tax returns, payment records, and any other relevant documents. Make sure to keep copies of all documents for your records. |

| 3. Complete the form accurately: | Take your time to fill out Form 843 accurately and completely. Provide all the necessary information, including your personal details, the type of tax or penalty you are seeking relief from, and the amount you are requesting to be refunded or abated. Double-check all the information before submitting the form. |

| 4. File the form within the statute of limitations: | It is important to file Form 843 within the statute of limitations. Generally, you have three years from the date you filed your original tax return or two years from the date you paid the tax, whichever is later, to file the form. Filing within the statute of limitations ensures that your claim will be considered by the IRS. |

| 5. Submit the form to the appropriate IRS office: | Once you have completed Form 843, mail it to the appropriate IRS office. The address to which you should send the form can be found in the instructions provided by the IRS. Make sure to keep a copy of the form and any supporting documentation for your records. |

Filing Form 843 can be a complex process, and it is recommended to seek assistance from a tax professional if you are unsure about any aspect of the form. By following the proper procedures and providing accurate information, you can increase your chances of obtaining a refund or abatement of taxes, penalties, and interest.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.